Grid Constraints Drive 2026 Gas-to-Power Boom for AI Data Centers

AI Power Demand Overwhelms Grid: Midstream Gas Projects Pivot to On-Site Generation

Midstream gas players are shifting from being wholesale transporters to direct, on-site power providers for data centers, a strategic pivot driven by grid capacity failures that became acute in 2025. This “behind-the-meter” model bypasses congested public grids, offering hyperscalers the speed and reliability that utilities can no longer guarantee. The market has evolved from strengthening the existing grid system to building a parallel, private energy infrastructure dedicated to powering the AI revolution.

- Between 2021 and 2024, midstream strategy focused on bolstering the reliability of the existing gas network. Williams acquired Nor Tex Midstream in 2022 and gas storage assets from Hartree Partners LP in 2023 to improve supply security for the broader, grid-connected power market. Discussions with data center operators were nascent and centered on providing reliable fuel to utility-connected sites.

- Starting in 2025, the strategy shifted to direct supply and on-site generation as grid interconnection queues lengthened to several years. Williams began exploring the acquisition of upstream gas assets to create a fully integrated “wellhead-to-plug” solution. This model directly addresses the “speed-to-power” problem, as a behind-the-meter gas plant can be deployed in as little as 18 months, a critical advantage for AI projects generating billions in annual revenue.

- The scale of the new demand solidified this pivot. Projections for AI-driven natural gas consumption now reach up to 6 billion cubic feet per day (Bcf/d) by 2030. This represents an entirely new market segment that has forced midstream operators to become power producers to capture the opportunity.

