Top 10 Nuclear Powered Data Center Projects in the US in 2025

The Convergence of AI and Atoms: Top Nuclear-Powered Data Center Projects in the U.S.

Introduction: The Nuclear Imperative for AI Dominance

Hyperscale data center operators are now the primary drivers underwriting the next generation of U.S. nuclear power, shifting from passive energy consumers to anchor tenants to secure the immense, 24/7 carbon-free electricity required for artificial intelligence. This strategic pivot is a direct response to the physical limits of the U.S. electrical grid clashing with the exponential energy demands of AI. Key data points validate this trend, including Meta’s landmark portfolio agreement for up to 6.6 GW of nuclear capacity and Amazon’s commitment to a 5 GW Small Modular Reactor (SMR) deployment program. With projections showing data center power demand surging to over 12% of total U.S. electricity use by 2028, the dominant theme for 2025 is clear: tech giants are now directly financing and de-risking new nuclear projects to secure their own growth and power the AI revolution.

AI Power Demand Forecast to Skyrocket

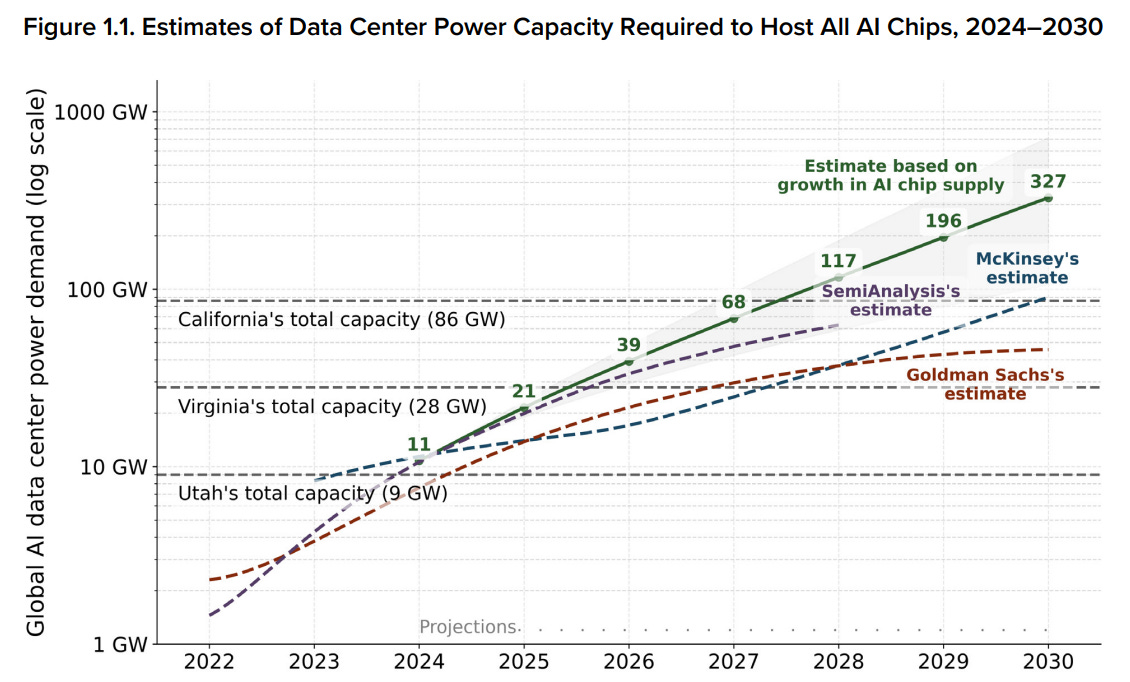

The exponential energy demand of AI, projected to reach as high as 327 GW by 2030, is the key driver compelling hyperscale data center operators to secure nuclear power.

(Source: ai-supremacy.com)

Key Projects and Initiatives

The following installations represent the leading edge of the strategic integration between the technology and nuclear energy sectors. These projects are categorized by their commercial structure, from large-scale power purchase agreements to fully integrated data and energy campuses.

