Ballard Power’s 2025 Commercial Pivot: How Fuel Cell Deals Validate Market Strategy

Ballard Power Commercial Scale Projects Transform Heavy-Duty Transport 2025

In 2025, Ballard Power Systems executed a definitive shift from research-oriented pilot projects to securing binding, large-scale commercial orders, validating its fuel cell technology as a viable decarbonization solution for heavy-duty transport.

- Between 2021 and 2024, the company’s activities centered on smaller, demonstration-focused projects that established technical feasibility but lacked commercial volume, such as initial collaborations with Ford Trucks and the development of a mining truck with Adani Group.

- The year 2025 marked a turning point with the announcement of multi-year supply agreements, including a landmark 6.4 MW order from e Cap Marine for Samskip container vessels and a ~5 MW agreement with MCV for buses, signaling a clear move to commercial-scale deployment.

- This commercial momentum was further reinforced by significant orders in the rail sector, with Sierra Northern Railway ordering 1.5 MW of fuel cell engines to convert diesel locomotives, building on earlier work with partners like CPKC.

- The expansion into stationary power through a partnership with Vertiv for data center backup systems illustrates that the market for fuel cells is diversifying beyond mobility into critical infrastructure applications.

Ballard Visualizes the Complete Hydrogen Energy Cycle

This infographic illustrates the hydrogen value chain, from renewable electricity generation to its use in fuel cell electric vehicles like buses and trucks.

(Source: Blog | Ballard Power Systems – Ballard’s fuel cell)

Ballard Power Investment Analysis Shows Strategic Capital Reallocation

Ballard Power Systems fundamentally reallocated its capital strategy in 2025, pivoting away from planned international expansion to concentrate investment in North American manufacturing while implementing major cost-control measures to align with market realities.

