Grid Constraint & Hyperscaler Response 2026: How Big Tech Is Funding a Parallel Power System

From Passive Consumer to Active Builder: Hyperscaler Energy Procurement Shifts in 2026

To secure power for AI growth, hyperscalers have fundamentally shifted their strategy from passive energy consumers to active infrastructure developers, directly funding and co-developing energy ecosystems to bypass public grid constraints. This move marks a definitive break from their prior reliance on traditional procurement instruments, signaling that power availability, not capital, is now the primary constraint on expansion.

- Between 2021 and 2024, the dominant strategy was securing renewable energy through Power Purchase Agreements (PPAs). This approach, while effective for achieving carbon-neutrality goals, treated the grid as an external service provider and did not solve the physical bottlenecks of transmission capacity and interconnection queues.

- The strategic inflection point occurred in late 2024 and 2025, as hyperscalers began directly financing generation. The most significant signal was the December 2024 partnership between Google, Intersect Power, and TPG Rise Climate, which aims to catalyze $20 billion in investment to co-locate new data centers with dedicated clean power generation, a model designed to collapse development timelines.

- Where grid connections are unavailable, operators are now deploying on-site power at scale. In February 2025, Vantage Data Centers partnered with Volta Grid to deploy over one gigawatt of generation capacity. This tactic is a direct response to the finding that 62% of data centers are power-constrained.

- This trend culminated in a shift from long-term contracts to direct asset control. Google’s acquisition of Intersect Power in December 2025 demonstrates a strategic decision to own and control generation assets, providing a level of supply security that PPAs cannot guarantee.

