Geothermal for Data Centers 2026: Why Policy is the Ultimate Catalyst for Scaling Power

Geothermal Projects for Data Centers: Corporate Adoption Hinges on Policy De-Risking

While corporate adoption of geothermal power accelerated significantly from 2025, moving from small pilots to large-scale power purchase agreements, this growth is confined to a few major technology firms and is entirely dependent on supportive policy to become a market-wide solution. The primary constraint is not a lack of interest or capital, but the high upfront risk and long development timelines that government action is uniquely positioned to mitigate.

- Between 2021 and 2024, industry adoption was characterized by small-scale validation projects, such as Google’s partnership with Fervo Energy for a 5 MW Enhanced Geothermal System (EGS) in Nevada, which became operational in late 2023. This phase was critical for proving the technical feasibility of next-generation geothermal for 24/7 power.

- Starting in 2025, the market shifted toward larger, commercially significant offtake agreements driven by the immense power needs of AI. Key examples include Meta’s development agreement with XGS Energy for 150 MW of geothermal power in New Mexico and its PPA with Sage Geosystems for another 150 MW in Texas.

- This transition from small pilots to substantial PPAs demonstrates that tech giants are now seeking firm, carbon-free power at a scale that intermittent renewables alone cannot provide. However, these are still complex, bespoke deals that do not represent a scalable, commoditized market.

- The persistence of natural gas as a default option, evidenced by proposed projects like the $70 billion Wonder Valley industrial park, highlights the urgent need for policy to make geothermal competitive on both cost and deployment speed for the broader data center industry.

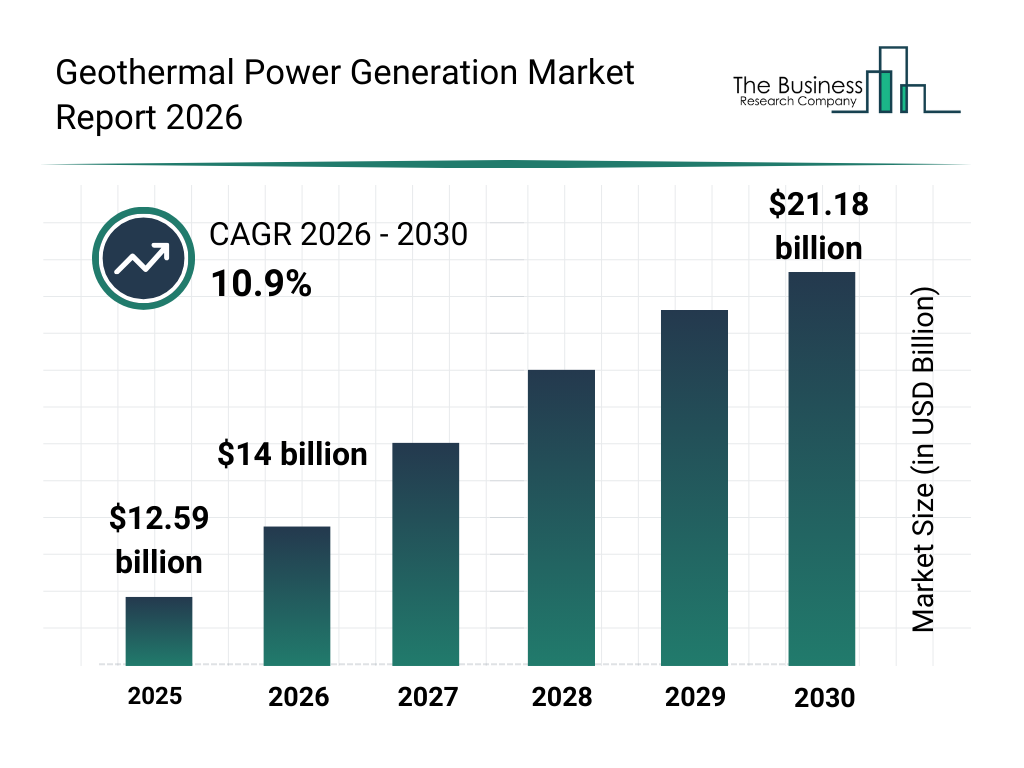

Geothermal Power Market Growth Accelerates

The market’s projected growth to over $21 billion by 2030 reflects the corporate adoption and large-scale power purchase agreements described in the section.