1. Meta Nuclear Portfolio

Company: Meta, Terra Power, Vistra Energy, Oklo

Capacity: Up to 6.6 GW

Application: Powering AI data centers via a diversified portfolio of existing plant PPAs, plant uprates, and advanced reactor development agreements.

Source: Meta Announces 6.6 GW Of Nuclear Energy Projects To …

2. ENTRA 1 & TVA SMR Program

Company: ENTRA 1 Energy, Tennessee Valley Authority (TVA), Nu Scale Power

Capacity: 6.0 GW

Application: Large-scale deployment of a fleet of Nu Scale Power SMRs to provide firm, clean power for the Tennessee Valley region, supporting its growing data center industry.

Source: Nu Scale Proudly Supports TVA and ENTRA 1 Energy …

3. Fermi America “Hyper Grid” Campus

Company: Fermi America, Westinghouse

Capacity: 5.0+ GW (Nuclear)

Application: An integrated energy and data complex featuring four Westinghouse AP 1000 reactors co-located with data centers to provide behind-the-meter power.

Source: US nuclear set to profit from world’s biggest data complex

4. Amazon SMR Program

Company: Amazon, X-Energy, Dominion Energy

Capacity: 5.0 GW

Application: A long-term program to develop and deploy a fleet of various SMRs by 2039 to provide 24/7 power to Amazon Web Services (AWS) data centers.

Source: Amazon, partners join forces on nuclear power for AIDCs

5. Talen Energy Cumulus Campus

Company: Talen Energy, Amazon

Capacity: 2.5 GW (from existing plant)

Application: A data center campus co-located directly with the Susquehanna nuclear plant, providing up to 960 MW of direct, carbon-free power to Amazon.

Source: Powering Data

6. Google Advanced Reactor Plan

Company: Google, Elementl Power

Capacity: 1.8 GW

Application: A strategic agreement to preposition three project sites for advanced reactors, each capable of hosting a 600 MW facility to power future Google data centers.

Source: Google Plans Three 600 MW Nuclear Projects for Data …

7. Last Energy Microreactor Fleet

Company: Last Energy

Capacity: 0.6 GW

Application: A planned phased deployment of PWR-20 microreactors in Texas, providing 600 MW of dedicated, on-site nuclear capacity for data center customers.

Source: Last Energy plans to deploy 600 MW of microreactors …

8. Google & Kairos Power Fleet

Company: Google, Kairos Power

Capacity: 0.5 GW

Application: A Master Plant Development Agreement to deploy a U.S. fleet of Kairos Power advanced reactors, starting with a 50 MW unit online by 2030 for Google’s data centers.

Source: Google Signs Deal to Power Data Centers from Advanced …

9. Vistra Nuclear Uprates for Meta

Company: Vistra Energy, Meta

Capacity: 0.433 GW

Application: Corporate financial support from Meta to fund uprates at two of Vistra’s Ohio nuclear plants, adding new, carbon-free capacity to the grid.

Source: Meta strikes deals with Vistra, Oklo, Terra Power

10. DOE Federal Site Initiative

Company: U.S. Department of Energy (DOE)

Capacity: 1.0+ GW (per site)

Application: An initiative to leverage federally owned land at four sites for the development of data centers co-located with power infrastructure, including nuclear.

Source: DOE Announces Site Selection for AI Data Center and …

Table: Top 10 Nuclear-Powered Data Center Projects & Initiatives

| Project/Initiative | Lead Companies | Capacity (GW) | Technology/Model | Status/Timeline |

|---|---|---|---|---|

| Meta Nuclear Portfolio | Meta, Terra Power, Vistra, Oklo | Up to 6.6 | Portfolio (Advanced Reactors, Uprates, PPAs) | Agreements signed Jan 2026; deployment through 2035+ |

| ENTRA 1 & TVA SMR Program | ENTRA 1 Energy, TVA, Nu Scale Power | 6.0 | SMR Fleet (Nu Scale) | Agreement announced Sep 2025 |

