Offshore Wind: Top 10 Companies in China in 2025

Beyond the Horizon: The Unstoppable Rise of China’s Ultra-Large Offshore Wind Turbines

Imagine a single spinning blade longer than a football field, sweeping through the sky miles from shore. Now imagine three of them, mounted on a tower that rivals the Eiffel Tower in height, generating enough clean electricity to power a small town. This isn’t a scene from a futuristic film; it’s the reality being built today off the coast of China. Fueled by ambitious national policy and fierce corporate competition, Chinese firms are locked in a technological “arms race” to create ever-larger, more powerful offshore wind turbines. This relentless escalation is not just redefining the limits of engineering; it’s positioning China to dominate the next chapter of the global energy transition, one colossal turbine at a time.

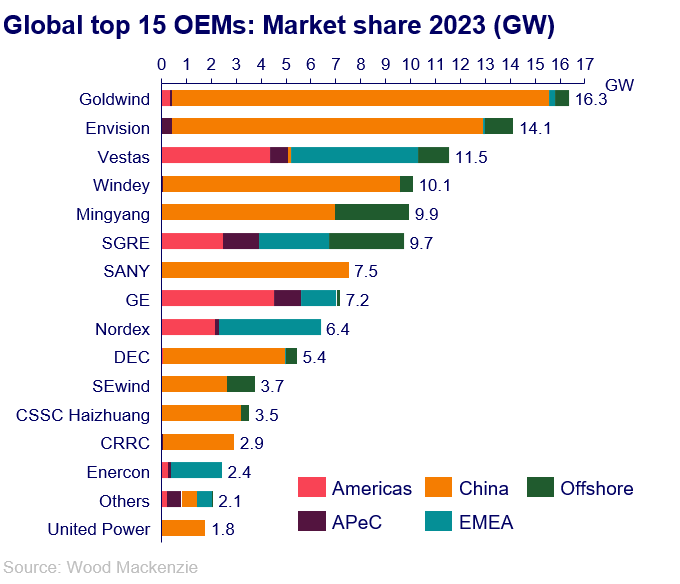

Chinese OEMs Dominate 2023 Wind Market

This chart establishes the article’s core premise by showing the market dominance of Chinese manufacturers like Goldwind and DEC, directly aligning with the introduction’s theme of ‘fierce corporate competition’.

(Source: Wood Mackenzie)

Installations: Milestones in the Race for Giga-Scale Wind

The past year has been marked by a series of groundbreaking achievements that showcase the staggering pace of innovation in China’s offshore wind sector. These installations and announcements represent not just individual projects but crucial milestones in the development of ultra-large offshore wind turbines, pushing the industry into a new era of scale and efficiency.

1. Dongfang Electric Corporation (DEC) Installs World-Leading 26 MW Prototype

Company: Dongfang Electric Corporation (DEC)

Installation Capacity: 26 MW (single-unit prototype)

Applications: Next-generation offshore wind power generation

Source: Offshore Wind Turbines in 2025: China Continues Leading …

2. Goldwind Advances with 20 MW Offshore Turbine Installation

Company: Goldwind Science & Technology Co.

Installation Capacity: 20 MW

Applications: Ultra-large offshore turbine technology demonstration in Fujian province

Source: Goldwind installs 20 MW offshore wind turbine

3. Mingyang Smart Energy Unveils Plans for a 50 MW Floating Turbine

Company: Mingyang Smart Energy Group

Installation Capacity: 50 MW (planned design)

Applications: Pioneering twin-head floating offshore wind technology

Source: China’s Ming Yang planning massive 50-MW floating offshore …

4. SANY Heavy Industry Secures Breakthrough Order for 13.6 MW Turbines

Company: SANY Heavy Industry

Installation Capacity: Multiple 13.6 MW units

Applications: Commercial entry into the offshore wind generation market

Source: China’s Sany enters offshore wind arena with ‘ …

5. China Huaneng Group Unveils Powerful Direct-Drive Floating Turbine

Company: China Huaneng Group

Installation Capacity: Not specified (described as “world’s most powerful” at the time)