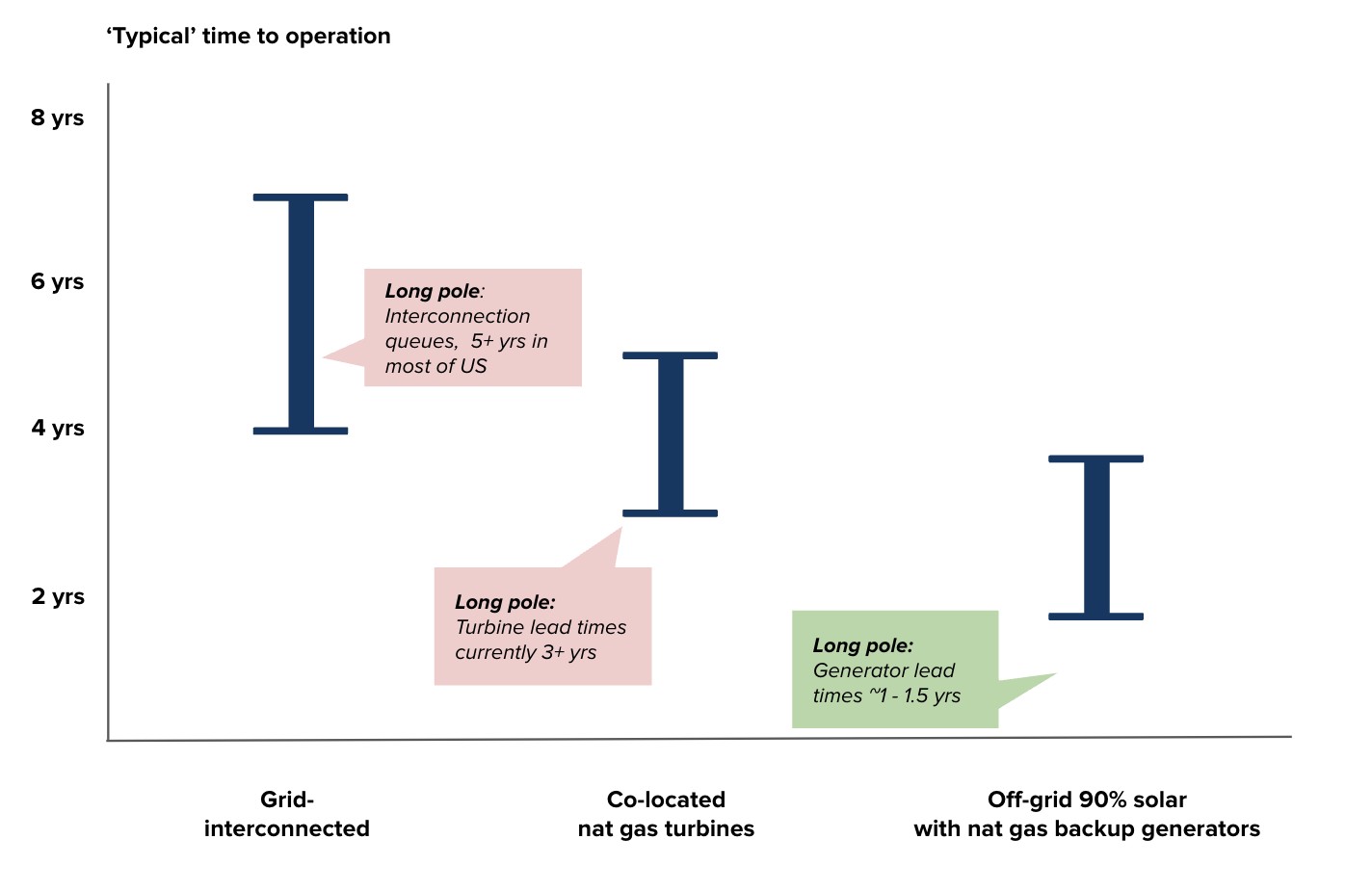

On-Site Power Bypasses Grid Delays

This chart illustrates the primary driver for the strategic shift, showing that on-site power solutions can be deployed in 2-5 years, bypassing grid interconnection queues that delay projects for 4-7+ years.

(Source: North American Clean Energy)

Capital as a Weapon: Tracing the Multi-Billion Dollar Investments in Hyperscaler Power Infrastructure

Since 2024, capital deployment has aggressively shifted from buying energy credits to directly financing the entire power value chain, attracting billions from private equity and creating a new infrastructure asset class at the intersection of AI and energy. This wave of private investment is now outpacing the planned spend of traditional utilities for data center support, fundamentally reshaping how critical energy infrastructure is funded and built.

Soaring Demand Drives Capital Investment

This chart quantifies the immense power requirements driving the multi-billion dollar investments, projecting U.S. data center demand will surpass 30 gigawatts by 2028.

(Source: Data Center Knowledge)

- The scale of direct investment is demonstrated by the Google-led partnership with Intersect Power and TPG Rise Climate, which is designed to channel $20 billion into new co-located data center and power projects. This model makes the data center the anchor client for entirely new generation facilities.

- Private equity has mobilized to capitalize on this trend. In October 2024, KKR and Energy Capital Partners (ECP) launched a strategic partnership targeting $50 billion of investment to build both data centers and the power generation required to support them.

- This investment is reflected in hyperscaler capital expenditures, which Morgan Stanley projected to reach $300 billion in 2025. A significant and growing portion of this spending is allocated to securing power, upgrading grid connections, and building on-site generation.

- The scale of this private-led investment dwarfs the public utility response. Goldman Sachs projected that U.S. utilities would need to invest $50 billion in new generation to support data centers, an amount now being matched or exceeded by single private equity partnerships targeting the sector.

Table: Key Investments in Hyperscaler-Driven Power Infrastructure (2024-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vantage Data Centers / Volta Grid | Feb 2025 | Partnership to deploy over 1 GW of on-site power generation capacity using natural gas and renewable natural gas. This strategy bypasses grid capacity bottlenecks for faster deployment. | Vantage Data Centers |

| Google / Intersect Power / TPG Rise Climate | Dec 2024 | A partnership to catalyze $20 billion in investment for co-locating data centers with new clean energy generation. The “power first” model aims to drastically reduce delivery timelines. | Intersect Power |

| KKR / Energy Capital Partners (ECP) | Oct 2024 | A strategic partnership targeting $50 billion of investment to build both data center and power generation capacity. It establishes a new asset class for private equity at the nexus of AI and energy. | ESG Today |

| Microsoft in Germany | Feb 2024 | Announced a €3.2 billion ($3.4 billion) investment to double its AI and cloud infrastructure in Germany. This expansion necessitates significant new power procurement and grid capacity. | Data Center Knowledge |

Strategic Alliances: How Hyperscalers and Utilities are Partnering to Modernize the Grid

Recognizing they cannot completely disconnect from the public grid, hyperscalers are forming deep technical alliances with utilities and grid operators to inject AI-driven intelligence into system operations, transforming their data centers from inflexible loads into active, stabilizing grid assets.

