Plug Power 2025: Fuel Cell Ecosystem Strategy Faces Execution Test After $1.66 B DOE Loan

Plug Power’s Commercial Projects Show Shift to High-Value Markets 2025

Plug Power is strategically pivoting its fuel cell applications from a singular focus on material handling to high-value, large-scale industrial markets, a move accelerated in 2025 with key agreements in stationary power, e-fuels, and aerospace.

- Between 2021 and 2024, Plug Power’s commercial focus was centered on deploying its Gen Drive fuel cells in the material handling sector, establishing a dominant position with over 69, 000 units at customers like Amazon and Walmart. This period was defined by achieving market penetration and scale in a single, proven application.

- Starting in 2025, the company executed a clear diversification strategy into more complex, higher-margin sectors. This includes a landmark agreement with Allied Biofuels to supply up to 2 GW of electrolyzers for an e-Sustainable Aviation Fuel (e SAF) project, and an LOI to supply hydrogen fuel cells for backup power to a major U.S. data center developer, targeting the energy-intensive AI industry.

- This strategic evolution is further validated by new customer acquisitions in niche, high-tech markets. The contract to supply liquid hydrogen to NASA and a 55 MW electrolyzer deal with Carlton Power in the UK demonstrate that Plug Power is successfully moving beyond its legacy business to become a critical technology provider for the broader energy transition.

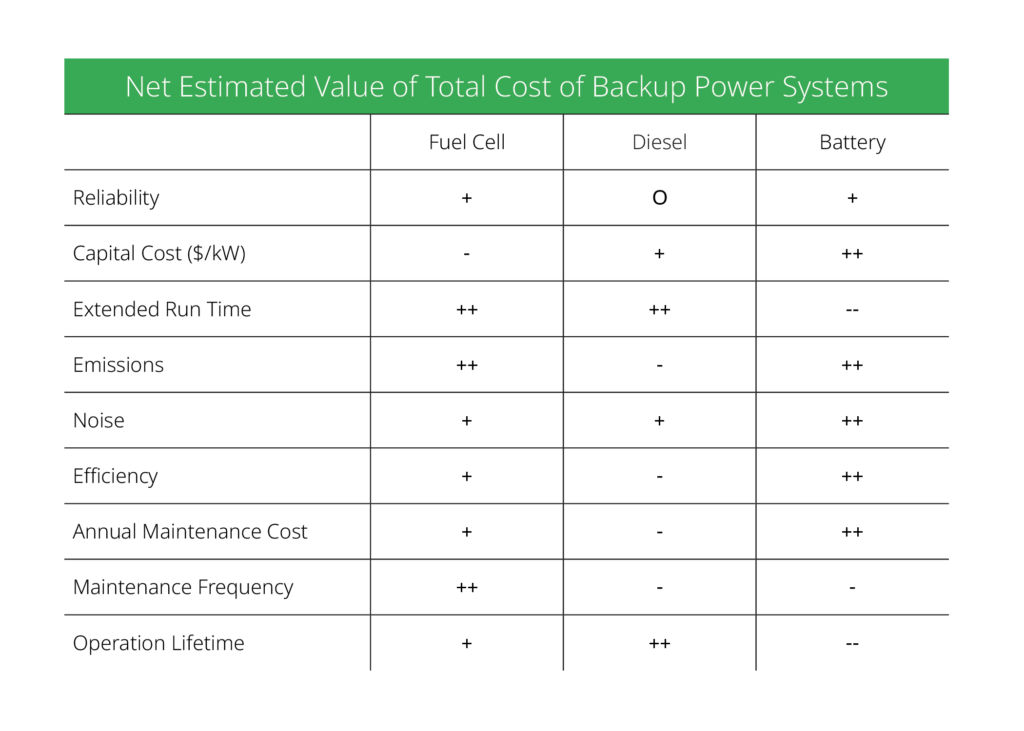

Fuel Cells Show Competitive Edge in Backup Power

This chart shows fuel cells outperforming batteries and diesel on key metrics like emissions and run time for stationary backup power. This supports the section’s point about Plug Power’s strategic pivot into new, high-value markets.

(Source: Plug Power)

Investment Analysis: Plug Power Secures Federal Funding to Execute Domestic Production Strategy

Plug Power’s investment strategy pivoted from raising private capital for global expansion before 2025 to securing U.S. government funding to underwrite a domestic production build-out, shifting the primary financial risk from capital access to project execution.