Applications: Advancing direct-drive technology for floating offshore wind

Source: Chinese firm unveils offshore wind turbine with world’s …

6. CNOOC Advances Deep-Water Floating Wind Demonstration

Company: China National Offshore Oil Corporation (CNOOC)

Installation Capacity: 150 MW (demonstration project)

Applications: Proving deep-water floating wind technology at scale

Source: Offshore Wind: Top 10 Projects and Companies in China …

7. China Three Gorges Corporation Completes Giga-Scale Wind Farms

Company: China Three Gorges Corporation (CTG)

Installation Capacity: Not specified (multi-farm project)

Applications: Operating giga-scale offshore wind farms (Jiangsu Yancheng, Fenghai Dafeng)

Source: Eastern International completes RMB 49 M wind projects

8. Eastern International Enables Ultra-Long Blade Installation

Company: Eastern International Ltd.

Installation Capacity: Not applicable (logistics)

Applications: Specialized transportation and installation of 110-meter turbine blades

Source: Eastern International Ltd. Completed Two Major Offshore …

Table: Recent Milestones in China’s Ultra-Large Offshore Wind Turbine Development

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Dongfang Electric Corporation (DEC) | 26 MW (prototype) | Next-generation offshore wind power generation | Source |

| Goldwind Science & Technology Co. | 20 MW | Ultra-large offshore turbine technology demonstration | Source |

| Mingyang Smart Energy Group | 50 MW (planned) | Pioneering twin-head floating offshore wind technology | Source |

| SANY Heavy Industry | 13.6 MW (multiple units) | Commercial entry into offshore wind generation | Source |

| China Huaneng Group | Not specified (leading capacity) | Advancing direct-drive floating offshore wind | Source |

| CNOOC | 150 MW (demo project) | Proving deep-water floating wind technology | Source |

| China Three Gorges Corporation (CTG) | Multi-farm project | Operating giga-scale offshore wind farms | Source |

| Eastern International Ltd. | Not applicable | Transportation and installation of 110-meter blades | Source |

From Blueprints to Blue Horizons: The Expanding Application Ecosystem

The diversity of these projects signals that industry adoption is moving beyond simply building larger turbines for standard, fixed-bottom wind farms. A crucial pattern is the strategic push into deep-water floating wind. Projects by CNOOC (a 150 MW demonstration) and technology unveilings from China Huaneng Group and Mingyang (with its ambitious 50 MW twin-head design) show a concerted effort to unlock wind resources in deeper waters, where fixed foundations are not feasible. This represents a significant expansion of the addressable market. Furthermore, the role of specialized firms like Eastern International Ltd., which handles the complex logistics of transporting 110-meter blades, highlights the maturation of a supportive ecosystem. The adoption of giga-turbines is therefore not a monolithic trend; it’s creating a vertically integrated supply chain, from turbine design to specialized maritime logistics, all scaling in tandem.

The East Is Green: How China Forged a Global Offshore Wind Nexus

The geographic concentration of these advancements is impossible to ignore: they are all happening in China. This is not a coincidence but the direct result of a powerful, state-driven industrial strategy. The Chinese government, through policies like the Beijing Declaration 2.0, provides a massive and predictable domestic market by mandating huge annual installations (at least 15 GW of offshore wind annually). This guaranteed demand de-risks investment and allows state-owned developers like China Three Gorges Corporation and China Huaneng Group to finance and build giga-scale projects. These developers, in turn, provide a captive market for turbine OEMs like Goldwind, Mingyang, and DEC, fueling their R&D and manufacturing scale-up. This closed-loop system creates an unparalleled competitive advantage. Now, this nexus is preparing to go global. Mingyang’s announcement of a potential $2 billion factory in Scotland is a clear signal that the strategy is shifting from domestic consolidation to aggressive international expansion, leveraging the scale and technology perfected at home.

State-Owned Giants Dominate China’s Wind Development

This chart directly visualizes the section’s core argument about a ‘state-driven industrial strategy’ by showing the market share concentration of state-owned developers like China Huaneng and Three Gorges.

