AI Power Demand 2026: How Grid Constraints Force a Trillion-Dollar Infrastructure Convergence

Grid Constraints Reshape AI Expansion: From Power Consumer to Power Producer

The primary constraint on AI expansion has shifted from computing hardware to power availability, forcing a strategic pivot from relying on public grids to developing integrated, dedicated power solutions. This change marks the end of an era where power was a secondary consideration in data center planning and establishes access to reliable, large-scale electricity as the principal determinant of growth.

- Between 2021 and 2024, the industry focused on quantifying the emerging power problem. Analyses revealed that grid connection lead times of one to two years and the extreme power density of AI racks, requiring 30 to 60 k W each, were making traditional data center models unsustainable. The challenge was defined, but solutions remained largely focused on in-rack efficiencies like liquid cooling.

- From 2025 to today, the response has become aggressive and systemic, with market leaders moving from being grid customers to becoming power infrastructure partners or owners. This is validated by landmark strategic partnerships, such as the one between utility Next Era Energy and Google Cloud to co-develop gigawatts of new capacity, which fundamentally redefines the relationship between technology and energy providers.

- The risk of grid unavailability is no longer a future forecast but an immediate commercial bottleneck that actively stalls projects. This has triggered a strategic move away from incremental efficiency gains toward a complete infrastructure overhaul, including on-site generation and the co-location of data centers with power plants, to secure the energy supply required for AI development.

