Data Center Power Crisis 2026: Why On-Site Generation Is Fueling the AI Boom

Projects Pivot to Private Power: How Grid Constraints Reshaped Data Center Development

The dominant strategy for data center development has fundamentally shifted from securing land in proximity to fiber hubs to acquiring locations with accessible, scalable power, forcing developers to become energy producers. Prior to 2025, the industry model relied on connecting to the public utility grid in established markets, but the explosive energy demand from AI has made this approach untenable due to multi-year interconnection queues and grid capacity shortfalls. This has triggered a strategic pivot to building on-site power generation, primarily using natural gas, to ensure the speed-to-market and power certainty required to support gigawatt-scale AI infrastructure.

- Before 2025, data center growth was concentrated in primary markets like Northern Virginia, which expanded by relying on grid operator Dominion Energy. The model was incremental expansion based on available utility capacity.

- Starting in 2025, hyperscalers and developers began launching massive projects with integrated power generation to bypass grid limitations. Meta initiated plans for a 2 GW data center in Louisiana supported by its own procurement of 1.5 GW of solar and natural gas power, exemplifying a move toward energy self-sufficiency.

- This trend is validated by large-scale projects designed to function as self-contained systems. In Pennsylvania, a plan emerged to build 4, 500 MW of gas-fired power on the site of a former coal plant specifically for data centers, while in Texas, developers are building dedicated gas plants, with one project planning 1, 200 MW of generation.

- Analysis from Cleanview Research confirms this strategic direction, identifying 46 data centers with a planned capacity of 56 GW that intend to build their own on-site power, with nearly 75% of this capacity being natural gas.

