Data Center Power Constraints: The Top Beneficiaries of Grid Bottlenecks in 2026

How Grid Delays and Power Scarcity Are Reshaping the Data Center Supply Chain

The central constraint for data center growth has definitively shifted from securing semiconductor chips to securing reliable power, creating a new class of beneficiaries that solve for multi-year grid interconnection delays. While the AI-driven demand for compute has stressed every part of the value chain, the inability of public grids to expand capacity has become the most acute bottleneck, fundamentally altering market dynamics and rewarding companies that control power, advanced cooling, and vertically integrated infrastructure.

- Between 2021 and 2024, the primary market concern was the availability of AI accelerators from companies like Nvidia and manufacturing capacity from TSMC. By 2025, this focus shifted as data from utility operators like PJM revealed grid interconnection queues extending 5-7 years in critical markets, making power access the dominant project risk.

- This structural delay created a direct market for on-site power generation as a primary energy source, not just for backup. In 2025, providers like USP&E Global began marketing rapidly deployable gas turbines as a solution to bypass grid wait times, turning an infrastructure failure into a market opportunity.

- The problem extends beyond grid connection to the grid itself, with long lead times for critical components like transformers creating a durable market for grid-independent power. This positions scaled industrial equipment suppliers like GE Vernova to capture demand from hyperscalers who cannot afford multi-year project delays.

- The evolution of risk is clear: what started as a component supply risk managed by hyperscalers designing their own silicon (e.g., Amazon’s Trainium 2) has become a systemic energy risk. This forces even the largest players toward strategic partnerships for on-site power and advanced cooling to enable their growth.