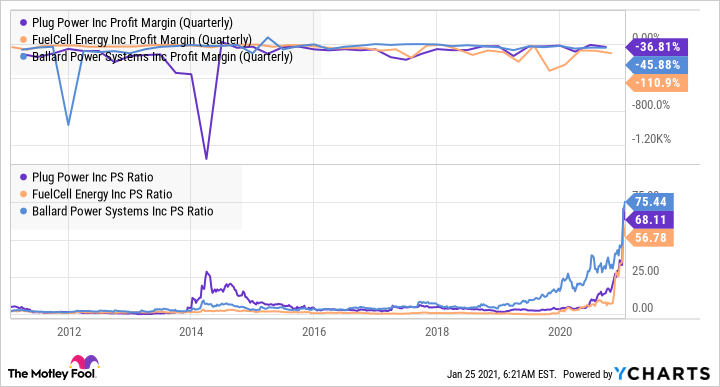

High Valuations Fueled Pre-2025 Investment Strategy

In 2021, high Price-to-Sales ratios existed despite negative profit margins, reflecting the strong investor confidence that enabled Plug’s private capital raises. This illustrates the financial environment before the company’s pivot to federal funding.

(Source: The Motley Fool)

- Before 2025, Plug Power’s major investments were characterized by strategic capital from partners like SK Group’s $1.6 billion infusion for Asian market entry and self-funding of its New York manufacturing hubs, including the $125 million Vista factory. This approach fueled growth but also led to significant cash burn and a “going concern” warning in late 2023.

- In 2025, the company’s financial trajectory was fundamentally altered by the conditional commitment of a $1.66 billion loan guarantee from the U.S. Department of Energy. This capital is earmarked specifically for constructing up to six domestic green hydrogen production plants, anchoring its vertical integration strategy with federal backing.

- Concurrent financing activities in 2025, such as raising $399 million to eliminate its first lien debt, demonstrate a strategic focus on strengthening the balance sheet to support the massive construction and operational phases enabled by the DOE loan.

Table: Plug Power Key Investments and Capital Events (2021-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Department of Energy | January 2025 | Received a conditional commitment for a $1.66 billion loan guarantee to fund the development of up to six green hydrogen production facilities across the U.S. This shifts focus to domestic build-out and de-risks capital-intensive expansion. | DOE Announces $1.66 Billion Loan Guarantee |

| Cash Financing Round | November 2025 | Netted $399 million in cash to eliminate first lien debt and fund its business plan. This move improves balance sheet health and financial stability ahead of major capital projects. | Plug Power Nets $399 Million in Cash |

| SK Group | February 2021 | Closed a $1.6 billion strategic investment from SK Group to form a joint venture (now SK Plug Hyverse) and accelerate entry into Asian markets, including building a gigafactory in South Korea. | Plug Power and SK Group Strategic Partnership |

| Vista Tech Campus | January 2025 | Brought its new $125 million gigafactory online in Slingerlands, NY. The facility is critical for scaling up production of electrolyzers and fuel cells to meet growing demand from new market segments. | Plug Power’s new $125 million Vista Tech Campus factory |

Partnership Analysis: Plug Power’s Alliances Evolve to Build an End-to-End Hydrogen Ecosystem

Plug Power’s partnership strategy has matured from securing anchor customers to building deep, multi-faceted alliances across the value chain, designed to establish and control an integrated green hydrogen ecosystem.

Visualizing Plug Power’s End-to-End Hydrogen Ecosystem

This infographic directly illustrates the vertically integrated hydrogen ecosystem described in the section. It visualizes how the company’s partnerships connect green energy production to end-use applications.

(Source: Plug Power)

- Between 2021 and 2024, partnerships focused on market entry and validation, exemplified by the HYVIA joint venture with Renault Group to penetrate the European LCV market and offtake agreements with Amazon and Walmart to scale the material handling business.

- The strategy in 2025 shifted towards securing the entire value chain. The Allied Biofuels partnership provides a massive, 2 GW demand anchor for electrolyzers in the new e-fuels market, while the collaboration with BASF validates Plug’s downstream liquefaction and purification technology within a major industrial setting.

- Recent R&D partnerships, such as the one with VSPARTICLE to reduce iridium use, demonstrate a focus on solving fundamental cost and material challenges, which is essential for making green hydrogen economically competitive and scaling the entire ecosystem.

