China’s Top 10 AI Chip Companies Leading the Self-Sufficiency Surge in 2025

China’s Artificial Intelligence (AI) chip industry in 2025 is defined by a state-driven surge toward technological self-sufficiency, fundamentally reconfiguring the market in response to U.S. export controls and creating a protected, rapidly consolidating ecosystem led by national champions. This strategic pivot is creating immense domestic opportunity, with projections showing the local AI chip market swelling from $6 billion in 2024 to $16 billion in 2025. The value concentration at the hardware layer is stark, with seven of the top 10 firms in the 2025 Hurun China AI Enterprises Top 50 being chip companies. Underscoring this trend, Huawei is on track to capture 50% of the domestic AI chip market by 2026. The dominant theme for the year is “de-Americanization, ” a national security imperative that has redirected billions in procurement and investment, forcing China’s tech giants to abandon foreign suppliers and cultivate a viable domestic hardware stack.

China’s Top 10 AI Chip Companies in 2025

The landscape is dominated by a mix of established tech giants creating chips for their own ecosystems, well-funded startups directly challenging foreign GPU dominance, and specialized innovators building novel architectures.

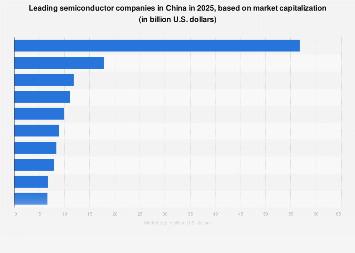

One Giant Leads China’s Semiconductor Market

This chart projects the 2025 market capitalization for China’s semiconductor leaders, directly introducing the competitive landscape discussed in the section. It highlights a clear market leader, which aligns with the article’s focus on Huawei’s dominance.

(Source: Statista)

1. Huawei (Hi Silicon)

Company: Huawei (Hi Silicon)

Strategic Focus / Key Product: The Ascend series of AI chips, including the current flagship Ascend 910 C. The strategy emphasizes system-level performance, connecting thousands of chips in “Super Pod” clusters to compete with Nvidia’s infrastructure.

Market Position / Milestone: As the undisputed national champion, Huawei is projected to own 50% of the Chinese AI chip market by 2026. The Ascend 910 C performs at approximately 60% of the level of Nvidia’s H 100 but is being widely adopted by state-backed firms and AI developers like Deep Seek.

Source: Huawei to own 50% of Chinese AI chip market by 2026

2. Alibaba (T-Head Semiconductor)

Company: Alibaba (T-Head Semiconductor)

Strategic Focus / Key Product: Developing processors for its massive cloud computing ecosystem, including the Yitian 710 server chip and Zhenwu processing unit. The focus is on reducing reliance on Nvidia for training smaller AI models and powering inference workloads.

Market Position / Milestone: A key player leveraging its vast captive cloud demand. The company is reportedly planning an IPO for T-Head and has developed a new AI inference chip said to match Nvidia’s H 20 performance.

Source: Alibaba, Baidu’s IPO plans for AI chip design units heighten …

3. Baidu (Kunlunxin)

Company: Baidu (Kunlunxin)

Strategic Focus / Key Product: Leveraging its position as a full-stack AI company with its Kunlun series of chips. The roadmap includes the M 100 inference chip (2026) and M 300 training chip (2027).

Market Position / Milestone: Emerging as a significant challenger to Huawei, Baidu has already deployed a 30, 000-chip cluster of its Kunlun P 800 processors to train its ERNIE AI models and plans a Hong Kong IPO for Kunlunxin in 2026.

Source: Baidu plans Hong Kong IPO of AI chip unit Kunlunxin in …

4. Moore Threads

Company: Moore Threads

Strategic Focus / Key Product: Developing general-purpose GPUs (GPGPUs) to directly compete with Nvidia’s architecture. Its new “Huagang” architecture, unveiled in December 2025, claims to increase computational density by 50%.

Market Position / Milestone: The second most valuable AI firm in China per the 2025 Hurun report. The company is preparing for an IPO and expects revenue to triple in 2025, driven by the national self-sufficiency push.

Source: Chinese AI chipmaker Moore Threads sees tripling of …

5. Biren Technology

Company: Biren Technology

Strategic Focus / Key Product: Developing its BR series of general-purpose GPUs to replace Nvidia hardware in the AI training market.

Market Position / Milestone: A key startup that raised approximately $207 million in June 2025 and is preparing for a Hong Kong IPO. Its blockbuster IPO debut in January 2026 added significant momentum to the rally in Chinese AI and chip stocks.

Source: China AI chip firm Biren raises new funds, plans Hong …

6. Meta X

Company: Meta X

Strategic Focus / Key Product: Developing high-performance GPGPUs as direct alternatives to Nvidia’s products for AI and data center applications.

