Grid Capacity 2026: How EV Smart Charging Unlocks Power for the Data Center Boom

Industry Adoption Moves from Pilots to Scaled Commercial Programs

Commercial adoption of grid-integrated EV charging has shifted from isolated pilots demonstrating technical feasibility between 2021 and 2024 to integrated, software-driven utility programs that quantifiably reduce peak load at scale in 2025 and beyond. This evolution from hardware-centric tests to platform-based commercial services provides the grid flexibility required to accommodate large, inflexible loads like data centers.

- In the 2021-2024 period, industry activity focused on demonstrating potential. For example, the city of Victoriaville, Quebec, partnered with Cleo on a Vehicle-to-Grid (V 2 X) project to prove that EVs could provide grid resilience, establishing the technical viability of bidirectional power flow in a real-world setting.

- Since January 2025, the focus has moved to commercial validation and economic efficiency. Amp Up’s load management program proved it could shift peak demand at a cost of less than $0.50 per k Wh, establishing a quantifiable economic case for managed charging as a non-wires alternative to costly infrastructure builds.

- The market is now maturing toward large-scale software integration. Weave Grid’s collaborations with automaker Rivian and enterprise software provider Oracle in 2025 show a strategic move to embed managed charging directly into utility and consumer ecosystems, enabling seamless, automated grid response across thousands of vehicles.

- This progression indicates that the industry is no longer just testing the technology but is actively deploying it as a core grid management tool, turning millions of EVs into a coordinated, dispatchable energy resource.

