AFC Energy 2025: Ammonia Cracking Unlocks Hydrogen Fuel Cell Commercialization

AFC Energy’s Commercial Projects: Ammonia Cracking Drives Hydrogen Generator Adoption 2025

In 2025, AFC Energy executed a decisive strategic pivot from technology demonstration to aggressive commercialization, driven by an integrated ammonia-to-power solution that directly addresses the fuel logistics barrier that previously limited market adoption.

- In the 2021 to 2024 period, AFC Energy focused on validating its H-Power generators through high-profile but temporary deployments, such as with the Extreme E racing series and construction trials with partners like Mace and Keltbray. These projects proved the technology’s viability but highlighted the challenge of sourcing and transporting hydrogen to off-grid sites.

- The strategy shifted fundamentally in 2025 with the launch of the Hy-5, a portable ammonia cracking module designed to produce hydrogen on-demand. This innovation transforms the company’s value proposition, enabling it to offer a complete energy solution rather than just a hardware component.

- This new capability is converting demonstration projects into commercial wins, evidenced by the FIA Extreme H World Cup contract and deployments at customer sites through the Speedy Hydrogen Solutions joint venture. The ability to provide both the generator and a reliable fuel source is accelerating adoption in target markets like temporary power and construction.

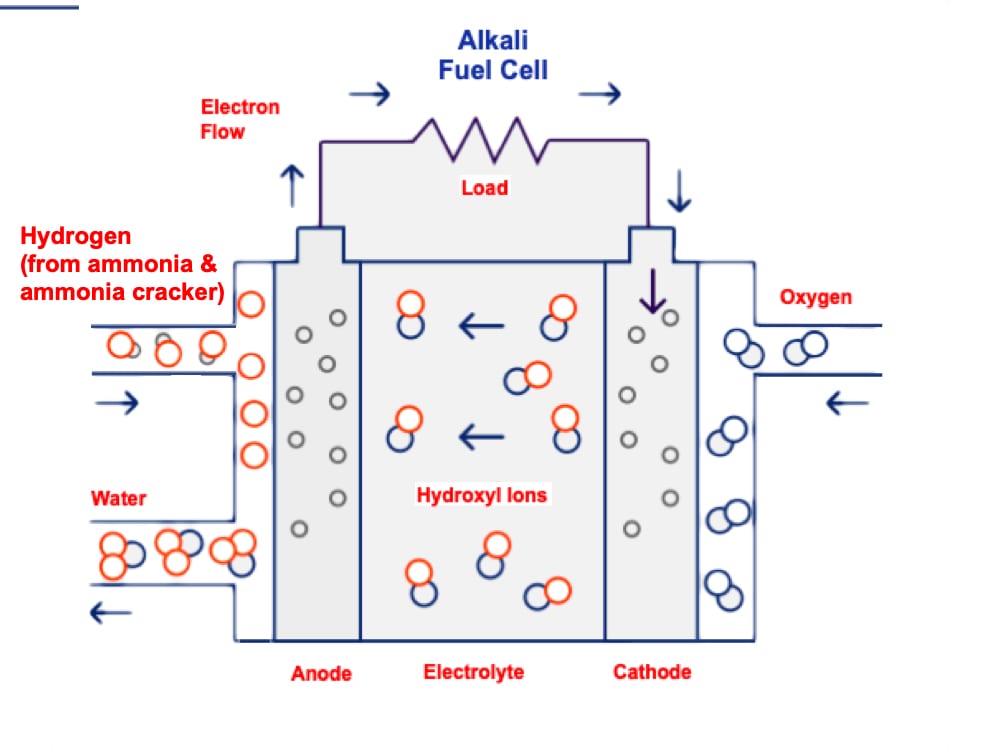

AFC’s Integrated Ammonia-to-Power System

This diagram illustrates the complete ammonia-to-power process that underpins AFC Energy’s commercial strategy. It shows how cracked ammonia provides hydrogen to the fuel cell to generate clean electricity.

