Ceres Power Fuel Cell Partnerships: SOFC & SOEC Commercialization in 2025

Ceres Power Commercial Scale Projects Validate SOFC and SOEC Adoption in 2025

Ceres Power transitioned from development-stage collaborations before 2025 to validated commercial-scale production in 2025, demonstrating market adoption of its Solid Oxide Fuel Cell (SOFC) technology for power generation and its Solid Oxide Electrolyzer Cell (SOEC) technology for green hydrogen.

- In the 2021-2024 period, Ceres Power focused on pilot projects and system development, including commissioning a 1 MW SOEC demonstrator and a planned but later canceled joint venture with Bosch and Weichai.

- The pivotal shift occurred in July 2025 when South Korean partner Doosan Fuel Cell commenced the first commercial-scale mass production of systems using Ceres Power’s technology in a new factory with a 50 MW annual capacity, specifically targeting the high-demand AI data center market.

- The company’s SOEC technology advanced significantly in May 2025 as a megawatt-scale demonstrator project with Shell in India successfully produced its first hydrogen, validating the technology’s high-efficiency pathway for industrial applications.

- Ceres Power further targeted the AI data center market through a new manufacturing license agreement with Weichai Power in China, signed in November 2025, which included $13 million in funding and allows Weichai to manufacture and sell Ceres Power’s SOFC stacks and systems.

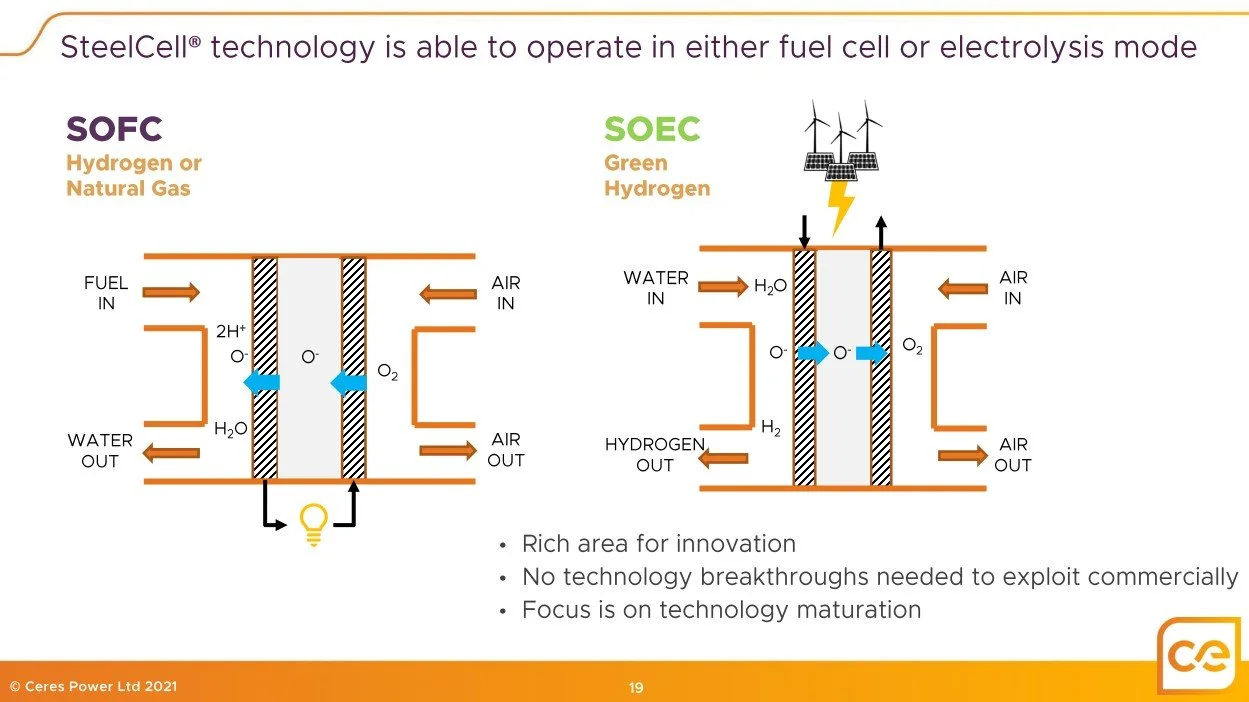

Ceres Tech Enables Both Power and Hydrogen

This diagram explains the dual-mode SOFC (power) and SOEC (hydrogen) capability of Ceres’ core technology. This versatility is key to the commercial adoption described in the section.

