Offshore Wind: Top 10 Companies in Europe in 2025

Europe’s Offshore Wind Energy: Forging a Green Superpower on the Seas

Introduction: A Continent’s Colossal Bet on the Wind

Imagine a continent re-engineering its entire energy system, not in sprawling land-based factories, but on the vast, tempestuous expanse of its surrounding seas. This is not science fiction; it is the reality of Europe’s offshore wind sector in 2025. Driven by an urgent need for decarbonization and energy independence, Europe is embarking on an industrial transformation of unprecedented scale. The goal is staggering: to install an average of 23 GW of new wind capacity every year until 2030. This ambition has turned the continent’s waters into a hotbed of innovation, multi-billion-euro investments, and strategic alliances, creating a new generation of energy giants and redefining what is possible in the quest for a sustainable future. It’s a story of colossal turbines, deep-water engineering, and the financial and political will to build a green-powered supergrid from the waves up.

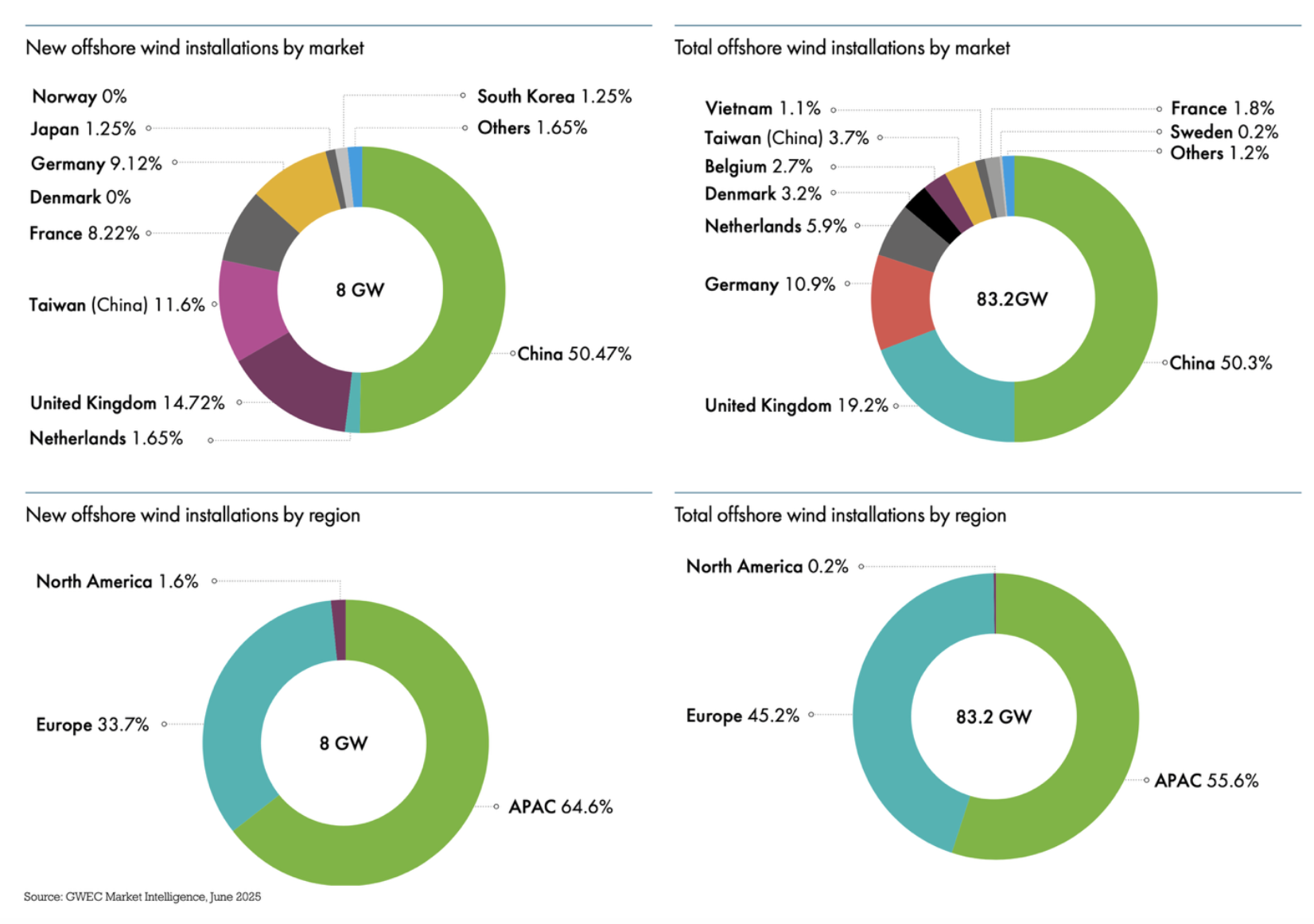

Europe Commands 45% of Global Offshore Wind

This chart illustrates Europe’s dominant 45.2% share of global offshore wind capacity. This data directly supports the article’s opening theme of Europe as a ‘green superpower’ on the seas, led by the UK and Germany.