(Source: EEPower)

AFC Energy Investment Analysis 2025: Funding the Pivot to Commercial Scale

AFC Energy secured critical growth capital in 2025 specifically to fund its new commercial strategy, signaling strong investor confidence in its integrated ammonia-to-power model and its potential to achieve commercial viability.

- The company’s strategic reset was validated in July 2025 by a significantly oversubscribed equity fundraising that secured £27.5 million. These funds are explicitly allocated to the commercialization of the Hy-5 ammonia cracker and the new low-cost LC 30 fuel cell generators.

- This targeted investment contrasts with the £15.8 million raised in June 2024, which supported a broader growth strategy. The 2025 funding round demonstrates a focused investor mandate to execute the company’s pivot to a complete solutions provider.

- The financial foundation for this pivot was laid in late 2023 with the £5 million joint funding commitment with Speedy Hire. This initial commercial investment created the dedicated market channel that the 2025 capital raise is now intended to supply.

Table: AFC Energy Strategic Investments and Capital Raises

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Equity Fundraising | July 2025 | Raised £27.5 million in an oversubscribed placing to fund the commercial rollout of Hy-5 ammonia crackers and low-cost LC 30 fuel cell generators. | Haynes Boone |

| Equity Placing | June 2024 | Raised £15.8 million to fund production scale-up, support the company’s growth strategy, and fulfill its growing order book. | Zeus Capital |

| Speedy Hydrogen Solutions JV | November 2023 | Initial joint funding commitment of up to £5 million (£2.5 million each from AFC Energy and Speedy Hire) to establish a hydrogen generator hire business. | Speedy Hire |

| Strategic Investment from ABB | April 2021 | ABB made a strategic investment as part of an expanded partnership to accelerate joint development for high-power EV charging and data center solutions. | AFC Energy |

AFC Energy Strategic Partnerships 2025: Building an Ammonia-to-Power Ecosystem

In 2025, AFC Energy forged critical partnerships to build a complete commercial ecosystem for its ammonia-to-power technology, moving beyond technology validation to establishing a scalable manufacturing and fuel supply chain.

- The most significant move was the October 2025 formation of a 50:50 joint venture with Industrial Chemicals Group (ICL). This partnership combines AFC Energy’s ammonia cracking technology with ICL’s chemical distribution network to produce and sell low-cost hydrogen, targeting a disruptive £10/kg price point.

- To make its generators cost-competitive with diesel, AFC Energy established a strategic manufacturing partnership with Volex in June 2025. This collaboration was instrumental in redesigning the fuel cell system to achieve a landmark 85% reduction in manufacturing cost for its new LC 30 generator.

- These 2025 supply chain and manufacturing partnerships represent a strategic evolution from the 2021 to 2024 period, which focused on downstream, end-user collaborations with companies like ABB, Mace, and ACCIONA to prove the technology’s application.

- The company’s ammonia cracker technology received crucial third-party validation in 2025 through a Joint Development Agreement with an unnamed S&P 500 industrial company, with the first phase of the project successfully completed in November 2025.

Clean Energy Demand Drives AFC Market

This analysis highlights the key market forces driving the adoption of alkaline fuel cells. The need to overcome infrastructure limits and meet clean energy demand creates the opportunity that AFC Energy’s partnerships aim to capture.

(Source: Coherent Market Insights)

Table: AFC Energy Strategic Partnership Analysis

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Industrial Chemicals Group (ICL) | October 2025 | Formed a 50:50 joint venture to produce and sell low-cost hydrogen from cracked ammonia, creating a secure fuel supply chain for its generators. | ICL |

| Volex Plc | June 2025 | Strategic manufacturing partnership to scale up global production of fuel cell systems and achieve an 85% unit cost reduction. | Fuel Cells Works |

| Unnamed S&P 500 Company | June 2025 | Joint Development Agreement to develop and commercialize ammonia cracker technology, providing key third-party validation. | Proactive Investors |

| Speedy Hire Plc | November 2023 | Formed the Speedy Hydrogen Solutions JV, creating a dedicated hire business and a primary commercial route-to-market in the UK. | Speedy Hire |

| ACCIONA | 2022 – 2024 | Collaboration began with technology demonstrations and matured into a commercial order for a 45 k VA H-Power Generator in December 2024. | AFC Energy |

AFC Energy Geographic Strategy: UK Commercialization and MENA Expansion

While maintaining a long-term focus on key international growth markets, AFC Energy has concentrated its immediate commercialization efforts in the UK, leveraging local partnerships to build a domestic ammonia-to-power ecosystem.

