Huawei’s AI Infrastructure Strategy: Powering Zhipu AI’s Energy-Efficient Sovereign Stack in 2026

Huawei AI Chip Adoption Fuels Sovereign Infrastructure Projects with Zhipu AI

Huawei has become the foundational enabler of China’s sovereign AI infrastructure, a strategic shift validated by Zhipu AI’s successful development of frontier models exclusively on its domestic hardware.

- Between 2021 and 2024, Chinese AI firms like Zhipu AI navigated a fragmented hardware market by partnering with multiple vendors, including Qualcomm. During this period, Huawei’s Ascend processors were an emerging option but had not yet proven their capacity to support a complete, frontier-level model training stack.

- A definitive pivot occurred from 2025 to 2026, cementing Huawei’s central role. In January 2026, Zhipu AI announced its GLM-Image model was trained entirely on Huawei’s Ascend Atlas 800 T A 2 server and Mind Spore framework, validating the all-domestic stack’s viability for advanced AI tasks.

- This progression from diversified hardware sourcing to deep, strategic integration with Huawei marks the industry’s successful adoption of a domestic platform in response to U.S. sanctions. This has created a new, potentially energy-optimized infrastructure standard within China.

- The commercialization of this stack is evident in Zhipu AI’s “AI-in-a-box” enterprise solution, which bundles its models with Huawei Ascend chips. This move shows adoption expanding from internal R&D to scalable commercial products for private deployments.