(Source: GWEC)

Installations: The Building Blocks of a Green Energy Revolution

The acceleration of Europe’s offshore wind market is best understood through the sheer scale and ambition of the projects being developed. From the established hubs of the North Sea to emerging frontiers in the Baltic, a wave of new capacity is coming online, backed by a mix of energy majors, specialist developers, and financial powerhouses.

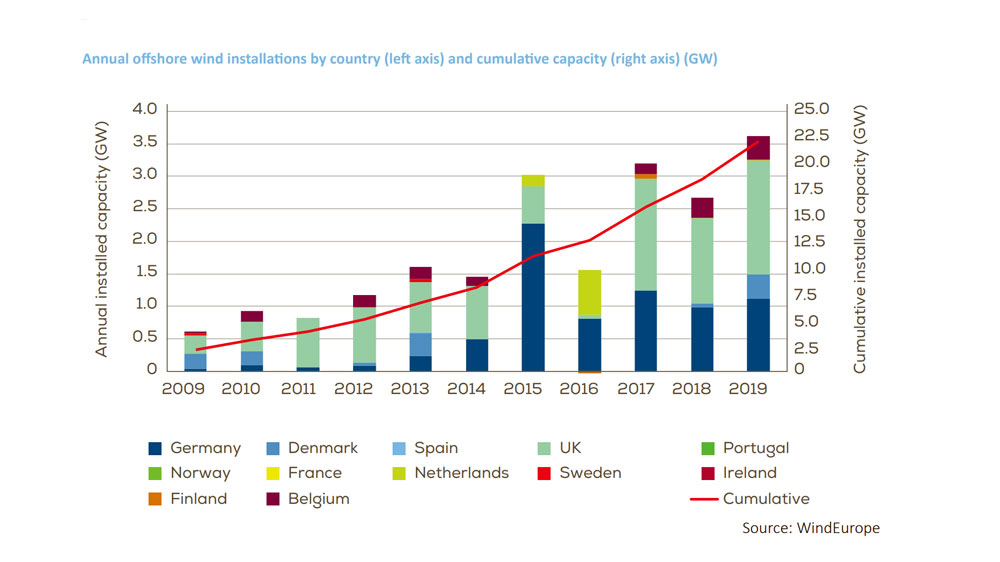

Europe’s Decade of Offshore Wind Growth

This chart’s depiction of cumulative capacity growth to over 22 GW by 2019 provides essential historical context. It visually represents the ‘building blocks’ of the energy revolution mentioned in the section.

(Source: Energy Industry Review)

1. UK’s Landmark Allocation Round 7 (AR 7)

Company: UK Government

Installation Capacity: 8.4 GW

Applications: Securing new offshore wind capacity through Contracts for Difference (Cf Ds) to power the national grid.

Source: Record breaking auction for offshore wind secured to take back control of Britains energy

2. RWE’s UK Expansion and KKR Partnership

Company: RWE, KKR

Installation Capacity: 6.9 GW (including Norfolk Vanguard and Dogger Bank South)

Applications: Development and construction of a major portfolio of UK offshore wind farms, financed through a $15 billion joint venture.

Source: KKR, RWE form $15 B UK offshore wind JV

3. Iberdrola and Masdar’s East Anglia THREE Project

Company: Iberdrola, Masdar

Installation Capacity: 1.4 GW

Applications: Co-investment in and development of the East Anglia THREE offshore wind farm in the UK, part of a €5.2 billion deal.

Source: Masdar and Iberdrola Strike €5.2 B Deal for UK’s Largest Offshore Wind Project

4. Ørsted’s Borkum Riffgrund 3 Farm

Company: Ørsted A/S

Installation Capacity: Not specified, but will be Germany’s largest upon completion.

Applications: Utility-scale power generation for the German grid; part of Ørsted’s portfolio, which exceeds 18 GW globally.

Source: Borkum Riffgrund 3, Ørsted’s largest offshore wind farm in …

5. Vattenfall’s Nordlicht Wind Cluster

Company: Vattenfall

Installation Capacity: 1.6 GW

Applications: Development of Germany’s largest offshore wind cluster in the North Sea, with construction planned for 2026.