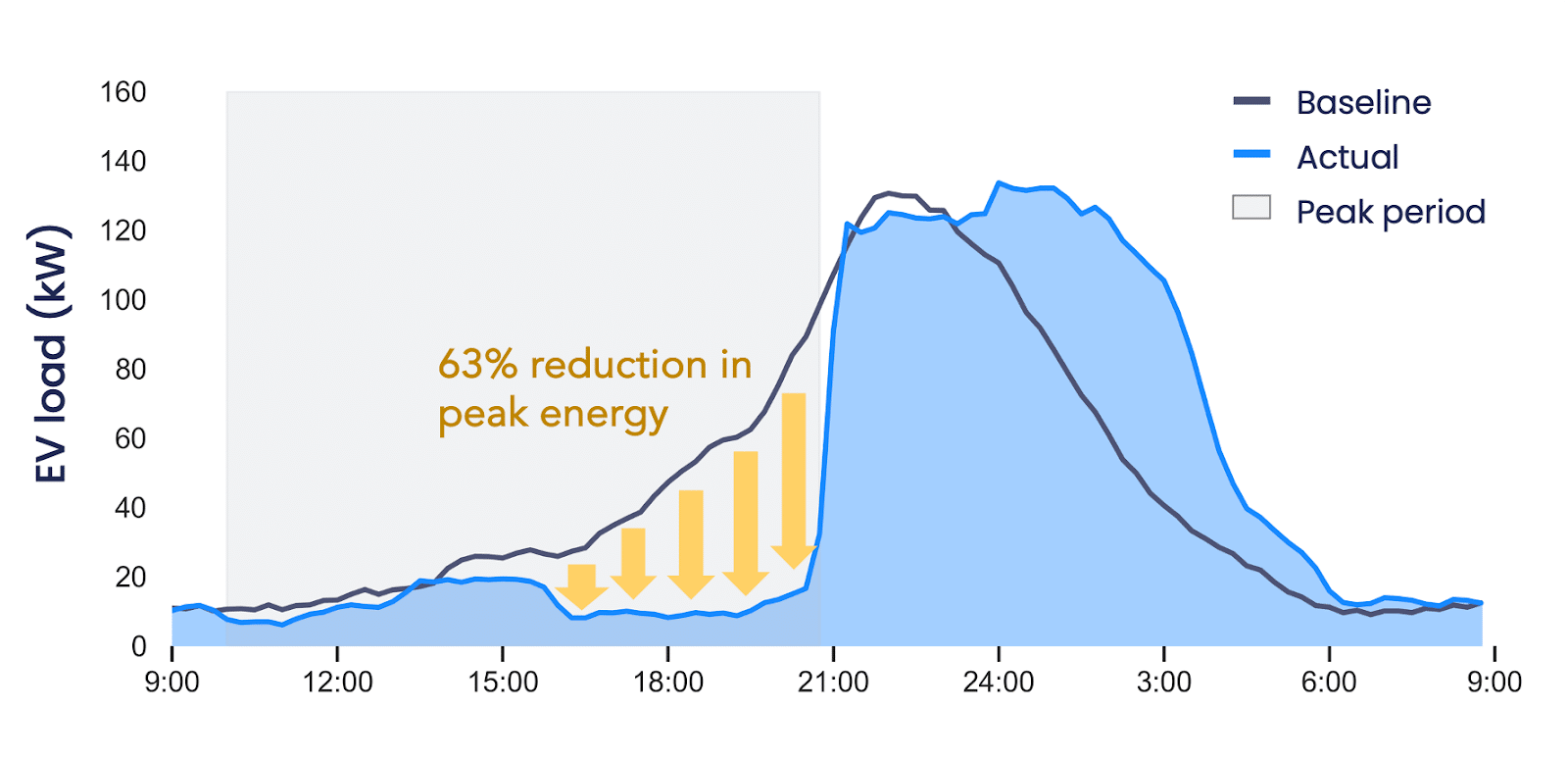

Managed Charging Reduces Peak Load

This chart shows how scaled commercial programs quantifiably reduce peak load, directly supporting the section’s focus on the evolution from pilots to effective, scaled grid services.

(Source: EnergyHub)

Geography: North America Becomes the Proving Ground for Grid Symbiosis

While early EV grid integration efforts were globally dispersed, North America has become the primary theater for scaling these solutions due to the acute, concurrent pressure from data center clusters and aggressive EV adoption targets. The intense, localized demand from data centers provides a powerful commercial incentive to deploy EV load management as a direct solution to grid constraints.

Modeling EV Impact on US Grid

This chart models EV charging’s impact on the Western US grid (WECC), directly supporting the section’s focus on North America as the primary proving ground for grid symbiosis.

(Source: Nature)

- Between 2021 and 2024, significant activity was seen in Europe, driven by high EV penetration, and in Canada, through government-backed initiatives like Quebec’s early V 2 X pilots. The focus was broadly on accommodating EV growth.

- From 2025 onward, the United States emerged as the epicenter of commercial deployment. This is because regions with high data center concentration are experiencing severe grid strain, with wholesale power costs surging by as much as 267%. This economic pain creates an immediate market for solutions from companies like Weave Grid and Amp Up that can free up grid capacity.

- Canada remains a leader in policy-driven innovation, with federal initiatives like the Electric Vehicle Infrastructure Demonstration (EVID) Program now funding projects specifically designed to resolve grid integration challenges at a national level.

- The direct geographic overlap between new data center developments, such as the 16 new data centers planned for Ontario, and areas with growing EV fleets is forcing utilities to treat EV flexibility as a critical infrastructure asset.

Technology Maturity: Software-Defined VPPs Emerge as a Commercial Reality

The core technology has matured from hardware-centric bidirectional chargers in pilot stages between 2021 and 2024 to commercially proven, software-defined Virtual Power Plants (VPPs) that aggregate and dispatch EV charging as a reliable grid service today. This shift from hardware feasibility to software-enabled scale is the key enabler of the spillover effect for data centers.

VPPs Shift Peak Electricity Demand

This visualizes how flexible resources, like the software-defined VPPs mentioned, absorb and reduce load to flatten the demand curve, matching the section’s technology maturity theme.

(Source: UCS blog – Union of Concerned Scientists)

- In the earlier 2021-2024 period, the technological focus was on hardware and site-level management. Companies like FLEXECHARGE and Versinetic pioneered Dynamic Load Management (DLM) to prevent overloads at individual charging sites, while the limited availability of V 2 G-capable vehicles was a primary constraint.

- Since 2025, the technology has become about aggregation and control at scale. Software platforms like Blu Wave-ai’s EV Everywhere Infrastructure Cube are now designed to manage and optimize charging across entire regions. The growing availability of bidirectional models, now numbering at least 14 in the U.S., provides the necessary distributed hardware base for these platforms to manage.

- Commercial validation is now based on quantifiable grid-level outcomes. Reports from 2026 confirm that managed charging can double the number of EVs a local grid can support without physical upgrades, a critical metric that gives utilities the confidence to approve new data center interconnections in constrained areas.

SWOT Analysis: Grid Integration of EV Charging

The strategic landscape has pivoted from overcoming technical barriers to capitalizing on a clear economic symbiosis between flexible EV charging and inflexible data center demand. However, the primary bottleneck is shifting from vehicle technology to the slower pace of regulatory and market design innovation.

