SMIC’s AI Chip Strategy 2026: Powering China’s Self-Sufficient Infrastructure

SMIC’s Commercial Scale Projects for China’s AI Chip Localization in 2026

SMIC has pivoted from a general-purpose commercial foundry to the designated national champion for producing strategic AI hardware, allocating its most advanced manufacturing capacity to meet China’s domestic self-sufficiency goals.

- Between 2021 and 2024, SMIC’s focus was on foundational capacity expansion, initiating multi-billion dollar projects for mature nodes like the $2.35 billion fab in Shenzhen. The key technological achievement was the development of a 7 nm process (N+2) using older Deep Ultraviolet (DUV) lithography, validated by the 2023 launch of Huawei’s Kirin 9000 S chip.

- From 2025 to 2026, the strategy shifted to scaling advanced AI chip production. This includes mass production of Huawei’s Ascend 910 B AI chip and a planned doubling of 7 nm capacity in 2026. Furthermore, SMIC entered pilot runs for its 5 nm process, targeting mass production for partners like Huawei and Alibaba.

- This adoption is driven by strategic necessity rather than commercial competitiveness. The yield rate for Huawei’s Ascend 910 C is reportedly between 20% and 40%, far below industry standards. This demonstrates a state-backed adoption model where securing a supply of domestically produced AI chips overrides conventional cost and efficiency metrics.

SMIC Market Share Stays Firm Amid Expansion

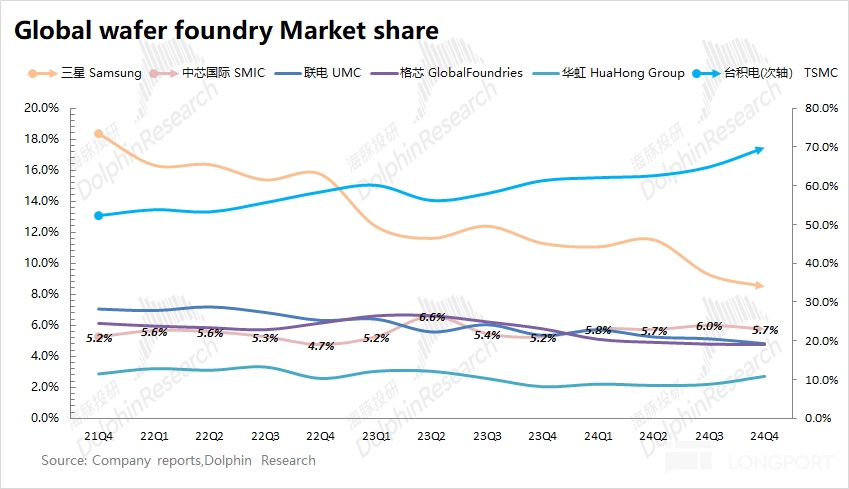

Despite massive internal investment in AI-focused capacity from 2021-2024, SMIC maintained a stable 5-6% global foundry market share. This provides context for its transition to a national champion focused on domestic goals.

(Source: Longbridge)

SMIC Investment Analysis: State-Backed Billions Fuel AI Chip Expansion

SMIC’s aggressive R&D and capacity expansion are almost entirely underwritten by a state-directed investment strategy designed to create a resilient domestic semiconductor industry and overcome the impact of U.S. sanctions.

- In May 2024, China launched its third national semiconductor fund, valued at 344 billion yuan ($47.5 billion), with SMIC positioned as a primary beneficiary to fund its advanced node development and equipment procurement efforts.

- Prior foundational investments laid the groundwork for this expansion, including a $7.5 billion commitment in August 2022 for a new 12-inch wafer factory in Tianjin and a $2.35 billion joint venture project in Shenzhen announced in March 2021.

- A strategic consolidation occurred in January 2026 when SMIC moved to acquire full control of its Beijing subsidiary, Semiconductor Manufacturing North China (SMNC), for $5.79 billion. This move streamlines operations and aligns its most advanced fabs directly with national AI objectives.

Table: SMIC’s Key Investments in AI Infrastructure Capacity

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Subsidiary Buyout (SMNC) | Jan 2026 | $5.79 billion plan to acquire the remaining stake in its Beijing fab. The purpose is to consolidate control over a key facility with advanced node capabilities (12 nm) and streamline operations for strategic AI projects. | Design & Reuse |

| China “Big Fund III” | May 2024 | $47.5 billion national fund established by the Chinese government. SMIC is a primary beneficiary, with funds intended to accelerate self-sufficiency in AI chips and domestic manufacturing equipment. | Light Reading |

| Tianjin Fab Construction | Aug 2022 | $7.5 billion investment to build a new 12-inch wafer plant. This project is designed to significantly expand overall manufacturing capacity to meet surging domestic demand for chips in AI, automotive, and telecom sectors. | Tech Node |

| Shenzhen Fab Construction | Mar 2021 | $2.35 billion joint venture with the Shenzhen government to build a new fab focused on 28 nm and larger nodes. The facility targets a capacity of 40, 000 12-inch wafers per month to support the broader electronics ecosystem. | Observer Research Foundation |

SMIC’s Strategic Alliances: Building a Sanction-Proof AI Ecosystem

SMIC has constructed an insular, domestic partnership ecosystem centered on national technology champion Huawei and other key Chinese firms to create a vertically integrated supply chain for AI hardware.