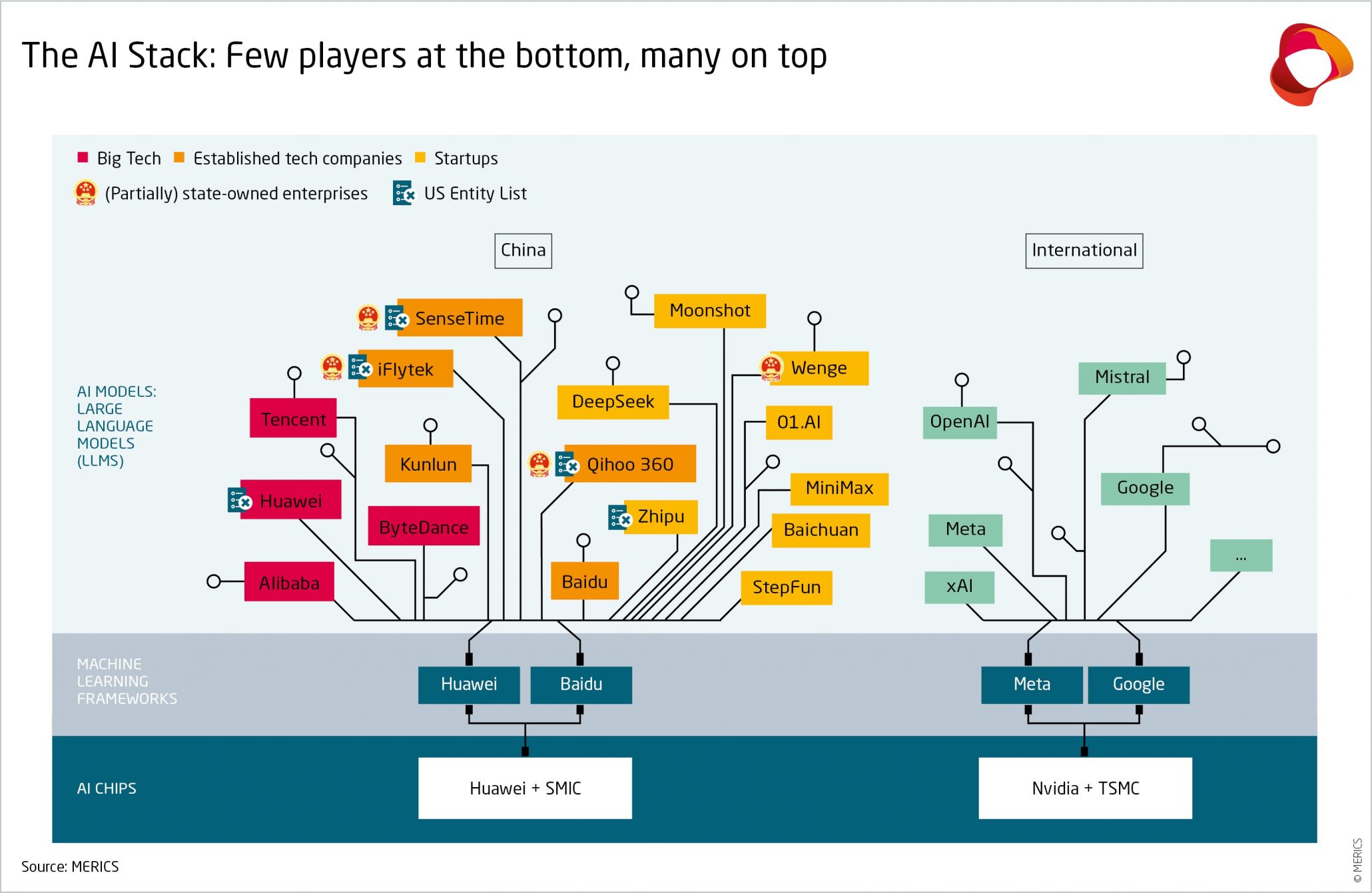

Huawei Forms Foundation of China’s Sovereign AI Stack

This diagram perfectly illustrates the section’s core topic, showing how Huawei’s foundational chips support the entire sovereign AI ecosystem, including model developers like Zhipu AI.

Zhipu AI’s Billion-Dollar Funding Fuels Huawei AI Hardware Investment

Zhipu AI’s successful fundraising of over $1.4 billion directly fuels the capital-intensive buildout of its AI infrastructure, with Huawei’s Ascend chip platform positioned as a primary beneficiary of this massive spending.

- Zhipu AI raised $558 million in its Hong Kong IPO on January 8, 2026, with a stated purpose of using the capital to develop its foundational models and system infrastructure. This infusion provides direct funding for acquiring high-performance domestic hardware.

- The IPO followed a series of large, state-backed funding rounds throughout 2025, including a $137 million investment from Shanghai state funds in July 2025. This signals a national strategic priority to finance the domestic hardware ecosystem through key software partners.

- The company’s financial disclosures reveal a significant cost structure heavily weighted toward hardware. Computing services constituted 71.8% of R&D expenses in the first half of 2025, a substantial portion of which is directed toward procuring Huawei hardware and related infrastructure.

Table: Zhipu AI’s Key Funding Events for Infrastructure Buildout

| Investor / Event | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Hong Kong IPO | January 2026 | Raised $558 million at a $6.6 billion valuation. Proceeds are allocated to foundational model development and system infrastructure, including hardware procurement. | CB Insights |

| Shanghai State Funds | July 2025 | Secured $137 million from state-backed funds like Pudong Venture Capital. This investment strengthened its balance sheet ahead of the IPO for infrastructure expansion. | Tech in Asia |

| Prosperity 7 Ventures | May 2024 | Participated in a $400 million funding round. This marked the first major foreign investment and provided international capital for compute resource acquisition. | Bloomberg |

| Alibaba & Tencent | October 2023 | Contributed to a total of $342 million raised in 2023. These investments provided capital and access to their extensive cloud infrastructure. | Data Center Knowledge |

Huawei and Zhipu AI’s Partnership: A Strategic Alliance Forging China’s AI Infrastructure

Huawei’s partnership with Zhipu AI has matured from a standard supplier relationship into a deep strategic alliance, focused on co-developing and validating a sovereign AI stack from the silicon to the application layer.

- The collaboration in January 2026 to open-source the GLM-Image model was a critical milestone. It showcased a complete, vertically integrated solution built on Huawei’s Ascend server hardware and its proprietary Mind Spore software framework.

- This alliance extends to government infrastructure projects. By June 2025, Zhipu AI and Huawei were creating a comprehensive ecosystem for governments to build their own national AI infrastructure, a key reason Zhipu AI is considered a top rival by Open AI.

- Earlier technical integrations in 2024 involved bundling eight of Huawei’s Ascend 910 AI chips with Zhipu AI’s 12-billion-parameter model, demonstrating a clear commercial strategy to push integrated hardware-software solutions to enterprise clients.

- While Zhipu AI also partners with companies like Alibaba Cloud for global distribution, the core training and development of its most advanced, sanction-resilient models are dependent on the deep technical alignment with Huawei.

