Top 10 Solar Powered Data Center Projects in Europe in 2025

Europe’s Data Center Power Play: The Rise of Gigawatt-Scale Solar Integration

Introduction: The Inescapable Convergence of Solar Power and Digital Infrastructure

The European data center market is fundamentally reshaping its growth strategy by decoupling from traditional grid constraints and directly investing in gigawatt-scale solar power. This strategic pivot is a direct response to the exponential energy demands of artificial intelligence (AI) colliding with congested national power grids. Key data points underscore this trend: Europe’s primary markets have a development pipeline of 20 GW, and integrated projects like the 1.2 GW Start Campus SINES DC in Portugal and Solaria’s 3.4 GW solar-for-data-center platform in Spain are becoming the new standard. The dominant theme for 2025 is the definitive shift from passive renewable energy procurement to the active co-development of dedicated, large-scale solar assets, creating a new class of “energy-first” digital infrastructure where sustainable power is the primary design driver, not an afterthought.

AI Boom Drives Data Center Power Demand

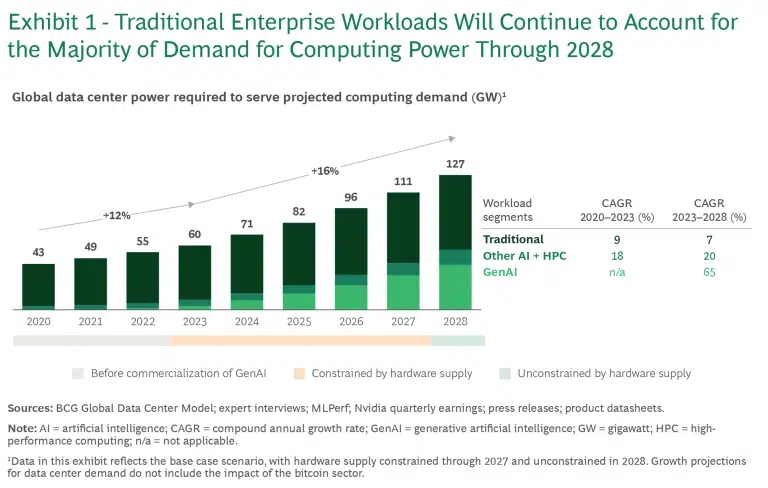

This chart directly illustrates the article’s core premise that exponential AI growth is causing a surge in data center power demand, necessitating new energy solutions. The 65% CAGR for Generative AI workloads quantifies the problem.

(Source: Boston Consulting Group)

2025 European Solar-Powered Data Center Installations

The following installations represent the leading edge of Europe’s strategic convergence between digital and renewable infrastructure. They are categorized by their approach: gigawatt-scale campuses designed for grid independence, large-scale Power Purchase Agreements (PPAs) underwriting new solar development, and on-site generation for direct power and facility resilience.

