Gridlock Drives On-Site Power: Why Distributed Fuel Cell Adoption for AI Data Centers Will Accelerate in 2026

From Niche to Necessity: How Grid Delays are Driving Commercial-Scale Fuel Cell Projects for AI

The adoption of on-site fuel cells for data centers has fundamentally shifted from a niche reliability or sustainability solution to a primary power strategy driven by acute and prolonged grid-level constraints. The multi-year lead times required for traditional grid interconnection have become an insurmountable barrier for AI companies needing to deploy compute capacity rapidly, making distributed generation a necessity, not an alternative.

- Between 2021 and 2024, fuel cell deployments at data centers were often incremental expansions or reliability projects, such as Intel‘s decision in May 2024 to add more fuel cell capacity to an existing site. These projects validated the technology but did not position it as a primary power source for new, large-scale builds.

- The market inflection occurred between 2025 and 2026, marked by a strategic pivot to using fuel cells to bypass grid delays entirely. Data from November 2024 confirms that interconnection queues for new large facilities can stretch from 3 to 5 years, a timeline that is incompatible with the pace of AI development.

- This infrastructure failure is the primary driver behind landmark agreements like the one between Bloom Energy and American Electric Power (AEP). This deal is not for backup power; it is for up to 1 GW of primary power specifically to circumvent grid delays for new data centers.

- The scale of the problem is validated by forecasts projecting that AI-related workloads will consume between 8% and 12% of total U.S. electricity by 2030. This demand cannot be met by the existing grid infrastructure on the required timeline, forcing a structural move to on-site generation.

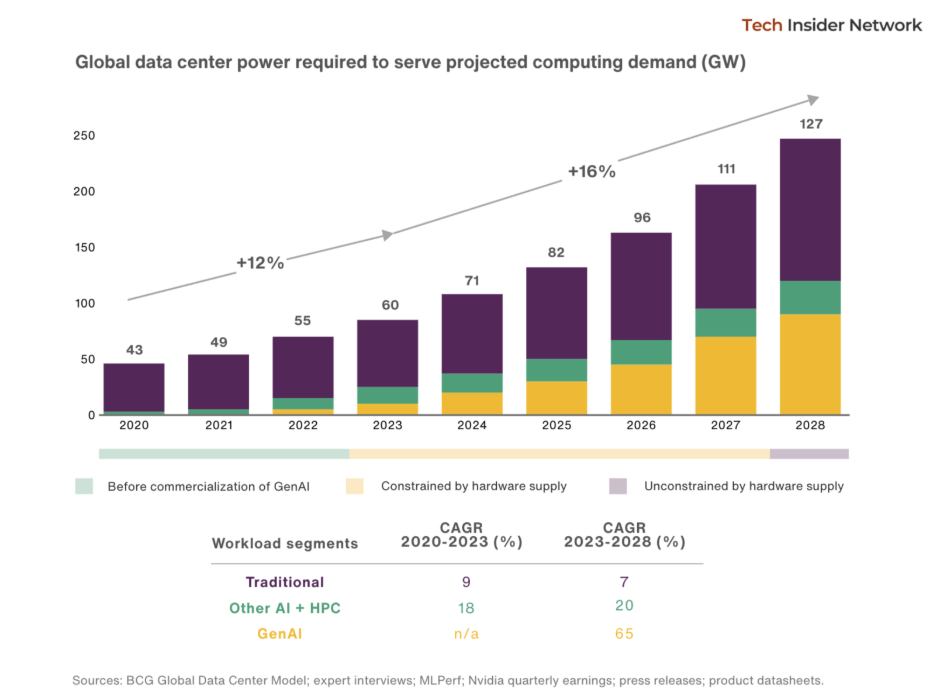

AI Drives Unprecedented Data Center Power Demand

This chart quantifies the explosive growth in AI power demand, which is the primary driver behind the grid constraints and the shift to on-site fuel cells described in the section.

(Source: Seeking Alpha)

Investment Analysis: Validating the On-Site Power Shift with Multi-Billion Dollar Commitments

Recent financial commitments demonstrate that the market has transitioned from funding individual fuel cell projects to financing entire ecosystems of distributed power for AI infrastructure. The scale and structure of these investments, moving from standard equipment sales to multi-billion-dollar strategic partnerships, validate on-site generation as a bankable, long-term solution to the data center power crisis.