(Source: NET-ZERO)

Ceres Power Investment Analysis: Navigating Revenue Volatility in 2025

Ceres Power’s 2025 financial performance reflects the lumpy nature of its licensing model, with a significant projected revenue decline despite securing new funding and maintaining a debt-free balance sheet.

- The company downgraded its full-year 2025 revenue guidance to approximately £32 million, a 38% decline from 2024’s £51.9 million, citing weaker performance in engineering services which highlights the unsteady nature of pre-royalty income streams.

- Despite the revenue downturn, Ceres Power secured $13 million in new funding in November 2025 as part of its manufacturing license agreement with Chinese conglomerate Weichai Power, providing capital to support technology scale-up.

- The company maintained a strong balance sheet from a debt perspective, reporting zero total debt and £153.8 million in shareholder equity as of May 2025, indicating it is funding its growth without leverage.

- Market capitalization showed significant volatility during 2025, surging to nearly $1 billion after the Weichai deal before settling around $558 million, reflecting investor reaction to both positive partnership news and negative financial guidance.

Table: Ceres Power Key Financial and Investment Events 2025

| Metric / Event | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Market Capitalization | Dec 2025 | Stood at approximately £541.2 million, reflecting significant volatility throughout the year tied to partnership news and financial guidance. | Ceres Power CWR Financials and Fundamentals Overview |

| Funding from Weichai | Nov 2025 | Secured $13 million in new funding as part of the manufacturing license agreement to support the scale-up of its SOFC technology in China. | Ceres Power surges to all-time high on China data center … |

| FY 2025 Revenue Guidance | Sep 2025 | Guided for full-year 2025 revenue of ~£32 million, a 38% year-over-year decline attributed to lower engineering services revenue. | Ceres Power shares tumble as it guides lower full-year … |

| H 1 2025 Financials | Sep 2025 | Reported first-half revenues of £21.1 million (a 26% decrease Yo Y) and an operating loss, reflecting continued R&D spend amid business transformation. | Ceres Power reports first half results amid business … |

Ceres Power’s Global Partnerships Drive SOFC and SOEC Manufacturing 2025

In 2025, Ceres Power strategically reshaped its partnership portfolio by securing new manufacturing licensees like Weichai and Delta while navigating the termination of its collaboration with Bosch, underscoring both the model’s potential and its inherent dependency risk.

- The most significant validation of the licensing model came in July 2025 when partner Doosan Fuel Cell began mass production of SOFC systems, marking the first commercial-scale output of Ceres Power’s technology.

- The company expanded its manufacturing base by signing a license agreement with Delta Electronics in January 2026 for both SOFC and SOEC technologies and a manufacturing license with Weichai Power in November 2025 to target the Chinese stationary power market.

- The risk of partner dependency materialized in February 2025 when Bosch announced the termination of its two-year partnership as part of a strategic shift away from stationary SOFC, leading to a sharp share price decline.

- Pilot and demonstration projects continued to advance, with a Shell-partnered SOEC project producing its first hydrogen in May 2025 and a demonstration with DENSO and JERA starting in September 2025, proving the technology in industrial settings.

Table: Ceres Power Strategic Partnerships and Terminations 2025

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Delta Electronics | Jan 2026 | Secured a license agreement for hydrogen energy technology, enabling Delta to develop and manufacture both SOFC and SOEC solutions in Taiwan. | Press Center – Delta Secures License to Hydrogen Energy … |

| Weichai Power | Nov 2025 | Signed a manufacturing license allowing Weichai to produce and sell SOFC systems in China, primarily targeting the AI data center market. | Chinese state-owned conglomerate to manufacture … |

| DENSO & JERA | Sep 2025 | Began Japan’s first demonstration of SOEC hydrogen production at a thermal power station owned by JERA to validate world-leading electrolysis efficiency. | DENSO and JERA announce demonstration of SOEC … |

| Doosan Fuel Cell | Jul 2025 | Commenced mass production of SOFC systems in a new 50 MW/year factory in South Korea, marking the first commercial-scale production by a partner. | Ceres jumps 44% as Doosan begins mass production of … |

| Bosch | Feb 2025 | German partner Bosch terminated its two-year technology partnership as it realigned its strategy to focus on PEM electrolyzers instead of stationary SOFCs. | Bosch to ditch solid-oxide fuel cells and refocus on PEM … |