Data Centers Are Pivoting to Renewable Energy

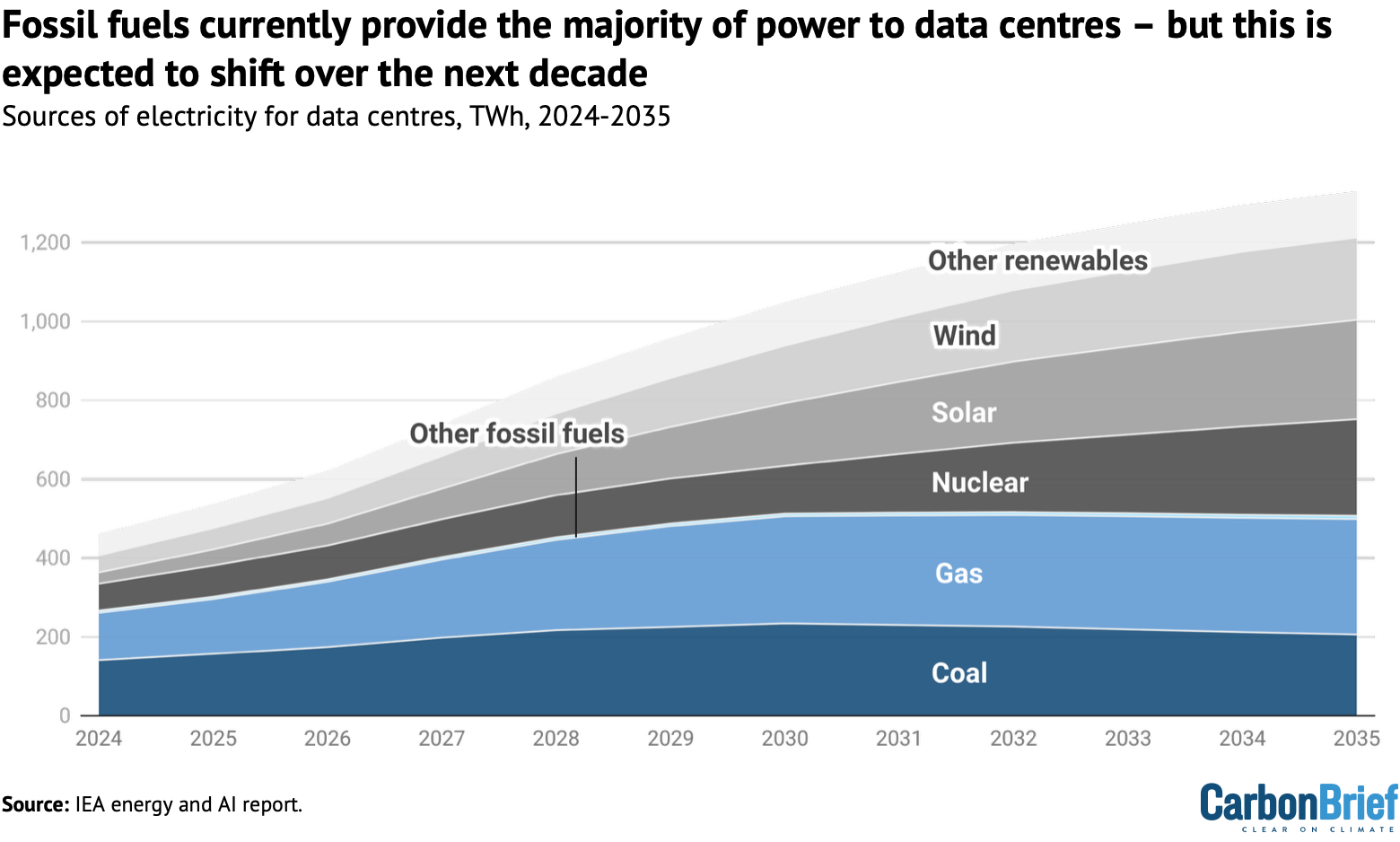

This forecast visualizes the strategic shift toward renewables that the upcoming project list exemplifies. It shows that solar and wind are projected to become the dominant power sources for data centers by 2035.

(Source: Carbon Brief)

1. Start Campus SINES DC (Portugal)

Company: Start Campus

Installation Capacity: 1.2 GW (IT Capacity)

Applications: Powering Europe’s first gigascale data campus with 100% renewable energy

Source: Top 7 Upcoming Data Centers in Europe (2025)

2. Solaria European Data Center Platform (Spain & Pan-EU)

Company: Solaria

Installation Capacity: 3.4 GW (Secured Grid Capacity); 1.2 GW (Solar Portfolio for Data Centers)

Applications: Developing a pan-European data center platform powered by a dedicated solar portfolio

Source: to triple its capacity, double EBITDA and accelerate its …

3. Aragón Data Center Hub (Spain)

Company: Amazon, Microsoft, Google

Installation Capacity: Over 1 GW (Under Development) / 2.5 GW (Projected Total Hub)

Applications: Powering hyperscale data center campuses in the Aragón region with Spain’s solar resources

Source: Spanish energy companies gear up to power data centres

4. Total Energies & Data 4 PPA (Spain)

Company: Total Energies, Data 4

Installation Capacity: 610 GWh/year PPA

Applications: Supplying renewable electricity from wind and solar farms to Data 4’s Spanish data centers starting in 2026

Source: Total Energies to Supply Renewable Electricity to Data 4’s Data Centers for 10 years

5. Microsoft & Zelestra PPA (Spain)

Company: Microsoft, Zelestra

Installation Capacity: 95.7 MW PPA

Applications: Securing solar power for Microsoft’s growing data center operations in Spain

Source: Microsoft (MSFT) Signs Solar Deal with Zelestra to Power …

6. RWE & Telehouse PPA (Pan-EU)

Company: RWE, Telehouse International Corporation of Europe

Installation Capacity: 10-year PPA (capacity not specified)

Applications: Powering European data center facilities, including the major London campus

Source: RWE agrees 10-year PPA with data centre provider

7. Downing Renewable Developments AI Data Centre (United Kingdom)

Company: Downing Renewable Developments

Installation Capacity: 40 MW

Applications: Co-located solar plant to directly power a new AI data center in Essex

Source: 40 MW solar park to power Essex data centre

8. LCL Data Centers Rooftop Solar (Belgium)

Company: LCL Data Centers

Installation Capacity: 3.4 MW

Applications: On-site rooftop solar portfolio to supply ~10% of total energy needs for its Belgian facilities

Source: LCL completes installation of rooftop solar portfolio in …

9. Google Saint-Ghislain On-Site Solar (Belgium)

Company: Google

Installation Capacity: 2.8 MW

Applications: On-site solar plant to directly power and reduce the carbon footprint of its Saint-Ghislain data center