Market Position / Milestone: Ranked third in the 2025 Hurun AI report, Meta X is already supplying advanced chips to state-controlled telecom provider China Unicom, demonstrating early commercial traction ahead of its IPO.

Source: China’s AI chip firms lead 2025 top 50 ranking: report

7. Cambricon Technologies

Company: Cambricon Technologies

Strategic Focus / Key Product: A dedicated AI chip design firm focused on specialized AI accelerators (ASICs) optimized for specific workloads, particularly inference.

Market Position / Milestone: China’s most valuable AI company, topping the 2025 Hurun AI ranking with a valuation of approximately $88 billion. It is a key supplier for running large language models like Deep Seek.

Source: China AI chipmaker Cambricon tops Hurun 2025 AI …

8. Enflame Technology

Company: Enflame Technology

Strategic Focus / Key Product: Development of high-performance AI training and inference accelerator cards, considered among the best-performing domestic options.

Market Position / Milestone: The company’s IPO application for Shanghai’s STAR Market was accepted in January 2026, signaling strong investor confidence and market momentum.

Source: Enflame’s STAR Market IPO Accepted, Signaling Strong …

9. Hygon Information Technology

Company: Hygon Information Technology

Strategic Focus / Key Product: Developing domestic CPUs and DCUs (Data Center Processing Units) for server and data center applications, benefiting from the push to use local technology.

Market Position / Milestone: A key domestic chipmaker whose stock has seen triple-digit gains amid the AI boom. Hygon is a major beneficiary of government mandates to replace foreign technology in critical infrastructure.

Source: China AI Hardware Firms Trump Internet Giants in Growth …

10. Iluvatar Core X

Company: Iluvatar Core X

Strategic Focus / Key Product: A newer entrant focused on GPGPUs for high-performance computing and AI training.

Market Position / Milestone: Unveiled an ambitious roadmap to achieve performance parity with Nvidia’s future “Rubin” platform by 2027, reflecting the national strategy of publicly committing to long-term roadmaps to bolster investor confidence.

Source: A Chinese AI Chip Startup Unveils a Roadmap That …

Table: China’s Top 10 AI Chip Companies in 2025

| Company | Strategic Focus / Key Product | Market Position / Milestone | Source |

|---|---|---|---|

| Huawei (Hi Silicon) | Ascend series AI chips, “Super Pod” clusters | Projected to own 50% of domestic market by 2026 | Huawei to own 50% of Chinese AI chip market by 2026 |

| Alibaba (T-Head) | Yitian 710 server chip, Zhenwu processing unit | Developing chips for its massive cloud ecosystem, planning an IPO | SCMP |

| Baidu (Kunlunxin) | Kunlun series processors (P 800) | Deployed a 30, 000-chip cluster for its ERNIE AI model | Recode China AI |

| Moore Threads | GPGPUs with “Huagang” architecture | #2 most valuable AI firm in China (Hurun); expects 3 x revenue growth in 2025 | SCMP |

| Biren Technology | BR series GPGPUs | Raised $207 M in 2025, completed a blockbuster IPO in Jan 2026 | Reuters |

| Meta X | GPGPUs for AI and data centers | #3 most valuable AI firm (Hurun); supplying chips to China Unicom | AI Magazine |

| Cambricon Technologies | Specialized AI accelerators (ASICs) | Most valuable AI company in China (approx. $88 B valuation) | Tech Node |

| Enflame Technology | AI training and inference accelerator cards | STAR Market IPO application accepted in Jan 2026 | Pandaily |

| Hygon Information Tech | Domestic CPUs and DCUs | Stock achieved triple-digit gains amid AI boom; key government supplier | Bloomberg |

| Iluvatar Core X | GPGPUs for HPC and AI | Ambitious roadmap to match Nvidia’s 2027 “Rubin” platform | WCCFTech |

From Cloud to Cluster: How Domestic Chips Are Powering China’s AI Ambitions

The diversity of applications for these homegrown chips signals a rapidly maturing and diversifying ecosystem. The adoption is no longer theoretical but a commercial reality across the entire AI value chain. At the high end, national champions are deploying massive clusters for foundational model training, a domain once exclusively held by Nvidia. For instance, Baidu is leveraging a 30, 000-chip cluster of its own Kunlun processors to train its ERNIE large language models, while AI leader Deep Seek has publicly opted for Huawei’s Ascend chips for some training tasks. This demonstrates a critical proof-of-concept for the viability of domestic hardware at scale. In parallel, tech giants like Alibaba are integrating their T-Head chips into their public cloud offerings, creating a captive market and a seamless transition for their customers away from U.S. technology. This dual-pronged adoption—powering both internal, cutting-edge R&D and external commercial services—indicates that the industry is building a comprehensive, vertically integrated stack.

Chinese AI Models Gain Inference Market Share

This chart shows the growing market share of Chinese AI models in inference, supporting the section’s theme of domestic chips powering real-world applications. The rise of models like DeepSeek, mentioned in both the text and chart, provides a concrete example of this trend.