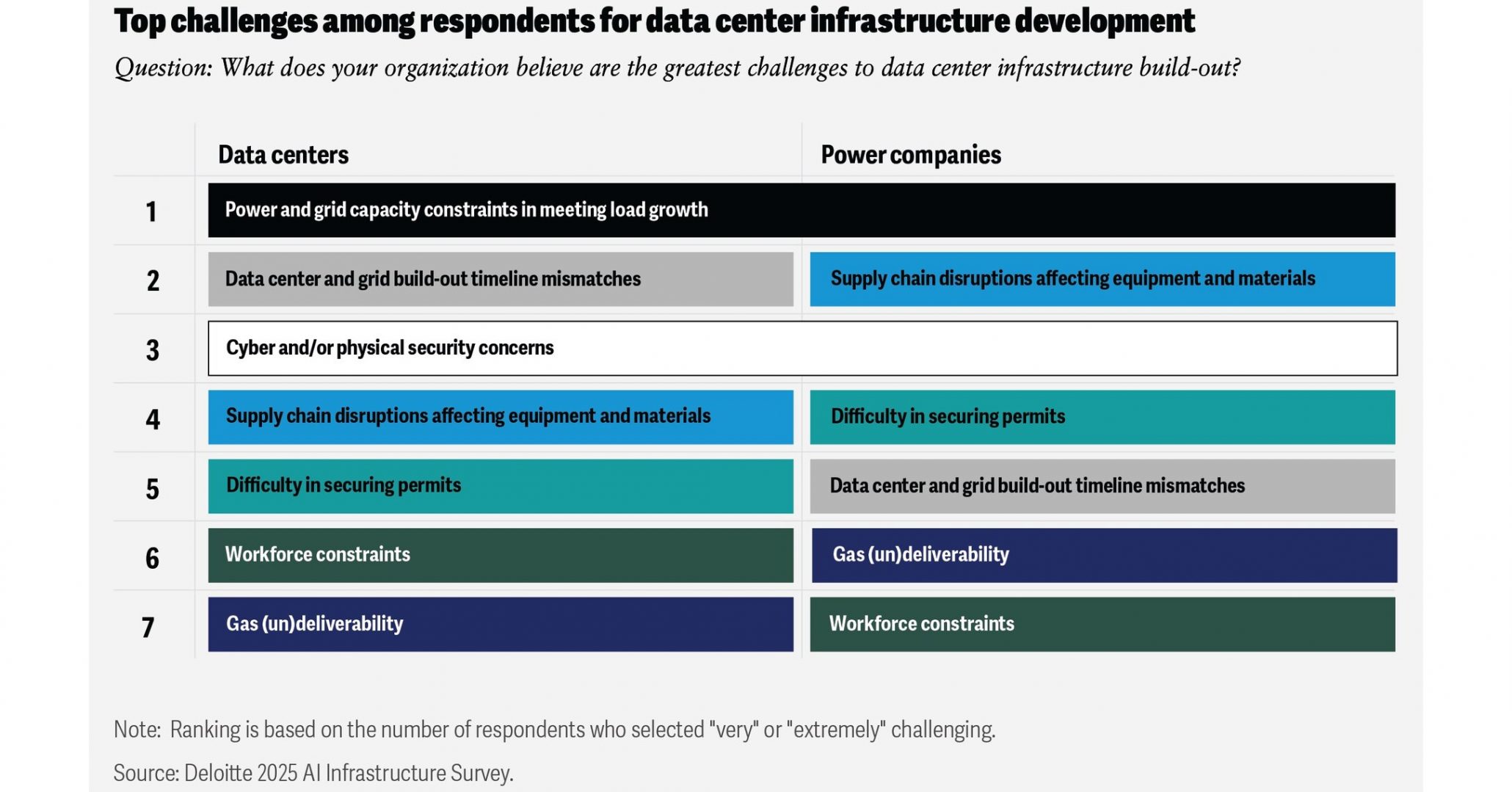

Power Is Top Challenge for Data Centers

This chart validates the section’s core argument that power availability is the primary constraint, showing industry leaders rank power and grid capacity as the number one challenge.

(Source: PR Newswire)

Trillion-Dollar Capital Influx: Investment Rushes to Solve AI’s Power Deficit

A generational wave of capital is being deployed to build an entirely new asset class that combines data centers with dedicated power generation, bypassing the limitations of the traditional utility model. Investors now recognize that the digital infrastructure for AI cannot be built without simultaneously building the energy infrastructure to support it, treating them as a single, inseparable investment thesis.

Capex Nears $1T to Fund AI’s Power Needs

This forecast quantifies the ‘trillion-dollar capital influx’ described in the section, showing combined hyperscaler and utility investment surging to solve the power deficit.

(Source: Deloitte)

- Before 2025, investments were significant but primarily targeted data center assets. For example, Goldman Sachs estimated that $50 billion in new generation capacity was needed, and Meta announced a $10 billion AI-optimized data center. These figures highlighted the scale of spending but did not yet reflect an integrated power-and-data strategy.

- Beginning in 2025, investment strategies matured into massive, dedicated funds and partnerships targeting the convergence of power and data infrastructure. The alliance formed by Black Rock, Microsoft, and Global Infrastructure Partners (GIP), with a potential scale of $100 billion, and KKR’s $50 billion fund with Energy Capital Partners (ECP), explicitly target building both data centers and the required power generation side-by-side.

- This shift is confirmed by macro-level forecasts from major institutional investors. Brookfield anticipates that total spending on AI-related infrastructure will exceed $7 trillion in the next decade, a figure that includes the construction of 75 GW of new AI data centers, underscoring that the market now views power and data as a unified ecosystem.

Table: Key Investments in AI Power and Data Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield | 2025 | Forecasts over $7 trillion in total AI infrastructure spending over the next decade, including 75 GW of new AI data centers, signaling a massive, long-term build-out. | DCD |

| Microsoft | 2025 | Announced plans to invest approximately $80 billion in fiscal year 2025 for AI-enabled data centers, a massive capital commitment to secure computing capacity. | Hanwha Data Centers |

| Google, Intersect Power, TPG Rise Climate | 2024 | Formed a partnership to co-locate gigawatts of new data center capacity with dedicated clean power, targeting $20 billion in renewable assets. | Intersect Power |

| KKR, Energy Capital Partners (ECP) | 2024 | Launched a $50 billion strategic partnership to invest in both data center and power generation capacity to support AI growth. | ESG Today |

| Black Rock, Microsoft, GIP, MGX | 2024 | Launched the AI Infrastructure Partnership with a potential investment scale of $100 billion to build data centers and supporting power infrastructure. | Microsoft News |

| Meta | 2024 | Announced a $10 billion AI-optimized data center in Louisiana, showing direct corporate investment in large-scale, dedicated facilities. | Opportunity Louisiana |

Energy-Tech Alliances: How Strategic Partnerships Are Overcoming AI Power Hurdles

Unprecedented, cross-industry alliances between technology firms, energy producers, and infrastructure investors are now the primary mechanism for de-risking and accelerating the build-out of AI-ready infrastructure. The traditional model of a data center simply buying power from a utility is obsolete, replaced by deep, strategic collaborations to co-develop entire energy and data ecosystems.

- The period between 2021 and 2024 was characterized by partnerships focused on efficiency and components within the data center. For example, Vertiv worked on power management systems to support new liquid cooling technologies. These collaborations were important but remained largely within the existing technology supply chain.

- The paradigm shifted in 2025, with partnerships becoming strategic, large-scale, and cross-sectoral. The agreement between utility giant Next Era Energy and Google Cloud to co-develop gigawatts of capacity exemplifies a tech company integrating directly with a power generator to secure its energy supply chain.

- The most recent alliances demonstrate full ecosystem integration, bringing together the entire value chain. The plan by Chevron, GE Vernova, and Engine No. 1 to deliver 4 GW of power shows energy producers directly targeting the data center market, while the Black Rock-led AI Infrastructure Partnership unites finance, technology, and energy providers under a single strategic umbrella.

