Why Grid Lock Is Fueling the $3 Trillion On-Site Data Center Power Market in 2026

Grid Delays Drive Unprecedented Shift to On-Site Data Center Power

The primary catalyst for the rapid adoption of behind-the-meter (BTM) generation is the failure of public grid infrastructure to keep pace with AI-driven power demand, turning on-site solutions from a secondary option into a primary strategy. This structural shift is forcing data center operators to become power producers to ensure speed-to-market and operational continuity.

- In the 2021-2024 period, BTM generation was largely a supplemental strategy for resilience or sustainability, with operators like Google and Next Era Energy signing large renewable Power Purchase Agreements and companies such as ECL initiating early-stage hydrogen pilots. The approach was often fragmented, designed to augment grid power rather than replace it.

- From 2025 onward, BTM became a core development strategy to bypass multi-year grid interconnection queues and secure power for AI workloads. This is confirmed by a landmark industry survey revealing that expectations for fully on-site powered data centers by 2030 soared from just 1% to 27% in a single year, a direct response to grid inadequacy.

- The technology mix has decisively shifted from a primary focus on intermittent renewables to a pragmatic need for firm power. While on-site solar is still deployed, the 2025-2026 period is defined by a surge in demand for immediately deployable natural gas turbines and strategic investments in clean firm power like Bloom Energy’s fuel cells, which secured a potential $5 billion partnership to power AI data centers.

- The scale of BTM projects has escalated dramatically from single-digit megawatt pilots to entire grid-independent campuses. By the end of 2025, developers had already announced approximately 40 projects representing a combined 48 GW of BTM capacity, signaling a fundamental change in how data center infrastructure is planned and built.

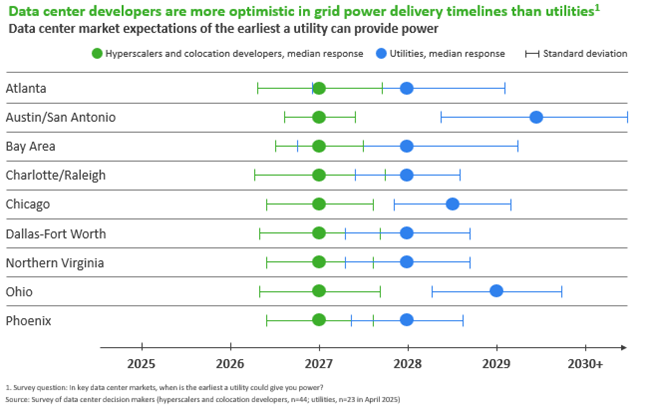

Grid Timelines Reveal Major Disconnect

This chart perfectly illustrates the section’s core theme of grid failure, showing the significant gap between when data centers need power and when utilities can deliver it.

(Source: Bloom Energy)

Data Center Power Investments: Billions Flow into BTM Generation to Circumvent Grid Delays

Capital is aggressively flowing into integrated digital and power infrastructure, with major private equity firms and hyperscalers deploying billions to build the on-site generation needed to power the AI expansion. This investment wave is no longer focused on incremental additions but on creating entirely new, self-sufficient power and data ecosystems.

- The scale of investment has exploded from project-level financing to massive platform-level commitments. A prime example is the 2025 formation of a $50 billion strategic partnership between KKR and Energy Capital Partners (ECP), specifically designed to develop integrated data center and power assets in response to AI-driven demand.

- Hyperscalers are now directly financing the development of their own power sources, a significant evolution from the earlier PPA model. Google’s December 2024 partnership with Intersect Power and TPG mobilizes up to $20 billion to create “powered land” with co-located renewable generation, directly addressing power availability as a core constraint.

- The market’s search for clean, firm power has unlocked massive strategic deals for enabling technologies. Bloom Energy’s October 2025 announcement of a $5 billion strategic partnership to supply its fuel cells for AI data centers is a landmark validation of hydrogen-ready systems as a viable, at-scale BTM solution.