(Source: The Business Research Company)

Geothermal Investment Analysis: Surging Capital Highlights Policy’s Role in Competitiveness

Private investment in next-generation geothermal surged after 2024, but its economic viability remains directly tied to federal and state incentives, making policy the determining factor in achieving cost-competitiveness against natural gas. The flow of capital confirms market confidence in the technology’s potential, but the underlying project economics are propped up by a policy foundation that must be maintained and strengthened to support gigawatt-scale deployment.

Next-Gen Geothermal Investment Surges

This chart directly illustrates the surge in capital for next-generation geothermal projects peaking in 2025, confirming the market’s confidence mentioned in the analysis.

(Source: Rinnovabili)

- Financing for next-generation geothermal projects reached nearly $2.2 billion in 2025, marking an 80% increase from the previous year. This capital influx, demonstrated by events like XGS Energy’s $13 million funding round, is directly fueling the development of new projects.

- Analysis shows the critical impact of policy on geothermal’s Levelized Cost of Energy (LCOE). With federal tax credits, a new EGS project’s LCOE is around $88/MWh; without them, the cost rises to $119/MWh, rendering it uncompetitive against new combined-cycle natural gas plants.

- The U.S. Department of Energy’s “Enhanced Geothermal Shot” initiative, which aims to reduce the technology’s LCOE to $45/MWh by 2035, underscores that sustained public investment in research and development is essential for long-term cost reduction and market viability.

Table: Key Geothermal Financing and Corporate Agreements

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Ormat Technologies / Switch | 2026-01-12 | A 20-year Power Purchase Agreement (PPA) for approximately 13 MW of geothermal capacity to power Switch’s data centers in Nevada. This marks Ormat’s first direct PPA with a data center operator. | Ormat Technologies Signs 20-Year PPA with Switch |

| Meta / XGS Energy | 2025-06-13 | A development agreement for 150 MW of geothermal power to supply Meta’s New Mexico data centers, signaling a major commitment to next-generation geothermal for AI workloads. | Meta signs geothermal power deal for New Mexico data centers |

| Google / Baseload Capital | 2025-04-15 | Taiwan’s first corporate geothermal PPA to provide 24/7 carbon-free energy for Google’s local data center operations, establishing a new market for geothermal procurement in Asia. | Google Ignites Taiwan’s First Corporate Geothermal Deal |

| Meta / Sage Geosystems | 2024-08-26 | PPA for up to 150 MW of geothermal power from a project in Texas, expected to come online in 2027. This diversifies Meta’s geothermal investments into different next-generation technologies. | Meta Platforms strikes geothermal energy deal |

| Google / Fervo Energy | 2024-06-13 | An agreement with utility NV Energy to supply Google’s Nevada data centers with 115 MW of geothermal power from Fervo Energy, scaling up from their initial pilot project. | Google to power Nevada data center with 115 MW of geothermal energy |

Geothermal Partnerships 2026: Ecosystem Forms to Address Scaling Challenges for Data Centers

A strategic ecosystem of partnerships emerged in 2025-2026, linking technology offtakers, geothermal developers, and specialized suppliers to address the complex development cycle. These collaborations are crucial for integrating the value chain and managing risk, but their success depends on a stable policy framework that justifies long-term financial and operational commitments.

- Developer-Offtaker Alliances: The most visible partnerships are long-term PPAs between developers and tech companies, such as Fervo Energy with Google and XGS Energy with Meta. These agreements provide the revenue certainty needed to secure financing for capital-intensive drilling and construction.

- Technology and Development Joint Ventures: To improve operational efficiency, technology firms are partnering directly with developers. The collaboration between oilfield services giant SLB and Ormat aims to co-develop and deploy integrated geothermal assets and EGS systems, combining subsurface expertise with power plant operations.

- Specialized Supply Chain Integration: The partnership between Vallourec, a provider of high-temperature tubular solutions, and XGS Energy is designed to accelerate a multi-gigawatt project pipeline. This collaboration directly addresses potential supply chain bottlenecks for critical drilling components.

