Data Center Power Crisis 2026: Why Grid Scarcity is the Definitive Supply Chain Bottleneck

Grid Constraints Become the Primary Risk to Data Center Projects in 2026

The primary risk to data center development has decisively shifted from managing IT hardware lead times to securing fundamental access to power, a structural constraint that now dictates project viability and timelines into 2026. This evolution marks a significant change from the preceding years, where component availability was the central concern.

- Between 2021 and 2024, the dominant supply chain challenge was the extended lead times for IT hardware. As of 2022, delivery times for critical components like servers, routers, and switches ballooned to as long as 52 weeks, a direct consequence of pandemic-era manufacturing and logistics disruptions.

- From 2025 onward, the bottleneck has migrated from the server rack to the substation. The focus is now on systemic grid failures, with U.S. interconnection queues delaying projects for years and utility providers warning of regional capacity shortages as early as 2026. Power availability is now officially the primary constraint to new construction.

- This shift is driven by the unanticipated, exponential energy demand from AI workloads. While IT hardware supply chains can scale production within 12-24 months, upgrading national power grids and manufacturing heavy electrical equipment like high-voltage transformers involves multi-year, and in some cases, decadal timelines.

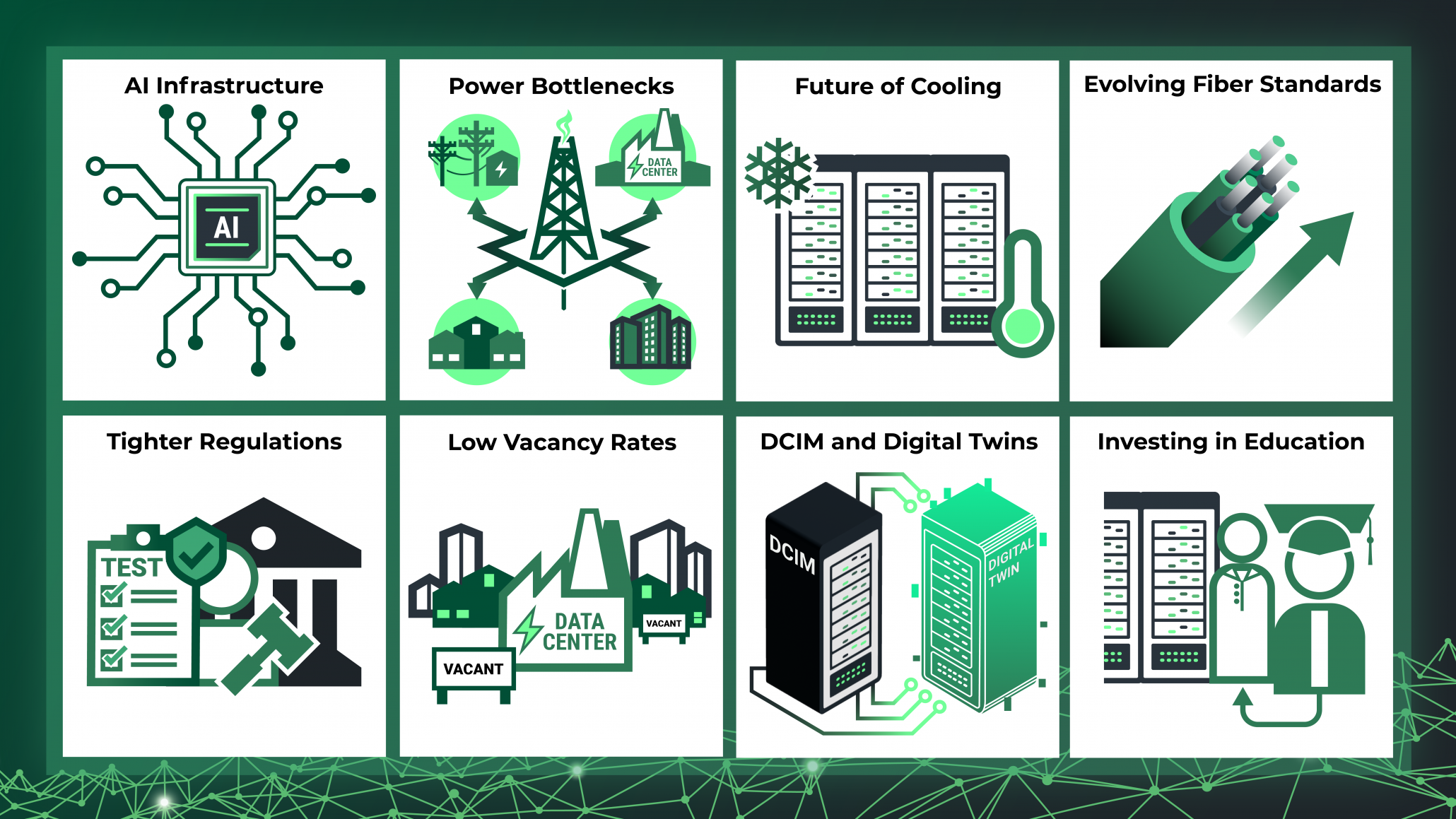

Power Bottlenecks are a Key 2026 Trend

The chart directly supports the section’s heading by identifying ‘Power Bottlenecks’ as a major trend for 2026, the exact year and topic discussed in the text.

(Source: Land Values Insider – Acres)

Strategic Capital Shifts to Secure Power Generation for Data Centers

Investment strategies within the data center sector are undergoing a fundamental transformation, with significant capital now being allocated to directly secure or develop power generation assets to circumvent public grid constraints. This move reflects a strategic acceptance that relying on existing utility infrastructure is no longer a viable path for rapid growth.

- Hyperscale operators are now making multi-billion dollar commitments to energy infrastructure. The most significant example is the partnership between Google, Intersect Power, and TPG, which will invest $20 billion in new clean energy projects specifically to power future data centers, establishing a model for captive power generation.

