AI Data Center Power Crunch 2026: How Grid Delays Catapulted Fuel Cells to Mission-Critical Status

From Pilot to Prime Power: Fuel Cell Adoption Accelerates to Overcome Grid Constraints

Fuel cell adoption has decisively shifted from small-scale pilots to large-scale, prime power deployments, driven by the urgent need for AI data centers to bypass multi-year grid interconnection delays. While the 2021-2024 period was defined by technology validation and backup power trials, the market since January 2025 is characterized by multi-billion-dollar procurements for continuous, on-site electricity generation, establishing fuel cells as a critical “time-to-power” solution.

- Between 2021 and 2024, industry adoption was led by hyperscalers conducting backup power demonstrations, such as Microsoft’s successful test of a 3 MW hydrogen system. Data center operators like Equinix were in the pilot phase, testing fuel cells as a potential replacement for diesel generators. These projects proved technical viability but did not represent commercial scale for primary power.

- The period from 2025 to today marks a clear inflection point to commercial-scale primary power. Bloom Energy secured a $2.65 billion agreement with utility American Electric Power (AEP) and a $5 billion partnership with Brookfield Asset Management specifically to deploy its solid oxide fuel cells (SOFCs) for AI data centers, bypassing traditional grid infrastructure limitations.

- In response to this market shift, other suppliers are strategically reorienting their businesses. In November 2024, Fuel Cell Energy announced a global restructuring to focus on the data center market, a strategy that materialized in January 2026 with a collaboration with Sustainable Development Capital LLP (SDCL) to deploy up to 450 MW of fuel cell power globally.

- The adoption model is evolving toward fully integrated, grid-independent solutions. Before 2025, this was a concept. Now, ECL is developing a 1 GW off-grid, hydrogen-powered “AI Factory” in Texas, with the first phase scheduled for delivery in 2025, signaling a new paradigm in data center infrastructure deployment.