| Fermi America “Hyper Grid” | Fermi America, Westinghouse | 5.0+ (Nuclear) | Integrated Campus (AP 1000 Large Reactors) | NRC applications filed; IPO planned |

| Amazon SMR Program | Amazon, X-Energy, Dominion Energy | 5.0 | SMR Fleet (Various) | Ongoing investment; deployment by 2039 |

| Talen Energy Cumulus Campus | Talen Energy, Amazon | 2.5 (from existing plant) | Co-located Data Center | Operational; Amazon acquired campus |

| Google Advanced Reactor Plan | Google, Elementl Power | 1.8 (3 x 600 MW) | Advanced Reactors | Strategic agreement signed May 2025 |

| Last Energy Microreactor Fleet | Last Energy | 0.6 | Microreactors (PWR-20) | Development phase; announced Feb 2025 |

| Google & Kairos Power Fleet | Google, Kairos Power | 0.5 | Advanced Reactors (Kairos Fluoride Salt-Cooled) | Agreement signed Oct 2025; first deployment by 2030 |

| Vistra Nuclear Uprates for Meta | Vistra, Meta | 0.433 | Uprates of Existing Plants | Part of Jan 2026 agreement |

| DOE Federal Site Initiative | U.S. Dept. of Energy | 1.0+ (per site) | Co-location on Federal Land | Site selection announced July 2025 |

Industry Adoption: From Power Purchase to Power Partnership

The pattern of adoption reveals a profound shift from passive procurement to active partnership. Hyperscalers are no longer just signing PPAs for available electrons; they are now shaping the future of energy supply to guarantee their own. This evolution is visible across three distinct models. First is the direct co-location model, exemplified by Amazon’s $650 million acquisition of Talen Energy’s Cumulus campus. This “behind-the-meter” strategy provides direct, resilient power and is the ultimate form of integration. Second is the diversified portfolio approach, where Meta’s 6.6 GW strategy is the benchmark. By combining long-term PPAs from existing assets (Vistra Energy), financing for capacity uprates (433 MW), and development agreements for advanced reactors (Terra Power, Oklo), Meta mitigates technology risk and timelines. Third is the direct investment and fleet development model. Amazon’s $500 million stake in X-Energy and Google’s Master Plant Development Agreement with Kairos Power signal a move from customer to enabler, providing the bankability required to build first-of-a-kind reactors.

Geography: Mapping the Nuclear-AI Nexus

Geographic trends show deployment clustering around two strategic priorities: revitalizing regions with existing nuclear infrastructure and building new energy hubs in high-growth corridors. The first strategy is evident in the industrial Midwest and East Coast. Projects in Pennsylvania (Talen Energy) and Ohio (Vistra’s uprates for Meta), along with planned deployments in Virginia (Amazon/Dominion Energy), leverage an established nuclear workforce and grid connections. This approach minimizes development risk while providing power to major data center alleys. The second strategy is focused on creating new, integrated campuses in power-hungry regions like Texas. Fermi America’s planned 11 GW “Hyper Grid” and Last Energy’s 600 MW microreactor project signal a clear intent to build self-contained energy and data ecosystems from the ground up. The DOE Federal Site Initiative overlays these trends, offering a geographically diverse set of fast-track locations in Idaho, Tennessee, Kentucky, and South Carolina that combines federal land with proximity to key infrastructure, further accelerating mainstream adoption nationwide.

Mapping the Nuclear-AI Nexus in the US

This map highlights states with potential for both new nuclear reactors and data centers, illustrating the geographic strategy of co-locating energy and demand as discussed in the text.