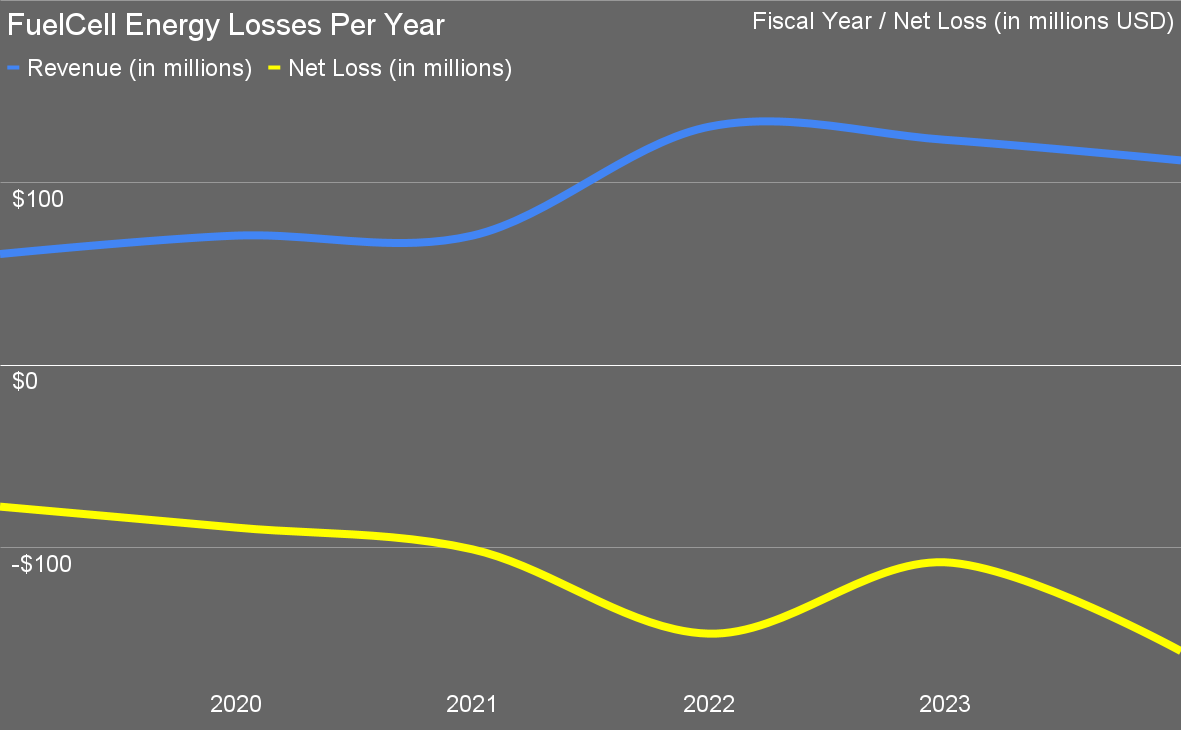

FuelCell Energy Losses Highlight Industry-Wide Profitability Hurdles

This chart shows FuelCell Energy’s revenue versus its significant net losses between 2020 and 2023, illustrating the financial pressures within the hydrogen sector.

(Source: CleanTechnica)

- The company initiated a significant restructuring in mid-2025 aimed at achieving positive cash flow, a direct response to what its CEO described as a “multi-year push-out of the hydrogen industry.”

- This strategic shift is highlighted by the decision to postpone the final investment decision on a planned Texas gigafactory, for which Ballard was allocated $40 million in U.S. Department of Energy grants.

- Simultaneously, the company put new investments in China “materially on pause” due to the country’s increasing preference for domestic suppliers, shelving a previously announced $130 million plan from 2022.

- Despite these holds on capital expenditure, the company’s financial position remains strong, with a balance sheet holding $525.7 million in cash and no debt as of Q 3 2025, providing a substantial runway to navigate market delays.

Table: Ballard Power Systems Key Investments and Financial Actions 2025

| Project / Action | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| China Investment Pause | October 2025 | New investments in China were paused due to market shifts favoring domestic suppliers, halting a previously planned expansion. | h 2-view.com |

| Strategic Realignment | July 2025 | Initiated a company-wide restructuring under new leadership to reduce operating expenses and focus on core markets to achieve positive cash flow. | prnewswire.com |

| Texas Gigafactory Hold | May 2025 | Postponed the final investment decision on the Texas gigafactory, despite securing a $40 million DOE grant, to align capital spending with a slower-than-expected market. | hydrogeninsight.com |

Ballard Power Partnership Strategy Matures to Secure Commercial Offtake

Ballard’s partnership strategy evolved from technology development in 2021-2024 to securing commercial offtake and strengthening its supply chain in 2025, locking in multi-year agreements with established OEMs and end-users.

Fuel Cell Component Market to Quintuple by 2034

The global market for Fuel Cell Balance of Plant (BOP) components is projected to grow from $4.2 billion in 2024 to $23.1 billion by 2034.

(Source: Market.us)

- In December 2025, Ballard deepened its relationship with South Korean supplier Kolon Industries through an MOU to secure key components and co-develop next-generation materials, a shift toward stabilizing its supply chain for scaled production.

- The company secured its position in the marine sector through a partnership with integrator e Cap Marine, which resulted in a 6.4 MW order to power vessels for logistics company Samskip, one of the largest marine fuel cell orders in history.

- In the bus market, a multi-year supply agreement signed in March 2025 with manufacturer MCV for approximately 5 MW of fuel cell engines demonstrates a move from one-off sales to predictable, recurring revenue streams.

- The consortium with Fontaine Modification, Forsee Power, and Linamar Corporation to develop a Class 6 truck shows a collaborative go-to-market approach, integrating Ballard’s systems with other key component suppliers to offer a complete vehicle solution.