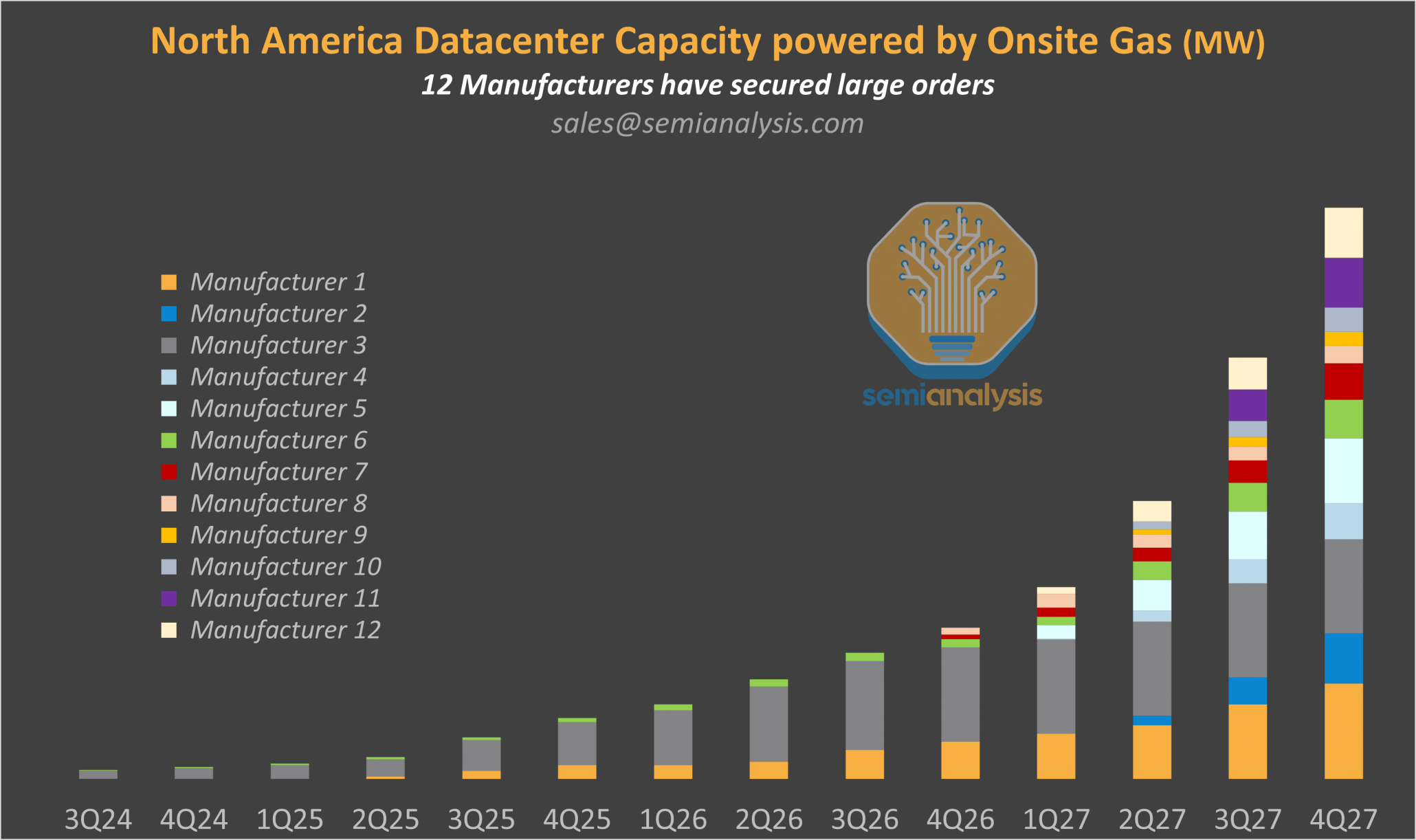

Onsite Power for Data Centers Accelerates

This chart illustrates the rapid acceleration of onsite power deployments, directly supporting the section’s theme of fuel cell adoption shifting from pilots to large-scale solutions.

(Source: SemiAnalysis)

Strategic Capital Inflows: Why Billions Are Pouring into Fuel Cells for AI Data Centers

Major infrastructure investors and utilities are now committing billions in capital, validating fuel cells as a bankable, utility-scale asset class for AI infrastructure. This represents a significant change from the smaller, project-specific financing that characterized the market before 2025, signaling deep confidence in the technology’s role in solving the data center power crisis.

- The definitive market signal came in October 2025 with the announcement of a $5 billion strategic partnership between Brookfield Asset Management and Bloom Energy. This commitment from a major infrastructure investor validates fuel cells as a core infrastructure asset, not just a niche technology.

- Utility-scale procurement has become a reality. The $2.65 billion agreement between AEP and Bloom Energy, supported by a 20-year offtake contract, moves fuel cells into the domain of regulated utility asset deployment, creating a scalable and repeatable business model.

- Companies are reallocating capital to capture this opportunity. In November 2025, Plug Power announced a pivot toward the data center market, a move intended to unlock $275 million to fund its entry into supplying backup and auxiliary power.

- Specialized financing vehicles are being created to fund deployments. The January 2026 collaboration between Fuel Cell Energy and infrastructure fund SDCL to deploy up to 450 MW of power demonstrates the emergence of dedicated capital pools for fuel cell projects at data centers.

Table: Key Investments & Financial Commitments for Data Center Fuel Cells (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | January 2026 | Strategic collaboration to explore deploying up to 450 MW of fuel cell power for data centers, providing a dedicated financing and deployment channel. | DCD |

| Plug Power Data Center Pivot | November 2025 | Strategic initiative to unlock $275 million to reposition the company as an energy supplier for data centers, focusing on backup power solutions. | Reuters |

| Bloom Energy & Brookfield | October 2025 | A $5 billion strategic partnership to deploy fuel cell technology at AI data centers globally, creating integrated “AI factories” combining power and compute. | Bloom Energy |

| Bloom Energy & AEP | Reported in Feb. 2026 | A $2.65 billion agreement to supply solid oxide fuel cells, supported by a 20-year offtake contract, to provide 100 MW of power over the next decade. | Simply Wall St |

Powering AI: Key Partnerships Driving Fuel Cell Integration in Data Centers

Strategic partnerships have fundamentally evolved from technology validation pilots to large-scale commercial deployment alliances, integrating fuel cell suppliers directly into the data center, utility, and infrastructure finance ecosystems. This shift institutionalizes fuel cells as a go-to solution for the AI power crunch.

