Plug Power 2025: Strategic Pivot to Gigawatt-Scale Hydrogen Projects Confronts Financial Reality

Plug Power’s Commercial Scale Projects Target New Industries in 2025

In 2025, Plug Power executed a significant strategic shift from its core material handling market to large-scale industrial hydrogen applications, including sustainable aviation fuel, data center power, and international energy projects.

- The period from 2021 to 2024 was defined by scaling deployments in logistics with anchor customers like Amazon and Walmart, which validated the use case for fuel cell forklifts in high-throughput distribution centers.

- In contrast, 2025 marked an expansion into heavy industry with a landmark agreement to supply up to 2 GW of electrolyzers for a sustainable aviation fuel (e SAF) project in Uzbekistan with Allied Green.

- The company also made a critical entry into the data center market through a collaboration with a major U.S. developer to provide hydrogen-powered fuel cells for backup power, aiming to monetize over $275 million in electricity rights.

- This diversification from single-site forklift deployments to multi-gigawatt international projects and critical infrastructure demonstrates a strategic response to growing demand for clean energy in energy-intensive industries.

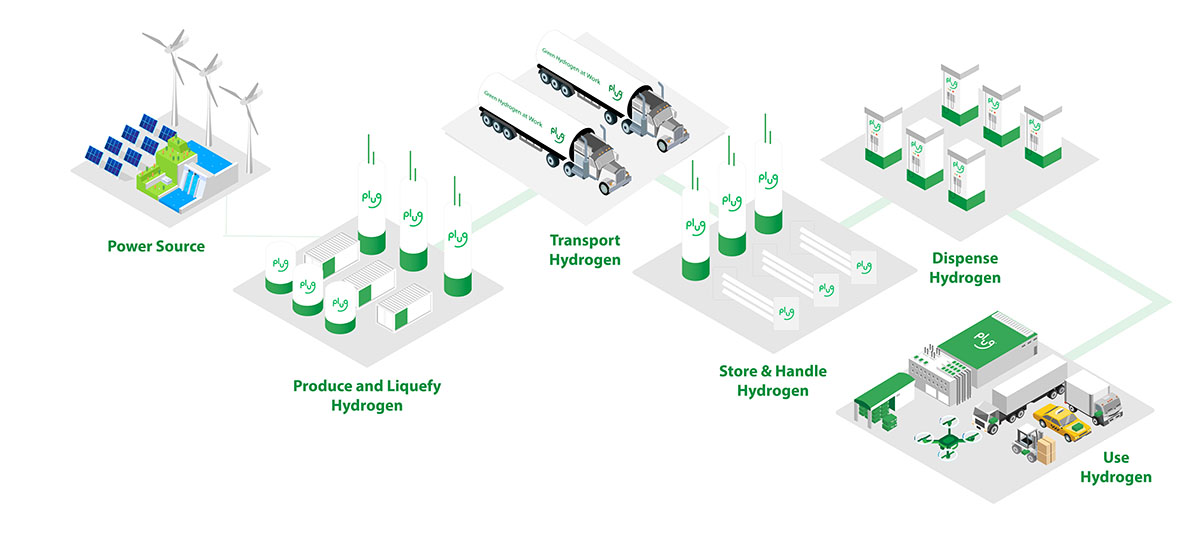

Plug Power’s End-to-End Hydrogen Ecosystem

This infographic illustrates the entire green hydrogen value chain, from production to various end-use applications. It visually supports the section’s focus on expanding into new industries beyond its core material handling market.

(Source: Plug Power)

Plug Power’s Investment Analysis: Government Loans and External Capital Fuel 2025 Operations

Plug Power’s operational expansion in 2025 was entirely enabled by securing billions in external capital and government support to address a precarious financial position and fund its growth.

Plug Power’s Losses Mount Despite Revenue Growth

The chart shows revenue growing while net losses deepened to over $2 billion in 2025. This visualizes the ‘precarious financial position’ that necessitated the government loans and external capital described in the text.