Visualizing the Modernized, Integrated Grid

This diagram directly illustrates the partnerships described, showing how data centers integrate with renewables and storage to act as a stabilizing asset for a modernized grid.

(Source: Nature)

- Microsoft is leading the integration of AI into grid management through partnerships with both MISO and PJM Interconnection, announced in January 2026. These collaborations use Microsoft’s cloud and AI platform to create unified data systems for modernizing grid planning and operations.

- Google is investing directly in physical grid upgrades. Its June 2025 collaboration with CTC Global aims to deploy advanced high-performance conductors across the U.S. grid, a technology that increases the capacity of existing transmission lines without requiring new right-of-ways.

- In February 2026, Energy Vault and Peak Energy announced a strategic agreement to develop a sodium-ion storage solution for AI data centers. The deal includes a 1.5 GWh supply agreement, signaling that hyperscalers are now driving technology development for critical enabling components like battery storage.

- Utilities are actively seeking these collaborations to manage the influx of new demand. The February 2026 partnership between Xcel Energy and GE Vernova focuses on using AI and joint R&D to manage the addition of large data center loads to the grid.

Table: Key Hyperscaler and Utility Grid Modernization Partnerships (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Energy Vault / Peak Energy | Feb 2026 | Strategic development agreement for a 1.5 GWh sodium-ion battery storage solution tailored for AI data centers. This partnership aims to accelerate deployment and reduce costs for on-site storage. | Morningstar |

| Xcel Energy / GE Vernova | Feb 2026 | Partnership focused on joint work in AI, grid modernization, and R&D to manage the rapid addition of large loads like data centers. It highlights the utility need for advanced technology to handle demand growth. | Power Engineering |

| Microsoft / MISO & PJM | Jan 2026 | Partnerships to use Microsoft’s cloud and AI to build unified data platforms for the grid operators. This initiative aims to transform grid planning and operations to handle increased demand from data centers. | ESG Today |

| Google / CTC Global | Jun 2025 | Collaboration to deploy advanced conductor technology across the U.S. power grid. This investment in physical infrastructure aims to increase the capacity of existing transmission assets. | DCD |

Geographic Hotspots: Where Hyperscaler Power Demand is Straining U.S. Grids

While data center growth was once geographically diffuse, acute power constraints are now forcing development into specific regions where generation and transmission capacity can be secured, making the U.S. Midwest, East, and Texas the primary arenas where the battle for gigawatts is being fought.

Texas Grid Overwhelmed by Demand

As a prime example of a geographic hotspot under strain, this chart shows new power requests in Texas overwhelming the grid’s capacity to approve them in 2025.

(Source: SemiAnalysis)

- Between 2021 and 2024, development was concentrated in established markets like Northern Virginia, but signs of strain were already emerging in secondary markets. A CBRE report noted that by mid-2024, significant development in Columbus, Ohio had already led to power availability constraints, foreshadowing the wider crisis.

- From 2025 onward, the PJM Interconnection, serving the U.S. East and Midwest, became a critical hotspot. The grid operator warned it could face a power shortfall of up to 60 GW within a decade, driven significantly by data center load. This is the region where Microsoft is partnering with PJM and Google established a demand response agreement with Indiana Michigan Power.

- Texas, operating under ERCOT, has emerged as another key region of grid stress. Charts from 2025 show that new large load requests, primarily from data centers and crypto mining, are far exceeding the grid’s capacity to approve new connections, making it a prime market for on-site generation.

- Although this is a global challenge, evidenced by Microsoft’s €3.2 billion investment in Germany, the most aggressive and systematic strategic responses are concentrated in the U.S., where the densest clusters of AI compute demand are colliding with the most severe grid limitations.

