SLB’s Top 10 AI Projects: A Blueprint for Energy Tech Leadership in 2025 and 2026

In a decisive strategic pivot, SLB has repositioned itself from a traditional oilfield services leader to a technology-first energy innovator, placing Artificial Intelligence at the center of its operating model. This transformation is not an incremental update but a fundamental overhaul of its business, targeting both the digital needs of the core energy sector and the burgeoning power demands of the AI and data center industry. The company’s financial projections and market performance, including a projected 2026 revenue between $36.9 billion and $37.7 billion, underscore the market’s validation of this AI-centric strategy, which is now defining competitive benchmarks for 2025 and beyond.

SLB Commercial Scale AI Projects Define Industry Adoption in 2026

SLB has aggressively accelerated its AI strategy from foundational development in 2021-2024 to the full-scale commercial deployment of proprietary AI platforms and agentic systems in 2025 and early 2026.

- Between 2021 and 2024, SLB’s AI strategy focused on building foundational capabilities, highlighted by its corporate rebrand from Schlumberger to SLB in October 2022 to reflect its technology focus, launching a digital platform partner program, and forming early alliances with tech firms like Cognite. This period was characterized by internal development and establishing an open ecosystem.

- The period from January 2025 to today marks a significant shift to commercialization and productization, demonstrated by the landmark launch of the Tela™ agentic AI assistant in November 2025. This technology is now at the core of major commercial agreements.

- This transition is validated by high-value commercial contracts where AI is a central component, including a multi-region deepwater contract with Shell in January 2025 to use AI for well delivery and the deployment of the Ai PSO platform with ADNOC in November 2025 to optimize production across all its fields by 2027.

- The application of AI now spans the entire energy value chain, from AI-enabled deepwater drilling contracts and the Neuro™ autonomous geosteering solution to production optimization with the Opti Site™ solution and even new energy applications like geothermal development.

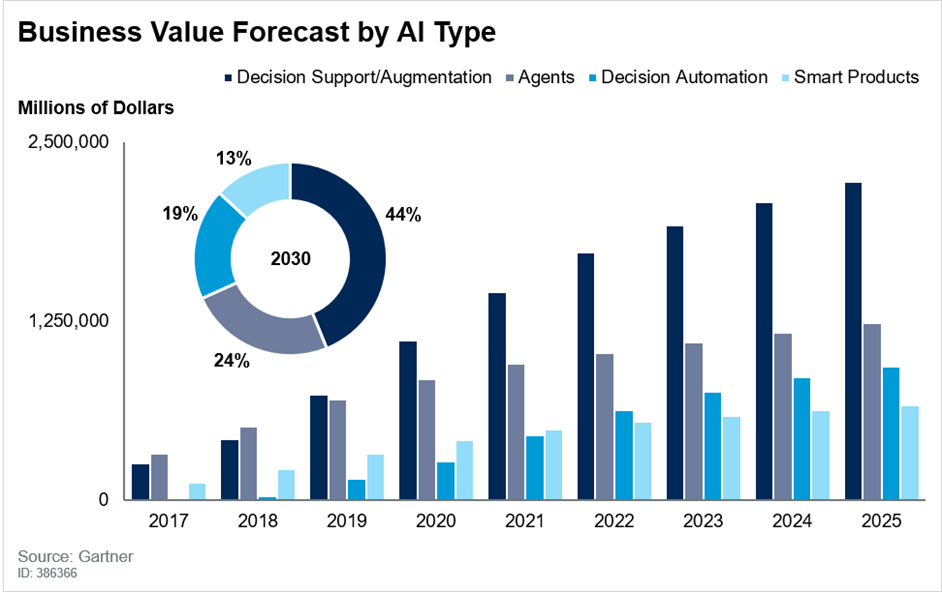

Agentic AI to Drive Future Business Value

This forecast shows agentic AI systems are projected to be a primary driver of business value, aligning with SLB’s strategic pivot to commercial-scale agentic platforms.