(Source: Finviz)

- The most significant financial event was the closing of a $1.66 billion loan guarantee from the U.S. Department of Energy (DOE), providing the foundational capital to construct up to six green hydrogen production facilities.

- To manage near-term liquidity challenges, the company secured a $525 million credit facility and a $1 billion standby equity agreement with Yorkville Advisors, highlighting its ongoing reliance on dilutive financing.

- Despite these infusions, financial performance remained weak, with Q 3 2025 revenue of $177 million missing targets and perpetuating operating losses, which are addressed by the cost-cutting initiative Project Quantum Leap.

- As a strategic move to raise cash, Plug Power sold its 49% stake in its South Korean joint venture, SK Plug Hyverse, in early 2026, exiting a partnership that was a cornerstone of its earlier Asian expansion strategy.

Table: Plug Power Key Investments and Financing (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| SK Plug Hyverse Stake Sale | Jan 12, 2026 | Sold its 49% stake in the South Korean joint venture to partner SK E&S. This strategic exit was aimed at improving immediate liquidity amid ongoing financial pressures. | Plug Power sells its 49% stake… |

| Financing Round | Nov 21, 2025 | Netted $399 million in cash. The capital was used to eliminate the company’s first lien debt and provide funding for its current business plan. | Plug Power Nets $399 Million in Cash… |

| Yorkville Advisors Credit Facility | May 6, 2025 | Closed a $525 million secured credit facility, with an initial tranche of $210 million drawn to enhance the company’s liquidity position. | Plug Power Closes $525 Million Secured Credit Facility… |

| Public Offering | Mar 19, 2025 | Secured approximately $280 million in gross proceeds from an upsized public offering to strengthen its financial position. | Plug Power Secures $280 M Offering… |

| Yorkville Advisors Equity Agreement | Feb 10, 2025 | Formalized a standby equity purchase agreement, giving Plug Power the option to sell up to $1 billion in shares to provide financial flexibility. | Plug Power Secures $1 Billion Equity Agreement |

| Department of Energy (DOE) Loan | Jan 17, 2025 | Closed a $1.66 billion loan guarantee from the DOE’s Loan Programs Office to finance the construction of up to six green hydrogen production facilities in the U.S. | DOE Announces $1.66 Billion Loan Guarantee… |

Plug Power’s 2025 Partnership Strategy Targets Global High-Growth Markets

Plug Power’s partnership strategy in 2025 pivoted from solidifying its logistics base to securing beachheads in new, high-growth global markets for its electrolyzer and stationary power technology.

Fuel Cells Outperform Diesel for Backup Power

This chart compares fuel cells to traditional backup power systems, highlighting their operational advantages. It explains the technological rationale behind Plug Power’s strategic partnership to enter the data center market, a key theme of the section.

(Source: Plug Power)

- The partnership with Allied Green for a 2 GW electrolyzer deployment in Uzbekistan for a $5.5 billion project represents a shift toward large-scale international energy infrastructure development.

- A collaboration with an unnamed U.S. data center developer marks a strategic entry into the critical backup power market, targeting a non-discretionary demand for resilient, zero-emission energy.

- The agreement with Carlton Power to supply 55 MW of electrolyzers across three UK projects establishes Plug Power’s role in developing regional green hydrogen hubs in Europe.

- The company continued to secure its technology supply chain through a cooperation agreement with BASF to integrate advanced purification solutions into its PEM electrolyzers, aiming to improve performance and durability.