- Between 2021 and 2024, AFC Energy’s geographic footprint was diverse, reflecting its focus on technology validation. This included trials in Spain with ACCIONA, maintaining a test facility in Germany with Air Products, and securing a distribution agreement for the MENA region with TAMGO.

- In 2025, the company’s commercial center of gravity shifted decisively to the UK. The Speedy Hydrogen Solutions JV provides direct access to the domestic construction and temporary power markets, while the joint venture with ICL is focused on building a UK-based hydrogen production and distribution network.

- The MENA growth strategy, initiated with the TAMGO agreement in 2021, continues to mature. The region is now a source of commercial orders and hosts the high-profile Extreme H motorsport series, establishing it as a key market for future expansion.

AFC Energy Technology Maturity: Ammonia Cracker Reaches Commercial Readiness in 2025

AFC Energy’s technology portfolio transitioned from demonstration to commercial-ready status between 2025 and today, a shift enabled by critical breakthroughs in both the efficiency of its ammonia cracker and the cost-effectiveness of its fuel cell generators.

- The 2021 to 2024 period was defined by pilot-scale validation. The company demonstrated its S-Series fuel cells in various off-grid settings while advancing its ammonia cracker technology, which reached the demonstration plant stage in late 2023.

- A clear inflection point occurred in 2025 with the launch of the Hy-5, a portable and modular ammonia cracker designed for commercial deployment, and the completion of the first LC 30 generator in January 2026. The new generator’s 85% manufacturing cost reduction makes it a viable competitor to diesel.

- The maturity of the ammonia cracker technology was further confirmed by the successful completion of the first development phase with its unnamed S&P 500 industrial partner in November 2025, providing essential third-party validation ahead of its commercial rollout.

Ammonia Cracker Achieves 100% Conversion

This diagram highlights the core technological breakthrough enabling AFC Energy’s commercial readiness. The advanced cracker achieves full ammonia conversion at lower temperatures, increasing efficiency and commercial viability.

(Source: Ammonia Energy Association)

SWOT Analysis: AFC Energy’s 2025 Strategic Pivot

AFC Energy’s strategic realignment in 2025 effectively leveraged its proprietary technology to address market-wide fuel logistic weaknesses and capitalize on the growing demand for diesel alternatives, though it remains dependent on successful partnership execution and access to capital.

- The company’s core strength is its dual-technology platform, which now offers an integrated ammonia-to-power solution, a significant advance from its earlier position as a hardware-only provider.

- The primary opportunity lies in displacing diesel generators in the vast off-grid power market by using ammonia’s established logistics network to deliver decentralized, low-cost hydrogen.

- However, the company remains pre-profit and reliant on external financing to fund its scale-up, while facing increasing competition from other fuel cell and ammonia cracking technology developers.

Table: SWOT Analysis for AFC Energy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Proprietary alkaline fuel cell (AFC) technology tolerant to lower-purity hydrogen. Early-stage partnerships (ABB, Mace) validating technology in target markets. | An integrated technology solution combining a cost-reduced fuel cell (LC 30) with a proprietary ammonia cracker (Hy-5). Strong IP portfolio and brand in ammonia-to-power. | The company moved from offering a component (the fuel cell) to a complete, economically viable energy solution, resolving the hydrogen logistics barrier for customers. |

| Weaknesses | High manufacturing costs for fuel cell generators. Dependence on third-party hydrogen supply and logistics. Pre-revenue status with significant cash burn. | Continued reliance on equity financing for growth (£27.5 M raise in 2025). Execution risk in scaling manufacturing with Volex to meet demand. Still pre-profit. | The launch of the ammonia cracker directly addressed the hydrogen supply weakness. However, financial dependency and manufacturing scale-up risks remain the primary challenges. |