(Source: ResearchGate)

The Race to the Top: Escalation from Prototype to Powerhouse

These installations reveal a technology in a state of hyper-acceleration. The market is not just mature; it’s in an active “arms race.” We can see a clear progression. First, you have the commercial-scale turbines like SANY’s 13.6 MW model securing its first major orders, representing the current market-ready technology. Simultaneously, companies are pushing the immediate boundary with record-breaking prototypes, such as DEC’s successful installation of a 26 MW turbine and Goldwind’s 20 MW machine. Finally, you have forward-looking R&D setting the stage for the next leap, exemplified by Mingyang’s conceptual plan for a staggering 50 MW floating turbine. This three-tiered progression—commercial deployment, prototype testing, and conceptual design—is happening concurrently and at a blistering pace. It shows that the technology is mature enough for mass deployment while still having enormous headroom for innovation, driven by intense domestic competition to be the first to the next milestone.

Offshore Turbine Ratings Trend Towards 18 MW

This chart perfectly illustrates the ‘hyper-acceleration’ and ‘arms race’ described in the text by showing a clear upward trend in the size (MW rating) of announced turbines over time.

(Source: Windletter – Substack)

Winds of Change: Charting the Future of Global Energy

The message from these milestones is unequivocal: ultra-large offshore wind turbines, engineered and scaled in China, are set to become a defining force in the global energy landscape. The future is not just about incremental increases in turbine size; it’s about the export of China’s entire vertically integrated model—combining state-backed project development, cost-competitive manufacturing, and cutting-edge technology. The relentless push from 13.6 MW commercial units to 26 MW prototypes and 50 MW concepts within a single year signals an industry compressing a decade of Western R&D cycles into a few years. As companies like Goldwind and Mingyang look to deploy over 200 GW internationally by 2034, Western manufacturers will face unprecedented competition not just on price, but on technological prowess and speed. The giga-turbines rising in the East are casting a long shadow, heralding a fundamental shift in the world’s clean energy supply chain.

Frequently Asked Questions

How large are the offshore wind turbines China is developing?

Chinese firms are developing turbines of unprecedented scale. The article highlights several milestones: SANY is deploying 13.6 MW commercial units, Goldwind has installed a 20 MW turbine, and Dongfang Electric Corporation (DEC) has a world-leading 26 MW prototype. Looking even further ahead, Mingyang Smart Energy has unveiled conceptual plans for a massive 50 MW floating turbine.

Why is China leading the world in this technology?

China’s dominance results from a state-driven industrial strategy. The government guarantees a massive domestic market by mandating large-scale annual installations (at least 15 GW). This allows state-owned developers to finance huge projects, creating a captive market for turbine manufacturers like Goldwind, Mingyang, and DEC, which fuels intense domestic competition and rapid innovation in a closed-loop system.

Which Chinese companies are the key players in this field?

The article identifies several key players. Turbine manufacturers like Dongfang Electric (DEC), Goldwind, Mingyang, and SANY are building the turbines. State-owned developers and operators like China Three Gorges Corporation, China Huaneng Group, and CNOOC are financing and building the giga-scale wind farms. There are also specialized logistics firms like Eastern International, which handle the complex transportation of components like 110-meter blades.

Are these giant turbines only for use in China?

No. While the technology was developed for China’s huge domestic demand, the article states the strategy is shifting towards aggressive international expansion. It mentions that companies like Goldwind and Mingyang aim to deploy over 200 GW internationally by 2034 and that Mingyang is considering a major factory in Scotland, signaling a move to compete globally on both price and technology.

What is the significance of the ‘floating wind’ projects mentioned?

Floating wind technology is crucial for unlocking wind resources in deeper waters where traditional fixed-bottom foundations are not feasible. Projects by CNOOC, China Huaneng, and Mingyang’s planned 50 MW floating design show a strategic push to expand the addressable market for offshore wind significantly, allowing for energy generation much farther from shore.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.