Ceres Power’s Geographic Focus: Asia Leads Commercial Scale-Up in 2025

Ceres Power’s commercial activities pivoted decisively toward Asia in 2025, with key partners in South Korea, China, and Japan initiating mass production and pilot projects, a clear shift from the more European-centric development partnerships of the 2021-2024 period.

- Between 2021 and 2024, Ceres Power’s partnerships were heavily weighted towards Europe, with a major collaboration and planned joint venture involving Germany’s Bosch, alongside its core R&D activities in the UK.

- In 2025, South Korea became the center of commercialization with Doosan Fuel Cell’s launch of a 50 MW mass production factory, validating the technology for its world-leading fuel cell market.

- China emerged as a primary target market in November 2025 through a new manufacturing license with Weichai Power, aimed squarely at serving the country’s rapidly expanding AI data center sector.

- Japan and India also became key sites for technology validation. Partner DENSO began Japan’s first SOEC demonstration with JERA, while a pilot with Shell and Thermax in India produced its first hydrogen.

- The signing of a license with Taiwan-based Delta Electronics in January 2026 further solidifies Ceres Power’s manufacturing footprint across key Asian technology hubs.

Ceres Power Technology Maturity: SOFC Reaches Commercial Scale in 2025

Ceres Power’s technology matured from pilot and demonstration phases between 2021 and 2024 to initial commercial-scale manufacturing in 2025, validating its SOFC platform while advancing its SOEC technology toward industrial readiness.

Ceres Steel-Based Cell Design Lowers Cost

This chart shows how Ceres’ steel-supported cell design allows for a much thinner ceramic layer. This innovation is fundamental to the technology’s maturity and readiness for commercial scale.

(Source: Ceres Power)

- The 2021-2024 period was defined by technology development and pilot-scale validation, highlighted by the successful commissioning of a 1 MW SOEC demonstrator in late 2023 and the CE certification of a 120 k W SOFC power system developed with partner Weichai.

- The critical maturity milestone for SOFC was reached in July 2025 with Doosan’s launch of a 50 MW/year mass production facility, moving the technology from development to a commercial market application.

- SOEC technology demonstrated industrial potential in May 2025 when a megawatt-scale pilot with Shell produced its first hydrogen with high efficiency of approximately 37 k Wh per kilogram, a ~30% improvement over competing technologies.

- Ceres Power announced plans in October 2025 to launch a new dual-purpose stack for both SOFC and SOEC applications, a sign of technology consolidation designed to streamline manufacturing and reduce costs for its partners.

SWOT Analysis: Ceres Power’s Strategic Position in 2025

Ceres Power’s 2025 strategy leverages its world-class technology and asset-light model but faces significant financial headwinds and partner execution risks, with the shift to commercial production being both its greatest strength and a potential vulnerability.

SOFC Market to Grow to $12.55 Billion

The chart quantifies the significant market opportunity available to Ceres, a key element of its SWOT analysis. This projected 25.72% CAGR underscores the growth potential if the company can capitalize on its strengths.

(Source: Fortune Business Insights)

- The company’s core strength, its highly efficient technology, was validated at commercial scale, while its primary weakness, a dependency on pre-royalty revenue, became more acute with a significant guidance downgrade.

- A massive new market opportunity in AI data centers emerged, which Ceres Power moved to capture with its Weichai partnership, but the long-standing threat of partner dependency was realized with the termination of the Bosch collaboration.