- The most significant signal is the October 2025 strategic partnership between Brookfield Asset Management and Bloom Energy, which includes an investment of up to $5 billion. This capital is not for a single project but is intended to finance the deployment of fuel cells as the preferred power source for a global portfolio of “AI factories, ” establishing a new, integrated infrastructure model.

- The January 2026 offtake agreement between Bloom Energy and an AEP subsidiary, valued at $2.65 billion, represents a landmark utility-scale endorsement. This 20-year deal for up to 1 GW of capacity de-risks fuel cell technology as a primary power source and provides the financial certainty needed for large-scale manufacturing and deployment.

- This pattern of programmatic, large-scale investment was largely absent between 2021 and 2024, a period characterized by smaller, project-specific capital expenditures. The recent shift signifies that major financial institutions and utilities now view on-site fuel cells as a critical and investable asset class for the AI economy.

Table: Key Investments Driving Distributed Fuel Cell Adoption

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| American Electric Power (AEP) | Jan 2026 | A $2.65 billion, 20-year offtake agreement for up to 1 GW of solid oxide fuel cells. The purpose is to supply primary power to data centers, bypassing grid interconnection delays. | Yahoo Finance |

| Brookfield Asset Management | Oct 2025 | A strategic partnership with an investment of up to $5 billion. The capital will be used to deploy Bloom Energy fuel cells as the preferred on-site power provider for Brookfield‘s global AI data center developments. | Bloom Energy Investor Relations |

Strategic Alliances in 2026: Analyzing Partnerships Driving Fuel Cell Adoption for AI Power

Partnerships have matured from simple customer-vendor transactions into integrated strategic alliances that span the energy, finance, and technology sectors. These collaborations are designed to create a complete value chain for delivering on-site power, connecting fuel cell manufacturers directly with utilities, infrastructure investors, and the hyperscale companies that face the most severe power constraints.

Fuel Cell Revenue Growth Set to Explode

As a companion to a table on key investments, this chart visualizes the projected outcome of those deals: explosive year-over-year revenue growth for the fuel cell market.

(Source: Seeking Alpha)

- The AEP partnership in 2026 is a defining example, where a major utility is not competing with on-site generation but is actively procuring it as a solution to serve its data center customers more quickly than the grid allows. This transforms the traditional utility relationship.

- The Brookfield alliance from October 2025 establishes a financial and deployment engine, pairing Bloom Energy‘s technology with Brookfield‘s capital and real estate expertise to build fully powered “AI factories” as a turnkey solution.

- Direct partnerships with AI end-users, such as the July 2025 agreement with Oracle and the July 2024 collaboration with Core Weave, embed fuel cell technology at the core of the AI compute ecosystem, ensuring power infrastructure is developed in lockstep with cloud and AI service growth.

- This contrasts with the 2021-2024 period, where partnerships like the expanded agreement with Equinix (February 2025) were significant but focused more on scaling existing relationships for colocation sites rather than forming new utility- and finance-led ecosystems to solve a systemic grid problem.

Table: Key Partnerships for AI Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| American Electric Power (AEP) | Jan 2026 | A 20-year offtake agreement for up to 1 GW of fuel cells, enabling a major utility to provide rapid, on-site power solutions for data center customers facing grid delays. | Yahoo Finance |

| Brookfield Asset Management | Oct 2025 | A strategic partnership to finance and deploy up to $5 billion in fuel cell technology as the preferred power provider for Brookfield‘s global AI factories. | Bloom Energy Investor Relations |

| Oracle | Jul 2025 | A strategic partnership to deploy fuel cells to provide reliable, low-emission power for Oracle‘s growing AI cloud infrastructure, ensuring power availability for expansion. | RCR Wireless News |

| Core Weave | Jul 2024 | Partnership to deploy on-site fuel cells at a high-performance computing data center, directly linking the power solution to a specialized AI cloud provider. | Bloom Energy Investor Relations |

Geographic Focus: Why North America Dominates Fuel Cell Adoption for AI Data Centers

While fuel cell technology has seen global adoption, the unprecedented power demand from the AI boom combined with severe grid infrastructure limitations has made North America the undisputed epicenter for large-scale fuel cell deployments in the data center sector. The region’s unique concentration of hyperscale development and congested transmission networks has created an urgent, market-driven need for on-site power that is less acute elsewhere.

Bloom Energy Pivots to Data Center Market

The section’s table lists key partnerships involving Bloom Energy. This chart provides essential context on Bloom, identifying data centers as its primary growth segment.