Table: Ballard Power Systems Strategic Partnerships 2025

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Kolon Industries | December 2025 | MOU to deepen cooperation on fuel cell components and ensure supply stability for key materials, supporting scaled manufacturing. | fuelcellsworks.com |

| e Cap Marine (for Samskip) | July 2025 | A landmark 6.4 MW order for FCwave™ engines to power two container vessels, validating the technology for commercial marine applications. | ballard.com |

| Sierra Northern Railway | June 2025 | A 1.5 MW order for FCmove®-XD engines to convert diesel locomotives, establishing a commercial foothold in the North American rail market. | ballard.com |

| Fontaine Modification Consortium | April 2025 | Joined a consortium with other suppliers to develop and deploy a fuel cell electric Class 6 truck, demonstrating a collaborative market entry strategy. | fontainemodification.com |

| MCV | March 2025 | Multi-year supply agreement for 50 bus engines, totaling ~5 MW, securing a key customer in the European bus market. | ballard.com |

| Vertiv | February 2025 | Partnership to develop a zero-emission UPS system for data centers, opening a new commercial market for stationary power. | fuelcellsworks.com |

Ballard Power Geographic Focus Shifts to North America and Europe

In 2025, Ballard Power Systems executed a decisive geographic pivot, halting new investments in China to strategically refocus its manufacturing and commercial efforts on North America and Europe, driven by policy incentives and market readiness.

- From 2021 to 2024, Ballard’s strategy included significant planned investments in China, such as a proposed $130 million MEA plant in Shanghai, to serve what was seen as a key growth market.

- By October 2025, the company announced its China investment plans were “materially on pause, ” citing a shift in Beijing’s policy toward domestic suppliers, which reduced the viability of further capital allocation in the region.

- The focus decisively shifted to North America, where Ballard was awarded $40 million in U.S. federal grants for a proposed gigafactory in Texas, designed to build a localized supply chain and capitalize on “Buy America” provisions.

- Europe remains a critical commercial market, as evidenced by large orders from customers like MCV (Egypt, for European deployment) and a long-standing relationship with Solaris, confirming its role as a primary revenue generator even as manufacturing investment is prioritized in the U.S.

Ballard Power Technology Maturity Reaches Commercial Viability in 2025

Ballard’s fuel cell technology progressed from broad application testing between 2021-2024 to the launch of application-specific, commercially validated products in 2025, designed to reduce costs and compete directly with incumbent diesel technologies.

- The 2021-2024 period was characterized by technology validation across different platforms, including the development of a megawatt-scale marine fuel cell with ABB and testing liquid hydrogen systems with Chart Industries.

- In October 2025, Ballard launched its ninth-generation FCmove®-SC, a fuel cell module engineered specifically for transit buses with a 25% increase in volumetric power density and a design aimed at lowering lifecycle costs to approach diesel parity.

- The commercial readiness of its product portfolio was validated by the deployment of the FCwave™ engine in the 6.4 MW Samskip marine order and the use of the FCmove®-XD in the Sierra Northern Railway locomotive project.

- This shift from general-purpose modules to specialized, cost-optimized products for targeted markets like bus, rail, and marine marks the transition of its technology from the R&D phase to full commercial maturity.

SWOT Analysis: Ballard Power’s Strategic Pivot in 2025

Ballard Power’s 2025 strategy successfully leveraged its strengths in technology and liquidity to capture commercial opportunities, but it remains exposed to weaknesses in profitability and threats from a slower-than-expected market adoption curve.

- Strengths were validated as decades of technology leadership translated into major commercial contracts and a strong balance sheet enabled strategic patience.

- Weaknesses in financial performance saw initial improvement, with gross margin turning positive, though overall profitability remains a long-term goal.

- Opportunities shifted from theoretical policy benefits to tangible government funding that now underpins the company’s core manufacturing strategy in the U.S.

- Threats from a slow market were openly acknowledged and are being actively managed through disciplined capital expenditure and a focus on core, high-potential markets.