Table: Key Investments in On-Site Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Bloom Energy Strategic Partnership | October 2025 | A $5 billion agreement to supply fuel cells for AI data centers, validating SOFCs as a key technology for clean, firm BTM power and securing a major supply chain for hyperscale developers. | Hydrogen Insight |

| Energy Capital Partners (ECP) & KKR | July 2025 | A $50 billion strategic partnership to develop integrated digital and power infrastructure. The first investment is a data center campus co-located with Calpine’s power generation facilities. | ECP |

| Google, Intersect Power, TPG | December 2024 | An up to $20 billion partnership to develop “powered land” with co-located renewable generation and storage, a strategic shift to control the entire power supply chain for new data centers. | ESG Today |

| Exowatt Seed Funding | April 2024 | A $20 million seed round to develop modular thermal energy storage, aimed at providing dispatchable heat and power for data centers as an alternative to conventional BTM generation. | Fintech Futures |

Strategic Alliances for On-Site Data Center Power: How Partnerships Are Solving Grid Constraints

Strategic partnerships have become the primary mechanism for de-risking and accelerating the deployment of on-site power, combining capital, technology, and development expertise to bypass grid-related bottlenecks. These collaborations are moving beyond simple offtake agreements to deep, co-development initiatives that shape the future of energy infrastructure.

- The period from 2025 onward is defined by large-scale, vertically integrated partnerships. The alliance between Energy Capital Partners (ECP) and KKR announced in July 2025 exemplifies this trend, aiming to co-locate data centers with power generation facilities to create a new, more efficient asset class.

- Technology providers and data center operators are forming deep alliances to validate next-generation solutions. The successful 2025 demonstration by Microsoft, Caterpillar, and Ballard using hydrogen fuel cells for backup power proved the technology’s reliability, paving the way for broader adoption for prime power applications.

- Utilities are beginning to adapt by forming innovative partnerships to retain data center customers. The January 2026 agreement between Microsoft and Black Hills Energy is structured to ensure datacenter growth strengthens the local grid rather than straining it, representing a new collaborative model that contrasts with the prior adversarial relationship defined by interconnection queues.

Table: Notable Partnerships Driving BTM Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Microsoft & Black Hills Energy | January 2026 | An innovative utility partnership in Wyoming to ensure data center growth supports and strengthens the local grid, creating a symbiotic model to avoid the typical strains on public infrastructure. | Microsoft On the Issues |

| Power Cell & U.S. Data Center Leader | December 2025 | An agreement to pilot hydrogen fuel cell systems for resilient power, signaling a move by major operators to test and validate clean firm power technologies for future at-scale deployment starting in Q 1 2026. | Fuel Cells Works |

| Sharon AI & New Era Helium | January 2025 | A behind-the-meter power agreement to supply a 250 MW data center in the Permian Basin, demonstrating the use of readily available local energy resources to bypass grid constraints in energy-rich regions. | Data Center Dynamics |

| Amazon Web Services (AWS) & Talen Energy | May 2023 | AWS acquired a data center campus co-located with the Susquehanna nuclear plant, with an agreement to buy up to 960 MW of power directly. This was a foundational move validating the co-location model for 24/7 carbon-free energy. | Utility Dive |

Global Hotspots for On-Site Data Center Generation: U.S. Leads Amid Power Scarcity

While data center growth is a global phenomenon, the pivot to behind-the-meter generation is most pronounced in the United States, driven by a unique combination of intense AI-related demand, severe grid congestion in key markets, and a volatile policy environment. This has made the U.S. the primary proving ground for at-scale on-site power solutions.

Virginia, Texas Dominate US Data Center Power

This chart supports the section’s claim that the U.S. is a primary hotspot by showing the heavy concentration of data center power capacity in a few key states.

(Source: Bismarck Brief)

- In the 2021-2024 period, data center development was widespread, but power solutions remained largely grid-dependent. The U.S., particularly in regions like Virginia and Texas, was already a major hub, but the strategic focus was on securing grid capacity, not bypassing it.

- Since 2025, the U.S. has become the undisputed epicenter of BTM development, with nearly 48 GW of announced BTM capacity by the end of the year. This activity is concentrated in areas with high data center density and acute grid constraints, such as the Permian Basin, where projects like the 250 MW Sharon AI facility are being developed.