- Financial forecasts quantify the scale of this energy-driven spending. Goldman Sachs projects a 15% compound annual growth rate in U.S. data center power demand through 2030, with data centers consuming 8% of all U.S. electricity by that year. This demand surge is a primary factor behind the projected growth in data center capex to $377 billion by 2026.

- Gartner’s prediction that power shortages will operationally constrain 40% of AI data centers by 2027 validates these aggressive investment strategies. The risk has moved beyond construction delays to include the potential for operational curtailments, making direct control over power supply a critical tool for ensuring uptime and service delivery.

Table: Key Investments and Financial Forecasts Highlighting the Pivot to Energy

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google, Intersect Power, TPG | December 2024 | Announced a $20 billion investment to develop new clean energy projects. The strategic purpose is to create a dedicated power supply for future data center growth, bypassing constrained public grids. | ESG Today |

| Goldman Sachs Forecast | April 2024 | Forecasts that U.S. data center power demand will grow at a 15% CAGR through 2030, reaching 8% of total U.S. power consumption. This frames the immense scale of new energy infrastructure required. | Goldman Sachs |

| Gartner Prediction | November 2024 | Predicts that by 2027, 40% of AI data centers will face operational constraints due to power availability shortages. This highlights the shift from a construction problem to an operational risk. | Gartner |

| Dell’Oro Group Forecast | August 2022 | Projected worldwide data center capex to reach $377 billion by 2026, driven by accelerated computing adoption. This spending is increasingly tied to securing the power and cooling infrastructure for these systems. | Dell’Oro Group |

Partnerships Pivot from Technology to Energy Infrastructure in 2026

Strategic partnerships in the data center ecosystem are rapidly evolving from technology-centric alliances to new coalitions focused on securing long-term energy supply. This signals an industry-wide recognition that power, not just processing capability, is the most critical resource for future growth.

Value Chain Highlights Energy’s Critical Ecosystem Role

This chart maps the data center value chain, visually supporting the section’s discussion of partnerships pivoting to the now-critical energy infrastructure component.

(Source: Generative Value)

Forecast Shows Soaring Data Center Power Demand

The chart provides a visual forecast for U.S. data center power demand growth through 2030, directly complementing the Goldman Sachs forecast mentioned in the section.