From PPA to Private Grid: The Maturing Technology Stack for Hyperscaler Energy Supply

Hyperscaler energy strategies have rapidly matured from simply procuring renewable energy credits to deploying a sophisticated and integrated portfolio of hardware and software, including on-site generation, grid-interactive controls, and advanced grid components, to guarantee energy supply.

The Technical Trade-Offs for Private Grids

This chart details a key technical aspect of the maturing energy stack, showing the significant redundancy overbuild required for the on-site generation that enables a private grid.

(Source: SemiAnalysis)

- During the 2021-2024 period, the primary procurement technology was the Power Purchase Agreement (PPA). This mature financial instrument allowed companies to buy renewable energy from off-site projects but proved insufficient for solving physical grid constraints like transmission congestion and intermittency.

- Since 2025, the technology stack has broadened to include on-site generation at commercial scale. The partnership between Vantage Data Centers and Volta Grid to deploy over 1 GW of dispatchable power validates this approach as a mainstream solution, while exploration of Small Modular Reactors (SMRs) indicates R&D is also being driven by this demand.

- Demand response and load-shifting software has transitioned from pilot programs to a core strategic tool. Google’s use of machine learning to shift non-urgent workloads and its formal demand response agreement with Indiana Michigan Power confirm this technology is now commercially deployed to add flexibility to the grid.

- Hyperscalers are now also investing in the physical grid itself. Google’s partnership with CTC Global to deploy advanced conductors represents a shift toward funding the deployment of mature hardware technologies that can increase the efficiency of the public grid.

SWOT Analysis: Hyperscaler Strategies for Navigating the Energy Crisis

Hyperscalers are effectively using their immense capital and technical expertise as a primary strength to overcome the existential threat of grid constraints, creating an opportunity to lead in grid modernization but also introducing new weaknesses related to infrastructure project execution and the risk of creating a two-tiered energy system.

Grid Transmission Deficits A Key Threat

This chart quantifies the core ‘threat’ in the SWOT analysis, showing the gigawatt-scale transmission shortfalls across major U.S. regions that hyperscaler strategies are designed to overcome.

(Source: Deloitte)

- Strengths: Access to vast capital and world-class technical expertise allows hyperscalers to fund and deploy energy solutions faster than traditional utilities.

- Weaknesses: By moving into direct infrastructure development, hyperscalers expose themselves to new risks, including construction timelines, supply chain delays for energy hardware, and the operational complexities of running power systems.

- Opportunities: Their investments can accelerate the commercialization of new energy technologies like advanced batteries and SMRs, drive down costs, and create a more flexible and modern grid.

- Threats: The primary threat remains the physical limitations of the grid, including a projected 60 GW shortfall in the PJM territory, long interconnection queues, and critical shortages of components like power transformers.

Table: SWOT Analysis for Hyperscaler Grid Response Strategies

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Financial strength to sign large, long-term PPAs for renewable energy. Technical expertise in software and data analysis. | Massive capital deployment ($20 B+ partnerships) to fund entire energy ecosystems. Using AI for grid management (Microsoft/MISO partnership). | The application of strength shifted from buying energy as a commodity to building energy as an integrated system. Capital became a tool for infrastructure development, not just procurement. |

| Weaknesses | Inflexible, 24/7 power demand profiles that strained local grids. Dependence on utility timelines for new connections. | Exposure to complex infrastructure project management and supply chains (e.g., transformers). Risk of public backlash over creating a private, high-reliability grid. | The weakness shifted from being a problematic customer to being an infrastructure developer. While gaining control, companies inherited the risks of physical asset construction and operation. |

| Opportunities | Achieve corporate sustainability goals through renewable energy procurement. Pilot early-stage demand response programs. | Accelerate grid modernization (Google/CTC Global). Drive down costs of enabling technologies (Energy Vault BESS deal). Shape energy markets and become integrated energy players. | The opportunity matured from passive participation to active market creation. Hyperscalers validated their ability to drive technology adoption and infrastructure build-out at scale. |

| Threats | Rising electricity costs and early signs of grid congestion in mature data center markets like Northern Virginia. | Existential threat of grid shortfalls (PJM’s 60 GW warning). Power availability becoming the primary blocker to AI growth. Long interconnection queues delaying projects by years. | The threat evolved from a manageable operational risk to a strategic crisis. This change was the primary catalyst forcing the shift from PPAs to direct investment and on-site generation. |

