Grid Constraints & AI Demand: Why Siemens Energy’s $1 B Investment Signals a 2026 Manufacturing Supercycle

AI Demand Surge Creates Commercial Scale Opportunities in Grid Technology for 2026

The energy industry has transitioned from piloting AI-driven software for grid optimization to funding large-scale physical infrastructure build-outs, a direct response to a verified and sustained surge in power demand from data centers. This strategic pivot from software-centric solutions to hardware manufacturing confirms that the primary constraint on AI’s growth is no longer computational power but the physical capacity of the electrical grid.

- Between 2021 and 2024, the focus was on using digital tools to enhance existing infrastructure. This included the launch of software like Siemens‘ Gridscale X™ for autonomous grid management and digital twin collaborations with partners like NVIDIA to optimize wind farm performance. These initiatives proved the value of AI in managing energy systems but did not address the fundamental power generation and transmission deficit.

- From 2025 onward, the market shifted decisively toward hardware. Siemens Energy‘s order backlog swelled to a record €146 billion, driven by demand for gas turbines and grid equipment. This is validated by tangible projects, such as Fermi America taking delivery of six Siemens Energy SGT-800 gas turbines in February 2026 and competitors like Hitachi Energy committing a parallel $1 billion to scale up U.S. transformer production in response to the same AI-driven demand signals.

- The adoption model has also inverted, with technology companies becoming direct catalysts for new energy projects. Initiatives like Microsoft’s potential revival of the Three Mile Island nuclear plant and Applied Digital‘s development of a dedicated 1 GW power plant with technology from Babcock & Wilcox and Siemens Energy show that data center operators are now underwriting new generation capacity, moving far beyond their prior role as passive electricity consumers.

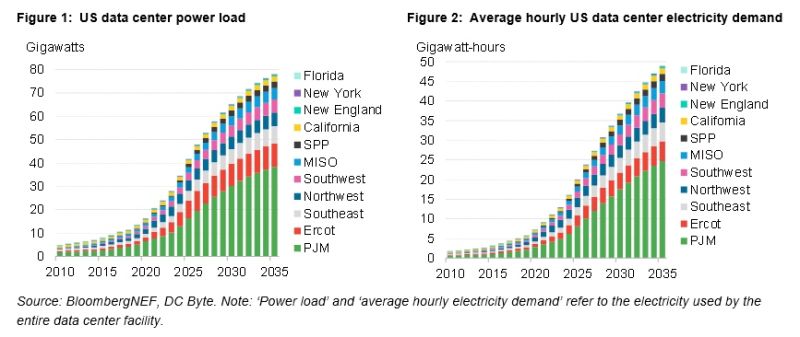

AI Power Demand Forecast to Quadruple

This chart directly illustrates the section’s core premise by forecasting a massive surge in U.S. data center power demand, which is the catalyst for the shift to large-scale grid hardware.

(Source: LinkedIn)

Investment Analysis: Over $2 B in Capital Commitments Signal a Power Equipment Supercycle

Major equipment manufacturers are deploying billions in new capital to expand factory output for critical power components, providing definitive financial validation that the AI-driven demand surge is a structural, multi-year growth cycle. These are not speculative investments but direct actions to fulfill a burgeoning order backlog and alleviate severe supply chain bottlenecks.

Siemens KPIs Confirm Equipment Supercycle

This chart provides definitive financial validation for the ‘supercycle,’ showing a massive €138B order backlog and high book-to-bill ratio, confirming the burgeoning orders and structural growth mentioned in the section.

(Source: Seeking Alpha)

- Siemens Energy‘s commitment of over $1 billion to the U.S. market, announced in February 2026, is the primary signal. This capital is targeted at expanding gas turbine manufacturing in North Carolina and building a new $300 million high-voltage equipment plant in Mississippi, directly addressing the need for both firm power generation and grid transmission hardware.

- This U.S.-focused investment is part of a wider strategy that began earlier. In July 2024, the company announced a €1.2 billion global plan to boost its grid technology business, preceded by a targeted $150 million investment in a U.S. power transformer factory in February 2024 to address component lead times exceeding two years.