Source: The Future of Powering AI Datacenters with Solar & Storage

10. Digital Realty Pan-EU Portfolio

Company: Digital Realty

Installation Capacity: 9.8 MW (across 19 sites)

Applications: Deploying behind-the-meter solar installations across its European data center portfolio

Source: On-site rooftop solar at data centers: Everything you need …

Table: 2025 European Solar-Powered Data Center Installations

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Start Campus | 1.2 GW (IT Capacity) | Powering Europe’s first gigascale data campus with 100% renewable energy | Top 7 Upcoming Data Centers in Europe (2025) |

| Solaria | 3.4 GW (Grid Capacity) | Developing a pan-European data center platform powered by a dedicated solar portfolio | to triple its capacity, double EBITDA and accelerate its … |

| Amazon, Microsoft, Google | Over 1 GW | Powering hyperscale data center campuses in the Aragón region with Spain’s solar resources | Spanish energy companies gear up to power data centres |

| Total Energies, Data 4 | 610 GWh/year PPA | Supplying renewable electricity to Data 4’s Spanish data centers starting in 2026 | Total Energies to Supply Renewable Electricity to Data 4’s Data Centers for 10 years |

| Microsoft, Zelestra | 95.7 MW PPA | Securing solar power for Microsoft’s growing data center operations in Spain | Microsoft (MSFT) Signs Solar Deal with Zelestra to Power … |

| RWE, Telehouse | 10-year PPA | Powering European data center facilities, including the major London campus | RWE agrees 10-year PPA with data centre provider |

| Downing Renewable Developments | 40 MW | Co-located solar plant to directly power a new AI data center in Essex | 40 MW solar park to power Essex data centre |

| LCL Data Centers | 3.4 MW | On-site rooftop solar portfolio to supply ~10% of total energy needs for its Belgian facilities | LCL completes installation of rooftop solar portfolio in … |

| 2.8 MW | On-site solar plant to directly power its Saint-Ghislain data center | The Future of Powering AI Datacenters with Solar & Storage | |

| Digital Realty | 9.8 MW (across 19 sites) | Deploying behind-the-meter solar installations across its European data center portfolio | On-site rooftop solar at data centers: Everything you need … |

Industry Adoption: From Procurement to Power Plant

The diversity of these solar projects reveals a multi-tiered strategy for industry adoption, tailored to different scales and objectives. The market is evolving beyond simple renewable energy procurement into active energy infrastructure development. At the entry level, on-site and co-located solar provides direct, behind-the-meter power. Projects like LCL Data Centers’ 3.4 MW portfolio and Google’s 2.8 MW plant in Belgium demonstrate a tactical approach to reduce grid dependency, lower transmission losses, and enhance facility resilience, typically offsetting a meaningful but partial portion of total demand (e.g., 10% for LCL). The workhorse of the industry remains the Power Purchase Agreement (PPA). Deals like Microsoft’s 95.7 MW PPA in Spain and the agreement between Total Energies and Data 4 are the primary mechanisms for hyperscalers to achieve sustainability goals at scale, underwriting the development of new, utility-scale solar farms. The pinnacle of this evolution is the gigawatt-scale renewable campus. Projects like Start Campus SINES DC and Solaria’s platform are not merely data centers with solar panels; they are integrated ecosystems where digital infrastructure is planned in tandem with massive renewable generation, fundamentally treating power as a core, co-developed asset rather than a procured utility.

Data Center Market Dominated by Key Providers

This chart contextualizes “Industry Adoption” by showing the market share of major providers like Digital Realty, which is mentioned in the article. It highlights how adoption strategies are driven by these large, influential players.

(Source: Brightlio)

Geography: The Iberian Peninsula as Europe’s Solar-Powered Digital Hub

The geographic distribution of these projects is not accidental; it is a direct function of solar irradiance, land availability, and supportive policy. The Iberian Peninsula is decisively emerging as the epicenter of Europe’s solar-powered data center boom. Spain and Portugal are the unambiguous leaders, attracting the lion’s share of gigawatt-scale investment. Key examples include the 1.2 GW Start Campus in Sines, Portugal, and the heavy concentration of activity in Spain, where Solaria is dedicating 1.2 GW of its solar portfolio to data centers and the Aragón region is developing a 2.5 GW hub for hyperscalers like Amazon, Microsoft, and Google. The fact that Spain has already granted 12 GW of power capacity for digital projects underscores the national strategic alignment. While other regions like the UK (Downing’s 40 MW project) and Belgium (Google, LCL) are seeing important on-site developments, the truly transformative, multi-gigawatt projects are anchored in the south. This indicates that site selection for future AI and hyperscale deployments will be increasingly dictated by proximity to abundant renewable resources, not just fiber optic cables.