Table: SWOT Analysis for Ceres Power

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strength | Patented Steel Cell® technology with proven high efficiency (>60%) in partner systems. Asset-light licensing model was a core strategic theory. | SOFC technology moves to mass production via Doosan’s 50 MW factory. SOEC efficiency of ~37 k Wh/kg is proven in a 1 MW pilot with Shell. | The theoretical asset-light model was validated by the first partner launching mass production, and SOEC’s efficiency leadership was confirmed in a real-world project. |

| Weakness | Reported significant operating losses (£59.4 M in 2023) and was reliant on lumpy engineering and license fees. A planned China JV with Bosch and Weichai collapsed. | Revenue guidance for 2025 was cut by 38% to £32 M due to weaker engineering services. The partnership with Bosch was officially terminated. | Financial weakness became more pronounced with a sharp revenue decline, and the risk of partner dependency was realized with the official exit of Bosch. |

| Opportunity | Growth in the green hydrogen market and developing a 100 MW modular SOEC system design with Atkins Réalis. | The AI data center boom created an immediate, high-demand market for SOFC systems, targeted via the Weichai and Doosan partnerships. | A massive, urgent, and power-hungry target market (AI data centers) emerged, providing a clear commercial focus for SOFC technology. |

| Threat | High dependency on partners’ execution and strategic alignment. Competition from other fuel cell chemistries like PEM. | The Bosch termination creates a partnership portfolio risk and a potential stock overhang from its minority stake. Competition from PEM electrolyzers cited in Bosch’s strategic shift. | A major partner officially de-committed from the technology, validating the threat of dependency and highlighting direct competition from alternative technologies. |

Ceres Power 2026 Outlook: Execution and New Partnerships are Critical

The strategic priority for Ceres Power entering 2026 is the successful production ramp-up by its manufacturing partners, as this execution is the sole path to converting its licensing model into the high-margin royalty revenues needed to achieve profitability.

Stationary Fuel Cell Market to Dominate Growth

This forecast supports the 2026 outlook by showing strong growth in the overall fuel cell market. The dominance of the ‘Stationary’ application segment is directly relevant to Ceres’ target markets with its partners.

(Source: Grand View Research)

- The primary focus will be on the operational execution at Doosan’s 50 MW facility and the establishment of manufacturing capabilities by Weichai Power and Delta Electronics, as their ability to scale is critical for future royalty streams.

- Securing at least one more major global manufacturing partner is a key catalyst to de-risk the business model from over-reliance on a few players, especially following the termination of the Bosch partnership.

- Investors will watch for a reversal of the projected 38% revenue decline in 2025, with future financial reports scrutinized for signs of stabilizing revenue and a clear path toward profitability.

- Progress in SOEC commercialization, including announcements of larger-scale deployments or new industrial partnerships following the successful Shell pilot, will be significant milestones to monitor.

Frequently Asked Questions

What was Ceres Power’s biggest commercial milestone in 2025?

The most significant milestone was the shift to commercial-scale production. In July 2025, partner Doosan Fuel Cell began the first mass production of systems using Ceres’ Solid Oxide Fuel Cell (SOFC) technology in a new 50 MW capacity factory, marking a major validation of its licensing model.

Why did Ceres Power’s revenue decline in 2025 despite new partnerships?

Ceres downgraded its 2025 revenue guidance by 38% to ~£32 million primarily due to lower-than-expected revenue from engineering services. This reflects the lumpy nature of its business model, which relies on upfront fees before consistent, high-margin royalty revenues from partners’ mass production begin to materialize.

What happened with the Bosch partnership in 2025?

In February 2025, the German conglomerate Bosch terminated its two-year technology partnership with Ceres Power. This was part of a strategic realignment by Bosch to shift its focus away from stationary SOFC technology and concentrate on PEM electrolyzers instead.

What is the status of Ceres Power’s two main technologies, SOFC and SOEC?

In 2025, the SOFC (Solid Oxide Fuel Cell) technology for power generation reached commercial maturity, validated by Doosan’s launch of a mass production facility. The SOEC (Solid Oxide Electrolyzer Cell) technology for green hydrogen production demonstrated industrial potential, with a megawatt-scale pilot with Shell successfully producing its first hydrogen with high efficiency.

Which new market opportunity is Ceres Power targeting and with which partners?

Ceres Power is strategically targeting the high-demand AI data center market for its SOFC power generation systems. The company is pursuing this opportunity through key partners, including Doosan Fuel Cell in South Korea, which has started mass production, and a new manufacturing licensee, Weichai Power, in China.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Wechai Power SOFC Strategy: 2025 Analysis & Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.