- The trend is sector-wide, confirming a non-discretionary market need. Hitachi Energy mirrored this strategy by announcing its own $1 billion investment in September 2025 to scale up U.S. production of transformers and high-voltage equipment, explicitly citing demand from data centers as the core driver.

Table: Key Investments in Power Generation & Grid Manufacturing Capacity

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Siemens Energy | Feb 2026 | Announced a $1 billion investment to expand U.S. manufacturing for gas turbines and grid equipment, creating over 1, 500 jobs to meet surging AI-driven demand. | Bloomberg |

| Hitachi Energy | Sep 2025 | Announced a $1 billion investment to increase U.S. manufacturing capacity for power transformers and high-voltage equipment, directly targeting AI data center demand. | Hitachi Energy |

| Siemens Energy | Jul 2024 | Planned a €1.2 billion global investment to expand its grid technology business, including hiring 10, 000 new employees to address grid modernization needs. | Financial Times |

| Siemens Energy | Feb 2024 | Invested $150 million to build a new power transformer factory in Charlotte, North Carolina, to alleviate critical U.S. supply chain shortages. | Investment Monitor |

| Siemens AG (Parent Co.) | Nov 2023 | Committed $510 million to expand its U.S. supply chain for data centers, including a new electrical equipment plant in Texas. | Data Center Knowledge |

Strategic Partnerships Evolve to Deliver End-to-End AI Power Solutions

Strategic alliances have matured from integrating software into existing systems to building complete, end-to-end power ecosystems designed to accelerate data center deployment. This shift reflects a market need for turnkey solutions that combine power generation, grid hardware, and digital controls to meet the aggressive timelines of AI infrastructure projects.

- Recent partnerships focus on tangible, integrated hardware solutions. The June 2025 collaboration between Siemens Energy and Eaton aims to deliver modular, on-site power generation systems, a solution designed specifically to reduce the construction and commissioning times for new data centers.

- The supply chain is being reconfigured to serve the AI industry directly. In January 2026, Babcock & Wilcox selected Siemens Energy as the steam turbine supplier for a 1 GW power plant dedicated to Applied Digital‘s data centers, demonstrating how industrial OEMs are forming direct links to power the AI sector.

- Partnerships are also tackling next-generation grid stability challenges at their source. A January 2026 pilot project between Siemens and Soluna is developing solutions to manage the volatile power swings caused by GPU processing, a critical step for integrating AI workloads with renewable energy sources.

- This contrasts with earlier collaborations, such as the 2022 partnership with NVIDIA to build digital twins of wind farms. While important for optimization, those efforts focused on software and simulation, whereas the new generation of partnerships is centered on manufacturing, deploying, and stabilizing physical power systems.

Table: Key Partnerships for AI-Driven Energy Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Babcock & Wilcox & Siemens Energy | Jan 2026 | Siemens Energy selected to supply steam turbine generator sets for a 1 GW power project dedicated to Applied Digital‘s AI data centers. | Babcock & Wilcox |

| Soluna & Siemens | Jan 2026 | Collaborating on a pilot project to manage GPU-driven power swings at the source, aiming to improve grid stability for AI workloads. | Siemens |

| Eaton & Siemens Energy | Jun 2025 | Partnered to offer integrated, on-site power generation solutions with modular data center construction to accelerate deployment timelines for AI facilities. | Eaton |

| Compass Datacenters & Siemens | Dec 2024 | Signed a multi-year agreement for custom electrical solutions designed to dramatically reduce the installation time for critical power systems in new data centers. | Compass Datacenters |

| NVIDIA & Siemens Gamesa | Mar 2022 | Partnered to use NVIDIA‘s Omniverse platform to create physics-informed digital twins of wind farms, focused on simulation and performance optimization. | NVIDIA |

U.S. Becomes Epicenter of AI-Driven Power Infrastructure Investment

The United States has emerged as the clear geographical focus for new power generation and grid hardware investment, driven by the unparalleled concentration of AI data center construction and supportive industrial policies. While manufacturers maintain a global footprint, the scale and urgency of recent capital commitments are overwhelmingly directed at the U.S. market to meet this specific demand driver.