AI Fuels Explosive Energy Demand

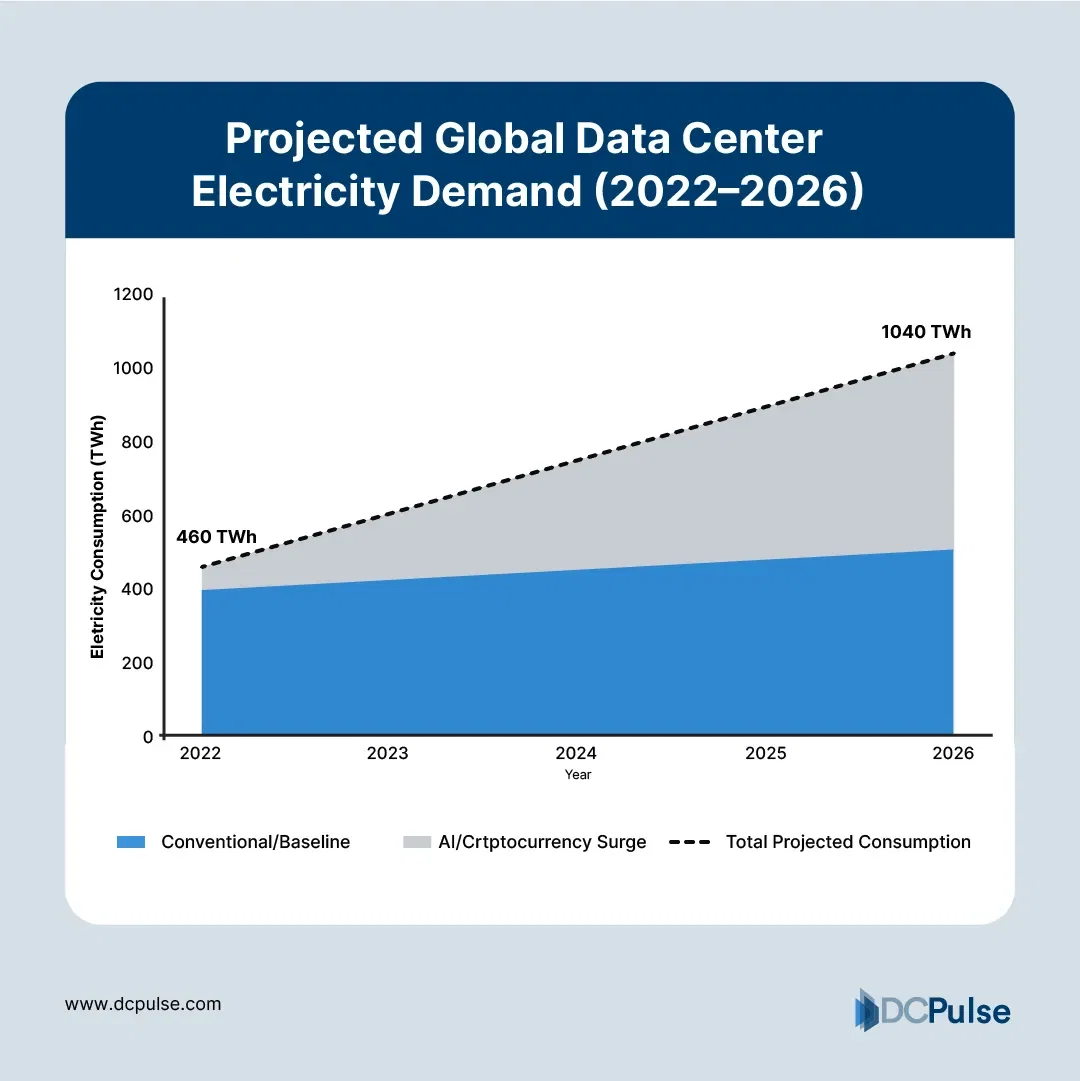

This chart shows the explosive growth in data center electricity demand, driven by AI, which is the core problem forcing the industry to pivot away from the public grid.

(Source: Voronoi)

Geographic Expansion: How the Hunt for Power Is Creating New Data Center Frontiers

The geographic expansion of data centers is now dictated almost entirely by energy availability, pushing development away from saturated primary markets into new regions in the U.S. and Canada that offer abundant power, available land, and favorable regulatory environments. While hubs like Northern Virginia continue to grow, their severe power constraints have redirected the most significant new investments toward secondary markets where gigawatt-scale energy infrastructure can be co-developed with data center campuses.

Americas to Lead Data Center Growth

This forecast highlights the Americas as the fastest-growing region for data center power demand, visually supporting the section’s focus on geographic expansion into new U.S. and Canadian frontiers.

(Source: The World Property Journal)

- Between 2021 and 2024, growth was centered in established markets like Northern Virginia, Phoenix, Dallas, and Silicon Valley. These locations offered robust fiber connectivity but began to face significant power grid limitations and rising land costs.

- The period from 2025 to today marks a clear migration to “energy-rich” regions. Projects like the proposed 1, 800 MW Tallgrass data center in Cheyenne, Wyoming, which includes its own gas-fired power, highlight a strategy of moving to the energy source.

- Midwestern states have become prime targets for expansion due to their robust power grids and development potential. Microsoft is building a 900 MW AI facility in Wisconsin and a $1 billion, 538 MW data center in La Porte, Indiana, signaling a strategic move into regions with more accessible power.

- Canada has emerged as a leading global market, with over 12 GW of tracked capacity. Southern Ontario, in particular, saw $14 billion in data center construction starts in 2025 and has 1.2 GW of capacity under development, a 400% year-over-year increase driven by its energy advantages.

Technology Maturity: Natural Gas as the Bridge to Next-Generation Data Center Power

The technology enabling the AI data center boom is a mix of mature, commercially available solutions and forward-looking, developing systems, with natural gas generation serving as the critical bridge technology. While data center IT hardware is mature (TRL 9), the supporting power infrastructure has become the main area of innovation. The urgent need for reliable, gigawatt-scale power has forced the adoption of on-site gas turbines (TRL 9 for this application) as the only viable near-term solution, while companies simultaneously invest in next-generation technologies like small modular reactors (SMRs) that are not yet commercially proven.

Planned Gas Power Capacity Surges

This chart directly validates the section’s thesis by showing the dramatic increase in planned natural gas generation, the critical bridge technology for powering new data centers.

(Source: Energy Industry Insights from Avanza Energy – Substack)

- The 2021-2024 period focused on optimizing grid-powered facilities, with innovation centered on improving Power Usage Effectiveness (PUE) and deploying standard diesel generators for backup power. The primary power source was assumed to be the public grid.

- From 2025 onward, the industry shifted to deploying on-site natural gas power plants as a primary energy source to overcome grid delays. According to projections, by 2030, an estimated 27% of all data center facilities will be fully powered by on-site generation to address a projected 35 GW grid energy gap.

- Hyperscalers are de-risking future operations by pursuing a dual strategy. While building gas plants for immediate needs, companies like Microsoft and Meta are signing offtake agreements and engaging with developers for SMRs, a technology still in the pilot and regulatory approval stage (TRL 6-8), to secure a long-term, carbon-free power source for future campuses.

SWOT Analysis: On-Site Power Generation for AI Data Centers

The strategic imperative to build on-site power generation provides data center developers with unprecedented control over their growth trajectory but simultaneously exposes them to new financial, operational, and regulatory risks associated with energy production. This pivot trades the known constraints of public grid dependency for the complexities of becoming a private power producer. The ability to manage these new risks will determine competitive advantage in the AI infrastructure race.

AI Drives Unprecedented Data Center Investment

This chart visualizes the massive spike in capital investment, contextualizing the high-stakes financial risks and strategic importance of the pivot to on-site power discussed in the SWOT analysis.