Table: Strategic Partnerships Driving AI Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Next Era Energy & Google Cloud | 2025 | A landmark partnership to scale multiple gigawatts of data center and energy capacity, representing deep integration between a hyperscaler and a utility. | Next Era Energy |

| Bloom Energy & Undisclosed Partner | 2025 | A $5 billion agreement to supply solid-oxide fuel cells for primary power to AI data centers, validating on-site generation as a solution to bypass grid constraints. | Hydrogen Insight |

| Chevron, GE Vernova, Engine No. 1 | 2025 | A joint development plan to deliver up to 4 GW of power to U.S. data centers, signaling that energy producers are now developing solutions specifically for the AI market. | Chevron |

| Black Rock, GIP, Microsoft, NVIDIA, x AI, etc. | 2025 | The AI Infrastructure Partnership (AIP) brings together finance, tech, and energy to drive investment in integrated data center and enabling infrastructure. | GIP |

Power Drives Placement: How Grid Availability Now Dictates Data Center Geography

The geographic expansion of AI data centers is no longer dictated by fiber optic routes and tax incentives but by the availability of large-scale, reliable power. This “energy-first” siting strategy is creating new economic hubs in regions with accessible energy infrastructure while threatening to stall growth in traditionally dominant but power-constrained markets.

- Before 2025, data center development was heavily concentrated in areas with robust fiber connectivity, like Northern Virginia. By 2024, however, these legacy markets were already experiencing extreme grid strain, with developers facing multi-year delays for new power connections.

- From 2025 to today, the urgent search for power has forced a geographic diversification into new regions. Amazon’s $3 billion investment in a Mississippi data center campus and Meta’s $10 billion project in Northeast Louisiana signal a strategic migration to states with available land and, critically, accessible power generation capacity.

- This trend is global, as nations now recognize that sovereign compute capability is directly tied to sovereign power security. Canada’s $705 million AI Sovereign Compute Infrastructure Program is an example of a government investing in integrated compute and power to attract development and ensure national competitiveness in the AI era.

Beyond the Grid: Maturing On-Site Power Tech Becomes Critical for AI Growth

The urgent need for reliable, 24/7 power is accelerating the commercialization of on-site and alternative generation technologies, moving them from niche backup applications to essential, primary components of AI infrastructure. As grid constraints become a primary business risk, technologies that offer energy independence are seeing rapid validation and adoption.

Solar and Storage Will Power Future Data Centers

This chart illustrates the shift ‘beyond the grid’ by showing which on-site and alternative technologies, like solar and battery storage, are expected to power future data centers.

- Between 2021 and 2024, the primary technological response to rising power consumption was improving efficiency inside the data center, most notably through the shift to liquid cooling. On-site generation technologies like hydrogen fuel cells, heavily promoted by firms such as Plug Power, were largely considered solutions for backup power or future deployment.

- From 2025 onward, the technology focus has expanded from the server rack to the power source itself. Bloom Energy’s $5 billion partnership to supply its fuel cells for primary AI data center power marks a major commercial validation of on-site generation as a viable strategy to bypass grid constraints today.

- The industry dialogue has matured from simply adding intermittent renewables to securing firm, carbon-free baseload power. While Small Modular Reactors (SMRs) remain a long-term goal for the 2030 s, the immediate commercial activity around fuel cells and strategic explorations of nuclear and geothermal by firms like Equinix show the industry is actively building a technological bridge to a future that is less dependent on the public grid.

SWOT Analysis: Navigating the Risks and Opportunities of AI’s Power Demand

The analysis reveals a market defined by immense growth opportunities fueled by unprecedented capital inflows, but severely constrained by aging and insufficient power infrastructure. The primary threat from grid instability and energy scarcity is being countered by strategic opportunities to create a new class of integrated energy and data assets.

Grid Supply Fails to Keep Pace With Demand

This chart visually represents the central tension of the SWOT analysis, quantifying the ‘threat’ of insufficient power infrastructure struggling to meet rising demand.

(Source: Deloitte)

- Strengths: An unparalleled wave of investment from technology companies, infrastructure funds, and energy producers is creating a multi-trillion-dollar supercycle.

- Weaknesses: The existing electrical grid is unprepared for the speed and scale of AI-driven demand, creating bottlenecks that delay projects and cap growth.

- Opportunities: The crisis is forcing the creation of new, highly efficient, and integrated infrastructure models, such as co-located data and power parks, that represent a generational investment opportunity.

- Threats: Unchecked demand in constrained areas could lead to systemic energy scarcity and significant electricity price hikes for all consumers, creating regulatory and social backlash.