(Source: Arya’s Substack)

- From 2025 to 2026, nearly all transformative, gigawatt-scale agreements for data center power have been centered in the United States. The landmark deals with AEP, Brookfield, Oracle, and Equinix are all focused on the U.S. market, where AI is projected to account for over 11% of national electricity demand by 2030.

- This marks a geographic shift from the 2021-2024 period, where the Asia-Pacific region, particularly South Korea and Japan, was a primary growth driver for the broader fuel cell market. This was often supported by national hydrogen policies and a focus on energy security, rather than being a direct response to an AI-specific power crisis.

- The intense concentration of activity in North America is a direct result of the timeline mismatch. The race to build AI capacity in the U.S. is immediate, while grid upgrades take years, making the rapid deployment of on-site fuel cells a unique and critical competitive advantage in this specific market.

Technology Status: Solid Oxide Fuel Cells Reach Commercial Scale for AI Data Center Power

Solid Oxide Fuel Cell (SOFC) technology has successfully transitioned from a proven but subordinate application to a commercially validated, utility-scale solution capable of serving as the primary power source for gigawatt-class AI infrastructure. This maturity was achieved not through a single technological breakthrough, but through market-driven validation at a scale that resolved previous questions about its reliability and bankability for mission-critical loads.

Explaining Scalable Solid Oxide Fuel Cell Technology

The section discusses the technology status of Solid Oxide Fuel Cells (SOFCs). This diagram directly explains how SOFCs work and how they scale to commercial size, matching the heading perfectly.

(Source: Fortune)

- In the 2021-2024 timeframe, SOFC deployments were typically smaller in scale and often served to enhance grid reliability rather than replace it. The primary commercial question was whether the technology could scale cost-effectively to meet the power demands of new, large data centers.

- The period from 2025 to 2026 provided the definitive answer. The AEP agreement for up to 1 GW and the Brookfield partnership for up to $5 billion of deployments act as unequivocal market validation. These commitments confirm that SOFCs are now accepted by utilities and major investors as a reliable primary power source.

- A key enabler of this commercial maturity is the technology’s fuel flexibility. The ability to operate on natural gas today provides an immediate solution to the power crisis, while the platform’s readiness to run on hydrogen or biogas offers a credible decarbonization pathway that aligns with the long-term goals of its hyperscale customers.

SWOT Analysis: Assessing Strengths and Weaknesses in Fuel Cell Adoption for AI Power

The strategic position of on-site fuel cells for powering AI data centers has been fundamentally strengthened by market validation of its core value proposition, though this rapid growth introduces new execution risks and highlights its continued reliance on natural gas in the near term.

Fuel Cells Achieve Scale Faster Than Alternatives

The SWOT analysis highlights ‘speed-to-power’ as a key strength. This chart provides direct visual evidence, showing fuel cells reached the 1 GW scale faster than other power technologies.

(Source: Fuel Cells Works)

- The analysis shows that the primary strength, speed-to-power, has transitioned from a theoretical benefit to a bankable asset, directly driving multi-billion-dollar deals.

- Meanwhile, the core opportunity has expanded from single data center projects to the development of entire powered AI ecosystems, a much larger addressable market.

- The primary weakness is shifting from technology risk to execution risk, as manufacturers now face the challenge of scaling production to meet a massive new order book.

Table: SWOT Analysis for Distributed Fuel Cell Adoption

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High reliability and efficiency were proven at a smaller scale (e.g., Intel, early Equinix deployments). Fuel flexibility was a stated feature. | Speed-to-power is now the primary, validated strength, enabling bypass of 3-5 year grid queues. Power density of 100 MW/acre is a critical advantage. | The AEP and Brookfield deals validated that speed-to-power is a bankable strength, transforming fuel cells into a primary power solution. |

| Weaknesses | Higher capital cost compared to grid power. Perceived technology risk for primary power applications at scale. Reliance on natural gas created ESG concerns. | Manufacturing capacity and supply chain constraints to meet gigawatt-scale demand. Execution risk on massive new projects. Natural gas reliance remains a medium-term issue. | The technology risk has been largely resolved by utility-scale validation. The main weakness has shifted from market acceptance to the industrial capacity to deliver on it. |

| Opportunities | Backup power market. Enhancing grid reliability for existing data centers. Early adoption by tech companies with strong sustainability goals. | Primary power source for new gigawatt-scale AI data centers. “Power-as-a-Service” models with infrastructure funds. Bypassing grid constraints is the core market. | The AI power crunch transformed the opportunity from a niche market to a core infrastructure play, validated by the entry of major utilities (AEP) and investors (Brookfield). |

| Threats | Competition from other on-site technologies (e.g., gas turbines). Long-term potential of grid upgrades. Fluctuations in natural gas prices. | Competition from other fuel cell providers (e.g., Plug Power) targeting the same market. Potential for future regulations on natural gas infrastructure. Long-term competition from SMRs. | The threat from waiting for grid upgrades has diminished due to the urgency of AI timelines. The main competitive threat is now from other on-site solutions that can also deliver power quickly. |