- The alliance model has matured from one-off pilots to programmatic deployments. The expansion of Bloom Energy’s agreement with Equinix, now exceeding 100 MW across 19 data centers, shows a repeatable, scalable partnership framework that has moved far beyond initial testing.

- Utilities are now active partners in deploying on-site generation. The AEP–Bloom Energy agreement is a landmark example of a utility procuring fuel cells as a non-wires alternative to provide power to large customers, effectively partnering with the technology provider to solve grid constraints.

- Hyperscalers are transitioning from research partners to procurement clients. Oracle’s collaboration with Bloom Energy in July 2025 to deliver on-site power within 90 days demonstrates a move toward deploying fuel cells as a rapid, commercial solution to meet immediate capacity needs.

- Infrastructure funds are creating new channels to market. The partnership between Fuel Cell Energy and SDCL establishes a crucial link between technology and project finance, enabling the deployment of up to 450 MW of power for data centers globally.

Table: Notable Data Center Fuel Cell Partnerships (2025-2026)

| Partners | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Doosan Fuel Cell & LG Electronics | February 2026 | Partnership to develop a business model utilizing waste heat from fuel cells for data center cooling and heating, creating a more efficient integrated system. | Chosun Biz |

| Fuel Cell Energy & SDCL | January 2026 | Collaboration to deploy up to 450 MW of fuel cell power at data centers, combining technology with specialized infrastructure investment. | Fuel Cell Energy |

| Bloom Energy & Brookfield | October 2025 | $5 billion partnership to finance and deploy fuel cells for AI data centers, creating a one-stop solution for integrated power and compute infrastructure. | Energy Connects |

| Fuel Cell Energy & Inuverse | July 2025 | MOU to explore deploying up to 100 MW of fuel cell power at an AI data center in South Korea, leveraging thermal energy for advanced cooling. | DCD |

| Bloom Energy & Oracle | July 2025 | Collaboration to deploy fuel cells at select Oracle Cloud Infrastructure (OCI) data centers with a delivery timeline of 90 days, emphasizing speed-to-power. | Bloom Energy |

North America Leads Fuel Cell Deployment for Data Centers as Global Activity Expands

While the United States is the clear epicenter for large-scale fuel cell deployment for data centers due to its massive AI buildout and severe grid congestion, significant commercial and pilot activity is accelerating in Asia and Europe. This signals a global recognition of fuel cells as a viable solution to the universal problem of powering next-generation computing infrastructure.

US Leads Data Center Power Demand

This forecast highlights the US as the largest and fastest-growing market for data center power, visually confirming the section’s focus on North American leadership in deployment.

(Source: EnkiAI)

- The United States dominates commercial-scale deployments, driven by landmark deals. The multi-billion dollar agreements secured by Bloom Energy with AEP, Brookfield, and Oracle are centered in the U.S. market, which faces the most acute power shortages for new data center construction.

- South Korea has emerged as a key secondary market with strong local and international activity. Fuel Cell Energy’s MOU with Inuverse for a 100 MW deployment in Daegu, along with new data center-focused platforms from domestic firms like S-Fuelcell and Doosan Fuel Cell, highlights the region’s advanced adoption curve.

- Europe is progressing from R&D pilots to commercial validation. Before 2025, activity was defined by tests like Microsoft’s hydrogen pilot with ESB in Dublin. Now, commercial players like Sweden’s Power Cell Sweden AB are entering the U.S. market with agreements to validate their systems in live data center environments.

- The market is expanding to new technology hubs facing power constraints. Bloom Energy’s collaboration in Taiwan, announced in late 2024, to support its AI data center expansion shows the model is being replicated in other regions with high-tech manufacturing and growing AI ambitions.

SOFC at Commercial Scale: Fuel Cell Technology Matures for Prime Power Data Center Use

Solid Oxide Fuel Cell (SOFC) technology has matured from a proven niche application to a commercially scalable, bankable prime power solution for data centers, while Proton Exchange Membrane (PEM) technology is solidifying its role in backup power and integrated hydrogen systems. This technology segmentation reflects a market that has moved past initial validation to deploying specific solutions for distinct data center power challenges.