- The BTM model is being replicated in other resource-constrained markets globally. The July 2025 launch of Singapore’s first hydrogen-powered data center by Day One highlights how nations with limited land and grid capacity are adopting advanced BTM solutions like SOFCs to enable digital growth.

- Specific U.S. states are becoming focal points for different BTM technologies. Wyoming is a site for innovative utility partnerships like the one between Microsoft and Black Hills Energy, while California is a testbed for advanced microgrids combining hydrogen and batteries, as demonstrated by the PG&E and Energy Vault project.

On-Site Power Technology for Data Centers: From Mature Gas to Emerging Nuclear

The behind-the-meter technology landscape is bifurcated: mature, fossil-fueled technologies are being deployed at scale to meet immediate needs, while capital-intensive, clean firm power technologies are being validated through strategic corporate commitments for post-2030 deployment. This dual track reflects a pragmatic response to the power crisis, balancing speed with long-term sustainability goals.

On-Site Power Technology Costs Compared

This chart directly aligns with the section’s discussion of the technology landscape by comparing the levelized costs of key options like natural gas, solar, and nuclear.

(Source: Energy Industry Insights from Avanza Energy – Substack)

- Natural gas turbines and reciprocating engines (TRL 9) remain the dominant choice for immediate, reliable BTM power, shifting from a backup role in 2021-2024 to a primary baseload solution in 2025-2026. The primary constraint has shifted from technology risk to supply chain availability, with reports of shortages of these turbines due to the sudden demand spike from data center developers.

- Solid Oxide Fuel Cells (SOFCs) (TRL 8-9) have crossed the chasm to commercial scale. In the early 2020 s, they were used in smaller, sub-megawatt deployments. Now, companies like Bloom Energy, with over 400 MW installed at data centers and a $5 billion supply agreement, have validated the technology as a primary, low-emission power source, even if initially fueled by natural gas.

- Small Modular Reactors (SMRs) (TRL 6-7) have moved from theoretical concepts to concrete commercial interest between the two periods. While no SMRs were tied to data centers before 2024, Amazon’s acquisition of a campus at an existing nuclear plant and Meta’s formal RFP for new nuclear capacity provided the commercial validation needed to advance the technology toward future deployment.

SWOT Analysis: On-Site Data Center Power Generation in 2026

The on-site power market is defined by the strength of its demand drivers and the opportunity to create new infrastructure asset classes. However, it faces significant weaknesses from acute supply chain bottlenecks and threats from fuel price volatility and an uncertain regulatory environment for fossil-fueled generation.

On-Site Power Expectations Skyrocket

This chart provides the exact data point mentioned in the SWOT analysis—that 27% of operators expect to be self-powered—validating the key ‘Strength’ of on-site generation.

(Source: Bloom Energy)

- Strengths: The market’s core strength has evolved from providing resilience to enabling business-critical speed-to-market.

- Weaknesses: The primary weakness has shifted from the high cost of BTM solutions to the physical inability to procure essential equipment like gas turbines.

- Opportunities: The opportunity has scaled from developing individual projects to creating entire integrated energy and digital ecosystems.

- Threats: The primary risks have transitioned from grid-side tariff changes to BTM-side operational risks like fuel costs and emissions regulations.

Table: SWOT Analysis for On-site Generation for Data Centers

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Provided backup power for resilience; supported ESG goals with on-site solar. | Enables speed-to-market by bypassing multi-year grid queues; provides the reliable baseload power required for massive AI compute clusters. | The strategic value shifted from a ‘nice-to-have’ for resilience to a ‘must-have’ for growth. This was validated by the survey showing 27% of operators expect to be fully BTM-powered by 2030. |

| Weaknesses | High upfront CAPEX compared to a standard grid connection; intermittency of on-site renewables (solar/wind). | Severe supply chain bottlenecks for critical components like natural gas turbines and transformers; reliance on natural gas for firm power creates emissions liability. | The main constraint moved from cost to physical availability of equipment. This was confirmed by widespread reports of shortages of gas turbines due to the demand surge from data centers. |

