Offshore Wind: Top 10 Projects in Europe in 2025

Europe’s Offshore Wind Revolution: How Mega-Projects and New Frontiers Define 2025

Imagine standing on the coast of the North Sea, looking out not at an empty horizon, but at a sprawling city of steel giants turning in unison. This is no longer a distant vision; it is the reality of 2025. Europe’s offshore wind sector has transcended the phase of pioneering individual projects and entered an era of full-scale industrialization. This year is marked by a breathtaking scaling of ambition, with multi-gigawatt wind farms becoming the new standard. As established markets push the boundaries of what’s possible, new regions are rapidly emerging, and next-generation floating technologies are finally moving from pilot to commercial reality. The story of 2025 is one of immense scale, strategic expansion, and technological breakthroughs that are fundamentally reshaping the continent’s energy future.

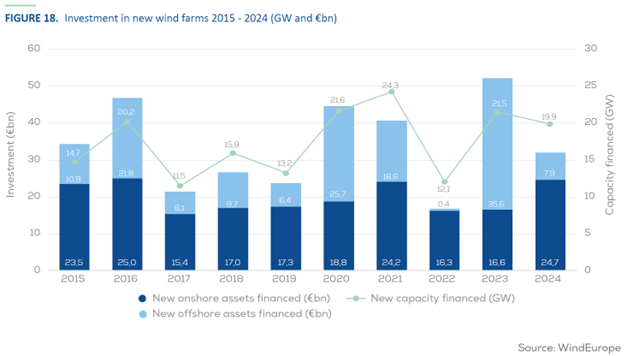

Record Investment Fuels 2025 Offshore Wind Boom

This chart shows that record investment in 2023 set the financial stage for the industrial-scale expansion described in this section. The surge in financing directly explains the ‘breathtaking scaling of ambition’ for 2025.

(Source: WindEurope)

Installations Powering a Continent

The year 2025 is pivotal, defined by massive projects moving through construction, achieving financial close, or winning critical government auctions. These installations are the concrete evidence of the industry’s trajectory, led by powerhouse developers like RWE, Equinor, and Ørsted. Below are the key projects shaping Europe’s energy landscape.

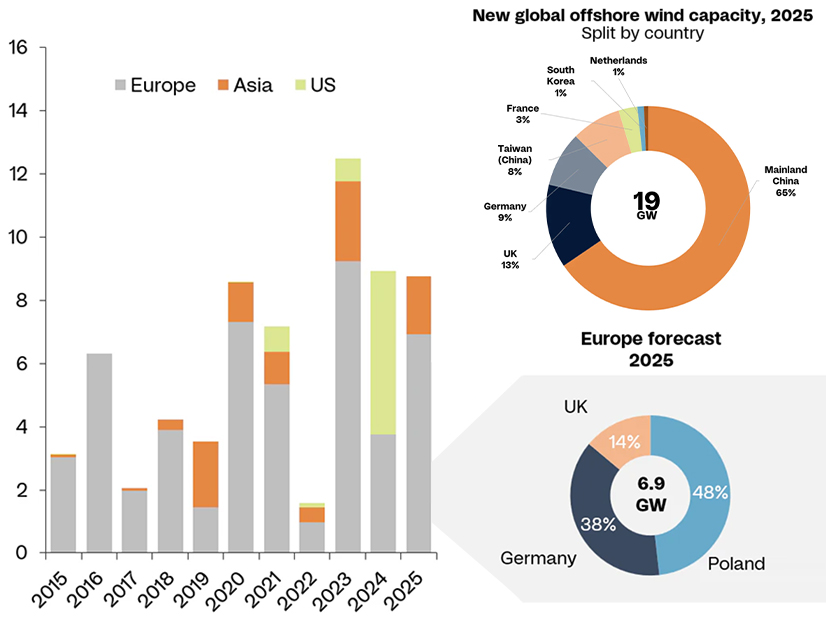

Europe to Add 6.9 GW in 2025

This chart provides the high-level context for the individual installations detailed in the following sections. It quantifies the total new capacity for 2025, highlighting the key countries like Poland and Germany that feature in the project list.

(Source: RTO Insider)

1. Dogger Bank Wind Farm (Phases A, B, C)

Company: SSE Renewables, Equinor, Vårgrønn

Installation Capacity: 3.6 GW

Applications: Grid-scale power generation; will power approximately six million UK homes.

Source: Offshore Wind: Top 10 Projects and Companies in Europe …

2. Dogger Bank South (East & West)

Company: RWE, Masdar

Installation Capacity: 3.0 GW

Applications: Grid-scale power generation; awarded capacity in the UK’s Cf D Allocation Round 7.

Source: UK awards 8.4 GW in Europe’s largest offshore wind …

3. Nordseecluster (A & B)

Company: RWE

Installation Capacity: 1.6 GW

Applications: Grid-scale power for the German market, developed in two phases.

Source: Offshore Wind: Top 10 Projects and Companies in Europe …

4. Nordlicht I & II

Company: Vattenfall

Installation Capacity: 1.6 GW

Applications: Grid-scale power for the German market; Germany’s largest single offshore wind project.