Grid Overload Creates On-Site Power Opportunity

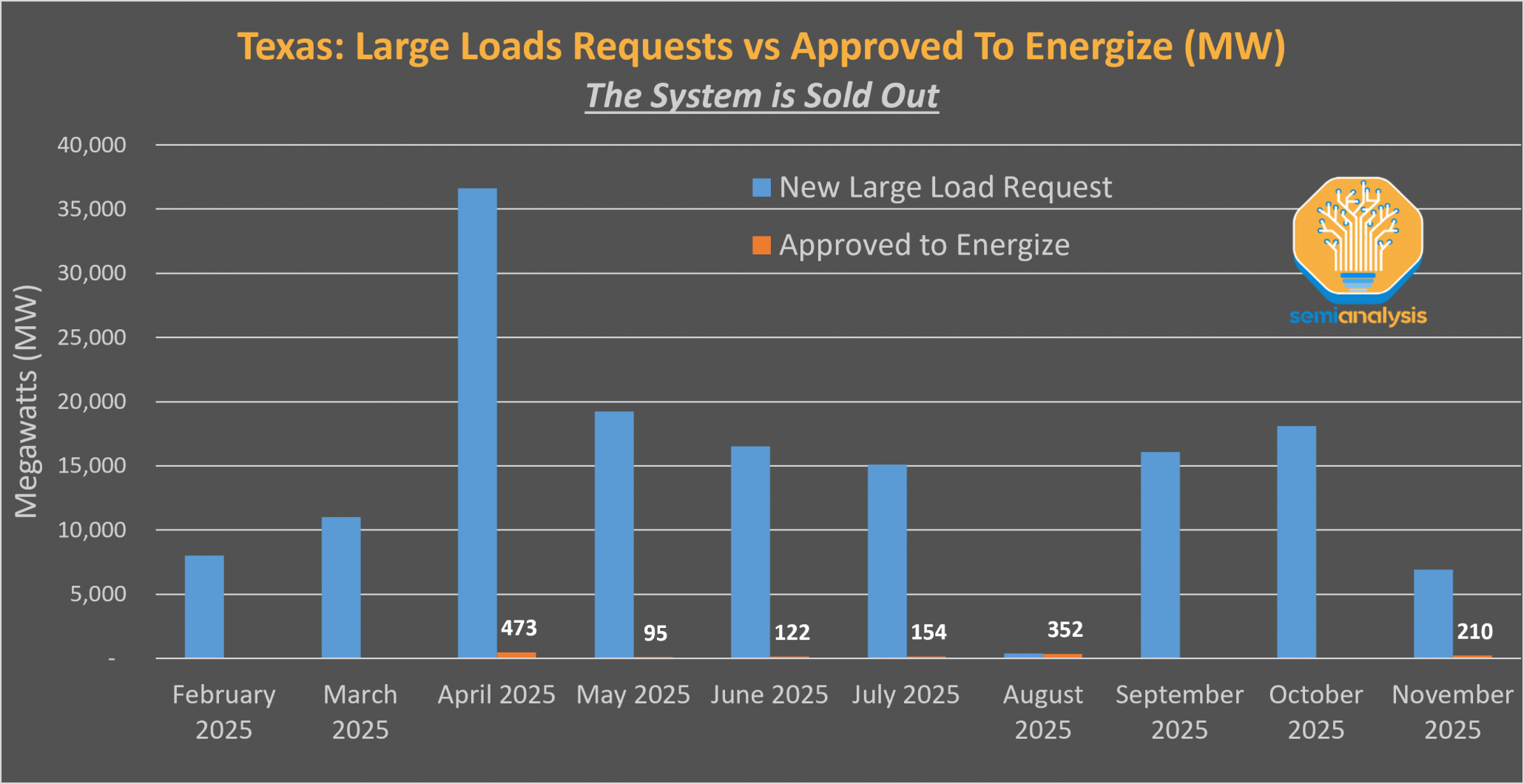

This chart visualizes the core problem stated in the section: grid capacity, as shown in Texas in 2025, is overwhelmed by new demand, forcing the pivot to on-site generation.

(Source: SemiAnalysis)

Williams Leads Multi-Billion Dollar Investment in AI Data Center Power Infrastructure

Capital allocation in the midstream sector has decisively moved towards building dedicated power generation infrastructure for AI, with Williams committing over $5 billion since 2025 to a new “power innovation” business model. This investment reflects a fundamental change from expanding shared pipeline capacity to constructing bespoke, client-focused energy assets that operate independently of the grid.

Williams Invests $5B in On-Site Power

This map directly illustrates the section’s focus on Williams’ $5 billion capital commitment, showing new on-site power projects being built near its existing gas pipeline infrastructure.

(Source: Rextag)

- Williams has announced a $5.1 billion portfolio for “power innovation, ” which includes building modular, gas-fired power plants at data center sites. This includes a $3.1 billion investment in two major data center power projects announced in October 2025 and a $1.6 billion investment in Project Socrates, set for completion in the second half of 2026.

- Competitors are also allocating capital to this market. Exxon Mobil has a pipeline of over 2.7 GW in data center power projects. Kinder Morgan took a differentiated approach by acquiring seven landfill gas-to-energy facilities for $135 million in October 2025 to supply renewable natural gas (RNG) to data centers.

- This contrasts sharply with the 2021-2024 period, where major investments were aimed at strengthening the core midstream business. Williams’ $1.95 billion purchase of storage assets in December 2023 and $423 million acquisition of Nor Tex Midstream were designed to improve the reliability of the public gas system, not to build dedicated power plants for private customers.

Table: Strategic Investments in Dedicated AI Power Generation (2025-Present)

| Company / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Williams / Power Innovation Portfolio | Ongoing (from 2025) | $5.1 Billion committed to building modular, behind-the-meter gas-fired power plants directly for data center clients. | Power Engineering |

| Williams / Two New Power Projects | Announced Oct 2025 | $3.1 Billion investment to construct two large power generation facilities specifically for data centers, bypassing the public grid. | Nasdaq |

| Williams / Project Socrates | 2 H 2026 Completion | $1.6 Billion project for committed power generation and associated gas pipeline infrastructure for a specific data center client. | East Daley Analytics |

| Kinder Morgan / Landfill Gas Facilities | Announced Oct 2025 | $135 Million acquisition to supply renewable natural gas (RNG) to data centers, addressing client demand for lower-carbon fuel. | Enki AI |

Midstream and Hyperscalers Form Direct Alliances to Bypass Grid Bottlenecks

Direct partnerships between midstream operators and hyperscale data center owners are now the primary commercial model for powering new AI facilities, replacing the previous reliance on traditional utility interconnects. These alliances are structured to de-risk power supply by creating private, integrated energy systems that provide both fuel and generation as a single service.

New ‘Gas-to-Power’ Business Model Visualized

This infographic from Williams perfectly illustrates the new commercial alliance model described, showing an integrated value chain from gas supply directly to ‘Behind-the-Meter Power Delivery’.

(Source: Williams Companies)

- A key example from the current period is Williams’ partnership to build and operate a dedicated gas-powered electric generation facility for a Meta Platforms data center campus in Ohio. This project defines the new commercial model of midstream as an integrated power provider.

- Other midstream players have followed this model. In February 2025, Energy Transfer announced a deal to supply natural gas directly to Cloud Burst’s AI-focused data center in Texas for on-site generation. Pembina Pipeline is reportedly near a similar agreement with Meta in Alberta.

- This is a significant evolution from the partnership activity between 2021 and 2024. During that time, Williams’ key collaborations with firms like Context Labs and Wipro were focused on developing platforms for certified, responsibly sourced gas (RSG). Those partnerships were designed to improve the emissions profile of gas sold into the existing commodity market, not to build dedicated infrastructure for a specific end-user.