Table: SWOT Analysis for Ballard Power

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong IP portfolio and established technology leadership. Solid cash position from capital raises. | Strong liquidity ($525.7 M cash, no debt). Landmark commercial orders (Samskip, MCV, Sierra Northern Railway). New, market-specific products (FCmove®-SC). | The company successfully translated its technological leadership into tangible, large-scale commercial contracts, validating its market position. |

| Weaknesses | Persistent negative cash flow and negative gross margins. High operating expenses relative to revenue. Reliance on smaller, pilot-scale projects. | Gross margin turned positive to 15% in Q 3 2025 (up 71 points Yo Y). Restructuring underway to reduce costs. Revenue soared 120% Yo Y in Q 3 2025. | Initial signs of improved operational efficiency and a path to profitability emerged, though sustained positive cash flow has not yet been achieved. |

| Opportunities | Anticipated growth from global hydrogen policies and incentives (e.g., U.S. Inflation Reduction Act). | Secured $40 million in U.S. DOE grants for a Texas factory. Focused strategy on “Buy America” compliance. Targeting high-potential markets: bus, truck, rail, marine. | Policy opportunities became concrete financial drivers, leading to a strategic pivot to build a domestic manufacturing base in the U.S. |

| Threats | Slow pace of hydrogen infrastructure build-out. Geopolitical risks and competition in the China market. | CEO acknowledged a “multi-year push-out of the hydrogen industry.” Paused investments in Texas and China due to market uncertainty and domestic competition. | The company explicitly acknowledged the threat of a slow market and responded with a pragmatic, cautious approach to capital expenditure, preserving its balance sheet. |

Forward-Looking Insights: Ballard’s Path to Profitability

Ballard Power’s success in the year ahead hinges on its ability to translate the significant commercial momentum of 2025 into sustained revenue growth and positive cash flow, proving the economic viability of its strategic pivot.

- The most critical indicator to watch is the company’s financial performance in the coming quarters. The impressive 120% revenue growth and positive 15% gross margin in Q 3 2025 must become a consistent trend, not an anomaly, to validate the new leadership’s focus on higher-margin contracts.

- Market adoption of the new, lower-cost FCmove®-SC fuel cell for transit buses will be a key test. Securing large, multi-year contracts for this ninth-generation module is essential to solidify Ballard’s leadership in the bus segment and demonstrate a clear path to cost-competitiveness with diesel.

- The final investment decision on the Rockwall, Texas, gigafactory remains a major milestone. The timing of this decision will signal the company’s confidence in near-term North American demand and its readiness to commit capital for large-scale production.

- Continued execution on its existing order book, including deliveries for the Samskip, Sierra Northern Railway, and MCV contracts, will be crucial for building investor confidence and demonstrating that Ballard can successfully manage the transition from securing orders to fulfilling them at scale.

Frequently Asked Questions

What was the biggest strategic change for Ballard Power in 2025?

In 2025, Ballard Power made a decisive pivot from small, demonstration-focused projects to securing large-scale, binding commercial orders. This was complemented by a financial strategy to control costs, pause major capital investments in Texas and China, and refocus commercial efforts on North America and Europe to align with market realities.

Why did Ballard pause its investment plans for a new factory in Texas, even after receiving a $40 million grant?

Ballard postponed the final investment decision on its Texas gigafactory in response to what its CEO called a “multi-year push-out of the hydrogen industry.” The move was part of a broader cost-control strategy to preserve cash and align capital spending with a market that was developing slower than previously anticipated.

What key commercial deals demonstrate Ballard’s pivot to large-scale orders?

The article highlights several landmark deals in 2025 that validate its commercial pivot, including a 6.4 MW order from e Cap Marine for Samskip container vessels, a ~5 MW multi-year agreement with bus manufacturer MCV, and a 1.5 MW order from Sierra Northern Railway to convert diesel locomotives.

How did Ballard’s financial performance change in 2025?

While sustained profitability is still a future goal, Ballard showed significant signs of financial improvement in 2025. Following a strategic restructuring, the company’s gross margin turned positive to 15% in Q3 2025 (a 71-point year-over-year improvement) and revenue soared 120% in the same quarter. It also maintained a strong balance sheet with $525.7 million in cash and no debt.

Besides trucks and buses, what other markets is Ballard now active in?

In 2025, Ballard demonstrated significant diversification beyond its core road transport markets. Key new orders and partnerships established a commercial presence in the marine sector (with e Cap Marine for Samskip vessels), the rail sector (with Sierra Northern Railway), and stationary power for critical infrastructure (with Vertiv for data center backup systems).

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.