How Fuel Cells Scale for Prime Power

This diagram explains how individual solid-oxide fuel cells are bundled into large-scale systems, matching the section’s focus on SOFC technology maturing for prime power use.

(Source: Fortune)

- Prior to 2025, the primary application for fuel cells in data centers was backup power, with PEM technology from companies like Ballard Power Systems and Plug Power leading pilot projects with Microsoft. The focus was on replacing diesel generators, not displacing the grid.

- The period from 2025 to today has established SOFC as the leading technology for primary, continuous power. Bloom Energy’s ability to secure gigawatt-scale orders and multi-billion-dollar financing for its SOFC platforms confirms the technology’s readiness for baseload data center operations.

- Other technologies are proving their viability for large-scale deployments. Fuel Cell Energy’s molten carbonate (MCFC) and solid oxide platforms are being positioned for prime power through major collaborations like the 450 MW initiative with SDCL, showing a broadening of mature technology options.

- An important maturation signal is the development of fuel-flexible systems. South Korean firm S-Fuelcell’s launch of a modular, hydrogen-ready platform in November 2025 shows the industry is engineering solutions that bridge today’s natural gas infrastructure with a future hydrogen economy.

SWOT Analysis: Grid Bottlenecks Create Unprecedented Opportunity for Fuel Cell Suppliers

The strategic context for fuel cell suppliers is defined by a massive external opportunity—the AI-driven power crisis colliding with inadequate grid infrastructure. This dynamic allows companies to leverage their core technological strengths, but they must navigate internal scaling challenges and external competitive threats to fully capitalize on this historic market opening.

Texas Grid Can’t Keep Up With Demand

This chart provides a stark visualization of the “grid bottlenecks” that create the central opportunity for fuel cells, a key point of the section’s SWOT analysis.

(Source: SemiAnalysis)

- Strengths: High electrical efficiency and rapid deployment capabilities have become decisive competitive advantages, enabling data center operators to get to market years ahead of grid-supplied power.

- Weaknesses: Historical financial unprofitability and the need for significant capital to scale manufacturing remain key challenges for companies like Plug Power and Fuel Cell Energy.

- Opportunities: The extreme opportunity cost of delaying AI data center deployments has made on-site power generation a mission-critical necessity, creating a multi-billion dollar addressable market.

- Threats: Competition from other on-site generation sources and long-term reliance on the volatile natural gas market pose risks, though the future transition to green hydrogen is a mitigating factor.

Table: SWOT Analysis for Fuel Cell Deployment in AI Data Centers

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High efficiency (SOFC >60%); fuel flexibility (natural gas, hydrogen); proven reliability in small-scale prime power and backup pilots (Microsoft, Equinix). | Rapid “time-to-power” (deployment in months vs. years for grid); high power density; bankability demonstrated by multi-billion dollar deals (Brookfield, AEP). | The core strength shifted from technical efficiency to a quantifiable commercial advantage: speed. The market now values deployment speed over the incremental cost of on-site generation, validating the technology as a bankable infrastructure asset. |

| Weaknesses | High upfront capital costs; lack of profitability for major players; reliance on subsidies and tax credits; unproven manufacturing scale for gigawatt-level demand. | Ongoing need for restructuring and cost-saving initiatives (Plug Power’s Project Quantum Leap); reliance on partnerships for large-scale financing; manufacturing capacity lagging behind demand surge (Bloom doubling capacity). | The weakness has shifted from a question of technological viability to one of industrial execution. The challenge is no longer proving the technology works, but rather manufacturing and deploying it profitably at an unprecedented scale. |

| Opportunities | Corporate sustainability goals; backup power market (diesel replacement); niche prime power for high-reliability sites; early interest from data centers. | AI-driven power demand creating a 160% surge by 2030; grid interconnection queues exceeding 5+ years; “Bring-Your-Own-Generation” (BYOG) becoming standard for new data centers. | The opportunity transformed from a gradual, green-driven transition to an urgent, crisis-driven necessity. The failure of the grid to keep pace with AI created an entirely new, multi-billion-dollar market for on-site power in under 24 months. |