Table: Key Infrastructure Partnerships of Zhipu AI

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Huawei (GLM-Image) | January 2026 | Collaborated to open-source an image model trained entirely on Huawei Ascend hardware, proving the viability of the domestic stack for cutting-edge AI. | Global Times |

| Malaysia Government | December 2025 | Advanced a sovereign AI initiative to power Malaysia’s national Model-as-a-Service (Maa S) platform, exporting the domestic infrastructure model. | Pandaily |

| Alibaba Cloud | April 2025 | Formed a partnership to leverage Alibaba’s regional cloud infrastructure to accelerate Zhipu AI’s international expansion ahead of its IPO. | Asian Fin |

| Intel | December 2024 | Collaborated to optimize Zhipu AI’s models to run locally on Intel Core Ultra processors, developing an on-device AI infrastructure strategy. | EEWorld |

Huawei and Zhipu AI Expand Sovereign AI Infrastructure from China to the Belt and Road

Huawei’s AI infrastructure, proven within China through its partnership with Zhipu AI, is now being systematically exported as a “sovereign AI” solution, extending China’s technological footprint across Southeast Asia, the Middle East, and Africa.

- From 2021 to 2024, the primary geographic focus was domestic. Huawei and Zhipu AI concentrated on building and validating their AI stack within China as a direct countermeasure to escalating U.S. technology sanctions.

- A distinct global strategy materialized in 2025. In December 2025, Zhipu AI announced progress on its collaboration with Malaysia to build a national Model-as-a-Service platform, the first major export of its sovereign AI infrastructure model.

- This expansion continued with partnerships established in the UAE, Saudi Arabia, and Kenya in July 2025. These agreements focus on developing AI infrastructure for state-owned enterprises, leveraging China’s Belt and Road Initiative as a distribution channel for this technological ecosystem.

Huawei’s AI Infrastructure Reaches Commercial Scale with Zhipu AI’s Frontier Models

Huawei’s AI hardware has quickly matured from a developmental alternative into a commercially viable, frontier-level platform capable of training and deploying large-scale models, a status validated by its use in developing Zhipu AI’s most advanced systems.

- In the 2021-2024 period, Huawei’s Ascend chips were largely in an R&D and pilot phase for generative AI. Chinese firms, including Zhipu AI, were still focused on procuring U.S.-designed GPUs where possible while experimenting with domestic alternatives.

- The technology achieved commercial-scale validation between 2025 and 2026. The release of Zhipu AI’s GLM-5 model in February 2026, a 744-billion parameter system trained and run on domestic chips including Huawei’s Ascend series, proved its capability to support frontier AI development.

- The public, open-source release of the GLM-Image model in January 2026 moved the technology beyond internal validation. This confirmed to the market that the Huawei-Zhipu stack was not just a theoretical alternative but a mature, commercially ready platform.

Zhipu AI’s Model Reaches Frontier-Level Performance

This chart validates the section’s claim by showing Zhipu AI’s model is competitive at the ‘frontier level,’ proving Huawei’s infrastructure is commercially viable for training advanced AI.

(Source: InfoQ)

SWOT Analysis: Huawei’s Strategic Position in AI Infrastructure with Zhipu AI

Huawei’s core strength is its government-backed, vertically integrated AI stack developed with Zhipu AI, but it faces significant threats from a constrained domestic supply chain and intense competition, creating an opportunity to dominate global sovereign AI markets if it can mitigate its weaknesses.

- The alliance with national champions like Zhipu AI provides Huawei with a protected and growing market, insulated from direct foreign competition within China.

- The primary weakness is the reliance on a nascent domestic chip manufacturing ecosystem, which creates potential supply bottlenecks and a performance gap compared to unrestricted Western hardware.

- This dynamic creates a major opportunity to export its full-stack solution to non-U.S. aligned nations that are actively seeking technological autonomy.

- However, the high cash burn rate of its key partners like Zhipu AI poses a threat, as any slowdown in their funding could directly impact demand for Huawei’s expensive hardware.