Source: Vattenfall firms FID on Germany’s largest offshore wind …

6. SSE’s Dogger Bank Wind Farm

Company: SSE Renewables, Equinor, Vårgrønn

Installation Capacity: 3.6 GW (in three 1.2 GW phases)

Applications: Construction of the world’s largest offshore wind farm to provide large-scale renewable power to the UK.

Source: Dogger Bank Wind Farm: The World’s Largest Offshore Wind …

7. Iberdrola’s German Baltic Sea Projects

Company: Iberdrola

Installation Capacity: 776 MW total (Baltic Eagle at 476 MW and Windanker at 300 MW)

Applications: Expanding offshore wind capacity in the German Baltic Sea to supply clean energy.

Source: Windanker, our third offshore wind farm in the Baltic Sea

8. ORLEN’s Baltic Power Project

Company: ORLEN Group, Northland Power

Installation Capacity: Not specified, but utilizing Europe’s largest 15 MW turbines.

Applications: Establishing Poland’s first major offshore wind farm and positioning the country as a key player in the Baltic Sea market.

Source: ORLEN commences installation of Europe’s largest …

9. Equinor’s Polish Baltic Sea Development

Company: Equinor, Polenergia

Installation Capacity: Not specified (Projects: Bałtyk 2 and Bałtyk 3)

Applications: Developing new offshore wind farms in Poland, backed by €700 million in financing from the European Investment Bank.

Source: Poland: EIB extends €700 million for development of two …

10. CIP’s Ossian Floating Wind Project

Company: Copenhagen Infrastructure Partners (CIP)

Installation Capacity: Not specified.

Applications: Development of one of the world’s largest floating offshore wind projects in Scotland, targeting deeper water resources.

Source: Projects

Table: Key European Offshore Wind Projects and Initiatives (2025)

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| UK Government | 8.4 GW | National capacity auction (AR 7) | gov.uk |

| RWE, KKR | 6.9 GW | Development of UK offshore wind portfolio | Stocktitan |

| Iberdrola, Masdar | 1.4 GW | East Anglia THREE project (UK) | Carbon Credits |

| Ørsted A/S | Germany’s largest (upon completion) | Borkum Riffgrund 3 farm (Germany) | Ørsted |

| Vattenfall | 1.6 GW | Nordlicht wind cluster (Germany) | Recharge News |

| SSE Renewables, et al. | 3.6 GW | Dogger Bank Wind Farm (UK) | Dogger Bank |

| Iberdrola | 776 MW | Baltic Eagle & Windanker farms (Germany) | Iberdrola |

| ORLEN Group, et al. | Using 15 MW turbines | Baltic Power project (Poland) | ORLEN |

| Equinor, Polenergia | Not specified | Bałtyk 2 & Bałtyk 3 farms (Poland) | EIB |

| Copenhagen Infrastructure Partners | Not specified | Ossian floating wind project (Scotland) | COP |

Industry Adoption: From Standalone Projects to Strategic Power Hubs

The defining trend in industry adoption is the strategic shift from developing single wind farms to orchestrating massive, multi-gigawatt energy hubs through complex partnerships. The sheer capital required for these ventures necessitates a new model of collaboration. The $15 billion joint venture between developer RWE and private equity giant KKR to build out 6.9 GW of UK capacity is a prime example. This structure combines RWE’s deep operational expertise with KKR’s access to vast pools of long-term capital, effectively de-risking the enormous financial outlay. Similarly, the €5.2 billion partnership between Spanish utility Iberdrola and UAE sovereign-backed investor Masdar for the 1.4 GW East Anglia THREE project illustrates a global convergence of capital and expertise. This trend signals that the industry has matured beyond asset-by-asset development and is now focused on building resilient, large-scale portfolios capable of anchoring national energy grids.

European Offshore Market to Surpass $29B

This forecast, showing the European market value growing to over $29.2 billion by 2032, quantifies the immense capital involved. It underscores the section’s point about the industry shifting to large-scale, capital-intensive ‘power hubs’.

(Source: Credence Research)

Geography: The North Sea’s Reign and the Rise of New Frontiers

Geographically, Europe’s offshore wind landscape is dominated by the North Sea, with the UK as its undisputed leader. The UK’s recent AR 7 auction, which secured a record 8.4 GW of capacity, and its hosting of megaprojects like the 3.6 GW Dogger Bank and RWE’s massive new pipeline, solidify its position. Germany remains a powerhouse, with projects like Ørsted’s Borkum Riffgrund 3 and Vattenfall’s 1.6 GW Nordlicht cluster demonstrating its commitment. However, the most insightful trend is the strategic expansion into new maritime territories. The Baltic Sea is rapidly emerging as the next major hub, with Poland at its heart. Projects like ORLEN Group’s Baltic Power and Equinor’s developments, backed by significant EIB financing, are set to unlock a region with an estimated 33 GW of potential. Simultaneously, the Celtic Sea is being cultivated as a dedicated zone for floating offshore wind, marking a deliberate move to commercialize technology for deeper waters off the coasts of Wales and Ireland.