US Becomes Siemens Energy’s Largest Market

This chart directly supports the section’s claim that the U.S. is the investment epicenter by showing it has become the single largest market for Siemens Energy, a key global supplier.

(Source: Bloomberg.com)

- Recent multi-billion-dollar investments are centered in the U.S. Siemens Energy‘s $1 billion capital injection announced in 2026 is targeted at expanding facilities in North Carolina and Mississippi. This follows Hitachi Energy‘s $1 billion U.S. manufacturing expansion announced in late 2025, solidifying a clear pattern of industrial re-shoring to serve domestic demand.

- Financial data confirms the U.S. market’s dominance. The U.S. now constitutes Siemens Energy‘s single largest market, accounting for 29% of its total order intake, a figure that directly substantiates its decision to concentrate new manufacturing investments there.

- This marks a significant acceleration compared to the 2021-2024 period. During that time, investments were more globally distributed and smaller in scale, such as Siemens‘ $12 million expansion of its transformer facility in Kalwa, India, in November 2024. The recent U.S. investments are an order of magnitude larger and more strategically focused on the AI demand thesis.

Grid Technology Shifts from Software Optimization to Commercial-Scale Hardware Deployment

The market for AI-related energy technology has definitively advanced from a software-focused, optimization phase to a full-scale commercial deployment phase centered on manufacturing and installing essential hardware. The core challenge is no longer proving that AI can help manage the grid but physically producing enough turbines, transformers, and switchgear to prevent grid capacity from capping AI’s growth.

Grid Tech Profit Forecasts Rise Sharply

This chart validates the section’s theme of a shift to hardware by showing a significant upward revision in profit targets for Siemens Energy’s ‘Grid Technologies’ division, reflecting the high value of hardware deployment.

(Source: Seeking Alpha)

- The period between 2021 and 2024 was characterized by the development and launch of digital solutions. This included Siemens‘ introduction of its Gridscale X™ software for autonomous grid management and the use of AI-powered digital twins. This phase established the business case for smarter energy systems but relied on existing physical infrastructure.

- Starting in 2025, the market’s focus pivoted to resolving physical bottlenecks. This is confirmed by Siemens Energy‘s record €146 billion order backlog, which is overwhelmingly for physical grid technology and gas turbines. The technology itself is mature, but the AI-driven demand is forcing an unprecedented ramp-up in manufacturing scale.

- The validation of this shift is the capital allocation itself. Billions of dollars from both Siemens Energy and its competitors are now being invested not in software R&D but in building and expanding factories. This demonstrates that the primary constraint has moved from digital innovation to industrial production capacity.

SWOT Analysis: Navigating the AI-Driven Energy Demand Surge

The surge in AI-driven energy demand presents a generational opportunity for industrial suppliers, defined by a validated, long-term revenue stream. However, this strength exposes the entire sector to significant execution risks, as the primary challenge shifts from securing demand to fulfilling it through massive, complex manufacturing expansions.

OEMs See Strong Profitability Growth Outlook

This chart quantifies the ‘generational opportunity’ mentioned in the SWOT analysis, projecting significant profitability growth across major energy OEMs as they capitalize on the AI-driven demand surge.

(Source: GasTurbineHub)

Table: SWOT Analysis for AI-Driven Grid & Generation Demand

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strength | Strong portfolio of digital and AI-powered software for grid optimization (e.g., Spectrum Power, digital twins). | Record order backlogs (Siemens Energy‘s €146 B) and market leadership in a validated high-demand sector (gas turbines, grid tech). | The value proposition shifted from the potential of software to the realized, bankable revenue from hardware orders driven by AI demand. |

| Weakness | Financial drag from underperforming divisions, particularly in the renewables sector (e.g., Siemens Gamesa issues). | Severe manufacturing capacity constraints and long lead times for critical components like power transformers (often >2 years). | The primary internal bottleneck moved from portfolio profitability issues to the physical limitations of the industrial supply chain. |