(Source: ImmuniWeb)

SLB Investment Analysis Reveals Strategic AI-Driven Growth

SLB’s financial strategy directly supports its AI pivot, leveraging strong cash flow to fund strategic technology acquisitions and project significant revenue growth from its digital and integration segments.

- The acquisition of Champion X for $7.76 billion, announced in April 2024, is a defining investment to bolster its AI-powered production chemistry and recovery solutions, with SLB expecting to realize 70-80% of the projected $400 million in annual synergies by 2026.

- The company has made targeted investments to secure key technologies, including its partnership with Geminus AI in January 2024, which provides exclusive access to the first physics-informed AI model builder for the energy sector.

- Demonstrating a dual strategy, SLB is also investing in the infrastructure to power the AI boom, announcing a $30 million expansion of its data-center manufacturing plant in Louisiana in December 2025.

- This investment strategy is underpinned by strong financial performance, with Q 4 2025 revenue of $9.75 billion and a commitment to return over $4 billion to shareholders in 2026, enabled by the profitability of its AI-driven business units.

Table: SLB Strategic AI Investments and Acquisitions

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Data Center Manufacturing Plant | Dec 2025 | A $30 million capital expenditure to expand a Louisiana plant, positioning SLB to supply the infrastructure needed for the growing AI industry. | Bloomberg |

| ILi AD Technologies | Jul 2024 | Participated in a funding round to continue a partnership focused on integrating innovative digital technologies into the SLB ecosystem. | PR Newswire |

| Champion X | Apr 2024 | A $7.76 billion all-stock acquisition to integrate production chemistry into SLB’s data-driven and AI-powered production and recovery solutions. | Enverus |

| Geminus AI | Jan 2024 | A strategic investment securing exclusive access to a physics-informed AI platform, enabling the creation of more accurate models for industrial applications. | SLB |

SLB Partnership Strategy Forges a Dominant AI Ecosystem

SLB has systematically built a powerful AI ecosystem through targeted alliances, shifting from foundational tech partnerships in 2021-2024 to deep, co-development agreements with industry supermajors and technology leaders in 2025 and 2026.

- In 2025, SLB secured landmark collaborations that validate its AI platform strategy, most notably the agreement with Shell in December 2025 to co-develop agentic AI solutions and the partnership with ADNOC and AIQ to deploy the Ai PSO production optimization platform.

- Before 2025, SLB established critical technology foundations, including a long-term digital platform co-development deal with Aker BP in July 2024 and a pivotal collaboration with NVIDIA in September 2024 to develop generative AI for the energy sector.

- The company’s ecosystem extends across the operational stack, from an alliance with SBM Offshore in October 2025 for AI in FPSO operations to a partnership with Mistral AI in June 2025 to host its digital platform on EU-based AI compute infrastructure.

- This network strategy ensures SLB’s AI solutions are not developed in a silo but are field-tested and co-created with clients, accelerating adoption and creating a sticky, integrated technology ecosystem.

Table: SLB Key AI and Digital Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Shell | Dec 2025 | Strategic collaboration to co-develop agentic AI-powered solutions on SLB’s Lumi™ platform, unifying data and workflows for upstream operations. | Reuters |

| Ormat | Oct 2025 | Development partnership to accelerate integrated geothermal asset development, combining SLB’s subsurface expertise with Ormat’s power plant technology. | Ormat Investor Relations |

| ADNOC / AIQ | Aug 2025 | Collaboration to design and deploy new agentic AI workflows across ADNOC’s subsurface operations, supported by the Lumi™ platform. | SLB |

| NVIDIA | Sep 2024 | Technology collaboration to co-develop generative AI solutions for the energy sector, aiming to optimize operations and advance decarbonization. | SLB |

| Total Energies | Jul 2024 | A 10-year agreement to collaborate on developing next-generation digital solutions, software, and new algorithms for geoscience and production. | SLB Investor Center |

SLB’s AI Geographic Focus Shifts to High-Value Commercial Hubs

SLB’s AI deployment strategy has evolved from establishing a broad global framework between 2021-2024 to executing targeted, high-value commercial projects in key energy hubs across the Middle East, Europe, and the Americas from 2025 onward.