Table: SWOT Analysis for Huawei’s AI Infrastructure Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Existing hardware portfolio and strong R&D capabilities in telecommunications and enterprise computing. | Deep, full-stack integration with national AI champion Zhipu AI. Proven ability to train frontier models like GLM-5 (744 B parameters) entirely on domestic hardware. | The partnership validated Huawei’s hardware as a viable alternative to U.S. GPUs for state-of-the-art AI, creating a defensible sovereign stack. |

| Weakness | Perceived performance gap with leading U.S. AI accelerators from Nvidia. Impacted by initial U.S. sanctions. | Supply chain constraints are now evident. Zhipu AI had to restrict sign-ups for services in January 2026 due to infrastructure limits, indicating production cannot meet demand. | The weakness shifted from a performance question to a critical supply chain bottleneck, limiting the growth of its partners. |

| Opportunity | Focused on becoming the primary domestic replacement for sanctioned U.S. hardware within China. | Began exporting the “sovereign AI” model globally. Zhipu AI partnerships in Malaysia (December 2025) and the Middle East (July 2025) use this stack. | The opportunity expanded from a domestic defensive play to an offensive global strategy targeting a new market segment of technologically autonomous nations. |

| Threat | Escalating U.S. sanctions restricting access to semiconductor manufacturing technology. | The unsustainable cash burn of key partners. Zhipu AI reported losing over $10 for every $1 in revenue (H 1 2025), posing a risk to future hardware orders if funding falters. | The primary threat evolved from external geopolitical pressure to internal financial instability within its core customer base. |

Future Outlook: Can Huawei’s Infrastructure Scale to Meet Zhipu AI’s Global Ambitions?

The critical challenge for 2026 and beyond is whether Huawei’s domestic manufacturing capacity can scale quickly enough to satisfy the immense compute demand from partners like Zhipu AI, whose global sovereign AI strategy is entirely dependent on this constrained supply chain.

- Zhipu AI’s decision in February 2026 to increase prices by over 30% and restrict sign-ups for its popular coding service is a direct market signal that its Huawei-based infrastructure is already operating at or near full capacity.

- The success of Zhipu AI’s international expansion into Malaysia and other Belt and Road countries depends entirely on its ability to deploy reliable, scalable hardware stacks from Huawei, making Huawei’s production output the ultimate bottleneck to growth.

- The financial health of Zhipu AI remains a key variable. Its high burn rate requires continuous capital infusions to fund the purchase of expensive Huawei hardware, meaning any disruption in its funding could have immediate and severe consequences for Huawei’s order book.

Chip Production Capacity is a Key Constraint to AI Scale

This chart directly supports the section’s focus on future challenges by quantifying chip production as a major bottleneck to scaling AI compute capacity by 2030.

(Source: AI Supremacy)

Frequently Asked Questions

Why did Zhipu AI switch to using Huawei’s hardware for its advanced AI models?

Zhipu AI pivoted to Huawei’s hardware primarily because it proved to be a viable and complete platform for training advanced, frontier-level AI models, a fact validated by the successful training of the GLM-Image model in January 2026 entirely on Huawei’s stack. This strategic shift was also a direct response to U.S. sanctions, allowing Zhipu AI to build a sanction-resilient, sovereign infrastructure for its most advanced systems.

How is Zhipu AI funding its purchase of expensive Huawei AI hardware?

Zhipu AI is financing its massive investment in Huawei’s AI hardware through substantial fundraising. This includes raising $558 million in its Hong Kong IPO in January 2026, with proceeds explicitly allocated for infrastructure and hardware procurement. The company also secured significant state-backed funding, such as a $137 million investment in July 2025, underscoring the national strategic importance of building a domestic AI ecosystem.

What is “sovereign AI” and how are Huawei and Zhipu AI exporting it?

“Sovereign AI” refers to a complete, self-reliant AI infrastructure solution—from hardware chips like Huawei’s Ascend to software frameworks and models from Zhipu AI. It is designed to give nations technological autonomy. Huawei and Zhipu AI are exporting this model to other countries, particularly along the Belt and Road Initiative. A key example is their collaboration with Malaysia in December 2025 to build its national AI platform.

What is the main challenge facing the Huawei-Zhipu AI partnership?

The most critical challenge is the supply chain bottleneck. According to the analysis, Huawei’s domestic manufacturing capacity cannot scale fast enough to meet the immense compute demand from Zhipu AI. This was evident when Zhipu AI had to restrict user sign-ups in early 2026 due to infrastructure limitations, indicating that demand for its services is outpacing the supply of Huawei’s hardware.

What specific achievement proved that Huawei’s AI infrastructure was ready for large-scale use?

The platform’s readiness was proven by the development of Zhipu AI’s frontier-level GLM-5 model in February 2026, a massive 744-billion parameter system trained on domestic chips including Huawei’s Ascend series. This, along with the open-sourcing of the GLM-Image model trained entirely on the Huawei stack a month earlier, confirmed that the infrastructure could support the most advanced, state-of-the-art AI development at a commercial scale.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.