2026 Outlook: The Rise of the Tech-Energy Conglomerate

The most critical trajectory for 2026 is the formalization of hyperscalers as integrated tech-energy companies, a trend that will see them move beyond partnerships to direct ownership and operation of power generation assets, fundamentally reshaping the architecture of the 21 st-century power grid.

Long-Term Forecast Drives Conglomerate Strategy

This long-term forecast provides the rationale for the 2026 outlook, showing that surging data center power demand could account for over 9% of all U.S. electricity use by 2030.

(Source: POWER Magazine)

- If this happens, expect to see hyperscalers not only funding new power plants but also acquiring existing generation assets to secure immediate capacity, following the strategic precedent set by Google’s acquisition of Intersect Power.

- Watch this for further validation: the announcement of new multi-billion-dollar private equity funds, backed by institutional investors, that are explicitly dedicated to the “AI infrastructure” asset class, mirroring the KKR and ECP partnership.

- This could be happening behind the scenes: utilities and regulators are likely developing new frameworks, such as dedicated tariffs or special economic zones, to accommodate and integrate these private “hypergrids” to prevent the stranding of public grid assets and ensure equitable cost allocation.

- What is gaining traction is the on-site generation model. The Vantage Data Centers and Volta Grid deal for over 1 GW of power is a definitive signal that bypassing the grid is now a scalable, commercial strategy for large-scale deployments.

- What is losing steam is the reliance on unbundled, standalone PPAs as the primary energy strategy. This model has been proven insufficient to solve the physical constraints of the grid, forcing the market toward more integrated and capital-intensive solutions.

Frequently Asked Questions

Why are tech companies like Google and Microsoft building their own power infrastructure instead of just buying clean energy?

The primary reason is that public power grids cannot expand fast enough to meet the explosive energy demand from AI. Tech companies are facing major roadblocks like limited transmission capacity and multi-year delays in grid connection queues. By directly funding and building power generation, they can bypass these public grid constraints and ensure a reliable power supply for their data centers, making power availability, not capital, the main focus.

What is the difference between the old PPA strategy and the new direct investment model?

The old strategy relied on Power Purchase Agreements (PPAs), which are financial contracts to buy renewable energy from off-site projects. This helped companies meet carbon goals but did not solve the physical problem of delivering power through a congested grid. The new model involves directly funding, co-developing, or even owning the power generation assets, often located next to the data centers. This gives hyperscalers control over the physical power supply, guaranteeing availability and speed of deployment.

How are private equity firms involved in this trend?

Private equity has identified this intersection of AI and energy as a major new infrastructure asset class. Firms like KKR, Energy Capital Partners (ECP), and TPG Rise Climate are forming multi-billion-dollar partnerships to fund the construction of both data centers and the dedicated power generation required to support them. Their capital is crucial for building these new, private energy ecosystems at the necessary scale and speed.

Are these hyperscalers completely disconnecting from the public grid?

No, they are pursuing a dual strategy. While building parallel power systems to ensure supply, they are also forming deep technical alliances with utilities and grid operators like PJM and MISO. They are using their AI expertise to help modernize grid management and investing in physical upgrades, such as advanced conductors, to increase the capacity of the existing public grid. This transforms their data centers from simple power consumers into active, stabilizing grid assets.

What specific technologies are part of this new ‘hyperscaler energy stack’?

The technology stack has moved beyond PPAs to include a range of physical hardware and software. Key components include: 1) On-site, dispatchable power generation (like the 1 GW natural gas project by Vantage/Volta Grid); 2) Large-scale battery storage solutions (like the 1.5 GWh sodium-ion battery deal between Energy Vault and Peak Energy); and 3) Advanced grid hardware to improve public infrastructure (like Google’s investment in advanced conductors from CTC Global).

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.