(Source: Ark Invest)

The Golden Triangle: How Beijing, Shanghai, and Shenzhen Fuel AI Chip Innovation

The geography of China’s AI chip revolution is highly concentrated within a “golden triangle” of its primary technology hubs: Beijing, Shanghai, and the Pearl River Delta (centered on Shenzhen). This is not a coincidence but the result of a deliberate industrial strategy combining government support, academic talent, and proximity to major customers. Shenzhen is the undisputed headquarters of the movement, home to market leader Huawei. Beijing serves as the AI brain, where Baidu develops its full-stack AI ecosystem from models to chips. Meanwhile, Shanghai has emerged as the financial and startup nexus, hosting ambitious challengers like Biren Technology and Enflame Technology that are tapping public capital via the city’s tech-focused STAR Market. This geographic clustering accelerates innovation by creating a dense network of suppliers, talent, and capital, all aligned with the national goal of semiconductor independence.

System-Level Solutions: China’s Strategy to Outmaneuver Chip-Level Gaps

While a performance gap with Nvidia’s state-of-the-art single chips persists, analyzing Chinese AI hardware on a chip-to-chip basis misses the strategic point. China’s key innovation is in system-level architecture and software co-design to deliver competitive cluster-level performance. Huawei’s “Super Pod” solution, which can network up to 15, 488 of its Ascend chips, is a prime example of this strategy. By optimizing interconnects and the software stack (like its CANN framework), Huawei can offer a turnkey data center solution that provides competitive performance for large-scale AI training, even if individual chips are less powerful. The market’s rapid adoption of these “good enough” but highly integrated domestic solutions shows a pragmatic shift. Firms like Meta X securing contracts with China Unicom and the planned IPOs of Moore Threads and Biren underscore that these companies have passed the R&D phase and are now commercially viable entities, successfully scaling production to meet the enormous demand created by U.S. sanctions.

A Bifurcated Future: The Self-Sufficient Stack and the Startup Gauntlet

The future of China’s AI chip market points toward a bifurcated structure. Huawei is on an undeniable trajectory to become the domestic market leader for high-end AI training, leveraging its unparalleled full-stack capabilities and deep alignment with state objectives. Its ability to provide everything from the chip to the data center solution creates a powerful, integrated alternative that is difficult for startups to challenge directly. Below this dominant player, a fierce battle is unfolding among a cohort of well-funded GPU challengers like Moore Threads, Biren Technology, and Meta X, who are vying for the general-purpose market. The relentless pace of IPOs is a clear signal that this capital-intensive race requires massive funding to compete in R&D and fabrication. Ultimately, the most significant trend is not just chip replacement but the construction of a complete, sovereign AI technology stack, securing China’s long-term ambitions in the global AI race.

Nvidia’s Revenue Share in China Plummets

This chart directly illustrates the market shift away from Nvidia in China, which is the core premise of the section. This decline creates the opening for the ‘bifurcated future’ where domestic champions and startups can compete.

(Source: Bloomberg.com)

Frequently Asked Questions

Why is China’s domestic AI chip market experiencing such rapid growth?

The rapid growth is driven by a state-led push for technological self-sufficiency, a strategy known as “de-Americanization,” in response to U.S. export controls. This has redirected billions in procurement and investment to domestic companies, creating a protected market. The article projects the market will swell from $6 billion in 2024 to $16 billion in 2025 as a result.

Who is the leading company in China’s AI chip industry?

Huawei (through its HiSilicon division) is the undisputed leader and national champion. The company is projected to capture 50% of the domestic AI chip market by 2026 with its Ascend series of chips and “Super Pod” cluster solutions.

Are Chinese AI chips as powerful as leading international chips from companies like Nvidia?

On a single-chip basis, a performance gap persists; for example, Huawei’s Ascend 910C performs at approximately 60% of the level of Nvidia’s H100. However, China’s strategy is to overcome this gap with system-level solutions, such as Huawei’s “Super Pod” clusters, which network thousands of chips with optimized software to deliver competitive performance for large-scale AI training.

Besides established giants like Huawei and Alibaba, who are the other key players?

The market features a cohort of well-funded startups directly challenging for market share. These include Moore Threads and Biren Technology, which are developing general-purpose GPUs (GPGPUs) and are preparing for IPOs, and Cambricon Technologies, which focuses on specialized AI accelerators (ASICs) and was ranked as China’s most valuable AI company by Hurun in 2025.

What is the “Golden Triangle” of AI chip innovation in China?

The “Golden Triangle” refers to the three geographic hubs concentrating China’s AI chip development: Shenzhen, Beijing, and Shanghai. Shenzhen is the headquarters for market leader Huawei; Beijing is the AI hub for companies like Baidu; and Shanghai has emerged as the financial and startup nexus, hosting ambitious challengers like Biren Technology and Enflame Technology.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.