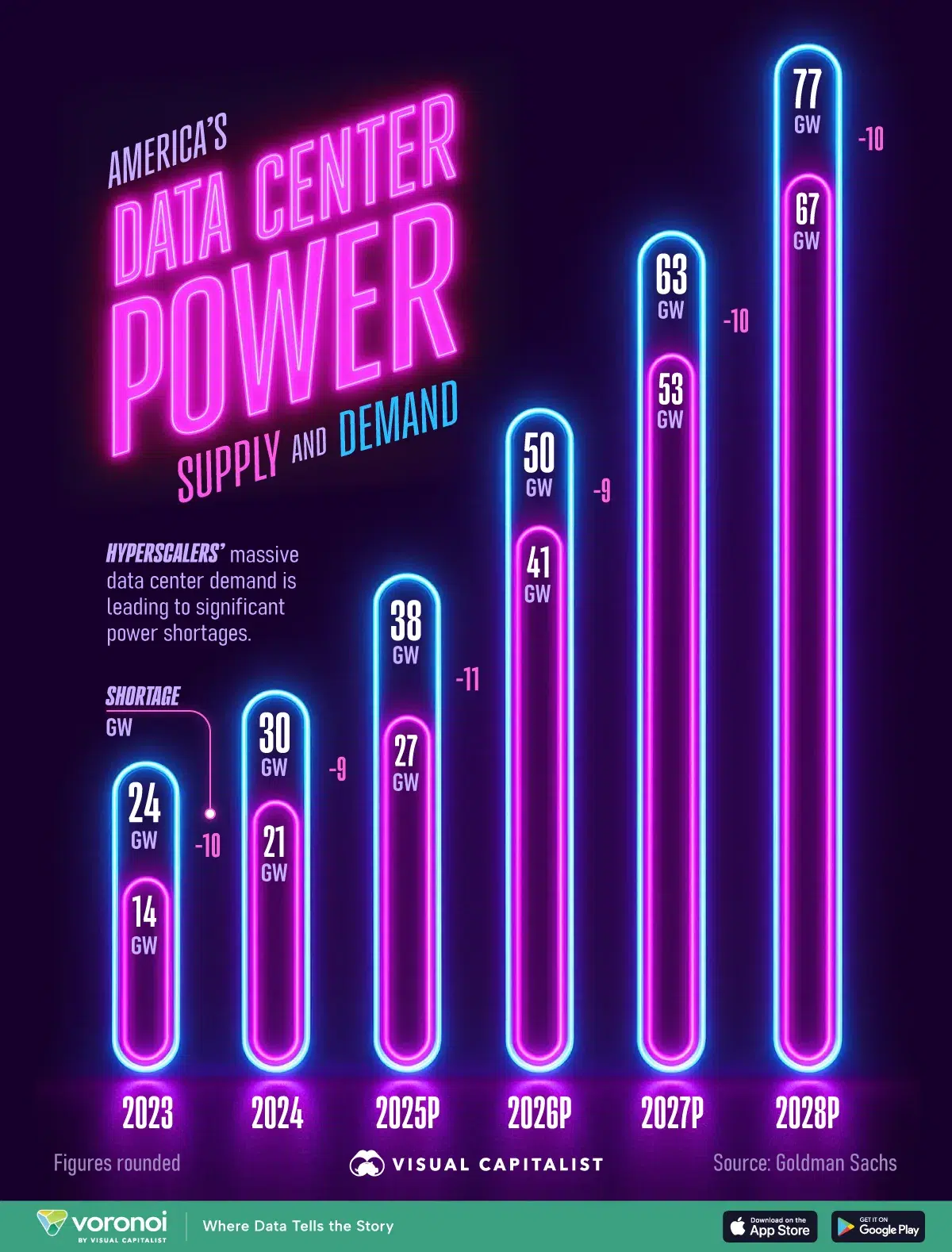

US Data Centers Face Widening Power Deficit

This chart perfectly illustrates the section’s core argument that power demand is significantly outpacing supply, creating the primary bottleneck for data center growth.

(Source: Visual Capitalist)

Strategic Alliances in the Data Center Supply Chain: Securing Power and Components

Strategic partnerships have evolved from securing semiconductor manufacturing capacity to building resilient, localized supply ecosystems designed to de-risk access to power and critical components. This marks a shift from a “just-in-time” to a “just-in-case” procurement model, where long-term, high-value agreements are used to insulate projects from global bottlenecks and geopolitical uncertainty.

Data Center Projects Require Long-Range Supply Planning

This diagram shows the multi-year planning cycle now required for data centers, reflecting the section’s point about a strategic shift from ‘just-in-time’ to ‘just-in-case’ models.

(Source: AIMMS)

- In the 2021-2024 period, key alliances focused on access to advanced manufacturing, such as cloud providers securing capacity at TSMC. By 2025-2026, the focus expanded to include the full infrastructure stack.

- The US$6 billion agreement between Meta and Corning in late January 2026 is a primary example of this new model. This deal secures a domestic supply of fiber optic cables and connectivity components, directly mitigating exposure to global shipping delays and geopolitical friction.

- Partnerships are also forming to solve the technical challenges of AI infrastructure. Schneider Electric‘s collaboration with Nvidia on a reference design for AI data centers validates the need for integrated power and cooling solutions to manage high-density GPU clusters.

- To address the immense capital requirements, firms are using joint ventures to fund expansion. Equinix‘s formation of a joint venture valued at over $15 billion to expand its x Scale data center portfolio demonstrates how partnerships are essential for pooling capital to meet hyperscale demand.

Table: Key Strategic Partnerships in the Data Center Supply Chain (2024-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Meta & Corning | Jan 2026 | Meta entered a US$6 billion agreement to procure US-made fiber optic cables from Corning. The purpose is to build a resilient, domestic supply chain for its data center connectivity needs and bypass global bottlenecks. | Supply Chain Digital |

| Schneider Electric & Nvidia | Dec 2024 | The companies partnered to release a reference design for AI data centers. This standardizes the deployment of high-density Nvidia GPU clusters using Schneider Electric’s power and cooling infrastructure, accelerating deployment and improving efficiency. | Schneider Electric |

| Equinix & GIC | Oct 2024 | Equinix expanded its joint venture with GIC, Singapore’s sovereign wealth fund, to a value of over $15 billion for its x Scale data center program. The purpose is to finance and develop hyperscale data centers for the world’s largest cloud service providers. | Equinix Investor Relations |

Geographic Shifts in Data Center Growth: How Power Availability Dictates Site Selection

Data center development is increasingly migrating away from traditionally dominant but power-constrained markets toward regions with ample energy capacity, a significant shift from the previous strategy of building near population centers. This pivot is driven by the realization that power availability, not low latency, has become the primary gating factor for new hyperscale projects.

Hyperscalers Commit Billions to Data Center Buildouts

This chart visualizes the massive capital commitments from firms like Meta, providing financial scale to the strategic partnerships detailed in the section’s table.