Table: Plug Power Strategic Partnerships and Alliances (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Hy 2 gen | Dec 4, 2025 | Signed a Letter of Intent to supply a 5 MW PEM electrolyzer for the Sunrhyse project in France, supporting the country’s hydrogen roadmap. | Plug Power Signs Letter of Intent with Hy 2 gen… |

| U.S. Data Center Developer | Nov 10, 2025 | Announced a collaboration to explore using hydrogen fuel cells for backup power, a key pivot into the data center market with a plan to monetize over $275 million. | Plug Power to unlock $275 million… |

| Edgewood Renewables | Oct 23, 2025 | Partnered to construct a renewable fuels facility in Nevada, integrating renewable feedstocks with advanced process design. | Plug Power Partners with Edgewood Renewables… |

| Allied Green Ammonia | Jun 9, 2025 | Expanded a collaboration with a new 2 GW electrolyzer agreement for a $5.5 billion sustainable fuels project in Uzbekistan. | Plug Power And Allied Green Expand Strategic … |

| BASF | May 7, 2025 | Signed a cooperation agreement to deploy BASF’s advanced purification solutions in Plug Power’s PEM electrolyzers to enhance efficiency and durability. | BASF partners with Plug Power… |

Plug Power’s Geographic Footprint Expands Beyond North America in 2025

In 2025, Plug Power dramatically expanded its geographic focus from a predominantly North American base to securing foundational projects in Europe and Central Asia.

- From 2021-2024, Plug Power’s commercial activity was heavily concentrated in the United States, centered on material handling deployments for customers like Walmart and Amazon and the development of its domestic hydrogen production network.

- The year 2025 saw a major international push, headlined by the 2 GW electrolyzer deal with Allied Green for a project in Uzbekistan, marking a significant entry into the Central Asian market.

- In Europe, Plug Power solidified its presence by announcing plans for three green hydrogen plants in Finland and securing a 55 MW electrolyzer deal with Carlton Power for multiple projects across the United Kingdom.

- This expansion reflects a strategy to capitalize on global demand for green hydrogen, driven by distinct regional energy security and decarbonization goals.

Plug Power’s Technology Maturity: Shifting from Deployment to Cost-Effective Scaling

Plug Power’s technology demonstrated commercial maturity in established applications while facing the test of cost-effective scaling for new, large-scale industrial markets in 2025.

Fuel Cells Maintain Performance as Batteries Degrade

This chart demonstrates the consistent performance of fuel cells compared to the degrading performance of batteries. This directly validates the section’s point about the proven reliability of Plug’s technology in demanding material handling applications.

(Source: Plug Power)

- Between 2021 and 2024, the company proved the reliability of its Gen Drive PEM fuel cells, deploying over 69, 000 systems in the demanding, high-uptime environment of material handling.

- The focus in 2025 shifted to its Gen Eco PEM electrolyzer technology, which became the cornerstone of multi-gigawatt agreements and was validated by record production at its Georgia liquid hydrogen plant.

- A critical technological milestone was achieved with VSPARTICLE, demonstrating a 10 x reduction in the use of expensive iridium catalyst, a key step toward achieving the industry goal of $1/kg green hydrogen.

- The launch of Project Quantum Leap, an internal initiative to reduce costs and optimize operations, underscores that while the technology is functional, achieving profitability at scale remains the primary challenge.

SWOT Analysis: Plug Power Navigates Growth and Financial Headwinds in 2025

In 2025, Plug Power leveraged its core strengths in technology and government support to seize new market opportunities, but its strategic expansion was continuously checked by persistent financial weaknesses and execution risks.

Plug Power Stock Soars Past Competitor in 2025

This chart shows Plug Power’s stock significantly outperforming a key competitor during 2025. This reflects strong market optimism about the growth opportunities mentioned in the SWOT analysis, despite the financial headwinds also noted.

(Source: Yahoo Finance)

- Strengths were validated by major government backing and a vertically integrated model that secured large-scale contracts.

- Weaknesses in financial performance necessitated significant external capital infusions and strategic pivots like asset sales.

- Opportunities in new markets like data centers and e SAF became tangible through new partnerships.

- Threats related to execution risk and regulatory dependence became more pronounced as project scale increased.