Table: Key Partnerships for Direct Data Center Power Supply

| Partners | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Williams / Meta Platforms | Announced 2025 | Building a dedicated, behind-the-meter gas-powered electric generation facility for a Meta data center campus in Ohio, establishing the new integrated service model. | ENR |

| Pembina Pipeline / Meta Platforms | Reported Oct 2025 | Near a deal to build a massive AI data center in Alberta, leveraging Pembina’s regional gas infrastructure for dedicated power supply. | The Logic |

| Energy Transfer / Cloud Burst | Announced Feb 2025 | Agreement to provide natural gas directly to an AI-focused data center development in Central Texas for on-site power generation. | ETF Trends |

Data Center Power Hotspots in Virginia and Texas Drive Regional Gas Infrastructure Strategy

Midstream investment is concentrating in regions with both high data center growth and extensive existing pipeline infrastructure, particularly Northern Virginia, Texas, and Ohio. Grid constraints in these specific geographies are so severe that they have become the primary driver for deploying new, on-site gas generation assets, shifting the focus from national network expansion to targeted, regional power solutions.

Infrastructure Map Underpins Regional Strategy

This map displays the extensive gas infrastructure that underpins the regional investment strategy, showing the assets being leveraged in power-hungry hotspots.

(Source: Natural Gas Intelligence)

- Between 2021-2024, geographic strategy focused on strengthening asset positions in key demand basins. Williams’ $423 million acquisition of Nor Tex Midstream in 2022 was a move to secure more pipeline and storage capacity in the high-demand North Texas market, serving a diverse customer base through the existing grid.

- From 2025 onward, the strategy became about building entirely new, dedicated assets within these zones to circumvent local grid failures. The situation in Texas, where new large load requests far outstrip the grid’s ability to approve them, exemplifies this driver. Williams’ Ohio project with Meta and Energy Transfer’s Texas deal with Cloud Burst are direct responses to such regional bottlenecks.

- The existence of robust pipeline networks, such as those operated by Williams and TC Energy in Northern Virginia and Kinder Morgan and Energy Transfer in Texas, is a critical enabler. These networks provide the fuel backbone that makes the rapid deployment of behind-the-meter gas generation feasible.

On-Site Gas Power Generation Reaches Commercial Scale for AI Data Centers

The behind-the-meter gas-fired power plant has rapidly matured from a conceptual backup solution to a commercially deployed, scalable primary power technology for AI data centers. The model’s validation is based not on technological novelty, as gas turbines are a mature technology, but on its unique ability to meet the non-negotiable speed and reliability requirements of the AI industry, which the public grid can no longer provide.

On-Site Gas Power Achieves Commercial Scale

This chart quantifies the section’s main point by showing the dramatic, exponential growth in on-site gas power capacity for data centers, proving the model has reached commercial scale.

(Source: SemiAnalysis)

- During the 2021-2024 period, on-site generation was primarily considered for backup power. The core technological focus for midstream companies was on enhancing pipeline monitoring and methane certification through digital platforms to improve the existing system’s performance and environmental credentials.

- Since 2025, on-site generation has become the primary power strategy for new, large-scale AI deployments. The technology’s maturity is now defined by its application. The ability to bring a 400 MW facility online in 18 months, as cited in market analysis, is the key validation point, as it can generate billions in revenue for a cloud provider far sooner than a grid-connected alternative.

- Projects like the one Williams is building for Meta are moving this model from pilot-scale theory to standard industry practice. The technology is considered commercially proven for this application, with the remaining challenges centered on project financing and securing long-term fuel supply.

SWOT Analysis: Strategic Positioning of Gas Infrastructure for AI Power

Midstream players are leveraging their extensive infrastructure and operational expertise to capture a massive new demand source in AI data centers, but this strategic pivot carries significant long-term risk related to decarbonization pressure and the durability of AI demand forecasts. The core strength lies in providing a near-term solution to the grid crisis, while the primary weakness is the long-term carbon liability of the new assets being built.

Infographic Highlights Strengths of Natural Gas

This infographic supports the SWOT analysis by detailing the key strengths of natural gas—reliability, affordability, and flexibility—which are central to its strategic value for powering AI.

(Source: Seeking Alpha)

- Strengths: The ability to deliver “speed-to-power” is a powerful, high-margin advantage that creates a significant competitive moat.

- Weaknesses: The strategy doubles down on fossil fuels, creating potential long-term asset risk from future carbon regulations or taxes.

- Opportunities: The AI power market is a generational, high-margin growth opportunity that could fundamentally rescale the midstream business.

- Threats: Long-term technological disruption from alternatives like Small Modular Reactors (SMRs) or a slowdown in AI demand could undermine the economics of these 20-year assets.