Table: Strategic Geothermal Partnerships for Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vallourec / XGS Energy | 2026-01-28 | A partnership to accelerate a multi-gigawatt project pipeline across the Western U.S. by securing the supply of high-performance tubular solutions for next-generation geothermal wells. | Vallourec and XGS Energy Partner to Accelerate Multi-Gigawatt |

| SLB / Ormat | 2025-10-27 | A partnership to accelerate integrated geothermal asset development, including EGS. This combines SLB’s subsurface and drilling expertise with Ormat’s power plant technology and operational experience. | SLB and Ormat Partner to Accelerate Integrated Geothermal Asset |

| Microsoft / G 42 | 2024-05-22 | A $1 billion co-investment to build a geothermal-powered data center in Kenya. This project aims to create a model for sustainable digital infrastructure in emerging markets with strong geothermal resources. | Microsoft and G 42 to build geothermal-powered data center in Kenya |

Geothermal Growth by Region: US West Leads Data Center Power Projects Amid Policy Incentives

Geothermal development for data centers is heavily concentrated in the Western U.S., a region with the dual advantages of favorable geology and supportive state-level policies. While this region remains the epicenter of activity, pilot projects and investments in international locations during 2025-2026 indicate a growing global recognition of geothermal’s potential to power digital infrastructure.

US West Leads Geothermal Potential

This chart highlights the concentration of geothermal potential in Western US states like California and Nevada, supporting the section’s focus on regional leadership.

(Source: Rhodium Group)

- From 2021 to 2024, activity was primarily exploratory and focused on proving the technology in areas with known geothermal resources, like Nevada. The Fervo/Google pilot was a key example of this early-stage geographic focus.

- In 2025 and 2026, development activity solidified into concrete, large-scale projects in key Western states. These include projects in Nevada (Ormat/Switch), New Mexico (XGS/Meta), and Texas (Sage/Meta), driven by the co-location of data center hubs and geothermal potential.

- State-level policies have been a critical enabler. Tax credits for geothermal equipment in New Mexico and other incentives create a more attractive investment environment, supplementing federal programs like the Inflation Reduction Act.

- The geographic scope began to widen with international projects like Google’s PPA in Taiwan and Microsoft’s planned $1 billion data center in Kenya. These moves signal that the geothermal-for-data-center model is being exported to other regions where geology and policy align.

Next-Generation Geothermal Technology: From Pilot to Commercial Viability for Data Centers

Next-generation geothermal, particularly Enhanced Geothermal Systems (EGS), progressed from small-scale pilots before 2024 to initial commercial validation in 2025-2026. However, scaling this technology to the gigawatt levels demanded by the AI boom requires overcoming significant cost and deployment timeline barriers that only targeted policy can effectively address.

EGS Market Expands Past Pilot Phase

The projected growth of the Enhanced Geothermal System (EGS) market to over $3 billion quantifies the technology’s move from pilot projects to commercial viability.

(Source: Zion Market Research)

- The 2021-2024 period was defined by technology demonstration. The successful operation of Fervo Energy’s 5 MW pilot project with Google provided the first concrete proof that EGS, which adapts drilling techniques from the oil and gas sector, could deliver reliable, carbon-free power for a data center.

- The period from 2025 to today marks the transition to commercialization, with companies signing offtake agreements for projects 10 to 30 times larger, such as Meta’s 150 MW deals. This reflects growing confidence that the technology works, but it has not yet achieved widespread, cost-effective deployment.

- A fundamental mismatch persists between geothermal development timelines (5-10 years) and the rapid construction cycles of data centers (2-3 years). This lag is almost entirely due to slow permitting and regulatory processes, not technological limitations.

- The DOE’s ambitious cost-reduction target of $45/MWh by 2035 reinforces that EGS is still on a technology maturation curve. Achieving this target depends on continued public R&D funding and policies that accelerate learning-by-doing through faster project deployment.

SWOT Analysis: Policy’s Critical Role in Geothermal for Data Centers

A SWOT analysis reveals that while strong corporate demand and improving technology are key strengths, significant weaknesses in cost and permitting timelines, coupled with the threat of natural gas competition, make policy support the pivotal factor for capitalizing on the opportunity. Policy is the mechanism that can amplify strengths, mitigate weaknesses, and defend against existential threats from fossil fuel alternatives.

Higher Power Prices Aid Geothermal

This chart visually explains a key point from the SWOT analysis, showing how geothermal’s competitiveness improves as the price of conventional electricity rises.