Spain’s Solar Pipeline Fuels Digital Growth

Supporting the section’s focus on the Iberian Peninsula, this chart shows Spain’s massive 131 GW solar capacity pipeline. This data provides the core reason why Spain is becoming a strategic hub for solar-powered data centers.

(Source: Visual Capitalist)

Tech Maturity: Integration at Scale is the New Innovation

These installations signal that the core technology—solar photovoltaics—is fully mature and commercially viable. The innovation lies not in the panels themselves but in the unprecedented scale of financial and operational integration. The market demonstrates three distinct levels of maturity. The most established is on-site, behind-the-meter solar, a commercially proven model being systematically rolled out by operators like Digital Realty across its 19-site European portfolio. The next level, large-scale PPAs, has also reached maturity and is now the standard tool for hyperscalers to secure clean energy, as exemplified by the multi-hundred-megawatt deals signed by Microsoft and facilitated by energy majors like RWE. The most advanced and forward-looking model is the fully integrated, co-located renewable campus. Projects like Start Campus and the platforms being built by Solaria represent the leading edge, moving from concept to gigawatt-scale execution. This demonstrates a strategic shift where the primary challenge is no longer technological, but one of complex project financing, grid integration, and long-term energy management for a new, hybrid asset class.

Europe’s Data Center Power Market to Exceed $5B

This chart quantifies the financial scale of the market discussed in the “Tech Maturity” section. The projected growth to $5.53 billion by 2033 underscores the commercial significance of integrating power and digital infrastructure at scale.

(Source: Market Data Forecast)

Forward-Looking Insights: The Inevitable Fusion of AI Factories and Renewable Parks

The installations of 2025 clearly signal that the future of the European data center industry is one of complete fusion with renewable energy infrastructure. The dominant trend is the move toward self-contained, renewably powered “AI factories.” The next iteration of this model will advance beyond solar alone, incorporating a hybrid mix of wind and solar coupled with multi-gigawatt-hour Battery Energy Storage Systems (BESS) to deliver 24/7 carbon-free power, a critical requirement for meeting corporate ESG goals and ensuring operational resilience. This shift is redrawing the competitive landscape. Leadership is now defined by the ability to secure and integrate energy at scale. Hyperscalers like Microsoft and Google are acting as market makers with their large-scale PPAs, while integrated energy companies like Total Energies and specialized developers like Solaria are becoming critical enablers, building GW-scale platforms specifically for the data center industry’s predictable, long-term demand. The ultimate winners will be the organizations that master the dual disciplines of managing both electrons and data within a single, integrated strategy.

Frequently Asked Questions

Why are European data centers suddenly investing so heavily in their own solar power projects?

Data centers are investing in dedicated, gigawatt-scale solar power as a strategic response to two converging factors: the massive, exponential energy demand created by artificial intelligence (AI) and the limitations of congested national power grids. This ‘energy-first’ approach allows them to decouple their growth from grid constraints and secure a sustainable, long-term power supply.

Which European countries are leading this trend of solar-powered data centers?

The Iberian Peninsula, specifically Spain and Portugal, has decisively emerged as the epicenter for Europe’s solar-powered data center boom. This is due to a combination of excellent solar irradiance, availability of land for large-scale projects, and supportive government policies. Major projects like the 1.2 GW Start Campus in Portugal and the 2.5 GW Aragón Data Center Hub in Spain highlight this geographic focus.

What are the main strategies data centers are using to integrate solar power?

The industry is adopting a multi-tiered strategy. The three main models are: 1) On-site/Co-located Solar, where smaller solar plants are built on-site to provide direct power (e.g., LCL’s 3.4 MW portfolio); 2) Power Purchase Agreements (PPAs), where companies like Microsoft sign long-term contracts to buy power from new, large-scale solar farms; and 3) Gigawatt-Scale Renewable Campuses, the most advanced model where the data center and massive solar generation are co-developed as a single, integrated ecosystem, like the Start Campus SINES DC.

What is the difference between a PPA and an on-site solar installation?

An on-site solar installation is physically located at the data center (e.g., on the rooftop or adjacent land) and provides ‘behind-the-meter’ power directly to the facility. In contrast, a Power Purchase Agreement (PPA) is a long-term financial contract to buy electricity from a large, off-site renewable energy project. The power is delivered through the existing grid, but the PPA guarantees the purchase and helps finance the new solar farm’s construction.

What does the future look like for data centers and renewable energy?

The trend points toward a complete fusion of digital and energy infrastructure, creating self-contained, renewably powered ‘AI factories’. The next step will be to move beyond solar alone, incorporating a hybrid mix of wind and solar combined with large-scale Battery Energy Storage Systems (BESS). The goal is to deliver 24/7 carbon-free power, ensuring both operational resilience and the fulfillment of corporate sustainability goals.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.