Table: SWOT Analysis for EV Charging Grid Integration and Data Center Capacity

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Technical feasibility of V 2 G and smart charging was demonstrated in isolated pilots and academic models. | Proven economic viability (less than $0.50/k Wh shifted via Amp Up). Scalable software platforms (Weave Grid, Blu Wave-ai) can aggregate thousands of EVs into VPPs. | The value proposition shifted from a technical concept to a commercially competitive, non-wires alternative for grid capacity. |

| Weaknesses | Limited availability of V 2 G-capable vehicles, fragmented communication standards, and low consumer awareness were significant barriers. | The V 2 G-capable fleet is still a small fraction of total EVs, though growing. Utility rate structures and market mechanisms often lack the sophistication to properly compensate EV owners for providing grid services. | The primary bottleneck has moved from vehicle hardware availability to the slow pace of market and regulatory reform. |

| Opportunities | The primary opportunity was seen as deferring general grid upgrades and absorbing intermittent renewable energy. | The opportunity is now highly specific: directly accelerating data center interconnection queues by providing utilities with a contracted source of local load relief and grid stability. | The opportunity became more immediate and lucrative by tying EV flexibility directly to enabling the multi-trillion-dollar data center and AI expansion. |

| Threats | The main threat was unmanaged “dumb” charging creating new, disruptive evening peaks that would destabilize local distribution grids. | The threat is now a systemic economic risk. Uncoordinated data center growth is causing extreme electricity price hikes (up to 267%) and gridlock in interconnection queues, threatening to stall both the energy transition and digital infrastructure growth. | The threat evolved from a technical problem of grid instability to a major economic and political problem of energy affordability and infrastructure paralysis. |

Scenario Modelling and 2026 Outlook

For 2026, the critical path requires utilities and regulators to establish market mechanisms that properly value and compensate EV flexibility. This will transform a latent capability into a dispatchable, contractible asset that data center developers can use to accelerate grid interconnections and mitigate their impact.

Grid Demand Forecast to 2030

This forecast of skyrocketing grid demand provides the critical context for the section’s 2026 outlook and the urgency behind its scenario modeling.

(Source: Prisma Photonics)

- If this happens: Utilities will formalize demand response programs, V 2 G tariffs, and time-of-use rates that create a clear financial incentive for EV owners to participate in grid services.

- Watch this: A rise in direct commercial agreements between data center developers, utilities, and VPP operators like Weave Grid. These partnerships will use managed EV fleets as a contracted solution to meet grid stability requirements for new data center interconnections.

- These could be happening: We expect to see the first regulatory approvals where a utility explicitly cites a large-scale managed EV charging program as the enabling factor for connecting a new hyperscale data center without requiring years of transmission upgrades. This will codify the symbiotic relationship and create a repeatable model for growth.

Frequently Asked Questions

How does EV smart charging help with the power demands of new data centers?

EV smart charging uses software to control when electric vehicles draw power, shifting demand to off-peak hours. This flexibility frees up capacity on the existing grid, which can then be used to power large, inflexible loads like data centers without requiring immediate, costly infrastructure upgrades. Essentially, coordinated EVs act as a ‘non-wires alternative’ to provide the grid with more breathing room.

Is this concept just a theory, or is it being used commercially?

It has moved from pilot projects to scaled commercial programs. The article notes that since 2025, companies like Amp Up have proven the economic viability, shifting demand for less than $0.50 per kWh. Furthermore, software platforms from Weave Grid and Blu Wave-ai are now aggregating thousands of vehicles into Virtual Power Plants (VPPs) as a reliable grid service, moving beyond technical demonstrations to commercial reality.

Why has North America become the main location for this development?

North America, particularly the U.S., faces a unique dual pressure: aggressive EV adoption targets and the rapid growth of power-hungry data center clusters in the same regions. This has created acute grid strain and a powerful commercial incentive to deploy EV load management. For example, some regions are seeing wholesale power costs surge by up to 267% due to this strain, making solutions from companies like Weave Grid and Amp Up immediately valuable.

What is the biggest challenge currently facing the growth of EV grid integration?

According to the analysis, the main bottleneck is no longer technology or the availability of capable vehicles. The primary challenge is the slow pace of regulatory and market reform. Utility rate structures and market rules are often not set up to properly value and compensate EV owners for providing grid services, which slows down the creation of large-scale, financially sustainable programs.

What is a Virtual Power Plant (VPP) and how does it relate to EVs?

A Virtual Power Plant, in this context, is a software platform that aggregates and controls the charging of many individual EVs, allowing them to act as a single, coordinated energy resource. Instead of managing one car at a time, VPPs from companies like Blu Wave-ai can dispatch charging across thousands of vehicles, creating a reliable and dispatchable grid service that can reduce peak load on a regional scale.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.