UK and Germany Dominate 2024 Wind Installations

This chart directly supports the section’s geographical analysis by showing Germany and the UK as the top two markets for new installations in 2024. It specifically highlights the UK’s leadership in new offshore capacity, reinforcing the North Sea’s reign.

(Source: Windletter – Substack)

Tech Maturity: Scaling Up and Floating Out to Deeper Waters

The installation data reveals a two-pronged approach to technological advancement. First is the relentless push for scale in conventional fixed-bottom turbines. The fact that ORLEN Group is installing 15 MW turbines in the Baltic Sea is a clear indicator that the industry is driving down the Levelized Cost of Energy (LCOE) through sheer size and efficiency. Manufacturers like Siemens Gamesa, which supplied machines for nearly three-quarters of new European capacity in 2024, are in an arms race to produce the next generation of larger, more powerful turbines. Second, and more forward-looking, is the tangible progress in commercializing floating offshore wind. What was once a niche, demonstration-level technology is now attracting serious investment. The development of Scotland’s Ossian project by specialists like CIP and the recent funding awards for floating farms in the Celtic Sea signal that the industry is ready to move beyond the shallow waters of the North Sea and unlock the immense wind resources available in deeper maritime zones.

High-Capacity Turbines to Dominate Future Market

This chart perfectly illustrates the ‘scaling up’ trend by showing a clear market shift towards higher-capacity turbines (over 8 MW). This visualizes the technological maturation described in the section, which is a key driver of efficiency.

(Source: Global Market Insights)

Forward-Looking Insights: The Dawn of the Offshore Supergrid

Looking ahead, the current wave of installations signals a future defined by three core themes: immense scale, strategic capital partnerships, and technological diversification. The market has moved decisively into an era of gigawatt-scale “energy hubs” that require alliances between developers, financiers, and national champions. The leadership of pioneers like Ørsted, with its three-decade operational track record, and aggressive growers like RWE, with its well-capitalized expansion strategy, is setting the template for the industry. The most critical emerging insight is the push toward both geographical and technological frontiers. The development of the Baltic and Celtic Seas will not only add massive capacity but also build out new supply chains and expertise. The parallel maturation of floating wind technology is the key that will unlock the deeper waters that hold the majority of Europe’s offshore wind potential. Ultimately, these individual projects are not just installations; they are the foundational nodes of a future European offshore supergrid, a network that promises to deliver energy security and power the continent’s net-zero ambitions.

Frequently Asked Questions

What is Europe’s primary goal for offshore wind development by 2030?

Europe’s main goal is to install an average of 23 GW of new offshore wind capacity every year until 2030. This ambitious target is driven by the continent’s dual objectives of achieving decarbonization and securing energy independence.

Which geographical areas are leading Europe’s offshore wind expansion?

The North Sea is the dominant region, with the UK and Germany hosting the largest projects. However, new frontiers are emerging rapidly. The Baltic Sea is becoming a major new hub, with Poland leading development, and the Celtic Sea is being specifically targeted for pioneering floating offshore wind projects.

What is the largest offshore wind farm mentioned in the article?

The largest project mentioned is the Dogger Bank Wind Farm in the UK. Being developed by SSE Renewables, Equinor, and Vårgrønn, it will have a total capacity of 3.6 GW upon completion, making it the world’s largest offshore wind farm.

Why are large partnerships, like the one between RWE and KKR, becoming common?

Developing massive, multi-gigawatt offshore wind hubs requires enormous capital investment. Partnerships, such as the $15 billion RWE and KKR joint venture, are essential to de-risk these projects by combining the operational expertise of energy developers with the vast financial resources of private equity firms and institutional investors.

What are the two main technological trends in the offshore wind industry?

The first trend is scaling up conventional fixed-bottom turbines to immense sizes, such as the 15 MW turbines being used in Poland, to improve efficiency and lower costs. The second, more forward-looking trend is the commercialization of floating offshore wind technology, which is crucial for harnessing wind energy in deeper waters where fixed foundations are not viable.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- IMO Decarbonization & Net Zero 2025: Policy Collapse

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.