- The partnership with Huawei is the cornerstone of SMIC’s AI strategy. SMIC serves as the exclusive foundry for Huawei’s Ascend series of AI chips, including the Ascend 910 C on its 7 nm process, and is collaborating on a 5 nm node for future chips.

- In December 2025, SMIC expanded its high-end AI chip partnerships by collaborating with Alibaba Group to develop and manufacture a new 5 nm chip customized for AI inference workloads, signaling growing demand from China’s cloud and data center giants.

- To secure its production capabilities long-term, SMIC is actively testing equipment from domestic suppliers. This includes a 28 nm DUV lithography machine from Yuliangsheng, with the goal of adapting it for 7 nm and 5 nm production to reduce reliance on foreign toolmakers like ASML.

- SMIC also serves a broader ecosystem of Chinese AI firms, providing foundry services for emerging companies like Deep Seek and Horizon Robotics to help them develop proprietary AI chips for edge and data center applications.

Table: SMIC’s Key Partnerships for AI Chip Development

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Alibaba Group | Dec 2025 | Collaboration to develop and manufacture a new 5 nm chip customized for AI inference. This alliance secures a domestic supply of high-performance hardware for China’s leading cloud provider. | Silicon ANGLE |

| Yuliangsheng | Sep 2025 | Testing of a domestically built 28 nm DUV lithography machine. The strategic goal is to adapt this technology for more advanced 7 nm and 5 nm nodes, breaking reliance on foreign equipment. | Reddit / r/Semiconductors |

| Huawei | Ongoing (2023-2026) | Strategic alliance for manufacturing Ascend AI chips on SMIC’s 7 nm and planned 5 nm processes. Huawei is SMIC’s largest and most critical customer for its advanced nodes. | Disruption Banking |

| Deep Seek & Horizon Robotics | Mar 2025 | Foundry services to fabricate proprietary AI chips for emerging AI model developers and edge AI hardware companies. This builds a broader domestic customer base for SMIC’s manufacturing services. | TSPA Semiconductor |

Geographic Focus: SMIC’s China-Centric AI Infrastructure Build-Out

SMIC’s entire strategic and operational footprint for advanced AI chip manufacturing is concentrated within mainland China, reflecting a deliberate national strategy to achieve technological sovereignty and supply chain resilience.

- Between 2021 and 2024, SMIC initiated large-scale fab construction projects in key Chinese technology hubs to build foundational capacity. This included the announcement of a $7.5 billion plant in Tianjin (2022) and a $2.35 billion facility in Shenzhen (2021).

- From 2025 to today, the geographic focus has narrowed to specific, high-tech production lines within these hubs. Shanghai has become the center for SMIC’s forthcoming 5 nm production for Huawei, while the January 2026 consolidation of its Beijing subsidiary (SMNC) tightens control over its northern manufacturing assets.

- This geographic concentration is not a commercial choice but a geopolitical necessity. By locating its most advanced manufacturing and R&D efforts in cities like Shanghai, Beijing, and Shenzhen, SMIC creates a closed-loop, localized ecosystem designed to withstand external supply chain disruptions and export controls.

SMIC Technology Status: Advancing to 5 nm Production Despite Sanctions

SMIC is successfully advancing its process technology to near-leading-edge nodes by refining older DUV lithography, an approach that demonstrates significant engineering capability but comes at the cost of poor yields and high production expenses.

- In the 2021-2024 period, SMIC made a critical technological leap from its mature 14 nm process to successfully mass-producing a 7 nm process (N+2). This was validated with the launch of Huawei’s Kirin 9000 S smartphone chip in 2023 and later the Ascend 910 B AI chip.

- From 2025 onwards, the company’s focus shifted to its next-generation 5 nm node. SMIC is currently conducting pilot runs and aims for mass production in 2026, which will be used for Huawei’s and Alibaba’s next-generation AI processors.

- The technology’s commercial maturity remains limited. The 7 nm process suffers from low yield rates reported to be between 20% and 40%. This indicates the technology is not yet globally competitive and relies on a protected domestic market and state subsidies to be viable.

SMIC Climbs Tech Ladder Despite Sanctions

This infographic visualizes SMIC’s technological progression toward 7nm and 5nm nodes, a key theme of this section. It frames this advancement against the backdrop of US sanctions and the gap with industry leaders.

(Source: semivision – Substack)

SMIC SWOT Analysis: Navigating a Geopolitical and Technological Divide

SMIC’s primary strength is its guaranteed domestic market and immense state support, while its main weakness is its persistent technological gap and reliance on sanctioned equipment, creating opportunities in localization but constant threats from further international restrictions.