(Source: Engineering Inc – ACEC)

Tech Maturity: Commercial Now, Advanced Next

These installations reveal a sophisticated, dual-track technology strategy across the industry. Hyperscalers are securing immediate, large-scale capacity from commercially proven technologies while simultaneously catalyzing the next generation of advanced reactors. The “Commercial Now” track is about scale and certainty. Deals like Meta’s 2.1 GW PPA with Vistra and Amazon’s 960 MW offtake from Talen Energy utilize existing large light-water reactors to meet today’s gigawatt-scale needs. Fermi America’s plan to use proven Westinghouse AP 1000 reactors fits this model. The “Advanced Next” track is about future-proofing and innovation. Commitments to Small Modular Reactors (SMRs) and advanced designs are creating the market for tomorrow’s technology. Amazon’s 5 GW SMR program and the landmark 6 GW TVA/ENTRA 1 program for Nu Scale technology are designed to move SMRs from demonstration to fleet-scale deployment. Further out, agreements like Meta’s with Terra Power for Natrium reactors and Google’s with Kairos Power provide the critical first orders needed to commercialize advanced reactor designs, with initial deployments targeted for the early 2030 s.

SMR Pipeline Signals Next-Gen Nuclear

The massive global pipeline for Small Modular Reactors (SMRs) visually represents the ‘Advanced Next’ strategy, showing significant capacity in development to meet future AI energy needs.

(Source: POWER Magazine)

Forward-Looking Insights: The New Energy Paradigm

The convergence of AI and nuclear energy is not a fleeting trend but the foundation of a new, resilient energy paradigm for the digital economy. The projects initiated in 2025-2026 signal that hyperscalers have become the financial anchors for a U.S. nuclear renaissance. Looking forward, this integration will deepen. We anticipate the standardization of “data center-ready” SMR and microreactor designs, optimized for co-location and rapid deployment. The long-term, high-value offtake contracts from tech giants will become the primary financing vehicle for First-of-a-Kind (FOAK) reactors, solving a historic bottleneck for the nuclear industry. Ultimately, the line between technology and energy companies will continue to blur. Integrated “Hyper Grid” campuses, pioneered by projects like Fermi America and Talen Energy, will become the blueprint for self-sufficient, gigawatt-scale digital infrastructure that is decoupled from public grid constraints, ensuring the power needed for continued AI innovation.

Frequently Asked Questions

Why are tech companies like Meta and Amazon turning to nuclear power?

Tech companies are turning to nuclear power to meet the massive and rapidly growing energy demands of artificial intelligence (AI). The existing U.S. electrical grid has physical limits, and nuclear energy provides the immense, 24/7, carbon-free electricity that hyperscale data centers require to operate reliably and achieve their clean energy goals.

What are the different ways tech companies are securing nuclear energy?

They are using three main strategies: 1) Direct Co-location, where data centers are built on-site with a nuclear plant, like Amazon’s Cumulus Campus. 2) Diversified Portfolios, where companies like Meta combine power purchase agreements (PPAs) from existing plants with investments in new reactor technologies. 3) Direct Investment, where companies like Amazon and Google finance and partner with advanced reactor companies like X-Energy and Kairos Power to help build first-of-a-kind reactors.

Are these projects all using new, unproven reactor technology?

No, companies are using a dual-track strategy. For immediate, large-scale needs (‘Commercial Now’), they are securing power from existing, proven large-scale reactors, like Amazon’s deal with Talen Energy or Meta’s with Vistra. Simultaneously, they are investing in the ‘Advanced Next’ track by providing the first orders for Small Modular Reactors (SMRs) and other advanced designs that are expected to be deployed in the early 2030s.

Which are the largest nuclear-AI projects mentioned in the report?

The largest projects by planned capacity include Meta’s Nuclear Portfolio for up to 6.6 GW, the ENTRA 1 & TVA SMR Program aiming for 6.0 GW, and both the Fermi America ‘Hyper Grid’ Campus and the Amazon SMR Program, each targeting over 5.0 GW of nuclear capacity.

What is a ‘behind-the-meter’ project, and can you give an example?

A ‘behind-the-meter’ project involves a data center receiving power directly from an adjacent power source, bypassing the public electrical grid. This provides highly reliable and resilient power. The prime example from the text is Amazon’s acquisition of Talen Energy’s Cumulus Campus, a data center co-located with the Susquehanna nuclear plant to receive up to 960 MW of direct, carbon-free power.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.