(Source: Market.us Scoop)

- Between 2021 and 2024, data center construction was heavily concentrated in established hubs like Northern Virginia. However, these areas began to show severe signs of power strain, with utilities warning of future capacity limitations.

- From 2025, this strain became an acute crisis. Interconnection queues in major US markets managed by PJM extended to 5-7 years, as documented in a Maryland Office of People’s Counsel letter. This made development in these prime locations functionally impossible for projects needing to deploy quickly.

- This has forced a geographic realignment. While the US market is still projected to lead global power demand growth with a CAGR of 18% through 2028, developers are now actively seeking new sites in states with surplus energy, fundamentally changing the map of data center infrastructure.

- The trend is reinforced by a push for supply chain onshoring. Intel’s Foundry Services expansion in the US and Europe and Meta’s landmark deal with US-based Corning highlight a strategic move to co-locate manufacturing and data center operations in politically stable regions with secure energy.

Technology Maturity: On-Site Power and Liquid Cooling Become Commercial Imperatives

Technologies previously considered niche, such as on-site power generation and direct-to-chip liquid cooling, have rapidly matured into commercial-scale necessities due to the dual constraints of grid unavailability and extreme heat from AI workloads. These solutions are no longer optional upgrades but are now core design components for modern AI data centers, enabling deployments that would otherwise be impossible.

AI Drives Evolution of Data Hall Cooling

This diagram shows how advanced cooling technologies like direct-to-chip are integrated into modern data halls, directly supporting the section’s claim that they are now commercial necessities.

(Source: DataBank)

- During the 2021-2024 period, advanced cooling was a growing field, but traditional air cooling remained viable for most data centers, while on-site power was typically reserved for backup.

- By 2025, the thermal and power landscape had transformed. AI workloads pushed rack densities well beyond 15 k W, rendering air cooling insufficient. This made Vertiv’s leadership in liquid cooling technologies critical, with the direct-to-chip market capturing 42.85% of the liquid cooling sector and immersion cooling projected to grow at a 26.62% CAGR.

- Simultaneously, on-site power generation shifted from a backup role to a primary power strategy. Companies like GE Vernova now market gas turbines as a direct path to faster deployment, bypassing grid queues and enabling developers to meet urgent demand for AI capacity.

- This maturity is validated by market leaders integrating these technologies into their core products. NVIDIA’s Blackwell platform incorporates liquid cooling by design, while Microsoft is developing its own immersion cooling systems. This signals that these technologies are now fundamental to the AI infrastructure roadmap.

SWOT Analysis: Navigating Data Center Supply Chain Constraints in 2026

The strategic landscape for data centers is now defined by the strength of controlling scarce resources like power and advanced components, while the primary threat has escalated from cyclical component shortages to systemic infrastructure failure. Companies that have secured these inputs through vertical integration, long-term contracts, or proprietary technology are positioned for outsized gains, while those exposed to public grid limitations face significant operational risk.

- Strengths: Market dominance in a critical bottleneck, whether it is high-performance GPUs, advanced cooling, or on-site power generation, confers immense pricing power and strategic control.

- Weaknesses: A high dependency on power from constrained public grids or on single-source global suppliers for critical components has become a primary business risk.

- Opportunities: The urgent need to bypass grid delays and manage extreme thermal loads has opened massive new markets for on-site power, liquid cooling, and domestically sourced components.

- Threats: The single greatest threat is the physical inability of regional power infrastructure to keep pace with exponential AI-driven demand, which could stall growth for the entire sector regardless of chip availability.

Table: SWOT Analysis for Data Center Supply Chain Beneficiaries

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Market dominance in a single component, such as Nvidia’s GPU leadership or TSMC’s advanced manufacturing. | Control over an entire system or bottleneck, including integrated hardware and cooling (Nvidia’s Blackwell platform) and on-site power generation (GE Vernova). | The source of strategic strength shifted from providing a single best-in-class component to providing a complete solution that solves a systemic bottleneck like power or heat. |

| Weaknesses | Reliance on a single foundry (TSMC) for advanced chip manufacturing and exposure to geopolitical tensions in the semiconductor supply chain. | Dependency on public electrical grids with multi-year interconnection queues and insufficient capacity, as highlighted by PJM and CSIS. | The primary weakness evolved from a manageable supply chain risk to a fundamental, structural dependency on public infrastructure that is failing to keep pace. |