Foundry Market Share Visualizes SMIC’s Challenge

This chart starkly illustrates a key weakness in SMIC’s SWOT analysis: the vast market and technological divide with leader TSMC. SMIC’s 5% share versus TSMC’s 62% quantifies the geopolitical challenge.

(Source: Voronoi)

Table: SWOT Analysis for SMIC (Semiconductor Manufacturing International Corporation)

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Beneficiary of state support (“Big Fund II”); established position as China’s top foundry. | Became the world’s 3 rd largest foundry by revenue (Q 1 2024); massive state backing via $47.5 B “Big Fund III”; exclusive foundry for Huawei’s advanced AI chips. | SMIC’s role transformed from a commercial entity to a critical, state-backed national asset with a guaranteed high-demand domestic market. |

| Weaknesses | Cut off from advanced EUV lithography; technologically 2-3 generations behind TSMC; initial struggles with advanced node yields. | Persistent low yield rates (20-40%) for 7 nm AI chips; high production costs and premiums; continued reliance on DUV for 5 nm development. | The engineering challenge of using DUV for advanced nodes was validated as possible but commercially inefficient, institutionalizing high costs and low yields. |

| Opportunities | Growing domestic demand for mature nodes due to US-China trade friction and early localization efforts. | Huge, protected demand for AI chips from Huawei, Alibaba, and others; development of a domestic equipment supply chain with partners like Yuliangsheng. | The opportunity shifted from backfilling mature node demand to becoming the sole domestic provider for cutting-edge (by Chinese standards) AI processors. |

| Threats | Placed on the U.S. Entity List; restrictions on accessing advanced U.S. technology and EUV machines. | Risk of further US sanctions; co-CEO warns of potential global oversupply and price wars for mature nodes, threatening profitability. | The initial threat of sanctions became a permanent operating condition, with new threats of market overcapacity emerging due to rapid, state-funded expansion. |

Forward Outlook: SMIC’s 2026 Focus on Yield Improvement and 5 nm Scale

The most critical objective for SMIC in the year ahead is to demonstrate it can successfully scale its 5 nm and 7 nm processes with improved yields, thereby proving its ability to reliably supply the hardware for China’s national AI infrastructure ambitions.

- The planned doubling of 7 nm production capacity in 2026 is a key milestone to watch. Its success will determine whether SMIC can alleviate the domestic AI chip bottleneck for its primary partner, Huawei.

- Achieving mass production on its 5 nm node by the end of 2026 will be a major validation point. The industry will closely monitor the yield rates and performance of these chips as a barometer of China’s progress in overcoming sanctions.

- The integration of domestically produced lithography tools, such as the one being tested from Yuliangsheng, is a crucial long-term indicator. A successful transition would signal a fundamental shift toward true technological independence.

- Despite its strategic importance, SMIC faces commercial headwinds. The co-CEO’s warning of a potential glut in AI data center capacity suggests that even with state support, the company must navigate market economics to maintain financial health.

SMIC’s Future Valuation Amid Global Giants

Supporting the forward outlook, this chart projects SMIC’s late 2025 valuation at $85.5 billion. This provides a future-oriented benchmark for the company’s progress while highlighting its relative scale against global titans.

(Source: Visual Capitalist)

Frequently Asked Questions

What is SMIC’s primary role in China’s AI strategy?

SMIC has shifted from a general-purpose foundry to China’s designated national champion for producing strategic AI hardware. Its main role is to provide a domestic, sanction-proof supply of advanced chips for key partners like Huawei, ensuring China can build its own AI infrastructure despite international restrictions.

How is SMIC producing advanced 7nm and 5nm chips without the latest equipment?

SMIC is using older Deep Ultraviolet (DUV) lithography technology to manufacture its advanced 7nm and 5nm nodes, as it is restricted from accessing the industry-standard EUV lithography machines. While this is a significant engineering achievement, it comes at the cost of very low yield rates (reportedly 20-40% for 7nm) and higher production expenses.

How is SMIC funding its massive expansion projects?

SMIC’s aggressive expansion is almost entirely underwritten by a state-directed investment strategy. It is a primary beneficiary of China’s national semiconductor funds, including the $47.5 billion “Big Fund III” launched in May 2024, which finances its advanced node development and capacity expansion to overcome U.S. sanctions.

Who are SMIC’s key partners for its AI chips?

SMIC’s most critical partner is Huawei, for whom it serves as the exclusive foundry for the Ascend series of AI chips. It is also building alliances with other Chinese tech giants, such as Alibaba Group, to develop and manufacture custom 5nm AI chips for their data center needs.

What is the biggest challenge for SMIC in 2026?

The most critical challenge for SMIC in 2026 is to improve its manufacturing yields for the 7nm and 5nm processes. Successfully scaling production with better efficiency is vital to prove it can reliably supply hardware for China’s national AI ambitions and alleviate the domestic AI chip bottleneck for partners like Huawei.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.