Table: SWOT Analysis for Plug Power (2021-2025)

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Vertically integrated hydrogen ecosystem strategy; PEM technology leadership; anchor customers like Amazon and Walmart. | Secured $1.66 B DOE loan; deployed over 72, 000 fuel cell systems; established international project pipeline (2 GW Allied Green deal). | The strength of its government relationships was validated by the massive DOE loan. Its technology leadership was confirmed by large-scale electrolyzer orders. |

| Weaknesses | Persistent unprofitability and negative cash flow; “going concern” warning in 2023; reliance on dilutive financing. | Continued operating losses ($177 M Q 3 revenue miss); high cash burn requiring a $525 M credit facility; sale of SK Plug Hyverse stake to raise cash. | The core weakness of unprofitability was not resolved but was managed through significant new debt and equity arrangements. The “going concern” risk was temporarily mitigated by these capital infusions. |

| Opportunities | Inflation Reduction Act (45 V tax credits); expansion into new markets (mobility, stationary power); growth of the global hydrogen economy. | Strategic pivot to data center power ($275 M monetization target); entry into e SAF market; expansion into European hydrogen hubs (Finland, UK). | The opportunity to enter new markets was validated through concrete partnerships with a data center developer and Allied Green for e SAF. |

| Threats | Competition from other fuel cell and battery technologies; execution risk on large projects; sensitivity to changes in government policy. | Execution of $700 M revenue target for 2025 is uncertain; business model remains highly dependent on 45 V tax credits; financial precarity despite new funding. | The threat of execution risk became more acute as project sizes grew from forklift fleets to multi-gigawatt electrolyzer plants. Dependency on government policy was unchanged. |

Forward-Looking Insights: Execution and Profitability Define Plug Power’s Path Forward

Plug Power’s survival and future valuation are contingent on its ability to convert its substantial project pipeline into profitable revenue before its recently secured capital is depleted.

- The most critical metric to watch is the company’s progress toward its $700 million revenue target for 2025 and any improvements in gross margin reported in upcoming quarters as a result of Project Quantum Leap.

- Successful execution on the DOE-funded hydrogen plants is paramount; delays or cost overruns would signal an inability to manage large-scale projects and would damage investor confidence.

- The penetration of the data center market will be a key validation point for the company’s diversification strategy and its ability to open new, substantial revenue streams.

- All financial projections remain highly sensitive to the final rules and long-term stability of the U.S. 45 V Production Tax Credit, making regulatory monitoring essential.

Frequently Asked Questions

What was Plug Power’s main strategic change in 2025?

In 2025, Plug Power executed a major strategic shift from its core business of supplying fuel cell forklifts to the material handling market toward large-scale industrial hydrogen applications. This new focus includes projects in sustainable aviation fuel (e-SAF), backup power for data centers, and multi-gigawatt international energy projects.

How did Plug Power fund its expansion in 2025 despite its financial struggles?

Plug Power’s 2025 expansion was enabled entirely by securing external capital. Key funding events included closing a $1.66 billion loan guarantee from the U.S. Department of Energy (DOE), a $525 million credit facility, and a $1 billion standby equity agreement with Yorkville Advisors to manage liquidity and fund its growth.

What are the most significant new markets Plug Power entered in 2025?

The two most significant new markets were sustainable aviation fuel (e-SAF) and data center backup power. The company secured a landmark agreement for a 2 GW electrolyzer project for e-SAF in Uzbekistan and announced a collaboration with a U.S. data center developer to use its hydrogen fuel cells for backup power.

Did Plug Power resolve its financial problems in 2025?

No, the company did not resolve its underlying financial issues. Despite raising billions in capital, financial performance remained weak, with missed revenue targets and ongoing operating losses in Q3 2025. The capital infusions were used to manage near-term liquidity challenges and fund operations, rather than signifying a return to profitability.

Why did Plug Power sell its stake in the SK Plug Hyverse joint venture?

Plug Power sold its 49% stake in its South Korean joint venture in early 2026 as a strategic move to raise cash. The article states the exit was aimed at ‘improving immediate liquidity amid ongoing financial pressures,’ highlighting the company’s need for capital.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.