Table: SWOT Analysis for Gas Infrastructure Repositioning to Power AI

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Extensive pipeline network; established operational reliability in commodity transport. | Ability to deliver “speed-to-power” with 18-month BTM deployments; capability for integrated “wellhead-to-plug” solutions. | The strength shifted from being a passive asset owner to an active, high-value solutions provider addressing a critical customer bottleneck (grid delays). |

| Weaknesses | Exposure to commodity price swings; public and investor ESG pressure on fossil fuels. | Long-term carbon lock-in for new 15-20 year assets; reliance on ESG-conscious tech clients who may pivot to zero-carbon alternatives. | The weakness evolved from general ESG pressure to specific, long-term balance sheet risk associated with newly built, carbon-emitting infrastructure. |

| Opportunities | Growth in LNG exports and general power demand from grid electrification. | Massive, high-margin demand from AI data centers (up to 6 Bcf/d); creation of a new “reliability-as-a-service” business model. | The scale and profitability of the opportunity fundamentally changed from incremental commodity demand to a high-value, integrated service market. |

| Threats | Pipeline permitting challenges; competition from utility-scale renewables. | Long-term technological disruption from SMRs or geothermal; risk of AI demand falling short of forecasts; future carbon taxes. | Threats became more structural and long-term, focused on technologies that could displace gas as the source of firm, clean power in the next decade. |

Forward Outlook: Vertical Integration is Key to Winning the AI Power Race

If AI-driven power demand continues on its current trajectory, the midstream companies that successfully integrate upstream gas supply with dedicated power generation will secure the most valuable, long-term contracts with hyperscalers. The ability to offer a single, reliable, and price-certain contract for a complete energy solution is the ultimate competitive advantage in this new market.

Diagram Shows Vertical Integration Model

This diagram visualizes the forward-looking strategy of vertical integration, showing how on-site gas resources are used to power a data center directly in a single, integrated system.

(Source: Seeking Alpha)

- If this happens, watch this: Monitor for a definitive announcement of an upstream gas asset acquisition by Williams. Such a move would fully validate the vertical integration strategy and likely trigger similar actions by competitors to avoid being relegated to simple fuel suppliers.

- Watch this: Track new project announcements from Energy Transfer, Kinder Morgan, and Enbridge. The key signal will be whether these projects are structured as integrated power-and-fuel deals, confirming the industry-wide adoption of the model pioneered by Williams.

- This could be happening: Hyperscalers may begin signing 15-20 year contracts that lock in this gas-powered model. This would create a significant moat for early movers but also introduce substantial long-term carbon risk for both the energy providers and their tech clients.

- This could be happening: The financial and operational success of initial projects like Project Socrates will likely accelerate a wave of new capital into behind-the-meter gas generation, potentially leading to an overbuild if AI demand forecasts prove too optimistic.

Frequently Asked Questions

Why are AI data centers suddenly turning to natural gas companies for power instead of the electric grid?

The primary reason is that the public electric grid is overwhelmed and cannot provide power to new, large-scale AI data centers quickly enough. According to the article, grid interconnection queues have lengthened to several years, while a dedicated ‘behind-the-meter’ gas power plant can be built in as little as 18 months. This ‘speed-to-power’ is critical for hyperscalers to capitalize on the AI boom.

What is the ‘behind-the-meter’ model that midstream companies are using?

The ‘behind-the-meter’ model involves midstream gas companies building and operating dedicated, on-site power plants directly at a data center’s location. This approach bypasses the congested public grid entirely, creating a private, integrated energy system that provides both the natural gas fuel and the electricity generation as a single, reliable service directly to the client.

Which companies are leading this shift to on-site data center power generation?

Williams is highlighted as a major leader, committing over $5.1 billion to a ‘power innovation’ business model, which includes projects like the $1.6 billion Project Socrates. Other significant players mentioned are Energy Transfer, which has a deal to supply gas directly to a data center in Texas, and Kinder Morgan, which is pursuing a renewable natural gas (RNG) strategy for data centers.

What changed in 2025 to trigger this strategic pivot?

In 2025, grid capacity failures became acute, and it became clear that utilities could no longer guarantee the speed and reliability required by the rapidly growing AI industry. This bottleneck forced midstream companies to shift their strategy from simply bolstering the existing public gas network to becoming direct, on-site power producers to capture the massive new demand from data centers.

What are the main risks associated with this gas-to-power strategy for AI?

The primary weakness is the long-term ‘carbon lock-in’ from building new fossil fuel infrastructure with a 15-20 year lifespan, creating potential risk from future carbon regulations. Other major threats include long-term technological disruption from zero-carbon alternatives like Small Modular Reactors (SMRs) and the possibility that AI demand could slow down, undermining the financial viability of these large investments.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.