| Opportunity | Grid modernization driven by general electrification and the integration of intermittent renewable energy sources. | AI data centers create a new, massive, and urgent customer segment requiring 24/7 firm power, accelerating grid investment timelines. | A more lucrative and less discretionary demand driver (AI) emerged, creating a structural supercycle for both generation and grid hardware. |

| Threat | Geopolitical and post-pandemic supply chain disruptions affecting component availability and project costs. | Intensifying competition as peers (e.g., Hitachi Energy) make identical, large-scale investments; significant execution risk on delivering massive capital projects on time. | The primary external threat has shifted from demand uncertainty to competitive pressure and the operational risk of failing to execute on promised capacity expansions. |

Forward Outlook: If Manufacturing Capacity Ramps Up, Watch for Supply Chain Consolidation

The critical path for the energy infrastructure sector over the next 24 months is the successful execution of announced factory expansions. If these new facilities come online as planned, market leaders will be positioned to consolidate their advantage; if they face delays, the market could fragment as customers seek alternative, faster, or more specialized solutions.

Siemens Earnings Forecast Aligns with Strengths

This chart illustrates the financial outcome of the ‘Strengths’ listed in the SWOT table, projecting strong earnings growth for Siemens Energy based on its market leadership and massive order backlog.

(Source: Seeking Alpha)

- If this happens: Industrial OEMs like Siemens Energy and Hitachi Energy successfully ramp up their new U.S. factories for transformers, switchgear, and turbines by their 2026-2027 target dates.

- Watch this: Monitor equipment lead times for a significant reduction from their current multi-year highs. Also, track the quarterly financial performance of the grid technology divisions of these companies for signs of margin pressure or execution delays on these large capital projects.

- These could be happening: To secure their supply chains, data center operators will increasingly sign exclusive, multi-year capacity agreements, similar to the Siemens-Compass Datacenters deal. Industrial leaders with proven execution may acquire smaller, innovative technology providers (like those in the Soluna pilot) to build more integrated and differentiated offerings for the AI market.

Frequently Asked Questions

Why are companies like Siemens Energy and Hitachi Energy investing billions in new factories right now?

These companies are investing billions to expand their manufacturing capacity for power equipment like transformers and gas turbines in direct response to a massive, verified surge in electricity demand from AI data centers. The primary bottleneck for AI’s growth is now the physical electrical grid, and these investments are necessary to build the hardware required to meet a record order backlog and prevent a power deficit.

What is the “2026 manufacturing supercycle” the article refers to?

The ‘manufacturing supercycle’ refers to a predicted long-term, structural growth period for power equipment manufacturing, peaking around 2026. It is driven by the urgent, non-discretionary need to build out grid infrastructure to support the energy demands of the AI industry. Billions in capital commitments from major industrial firms to expand factory output serve as the primary evidence for this cycle.

How has the energy industry’s focus shifted since 2024?

Before 2025, the industry focused on using AI-driven software and digital twins to optimize the performance of existing grid infrastructure. From 2025 onward, the focus has pivoted decisively to hardware. The priority is now the large-scale manufacturing and deployment of physical components like gas turbines and high-voltage equipment to address the fundamental power generation and transmission shortfall caused by AI demand.

Why is the United States the main recipient of these multi-billion dollar investments?

The U.S. has become the epicenter for these investments due to the unparalleled concentration of AI data center construction within the country. To serve this massive and urgent domestic demand, and to overcome severe supply chain bottlenecks, global manufacturers like Siemens Energy and Hitachi Energy are strategically focusing their capital on expanding their U.S.-based factories.

What has changed about the partnerships in the energy sector?

Strategic partnerships have evolved from software-focused collaborations to building end-to-end physical power systems. Earlier partnerships, like the 2022 Siemens-NVIDIA deal, focused on digital simulation. In contrast, recent partnerships (e.g., Siemens Energy with Eaton and Babcock & Wilcox) are focused on delivering tangible, integrated hardware solutions—like modular power plants—to accelerate the deployment of new data centers.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.