| Opportunities | Capitalizing on the broad, accelerating demand for cloud computing and the early stages of the AI boom. | Developing solutions that directly bypass grid constraints (USP&E Global’s turbines) and onshoring supply chains to reduce risk (Meta and Corning’s $6 B deal). | Opportunities became more targeted, focusing on solving specific, acute bottlenecks (power, cooling, domestic supply) rather than just serving general market growth. |

| Threats | Cyclical semiconductor downturns, geopolitical tensions impacting chip supply, and increasing competition in the AI chip market. | Widespread power shortages operationally restricting data centers, as predicted by Gartner, and the physical limitations of grid infrastructure becoming the ultimate cap on growth. | The main threat transitioned from a market or policy risk to a physical infrastructure risk. The inability to get electrons to the data center is now a greater danger than the inability to get chips. |

2026 Outlook: If Grid Constraints Persist, Watch for Energy-Led Data Center Development

If grid interconnection delays and power shortages continue, the data center industry will pivot to a model where energy infrastructure dictates site selection and design, leading to the rise of integrated power-and-compute campuses. The ability to secure and generate power will become the most valuable competitive advantage, reshaping the industry’s geography, economics, and key players.

AI Power Demand Forecast to Surge 31x

This forecast quantifies the primary driver behind the section’s outlook, showing why the industry must pivot towards an energy-led development model to cope with skyrocketing demand.

(Source: Deloitte)

- If this happens, watch this: A significant increase in data center projects being co-located directly with power generation facilities, such as natural gas plants, large-scale solar farms, or potentially small modular reactors in the future. Energy companies and equipment suppliers like GE Vernova will become integral development partners, not just vendors.

- This could be happening: Private equity firms like Blackstone will accelerate their strategy of funding paired data center and energy generation projects, acquiring power assets to support their data center investments. Hyperscalers will follow by directly investing in or acquiring power generation capacity to ensure their growth is not constrained by the public grid.

- If this happens, watch this: Hyperscalers like Amazon and Microsoft will sign more multi-billion-dollar, long-term deals not just for renewable energy credits, but for firm, dispatchable power capacity and the equipment to generate it on-site.

- This could be happening: The data center market will bifurcate sharply. Players with secured power access will continue their rapid expansion, while those stuck in grid queues will face project cancellations, consolidation, or acquisition. This trend would validate Gartner’s prediction that power shortages will operationally restrict 40% of AI data centers by 2027.

Frequently Asked Questions

What is the main bottleneck for data center growth in 2026?

The primary constraint for data center growth has shifted from securing semiconductor chips to securing reliable power. The inability of public grids to expand capacity, leading to multi-year interconnection delays of 5-7 years in critical markets, has become the most acute bottleneck and dominant project risk.

Which companies are benefiting from these grid and power issues?

Companies that provide solutions to bypass grid constraints are the top beneficiaries. This includes providers of on-site power generation like GE Vernova and USP&E Global, leaders in advanced liquid cooling such as Vertiv and Schneider Electric, and domestic suppliers of critical components like Corning, who can help de-risk supply chains.

Why is liquid cooling technology now a necessity for AI data centers?

AI workloads generate extreme heat and push rack power densities well beyond 15 kW, rendering traditional air cooling insufficient. Technologies like direct-to-chip and immersion liquid cooling have become commercial necessities to manage these high thermal loads, enabling the deployment of high-density GPU clusters that would otherwise be impossible to operate.

How are strategic partnerships in the data center industry changing?

Strategic partnerships have evolved from focusing on securing semiconductor manufacturing capacity (e.g., at TSMC) to building resilient, localized supply ecosystems. For example, Meta’s $6 billion deal with Corning secures a domestic supply of fiber optic cables to bypass global shipping risks. Alliances also focus on pooling capital for expansion, like Equinix’s $15 billion joint venture with GIC to build hyperscale data centers.

How is power scarcity affecting where new data centers are being built?

Data center development is migrating away from traditionally dominant but power-constrained markets, like Northern Virginia, toward regions with ample energy capacity. Power availability has replaced low latency (proximity to population centers) as the primary factor for site selection, forcing developers to fundamentally change the geographic map of data center infrastructure to states and areas with surplus energy.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google AI Infrastructure: Cooling & TPU Strategy for 2025

- AWS Liquid & Immersion Cooling: AI Strategy 2025

- Azure's 2025 Liquid & Immersion Cooling Tech Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.