Table: Plug Power Strategic Partnerships and Collaborations (2021-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Allied Biofuels | October 2025 | Expanded partnership for a landmark e-Sustainable Aviation Fuel project in Uzbekistan, with Plug set to deploy up to 2 GW of its PEM electrolyzers. This opens a new, large-scale market for its core technology. | News Details |

| Carlton Power | November 2025 | Selected to supply 55 MW of PEM electrolyzers across three green hydrogen projects in the UK. This agreement expands Plug’s footprint in the growing European hydrogen production market. | Plug Power Selected by Carlton Power |

| Amazon | August 2022 | Signed a foundational agreement to supply 10, 950 tons per year of liquid green hydrogen starting in 2025. This deal provided demand certainty to support Plug’s investment in green hydrogen production plants. | Plug and Amazon Sign Green Hydrogen Agreement |

| Renault Group (HYVIA JV) | November 2025 (Ongoing) | The HYVIA joint venture is actively developing a complete ecosystem for fuel cell-powered light commercial vehicles (LCVs) in Europe, including vehicles, hydrogen production, and refueling infrastructure. | HYVIA: Renault Group and Plug Power’s joint venture |

Plug Power’s Geographic Focus: Global Sales Footprint Supports U.S. Production Build-Out

Plug Power leveraged international partnerships to establish a global sales footprint between 2021 and 2024, and in 2025 is using that presence to secure major overseas projects that support and justify its core production expansion centered in the United States.

- From 2021-2024, Plug Power expanded beyond its North American base by forming strategic joint ventures. The SK Plug Hyverse JV was created to penetrate Asian markets, centered on South Korea, while the HYVIA JV with Renault targeted the European light commercial vehicle market from France.

- Activity in 2025 shows this strategy bearing fruit with significant project wins outside the U.S. Key examples include the 2 GW electrolyzer agreement in Uzbekistan with Allied Biofuels and the 55 MW deal in the United Kingdom with Carlton Power, proving its technology is competitive on a global scale.

- Despite these international sales successes, Plug Power’s core investment in production infrastructure remains firmly centered in the United States. The $1.66 billion DOE loan is explicitly for building up to six domestic hydrogen plants, creating a strategy where international orders help fill a manufacturing base located primarily in the U.S.

Technology Maturity of Plug Power: From Niche Application to Multi-Sector Industrial Platform

Plug Power’s PEM fuel cell technology has transitioned from a commercially mature solution in a single niche market to a versatile industrial platform being validated for large-scale, high-power applications, with 2025 marking a key year for both manufacturing scale and critical cost-reduction breakthroughs.

Fuel Cells Prove Cheaper Than Batteries

This cost comparison highlights the significant savings fuel cells offered in the material handling market. This demonstrates the technology’s maturity and commercial success in its initial niche application before its expansion into other industrial sectors.

(Source: Plug Power)

- Between 2021 and 2024, the company’s technology was primarily proven at scale in the material handling market through its Gen Drive systems. While reliable, this application represented a low-power, standardized use case. The development of its electrolyzer business was still in a growth phase.

- In 2025, the technology demonstrated its readiness for more demanding applications. Plug received industry certification for its high-powered stationary systems, a prerequisite for entering the data center market, and successfully integrated its Pro Gen fuel cells into a Class 6 truck for middle-mile logistics.

- Simultaneously, the technology’s economic viability took a major step forward. The Vista gigafactory became operational in January 2025 to enable manufacturing at scale, while a collaboration with VSPARTICLE yielded a breakthrough that improves iridium utilization by a factor of 10, directly addressing a critical material cost in PEM electrolyzers and advancing toward the industry goal of $1/kg green hydrogen.

Plug Power SWOT Analysis: From Financial Uncertainty to Execution-Focused Growth

Plug Power’s strategic position has evolved from a first-mover with significant financial instability to a federally-backed leader in the hydrogen ecosystem, shifting its primary risk from corporate survival to operational execution on an industrial scale.

Revenue Growth Contrasts With Deepening Financial Losses

This chart perfectly illustrates a key tension in the SWOT analysis: strong revenue growth (a strength) versus significant net losses (a weakness). This visualizes the financial uncertainty that characterized the company’s position prior to its recent strategic shifts.

(Source: Yahoo Finance)

- Strengths: Plug Power’s first-mover advantage, validated by over 72, 000 deployed systems and a vertically integrated model, is now amplified by a large order backlog and significant intellectual property.

- Weaknesses: Persistent unprofitability and negative gross margins remain the company’s chief vulnerability, creating continued reliance on external financing to fund operations.

- Opportunities: The company is strategically positioned to capitalize on massive new markets like AI-driven data center power demand and e-fuel production, with government support like the IRA and the DOE loan providing powerful tailwinds.

- Threats: The primary threat is now execution risk; failure to build its hydrogen plants on time and on budget, or to translate revenue into profit, could undermine its progress despite secured funding.