(Source: Rhodium Group)

Table: SWOT Analysis for Scaling Geothermal Power for Data Centers

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Theoretical potential as a 24/7 clean baseload power source. Transferable drilling technology from oil and gas. | Demonstrated technology through pilots (Fervo/Google). Validated, large-scale corporate demand from tech giants (Meta, Google). | The value proposition shifted from theoretical to proven. Corporate demand was validated by PPAs in the 100+ MW range, providing revenue certainty for new projects. |

| Weaknesses | High upfront capital risk for exploratory drilling (“wildcatting”). Long and uncertain permitting timelines. | High LCOE ($119/MWh) without incentives. Development timelines (5-10 years) are misaligned with rapid data center construction (2-3 years). | The core weaknesses were quantified and became acute. The LCOE’s dependence on policy was confirmed, and the timeline mismatch emerged as a critical barrier to scaling at the speed of the AI boom. |

| Opportunities | Rising electricity demand from a growing data center market. Corporate ESG goals requiring clean energy. | Exponential AI-driven power demand (up to 9.1% of U.S. total by 2030). Major policy support (IRA, BIL). Potential for co-location with data centers to bypass grid constraints. | The AI boom transformed the market opportunity from a steady growth driver into an urgent, massive demand signal. Federal policies created a strong, albeit incomplete, financial foundation for investment. |

| Threats | Competition from increasingly cheap solar and wind, paired with battery storage. | Natural gas combined-cycle plants as the faster, cheaper, and more scalable default baseload option for meeting urgent data center power needs. | The primary threat shifted from other renewables to natural gas. The speed required by data center developers makes natural gas the path of least resistance, risking decades of locked-in emissions. |

2026 Outlook for Geothermal Energy: Permitting Reform is the Key Signal to Watch

The primary determinant for scaling geothermal to meet data center demand in 2026 and beyond will be the implementation of aggressive permitting reform. Without policies that drastically shorten development timelines, private investment will remain concentrated in a few high-profile projects, and the broader industry will cede the baseload power opportunity to natural gas.

Surging Data Center Demand at Stake

The projected surge in data center electricity demand illustrates the scale of the opportunity that geothermal must scale quickly to capture, as highlighted in the outlook.

(Source: Rhodium Group)

- If this happens: If federal and state governments implement “fast track” permitting authority that reduces geothermal approval timelines from over five years to a target of 24 months, it will fundamentally alter the competitive dynamics of the technology.

- Watch this: The key signal to watch will be an increase in the number of mid-sized developers and independent power producers securing financing for geothermal projects. This would indicate that the risk-return profile has improved enough to attract a wider pool of capital beyond tech giants.

- These could be happening: Success would be marked by a diversification of corporate offtakers and the emergence of standardized project finance structures for geothermal. This would confirm that geothermal is transitioning from a high-risk, bespoke solution into a scalable energy commodity that can compete with natural gas on deployment speed. The White House’s July 2025 action to accelerate permitting was a positive signal, but far more specific and binding reforms are required to unlock the market.

Frequently Asked Questions

Why are data centers suddenly turning to geothermal power?

The shift is driven by the massive and constant power demands of Artificial Intelligence (AI). Tech companies are seeking a reliable, 24/7, carbon-free energy source that intermittent renewables like solar and wind cannot provide alone. Geothermal offers this ‘firm’ power, making it an ideal solution for energy-intensive AI workloads.

What is the biggest obstacle preventing more data centers from using geothermal energy?

The biggest obstacles are the long development timelines (5-10 years) and high upfront financial risks associated with exploration and drilling. These long lead times, largely due to slow permitting and regulatory processes, are misaligned with the rapid 2-3 year construction cycles of data centers, making natural gas a faster alternative.

Is geothermal power cost-competitive with natural gas?

Currently, its competitiveness depends almost entirely on government policy. With federal tax credits, a new Enhanced Geothermal System (EGS) costs around $88/MWh. However, without those incentives, the cost jumps to $119/MWh, making it uncompetitive against new natural gas plants. Policy support is essential to bridge this cost gap.

Which companies are leading the adoption of geothermal for their data centers?

A few major technology firms are pioneering large-scale geothermal adoption. Key leaders mentioned are Meta (with 150 MW deals with XGS Energy and Sage Geosystems), Google (with a 115 MW project with Fervo Energy), and Switch (with a 13 MW agreement with Ormat Technologies). Microsoft is also pursuing it with a major investment in Kenya.

What is the most important change needed to help geothermal energy scale up?

The single most critical factor is aggressive permitting reform. Reducing the approval timeline for geothermal projects from over five years to a target of 24 months would make it competitive with natural gas on deployment speed. This change is seen as the key to unlocking broader investment and moving geothermal from bespoke projects to a scalable energy commodity.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.