Table: SWOT Analysis for AI Data Center Infrastructure

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Growing recognition of AI’s value led to large, company-specific capex announcements from hyperscalers like Meta. | Unprecedented capital mobilization into dedicated cross-sector funds from Black Rock, KKR, and others targeting the power-data convergence. | The market validated that the challenge requires systemic, not just corporate, investment. Capital shifted from funding projects to funding entire ecosystems. |

| Weaknesses | Grid interconnection queues and high power densities were identified as emerging, theoretical bottlenecks for future growth. | Grid constraints became a tangible, immediate reality, overwhelming utility forecasts and forcing developers to abandon or delay projects in primary markets. | The weakness moved from a projected risk to an active, primary constraint on commercial expansion, making power the number one siting factor. |

| Opportunities | The opportunity was seen in component-level efficiencies, primarily the shift from air to liquid cooling to manage higher rack densities. | The opportunity is now the creation of a new, integrated asset class, exemplified by partnerships like Google and Intersect Power building co-located data and energy parks. | The market opportunity scaled from improving existing data centers to building entirely new, self-powered infrastructure models from the ground up. |

| Threats | The primary threat was the rising carbon footprint and operational cost (PUE) of data centers, an internal industry concern. | The threat became systemic energy scarcity and price volatility, with wholesale electricity costs up 267% near data center clusters, impacting all consumers. | The threat broadened from an environmental and operational issue to a socioeconomic and political one, pitting AI’s growth against public energy stability. |

2026 Outlook: The Year of the Integrated Power-Data Asset

In 2026, the success of AI deployments will be measured not by model performance alone, but by the ability to secure and control the underlying power infrastructure, making integrated power-data assets the most critical strategic priority. The ability to execute on this new infrastructure paradigm will separate the leaders from the laggards in the AI race.

- If this happens: If utilities and regulators cannot dramatically accelerate grid upgrade and interconnection timelines to meet the 30 x demand surge projected by Deloitte…

- Watch this: Watch for an acceleration of technology companies directly funding, acquiring, or co-developing energy assets to achieve supply certainty, moving far beyond traditional power purchase agreements.

- These could be happening: This shift is already underway. The formation of the Black Rock-led AI Infrastructure Partnership is a direct market response to this bottleneck. Bloom Energy’s $5 billion fuel cell deal confirms companies will pay a premium to bypass the grid. The geographic diversification into states like Mississippi and Louisiana confirms developers are actively fleeing constrained grids. The next signal to watch for is the first large-scale data center powered primarily by a dedicated, advanced energy source like an SMR or geothermal plant, which will mark the maturation of this converged infrastructure model.

Frequently Asked Questions

Why can’t AI data centers just buy more power from the existing electrical grid?

The existing electrical grid is the primary bottleneck for AI expansion. According to the article, the grid is unprepared for the speed and scale of AI-driven demand, leading to connection lead times of one to two years and multi-year project delays. This unreliability and lack of capacity has made relying on public grids an immediate commercial risk, forcing companies to seek alternative power solutions.

What does the ‘convergence of power and data infrastructure’ mean?

It means that the strategy for building AI infrastructure has shifted to treating data centers and their power sources as a single, inseparable asset. Instead of building a data center and then buying power from a utility, companies are now co-developing data centers with dedicated, on-site, or nearby power generation facilities. This integrated approach is designed to bypass grid limitations and secure a reliable energy supply.

How is this massive infrastructure build-out being funded?

A ‘generational wave of capital’ is being deployed through massive, dedicated funds and strategic partnerships. The article highlights several multi-billion-dollar examples, including a potential $100 billion AI Infrastructure Partnership led by BlackRock and Microsoft, a $50 billion fund from KKR and Energy Capital Partners, and direct corporate spending, such as Microsoft’s planned $80 billion investment for AI-enabled data centers in fiscal year 2025.

Are data centers moving to new locations because of these power issues?

Yes. The article states that ‘energy-first’ siting is forcing a geographic diversification away from traditionally dominant but power-constrained markets like Northern Virginia. Companies are now building major data center campuses in regions with more accessible power, citing Amazon’s $3 billion investment in Mississippi and Meta’s $10 billion project in Northeast Louisiana as key examples of this strategic migration.

What alternative technologies are being used to power AI data centers besides the grid?

On-site power generation technologies are moving from niche backup applications to primary power sources. The article specifically highlights a $5 billion agreement for Bloom Energy to supply its solid-oxide fuel cells as a primary power source for AI data centers, validating this as a commercially viable way to bypass the grid. While Small Modular Reactors (SMRs) and geothermal are seen as future solutions, fuel cells are an immediate technology being adopted.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.