Table: SWOT Analysis for Plug Power

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | First-mover with a large installed base in material handling (>69, 000 systems); strategic partnerships with Amazon, Walmart. | End-to-end ecosystem provider with major electrolyzer orders (2 GW with Allied Biofuels), operational gigafactories, and downstream technology (liquefaction). | The company’s strength evolved from being a leading fuel cell supplier to becoming an integrated hydrogen ecosystem architect, validated by large-scale, multi-technology deals. |

| Weaknesses | Severe cash burn, deeply negative gross margins, and a “going concern” warning issued in late 2023, signaling existential financial risk. | Continued unprofitability (TTM Gross Margin -70.7%, EPS -$2.05) and reliance on capital markets, evidenced by the need for a shareholder vote to increase authorized shares. | While still unprofitable, the immediate financial risk was mitigated by the $1.66 B DOE loan and $399 M financing, shifting the weakness from “survival” to “path to profitability.” |

| Opportunities | Broad market trends such as decarbonization goals and the passage of the Inflation Reduction Act (IRA), creating a favorable policy environment. | Targeted, high-growth markets including AI data center power demand (LOI signed), e-fuels (Allied Biofuels deal), and the space industry (NASA contract). | The company moved from benefiting from general macro trends to actively securing contracts and LOIs in specific, tangible, high-value markets that have emerged as primary drivers for hydrogen. |

| Threats | Competition from other fuel cell companies and alternative clean technologies; risk of running out of cash to fund its ambitious expansion. | High execution risk on delivering its plant build-out; potential for significant shareholder dilution to fund future growth; dependence on favorable hydrogen tax credit rules. | The primary threat shifted from financing risk to execution risk. The question is no longer “if” they can fund their plan, but “if” they can execute it profitably and on schedule. |

Forward-Looking Insights: Plug Power’s Future Hinges on Profitable Production

The single most critical factor for Plug Power’s success over the next 12-24 months is its ability to execute the construction of its domestic green hydrogen plants and achieve positive gross margins, as its strategy is now fully dependent on converting government-backed capital into a profitable industrial operation.

- The finalization and deployment of the $1.66 billion DOE loan is the immediate catalyst. The market will be watching for progress on the six planned facilities, as this build-out is the foundation of Plug’s vertical integration strategy and its path to controlling hydrogen supply costs.

- Success in penetrating the data center market is a crucial test of its diversification strategy. Converting the existing Letter of Intent with a major developer into a definitive, large-scale agreement would validate its pivot to high-margin stationary power applications.

- All financial metrics will be scrutinized for signs of improvement, particularly gross margin. The “Project Quantum Leap” initiative must deliver tangible cost reductions and efficiency gains to move the margin from its deeply negative level of -70.7% toward positive territory, which is essential for long-term sustainability.

- The upcoming shareholder vote on January 29, 2026, to potentially double authorized shares is a key event. Its outcome will determine the company’s financial flexibility to fund growth beyond the current scope of the DOE loan, but it also highlights the continued risk of shareholder dilution.

Frequently Asked Questions

What is the main change in Plug Power’s strategy in 2025?

In 2025, Plug Power strategically shifted its focus from its dominant position in the material handling market to higher-value, large-scale industrial sectors. Key new areas include stationary power for AI data centers, e-fuels (e-SAF) with partners like Allied Biofuels, and aerospace applications with customers like NASA.

How significant is the $1.66 billion Department of Energy (DOE) loan for Plug Power?

The $1.66 billion DOE loan guarantee is a fundamental game-changer. It shifts the company’s primary financial risk from accessing capital (which had previously led to a “going concern” warning) to project execution. The loan specifically funds the construction of up to six domestic green hydrogen plants, anchoring its vertical integration strategy with federal backing.

Despite the positive developments, what is Plug Power’s biggest challenge moving forward?

Plug Power’s biggest challenges are execution risk and its persistent unprofitability. The company must successfully build its hydrogen plants on time and on budget while also improving its deeply negative gross margins (noted as -70.7% TTM). Converting its large-scale projects and government funding into a profitable operation is the critical test.

What new markets is Plug Power targeting with its technology?

Plug Power is targeting several new high-growth markets. These include providing backup power for the energy-intensive AI data center industry, supplying up to 2 GW of electrolyzers for e-Sustainable Aviation Fuel (e-SAF) production, and providing liquid hydrogen for the space industry through a contract with NASA.

How has Plug Power’s partnership strategy evolved?

Before 2025, partnerships like the HYVIA joint venture with Renault focused on market entry and validation. In 2025, the strategy matured to build an end-to-end hydrogen ecosystem. New alliances, such as the 2 GW deal with Allied Biofuels, aim to secure the entire value chain by creating massive demand for its electrolyzers and validating its downstream technologies.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.