(Source: Bloomberg.com)

Table: SWOT Analysis for Data Center On-Site Power Generation Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Capital efficiency by leveraging existing utility grids. Focus on core competency of data center operations. | Speed-to-market by bypassing multi-year grid interconnection queues. Power certainty and operational control. | The market validated that power certainty is more valuable than capital efficiency. Hyperscalers like Meta and Microsoft are now developing integrated energy and data campuses. |

| Weaknesses | Vulnerability to utility power constraints, moratoriums, and escalating energy costs in primary markets. | Higher upfront capital expenditure for power generation assets. New operational complexity of managing fuel supply and power plant operations. | The primary weakness shifted from external dependency on grids to internal financial and operational risk. A data center can sell capacity for $10 billion to $12 billion per gigawatt, justifying the added risk. |

| Opportunities | Incremental expansion in established, network-dense markets like Northern Virginia and Silicon Valley. | Unlocking new geographic frontiers (e.g., Wyoming, Indiana, Canada) with abundant energy. Creation of massive, self-sufficient “AI Factories.” | The opportunity expanded from leasing space to developing entire infrastructure ecosystems, as seen with the Crusoe 1.2 GW campus in Texas. |

| Threats | Grid capacity shortfalls and development moratoriums in top-tier markets stalling projects. | Permitting delays for new gas power plants. Environmental regulations targeting fossil fuels. Social license challenges for new energy projects. | Regulatory risk shifted from the utility level to the developer level. Developers now face direct exposure to energy policy and environmental activism. |

Scenario Modeling: The Critical Path for AI-Driven Data Center Growth

The future trajectory of data center expansion now depends entirely on the successful execution of private power generation projects; if developers can consistently permit, build, and operate their own energy infrastructure, the AI boom will accelerate into new regions, completely untethered from the constraints of the public grid.

AI Data Center Market to Surge 10x

This long-term market projection quantifies the potential of a successful private power strategy, showing a near 10x surge that illustrates the ‘AI boom acceleration’ scenario.

(Source: Yahoo Finance)

- If this happens: Developers successfully bring the first wave of large-scale, on-site natural gas plants online within projected timelines, such as the planned 4, 500 MW project in Pennsylvania or the multi-gigawatt campuses in Texas and Louisiana. This success would create a repeatable playbook for future developments.

- Watch this: Monitor the permitting process and any public opposition for new gas power plants dedicated to data centers. Also, track whether hyperscalers like Meta and Microsoft convert their interest in SMRs into firm, binding contracts, which would signal the next technological shift in data center power.

- These could be happening: A rapid acceleration of data center construction in states with favorable natural gas resources and streamlined energy regulations. A market bifurcation emerges, with hyperscalers capable of funding their own power dominating growth, while smaller operators remain bottlenecked by the public grid.

Frequently Asked Questions

Why are data centers suddenly building their own power plants instead of using the public grid?

The primary reason is the explosive energy demand from AI, which has overwhelmed public utility grids. Data center developers face multi-year interconnection queues and grid capacity shortfalls. Building on-site power, primarily with natural gas, allows them to bypass these delays, ensuring the speed-to-market and power certainty required for new gigawatt-scale AI infrastructure.

What type of fuel are these on-site power plants using?

The dominant fuel source for this new on-site generation is natural gas. According to Cleanview Research, nearly 75% of the planned 56 GW of self-generated data center capacity will be powered by natural gas. It is considered a ‘bridge technology’ to meet immediate power needs, while companies also explore future carbon-free options like Small Modular Reactors (SMRs).

Where are these new, self-powered data centers being built?

Developers are moving away from traditional, power-constrained markets like Northern Virginia and into new ‘energy-rich’ regions. The article highlights new frontiers such as Wyoming (Tallgrass 1,800 MW project), Indiana (Microsoft 538 MW project), Pennsylvania (4,500 MW planned), Texas, and Canada, which has emerged as a leading market with over 12 GW of tracked capacity.

What are the main risks of this new strategy for data center developers?

While building on-site power provides control and speed, it introduces new risks. These include much higher upfront capital expenditure, the operational complexity of managing power plants and fuel supplies, and new regulatory threats. Developers now face direct exposure to permitting delays for power plants, environmental regulations targeting fossil fuels, and potential social license challenges.

When did this major shift in data center strategy occur?

The article identifies 2025 as the pivotal year. Prior to 2025, the industry model was incremental expansion based on available utility capacity in established markets. Starting in 2025, the strategy fundamentally shifted, with hyperscalers and developers beginning to launch massive projects with integrated power generation to bypass grid limitations and support the AI boom.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.