| Opportunities | Growing regulatory pressure and corporate ESG goals driving demand for diesel generator replacements in construction, events, and other off-grid applications. | Leveraging ammonia’s existing global infrastructure for transport and storage. Disrupting the decentralized hydrogen market with a target price of £10/kg via the ICL JV. | The addressable market expanded significantly. The ammonia cracker unlocked a practical path to serve the off-grid power market at a competitive price point. |

| Threats | Competition from established fuel cell technologies like PEM. Slow market adoption due to the lack of widespread hydrogen refueling infrastructure. | Emerging competitors in both fuel cell generators and modular ammonia cracking technology. Potential for new regulations on ammonia handling and transport. | The competitive threat shifted from a lack of hydrogen infrastructure to direct competition within the emerging ammonia-to-power ecosystem. |

AFC Energy’s Outlook: Execution of the Ammonia-to-Power Strategy is Critical

The success of AFC Energy over the next 12 to 18 months hinges on its ability to flawlessly execute the commercial rollout of its integrated ammonia cracker and low-cost fuel cell generator solution through its newly formed strategic partnerships.

- The most critical milestone will be the first commercial deliveries of the Hy-5 ammonia cracking module, scheduled for 2026. Successful deployment through the ICL joint venture will provide the ultimate validation of the company’s “hydrogen-on-demand” strategy.

- Achieving volume production of the cost-reduced LC 30 generator with Volex is essential. This must be coupled with a steady stream of commercial orders through the Speedy Hydrogen Solutions JV to convert the company’s significant order book into tangible revenue.

- The company’s financial results for fiscal year 2025, due in February 2026, will be closely scrutinized. The report must demonstrate meaningful revenue growth and disciplined management of cash burn to maintain investor confidence and support its path to commercial viability.

📄 Download Full Report

Please enter your email to download the analysis as PDF.

Frequently Asked Questions

What was AFC Energy’s main strategic shift in 2025?

In 2025, AFC Energy pivoted from demonstrating its technology in temporary trials to aggressively commercializing its products. The core of this shift was the launch of an integrated ‘ammonia-to-power’ solution, combining their hydrogen generators with the new Hy-5 ammonia cracker to produce hydrogen fuel on-site, thereby solving a major logistics barrier.

Why is the ammonia cracker (Hy-5) so important for AFC Energy’s commercialization?

The Hy-5 ammonia cracker is crucial because it allows AFC Energy to produce hydrogen on-demand directly at the customer’s site. This overcomes the significant challenge and cost of transporting and storing compressed hydrogen. By using ammonia—which has an established global logistics network—as a carrier for hydrogen, AFC Energy can offer a complete, reliable, and more economically viable off-grid power solution, rather than just selling a piece of hardware.

How did AFC Energy fund its pivot to a commercial solutions provider in 2025?

AFC Energy secured £27.5 million through a significantly oversubscribed equity fundraising in July 2025. This capital was specifically raised to finance the commercial rollout of its Hy-5 ammonia crackers and the new low-cost LC 30 fuel cell generators, signaling strong investor confidence in its integrated ammonia-to-power strategy.

What key partnerships did AFC Energy establish to support its new strategy?

In 2025, AFC Energy formed several critical partnerships to build a complete commercial ecosystem. Key partners include: 1) Industrial Chemicals Group (ICL) in a joint venture to produce and sell low-cost hydrogen from ammonia; 2) Volex, as a strategic manufacturing partner to scale up production and achieve an 85% cost reduction on its new generators; and 3) the Speedy Hydrogen Solutions joint venture (formed late 2023) as the primary commercial channel for hiring out generators in the UK.

What is the next major milestone for AFC Energy?

The most critical upcoming milestone is the first commercial delivery of the Hy-5 ammonia cracking module, which is scheduled for 2026. Successfully deploying this technology through its partnerships, particularly the ICL joint venture, will be the ultimate validation of the company’s ‘hydrogen-on-demand’ strategy and its ability to execute its commercial plan.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.