| Threats | Competition from solar + storage and natural gas engines; volatility in natural gas prices; slow development of green hydrogen supply chain. | Improved performance and cost-competitiveness of natural gas turbines for large-scale power; policy risks related to natural gas use; potential for new grid technologies to shorten interconnection times. | The threat evolved from competing clean technologies to incumbent fossil fuel solutions (gas turbines) that can also be deployed on-site. The long-term reliance on natural gas is now a more prominent risk as deployments scale into the hundreds of megawatts. |

2026 Outlook: From Component Sales to Integrated ‘AI Factories’

If fuel cell suppliers can successfully scale manufacturing to meet the demand signaled by recent multi-billion dollar agreements, the market will rapidly shift from selling standalone power units to delivering fully integrated, off-grid “AI Factory” solutions as a standard infrastructure product. Success is no longer about technology validation but industrial execution.

The Rise of On-Site Energy for AI

This conceptual image visualizes the growth of on-site energy solutions, aligning with the section’s outlook on a market shift towards integrated “AI Factory” power systems.

(Source: Yahoo Finance)

- Watch this signal: Monitor Bloom Energy’s progress on its announced plan to double manufacturing capacity to 2 GW. Achieving this target is a critical proof point for the entire sector’s ability to meet the historic surge in demand from data centers.

- Watch this signal: Track the development of ECL’s planned 1 GW off-grid data center in Texas. The successful delivery of its first phase in 2025 would validate the fully integrated, hydrogen-powered data center model and likely trigger a wave of similar projects.

- Watch this signal: Observe the financial performance and gross margins of Fuel Cell Energy and Plug Power throughout 2026. Their ability to achieve profitability while executing their data center pivots will determine if they can become sustainable, long-term players in this market.

- Watch this signal: Look for the next major utility partnership that follows the AEP-Bloom Energy model. If another large U.S. or European utility announces a similar gigawatt-scale procurement agreement, it will confirm a systemic shift in how utilities provision power for hyperscale customers.

Frequently Asked Questions

Why are fuel cells suddenly so critical for AI data centers?

The primary driver is the urgent need to bypass multi-year delays in connecting to the electrical grid. As the AI boom creates massive power demand, grid infrastructure can’t keep up. Fuel cells provide a rapid ‘time-to-power’ solution, enabling data centers to get on-site, continuous electricity in months rather than years, which is essential for the fast-paced AI market.

What is the main difference in how fuel cells were used before 2025 versus now?

Before 2025, fuel cells were used in small-scale pilot projects, primarily for backup power to replace diesel generators, as seen in Microsoft’s 3 MW test. Since 2025, the market has shifted decisively to using fuel cells for large-scale, continuous prime power. This is demonstrated by multi-billion-dollar procurements by companies like Bloom Energy to power entire data centers, effectively displacing the need for a primary grid connection.

Who are the main companies and investors driving this market shift?

Bloom Energy is a prominent leader, securing massive deals with utility American Electric Power (AEP) and infrastructure investor Brookfield Asset Management. Fuel Cell Energy has also strategically pivoted to the data center market, partnering with infrastructure fund SDCL for large deployments. These partnerships show that major utilities and large capital investors are now validating fuel cells as a bankable, utility-scale asset class.

Is this a US-only trend, or is it happening globally?

While the United States is the clear leader in large-scale commercial deployments due to its acute grid congestion and AI buildout, this is a global trend. The article highlights South Korea as a key secondary market with major projects planned, and notes that Europe is moving from pilot projects to commercial validation. The model is also being replicated in other tech hubs like Taiwan.

What type of fuel cell technology is being used, and what do they run on?

Solid Oxide Fuel Cell (SOFC) technology has emerged as the leader for prime, continuous power due to its high electrical efficiency and proven scalability, as demonstrated by Bloom Energy’s large contracts. Currently, these systems primarily run on natural gas to solve the immediate power crisis. However, many are designed to be fuel-flexible, providing a future path to run on green hydrogen as that supply chain matures.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.