(Source: AIMMS)

- The alliance between Google, Intersect Power, and TPG represents a new paradigm for data center development. This is not a typical technology integration or co-location agreement but a vertically integrated partnership designed to develop power generation assets in parallel with data center construction, thereby de-risking projects from grid-related delays.

- Beyond direct investment, data center operators are now forced to engage in earlier and more complex negotiations with utility companies. The severe backlogs in grid interconnection queues mean that securing a “spot in line” and co-developing grid upgrades have become critical, pre-construction milestones.

- This contrasts sharply with the 2021–2024 period, where key partnerships revolved around cloud service integration, hardware supply agreements, and software ecosystems. The new class of energy-focused partnerships emerging in 2025–2026 demonstrates that solving for power is now the central strategic challenge.

Table: Analysis of Key Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google / Intersect Power / TPG | December 2024 | A landmark $20 billion partnership to fund and develop a portfolio of clean energy projects. This initiative provides Google with a dedicated, de-risked power source for its data centers, directly addressing the grid capacity bottleneck. | ESG Today |

Power Availability Dictates New Geographic Expansion for Data Centers Beyond 2026

Data center site selection is now fundamentally governed by power availability, forcing a geographic diversification away from historically dominant but power-constrained primary markets toward secondary and tertiary regions with available grid capacity.

- Between 2021 and 2024, data center development was heavily concentrated in established hubs like Northern Virginia and Silicon Valley. The primary geographical challenges in these areas were land acquisition costs and navigating mature regulatory environments.

- Starting in 2025, the calculus has changed. Acute power constraints and grid interconnection bottlenecks are effectively closing these primary markets to new, large-scale development. This forces developers to look toward new regions where utilities have surplus capacity, even if other infrastructure like fiber connectivity is less mature.

- This trend is validated by reports of massive interconnection queues in the U.S. and projections that certain established markets will face electricity shortages as soon as 2026. The search for megawatts is now the primary driver of data center geography, superseding factors like latency or proximity to existing infrastructure.

Grid Infrastructure Lag Creates a Maturity Mismatch with Data Center Technology

A critical maturity gap has emerged between the rapid innovation cycles of data center technologies and the slow, linear deployment pace of the underlying electrical grid infrastructure, creating the single greatest structural impediment to growth in 2026.

Chart Details Previous Supply Chain Challenges

The chart illustrates the supply chain challenges of 2023, providing direct visual context for the ‘2021-2024 period’ hardware risks that the section contrasts with today’s grid issues.

(Source: ElectroIQ)

- In the 2021–2024 period, the main technology challenge was the manufacturing and supply chain maturity for advanced IT hardware. While technologies like high-performance GPUs were available, scaling their production to meet demand was the primary constraint.

- By 2025, the bottleneck is no longer the technology within the data hall but the infrastructure that powers it. While AI accelerators and liquid cooling systems advance on a monthly cycle, the lead times for essential grid components like high-voltage transformers have stretched to 2-4 years, and new high-voltage transmission lines can take over a decade to permit and build.

- This creates a fundamental mismatch. The data center industry’s ability to deploy next-generation computing power is now entirely dependent on the decades-old technology and regulatory paradigms of the utility sector. The problem is not a lack of technological capability but a failure of foundational infrastructure to keep pace.

SWOT Analysis: Data Center Supply Chain Shifts from Component Risk to Energy Risk

The strategic environment for the data center industry has fundamentally pivoted, with its core strengths in technology innovation and capital deployment now directly threatened by external weaknesses in the global energy and electrical equipment supply chains.

Power Constraints Ranked Top Data Center Challenge

This chart perfectly quantifies the section’s thesis by ranking ‘Power and grid capacity constraints’ as the #1 challenge, confirming the shift from component risk to energy risk.

(Source: Insights2Action – Deloitte)

- The industry’s key strengths, such as unprecedented AI-driven demand and access to capital, remain intact but are increasingly ineffective without a solution to the power problem.

- Weaknesses have migrated from internal IT supply chain management to external dependencies on grid capacity and the manufacturing of heavy electrical gear.

- Opportunities are now found in innovative energy strategies, such as vertical integration into power generation and geographic expansion into power-rich regions.