| Opportunities | Development of microgrids; signing of renewable Power Purchase Agreements (PPAs). | Creation of a new integrated infrastructure asset class (e.g., KKR/ECP); development of clean firm power (SMRs, Hydrogen); ability to provide grid services for new revenue. | The opportunity scaled from individual projects to entire ecosystems and new investment platforms. This was validated by the establishment of the $50 billion KKR/ECP partnership. |

| Threats | Changing utility tariffs; uncertainty in federal clean energy policy. | Fuel price volatility (natural gas, hydrogen); stricter state or federal emissions regulations creating stranded asset risk; complex local permitting for on-site power plants. | The primary risk profile shifted from grid-side economics to BTM-side operational and regulatory risk. This is highlighted by growing concerns over the long-term viability of new natural gas assets. |

Forward Outlook: Key Signals for the On-Site Data Center Power Market

If grid interconnection queues remain congested and AI power demand continues its exponential rise, watch for an acceleration in the development and financing of clean firm power solutions as the primary strategic signal, with natural gas serving as a strained and increasingly controversial bridge technology.

AI to Triple Data Center Power Demand

This chart visualizes the core premise of the forward outlook, showing the exponential rise in power demand specifically driven by AI, which the section identifies as a key signal.

(Source: Visual Capitalist)

- If the first wave of large-scale BTM campuses powered by natural gas and fuel cells come online successfully in the next 12-24 months, watch for a flood of similar projects from second-tier data center operators and a further tightening of the gas turbine and transformer supply chains.

- A key signal gaining traction is the transition from natural gas-powered fuel cells to systems capable of running on green hydrogen. Favorable final guidance on the U.S. Treasury’s 45 V tax credit would be a major catalyst. Early indicators like the PG&E and Energy Vault hydrogen microgrid are paving the way for this shift.

- The narrative of relying solely on on-site solar and wind for baseload data center power is losing steam due to the immense cost and land footprint required for firming with batteries. The market is clearly signaling a preference for a hybrid approach that includes a firm power source, evidenced by the rising investment in fuel cells and serious commercial interest in SMRs.

- We could be at the beginning of a fundamental re-integration of power generation and digital infrastructure. The ECP-KKR partnership and Google’s “powered land” initiative suggest a future where data centers are no longer just customers of the grid but are anchor tenants of new, localized energy systems.

Frequently Asked Questions

Why are data centers suddenly building their own on-site power instead of using the public grid?

The primary reason is that public grid infrastructure cannot keep pace with the massive power demand driven by AI. Data centers face multi-year delays to get connected to the grid, so they are building their own ‘behind-the-meter’ (BTM) power to ensure speed-to-market and operational continuity for their new facilities.

What types of on-site power technologies are data centers using?

To meet immediate needs for reliable power, data centers are deploying mature technologies like natural gas turbines and reciprocating engines. For cleaner, firm power, there’s a surge in strategic investments in solutions like Bloom Energy’s Solid Oxide Fuel Cells (SOFCs). Emerging technologies like Small Modular Reactors (SMRs) are also gaining serious commercial interest for post-2030 deployment.

Who is investing in this shift to on-site data center power?

Major private equity firms and hyperscalers are deploying billions. Key examples include a $50 billion partnership between KKR and Energy Capital Partners (ECP) to build integrated power and data assets, and a partnership of up to $20 billion involving Google, Intersect Power, and TPG to develop “powered land” with co-located generation.

What are the main risks or weaknesses of this on-site power strategy?

The primary weaknesses have shifted from high upfront cost to severe supply chain bottlenecks for critical equipment like natural gas turbines and transformers. Other significant threats include volatility in fuel prices (like natural gas), the risk of stricter emissions regulations making new fossil-fuel assets obsolete, and complex local permitting for on-site power plants.

Is this trend of on-site data center power happening only in the United States?

While the trend is most pronounced in the U.S., where nearly 48 GW of on-site capacity was announced by the end of 2025, it is a global phenomenon. The article notes that other resource-constrained markets are also adopting this model. For example, Singapore launched its first hydrogen-powered data center in 2025 to enable digital growth despite land and grid limitations.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.