- The 2021-2024 period focused on creating globally accessible platforms, such as making its core software available on cloud providers like AWS and launching its digital partner program to foster a worldwide ecosystem. The intent was to build a globally consistent digital infrastructure.

- Starting in 2025, the strategy shifted to securing major commercial deployments in specific regions. The partnership with ADNOC to roll out the Ai PSO platform across the UAE and the deployment of the Lumi AI platform in Libya to boost production are prime examples of this focus on the Middle East and North Africa.

- Europe remains a key market, evidenced by the subsea compression contract for the Gullfaks field in the North Sea (February 2026) and the technology partnership with Mistral AI to serve the EU market.

- The Americas are central to SLB’s AI initiatives, with multi-region contracts from Shell covering projects in the Gulf of Mexico and Trinidad and Tobago, alongside the strategic investment in a Louisiana data center manufacturing hub.

Cloud Becomes the Foundation for AI Deployment

With 84% of organizations adopting cloud AI, the infrastructure is in place for SLB to successfully execute its strategy of deploying AI platforms on a global scale.

(Source: Orca Security)

SLB’s AI Technology Maturity Reaches Commercial Scale in 2026

SLB’s AI technology has rapidly advanced from early-stage digital tools and pilot programs during 2021-2024 to commercially validated, scalable, and agentic AI platforms that are generating revenue in 2025 and 2026.

- The earlier period (2021-2024) was defined by building foundational technology. This included launching the open Delfi platform, establishing the Innovation Factori for co-development, and introducing initial AI-driven solutions like the Vision intelligence applications for rig safety.

- The launch of the Lumi platform in September 2024 and the Neuro™ autonomous geosteering solution in December 2024 marked a transition point, introducing more sophisticated, AI-native products.

- In 2025, SLB achieved a new level of technological maturity with the launch of its flagship Tela™ agentic AI assistant. This technology moves beyond predictive analytics to automate complex workflows and orchestrate tasks, representing a significant step toward autonomous operations.

- The market has validated this maturity through major commercial wins. Contracts with industry leaders like Shell and ADNOC to deploy these new AI systems confirm their readiness for enterprise-scale use. This progress is further reflected in SLB’s intellectual property, as it rose to rank #77 on the 2026 Patent 300® list.

SLB Deploys High-Accuracy AI Monitoring Systems

SLB’s mature AI technology is demonstrated by real-world dashboards that automatically detect operational events with high accuracy, validating its commercial-scale capabilities.

(Source: SLB)

SLB SWOT Analysis of AI Transformation 2021-2026

SLB’s strategic transformation into an AI-driven technology company has fortified its market leadership and opened new growth avenues, though this pivot also introduces execution risks and heightens competition with both traditional and non-traditional players.

- The analysis shows a clear progression from building foundational strengths in digital platforms to achieving a dominant position through proprietary AI technology and deep ecosystem partnerships.

- Opportunities have expanded from digitalizing core energy operations to capturing value from the energy needs of the AI industry itself, creating a powerful dual-market strategy.

- The primary weakness has shifted from overcoming a legacy identity to managing the complexities of integrating large acquisitions and relying on a new, technology-centric business model for future growth.

Rising AI Training Costs Shape Competitive Landscape

The escalating cost of training state-of-the-art AI models, now exceeding $100M, highlights the significant financial commitment required to compete, a key threat noted in SLB’s SWOT analysis.

(Source: Stanford HAI – Stanford University)

Table: SWOT Analysis for SLB’s AI Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong global footprint; established digital platforms (Delfi); initial partnerships (Cognite). | Proprietary agentic AI (Tela™); deep ecosystem partnerships (Shell, ADNOC, NVIDIA); strong digital segment financials and revenue forecasts. | SLB transitioned from being a service provider using digital tools to a technology leader selling AI-driven outcomes, validated by major commercial contracts and strong stock performance. |

| Weaknesses | Legacy perception as an oilfield services company; digital revenue was a smaller, developing part of the business. | Execution risk in integrating the $7.76 B Champion X acquisition; reliance on co-development partners for innovation in key areas. | The strategic pivot, while successful so far, introduces significant operational complexity and a dependence on a new business model that is still scaling. |