- The primary threats are no longer logistical but structural and regulatory, including systemic power scarcity and multi-year permitting delays for essential infrastructure.

Table: SWOT Analysis for Data Center Supply Chain Challenges in 2026

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong demand from cloud adoption; well-established supply chains for traditional hardware; access to capital for construction. | Explosive, non-discretionary demand from AI; development of vertically integrated supply chains (e.g., Aligned Data Centers); massive capital inflows. | The scale of demand grew exponentially with AI, validating the need for new, more resilient supply chain and energy models beyond traditional procurement. |

| Weaknesses | Fragile semiconductor supply chains; long lead times for servers and routers (up to 52 weeks in 2022); reliance on just-in-time logistics. | Severe grid capacity limitations; extreme lead times for electrical gear (transformers at 2-4 years); shortage of skilled construction labor. | The primary weakness shifted from the IT equipment inside the data center to the utility-scale infrastructure required to power it. The problem is now external. |

| Opportunities | Expansion into emerging markets; adoption of more efficient cooling technologies; development of modular data center designs. | Direct investment in captive power generation (e.g., Google/TPG’s $20 B fund); geographic expansion driven purely by power availability; development of on-site power (SMRs, gas). | Opportunities are no longer about building more efficiently but about securing the fundamental energy input. The industry is being forced to become an energy player. |

| Threats | Pandemic-related logistics disruptions; geopolitical tensions impacting chip manufacturing (e.g., in Taiwan). | Systemic, long-term power scarcity; multi-year regulatory and permitting delays for grid interconnections; water availability becoming a new constraint. | Threats have become less cyclical and more structural. A lack of power is now an absolute barrier to entry, a more existential threat than a temporary component shortage. |

Forward Outlook: Securing Power Becomes the Decisive Competitive Advantage in 2026

If grid constraints and electrical equipment lead times persist as projected, the primary signal to watch is the rate at which data center operators vertically integrate into the energy sector through direct asset ownership, co-development, and other non-traditional power procurement strategies. This will become the definitive competitive differentiator.

- If this happens: Grid interconnection queues continue to lengthen, and lead times for high-voltage transformers and switchgear remain above 18-24 months.

- Watch this: An increase in the number and scale of direct investments by hyperscalers into power generation assets, following the model set by Google’s $20 billion energy fund. Monitor announcements for data center projects co-located with new power sources, such as next-generation nuclear SMRs or large-scale renewable-plus-storage projects.

- These could be happening: A market bifurcation between operators who have secured long-term power and those stuck in development limbo, leading to project cancellations and consolidation. Expect premium pricing for data center capacity that comes with guaranteed power delivery timelines, making energy procurement a core value proposition.

Frequently Asked Questions

What is the main bottleneck for building new data centers in 2026?

The primary bottleneck has decisively shifted from securing IT hardware (like servers and routers) to securing fundamental access to power. Structural constraints like limited grid capacity, long interconnection queues, and multi-year lead times for heavy electrical equipment are now the main factors delaying data center projects.

Why has power suddenly become a bigger problem than computer parts?

The sudden shift is driven by the exponential and unanticipated energy demand from AI workloads. While IT hardware manufacturing can scale up within 12-24 months, upgrading national power grids and producing components like high-voltage transformers involves multi-year or even decadal timelines, creating a severe maturity mismatch.

How are major tech companies like Google responding to this power shortage?

Hyperscale operators are now directly investing in power generation to bypass public grid limitations. A key example is the $20 billion partnership between Google, Intersect Power, and TPG to develop new clean energy projects specifically to create a dedicated power supply for future data centers.

How is this power crisis changing where new data centers are built?

Previously, development was concentrated in hubs like Northern Virginia. Now, acute power shortages in these primary markets are forcing developers to seek out secondary and tertiary geographic regions that have surplus grid capacity. The availability of megawatts has become the main driver for site selection, superseding factors like latency.

How significant is the projected increase in data center power consumption?

The increase is substantial. Goldman Sachs projects a 15% compound annual growth rate (CAGR) in U.S. data center power demand through 2030. By that year, data centers are forecast to consume 8% of all electricity in the United States, highlighting the immense scale of the energy infrastructure required.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.