Forward Outlook for 2026: Key Signals for Distributed Power Growth

If major utilities and infrastructure investors continue to formalize on-site generation as a standard solution for the data center industry’s grid challenges, the model will rapidly expand beyond a few first-movers and become an integral part of AI infrastructure development globally. The critical factor to watch is the supply-side response to this demand shock.

Fuel Cell Installations Forecast for Major Spike

Matching the section’s ‘Forward Outlook’ theme, this chart provides a key signal for future growth by forecasting a massive spike in fuel cell installations in early 2025.

(Source: Seeking Alpha)

Fuel Cell Market Projected for Massive Growth

This market forecast chart complements the detailed SWOT table by visually representing the primary ‘Opportunity’—the multi-billion dollar market growth projected by 2030.

(Source: MarketsandMarkets)

- If this happens: Another major U.S. utility, besides AEP, announces a large-scale procurement agreement for fuel cells to serve its data center customers. Watch this: This would confirm a systemic shift in utility strategy nationwide, moving from grid-only solutions to a hybrid model that includes customer-sited generation. This could be happening: This signal is gaining traction as utilities in data center hotspots like Virginia and Texas face similar grid congestion and power deficits.

- If this happens: The first major “AI factory” powered under the Brookfield partnership begins construction or comes online. Watch this: This event would validate the integrated finance-and-build model, likely triggering other infrastructure funds to create similar investment vehicles. This could be happening: This is gaining traction, as the $5 billion commitment provides the capital needed to begin site acquisition and deployment.

- If this happens: Bloom Energy or a key competitor announces a major new manufacturing plant or a significant expansion of existing facilities. Watch this: This would be a direct response to the massive new demand from deals like the AEP agreement and would signal that the industry is preparing for a sustained period of high growth. This could be happening: This signal is gaining traction, as current capacity is insufficient to meet multi-gigawatt order backlogs.

Frequently Asked Questions

Why are AI data centers suddenly turning to on-site fuel cells for power?

The primary driver is severe and prolonged grid-level constraints. According to the analysis, interconnection queues for new large data centers can take 3 to 5 years, a timeline that is far too long for AI companies that need to deploy computing power rapidly. On-site fuel cells allow them to bypass these grid delays and get power much faster, making it a necessity for speed-to-market.

How has the use of fuel cells in data centers changed between 2024 and 2026?

The role of fuel cells has shifted from a niche solution to a primary power strategy. Between 2021 and 2024, deployments were typically for reliability or incremental expansions on existing sites. However, from 2025 to 2026, there was a strategic pivot to using fuel cells as the main power source for new, large-scale AI data centers specifically to circumvent multi-year grid connection delays.

Aren’t fuel cells just running on natural gas? How is that a long-term solution?

While current Solid Oxide Fuel Cell (SOFC) deployments primarily use natural gas to provide an immediate solution to the power crisis, the technology is fuel-flexible. This provides a clear decarbonization pathway. The platform is designed to run on clean fuels like hydrogen or biogas in the future, allowing data center operators to meet today’s urgent power needs while aligning with long-term sustainability goals.

Who are the key companies and partners involved in this trend?

The trend is being driven by strategic alliances between technology providers, utilities, and major investors. Key examples highlighted include fuel cell manufacturer Bloom Energy partnering with utility giant American Electric Power (AEP) for a 1 GW power agreement, infrastructure investor Brookfield Asset Management for a $5 billion financing partnership, and AI end-users like Oracle and Core Weave.

What is the biggest challenge or weakness for fuel cell adoption going forward?

According to the SWOT analysis, the primary weakness has shifted from technology risk to execution risk. With multi-billion dollar, gigawatt-scale orders now validated by the market, the main challenge is whether manufacturers can scale their production capacity and supply chains quickly enough to meet this massive new demand and deliver on these large projects.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.