| Opportunities | Broad digitalization trend across the energy industry; improving operational efficiency for clients. | Dual-market strategy: applying AI to energy and providing energy/infrastructure for AI data centers; expansion into new energy (geothermal via Ormat partnership). | The addressable market has been expanded beyond traditional oil and gas services to include the high-growth AI infrastructure and new energy sectors. |

| Threats | Competition from other oilfield service companies’ digital initiatives (e.g., Halliburton Landmark). | Increased competition from technology-focused peers like Baker Hughes and potential encroachment from big tech companies entering the industrial AI space. | The competitive environment has intensified and diversified, now including both traditional rivals who are also investing in AI and well-capitalized technology giants. |

Forward-Looking Outlook for SLB: AI Adoption and Revenue Growth in Focus

The primary indicator to watch for SLB in the year ahead is the successful scaling and revenue generation from its Digital & Integration segment, driven by the market adoption of its Tela™ agentic AI platform and related solutions.

- Achieving the ambitious 2026 revenue forecast of $36.9 billion to $37.7 billion will be the ultimate validation of the AI-centric strategy, with investors closely monitoring the specific contribution from the digital business unit.

- The full-scale deployment of the Ai PSO platform across all of ADNOC’s fields by 2027 will serve as a critical case study, proving the scalability and effectiveness of SLB’s AI solutions at a national oil company level.

- Continued expansion into powering the AI industry, through its New Energy division and data center infrastructure business, represents a significant growth vector that could further diversify SLB’s revenue base away from traditional energy cycles.

- The evolution of agentic AI through collaborations with partners like Shell will be a key indicator of SLB’s ability to maintain its technological lead and continue delivering differentiated value.

Frequently Asked Questions

What is the core of SLB’s new AI-centric strategy?

The core of SLB’s strategy is a fundamental shift from being a traditional oilfield services leader to a technology-first energy innovator. This involves placing Artificial Intelligence at the center of its operating model, developing proprietary AI platforms like the Tela™ agentic assistant, and pursuing a dual-market strategy: applying AI to optimize energy operations and also supplying the infrastructure (like data centers) needed to power the AI industry.

What is the Tela™ agentic AI assistant and why is it significant?

Launched in November 2025, Tela™ is SLB’s flagship agentic AI assistant. Unlike earlier AI for predictive analytics, Tela™ is designed to automate complex workflows and orchestrate tasks, moving the industry closer to autonomous operations. Its significance is validated by its central role in major commercial agreements with industry leaders like Shell, marking a shift from AI development to full-scale commercial deployment.

How is SLB’s financial strategy supporting its AI pivot?

SLB is using its strong cash flow to fund its AI strategy through key investments. This includes the $7.76 billion acquisition of Champion X to bolster AI-powered production solutions, a strategic partnership with Geminus AI for exclusive access to physics-informed AI, and a $30 million investment to expand a data center manufacturing plant. This investment strategy underpins the company’s projected 2026 revenue growth to between $36.9 and $37.7 billion.

Why are partnerships with companies like Shell, ADNOC, and NVIDIA so important to SLB?

These partnerships are crucial for co-developing, validating, and scaling SLB’s AI solutions in real-world, high-value environments. The collaboration with Shell is for developing next-generation agentic AI, the partnership with ADNOC proves the scalability of its production optimization platform (Ai PSO) at a national level, and the alliance with NVIDIA provides foundational generative AI technology. This ecosystem approach accelerates adoption and ensures SLB’s AI is field-tested and integrated with client needs.

What changed in SLB’s AI strategy between the 2021-2024 and 2025-2026 periods?

Between 2021 and 2024, SLB focused on building foundational capabilities, establishing digital platforms like Delfi, and forming initial tech partnerships. The period from 2025 to 2026 marks a decisive shift to commercialization and productization. This is demonstrated by the launch of revenue-generating products like the Tela™ agentic AI and securing large-scale commercial contracts with supermajors like Shell and ADNOC to deploy these new AI systems.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.