Source: Vattenfall confirms FID for 1.6 GW Nordlicht offshore wind …

5. Borssele Wind Farm Zone (1-5)

Company: Ørsted, Blauwwind II c.s., Two Towers

Installation Capacity: 1.6 GW

Applications: Grid-scale power; fully operational benchmark project in the Netherlands.

Source: Wind energy in Europe: the continent’s largest wind farms

6. Hornsea 2

Company: Ørsted

Installation Capacity: 1.4 GW

Applications: Grid-scale power; currently the world’s largest single operational wind farm in the UK.

Source: Wind energy in Europe: the continent’s largest wind farms

7. Sofia Offshore Wind Farm

Company: RWE

Installation Capacity: 1.4 GW

Applications: Grid-scale power; major UK project currently under construction.

Source: Offshore Wind: Top 10 Projects and Companies in Europe …

8. Baltic Power

Company: ORLEN Group, Northland Power

Installation Capacity: 1.2 GW

Applications: Grid-scale power; a flagship project for Poland’s energy transition away from coal.

Source: Cadeler

9. Awel y Môr

Company: RWE (60%), Stadtwerke München (30%), Siemens Financial Services (10%)

Installation Capacity: 0.775 GW

Applications: Grid-scale power; secured capacity in the UK’s Cf D Allocation Round 7.

Source: UK awards 8.4 GW in Europe’s largest offshore wind …

10. Îles d’Yeu et de Noirmoutier (EMYN)

Company: Ocean Winds (joint venture of ENGIE and EDPR)

Installation Capacity: 0.496 GW

Applications: Grid-scale power; achieving full operation in 2025 and supporting France’s offshore targets.

Source: Ocean Winds celebrates the successful installation of …

11. BC-Wind

Company: DEME Group (installation contractor)

Installation Capacity: 0.390 GW

Applications: Grid-scale power; another key project establishing Poland’s offshore wind market.

Source: Poland: With €600 million loan, EIB is the main financier …

12. Erebus

Company: Blue Gem Wind

Installation Capacity: 100 MW

Applications: Commercial-scale floating wind power; a landmark winner in the UK’s AR 7 auction.

Source: AR 7: RWE wins big in 8.4 GW Cf D auction

13. Pentland

Company: Copenhagen Infrastructure Partners (CIP)

Installation Capacity: 92.5 MW

Applications: Commercial-scale floating wind power; secured a Cf D in the UK’s AR 7 auction, signaling economic viability.

Source: Two floating projects land deals in UK offshore wind auction

Table: European Offshore Wind Projects, 2025

| Company | Installation Capacity (GW) | Applications | Source |

|---|---|---|---|

| SSE Renewables, Equinor, Vårgrønn | 3.6 | Grid-scale power for UK homes | Source |

| RWE, Masdar | 3.0 | Grid-scale power (Cf D awarded) | Source |

| RWE | 1.6 | Grid-scale power for the German market | Source |

| Vattenfall | 1.6 | Grid-scale power for the German market | Source |

| Ørsted, Blauwwind II c.s., Two Towers | 1.6 | Grid-scale power (operational benchmark) | Source |

| Ørsted | 1.4 | Grid-scale power (operational benchmark) | Source |

| RWE | 1.4 | Grid-scale power (under construction) | Source |

| ORLEN Group, Northland Power | 1.2 | Grid-scale power for Poland’s energy transition | Source |

| RWE, Stadtwerke München, Siemens | 0.775 | Grid-scale power (Cf D awarded) | Source |

| Ocean Winds (ENGIE and EDPR) | 0.496 | Grid-scale power for the French grid | Source |

| DEME Group (contractor) | 0.390 | Grid-scale power for Poland’s grid | Source |

| Blue Gem Wind | 0.100 | Commercial-scale floating wind power | Source |

| Copenhagen Infrastructure Partners | 0.0925 | Commercial-scale floating wind power | Source |

From Projects to Powerhouses: The Cluster Strategy

The clear trend in industry adoption is the shift from executing single projects to developing massive, multi-phase clusters. This “industrialization” of offshore wind is a strategic move to maximize economies of scale. Instead of treating each wind farm as a standalone effort, developers are securing vast seabed areas to develop over many years. The Dogger Bank zone is the prime example, with the initial 3.6 GW project now being followed by an additional 3.0 GW awarded to RWE and Masdar. Similarly, RWE‘s Nordseecluster (1.6 GW) in Germany follows the same logic. This cluster approach streamlines supply chains, optimizes vessel deployment, and reduces operational overhead, driving down the levelized cost of energy. This strategic shift signals that offshore wind is no longer a niche renewable but a mature, industrialized power source capable of delivering baseload-scale capacity to national grids.

North Sea Dominance and Baltic Ambitions

Geographically, the North Sea remains the undisputed heartland of European offshore wind, with the UK and Germany leading the charge. The sheer density of mega-projects like Dogger Bank, Hornsea 2, Sofia, and the German clusters highlights the region’s maturity, which is built on decades of investment, established supply chains, and supportive policy frameworks like the UK’s Contracts for Difference (Cf D) auctions. However, 2025 also marks the significant rise of new markets. Poland is rapidly establishing itself as a key player in the Baltic Sea. The 1.2 GW Baltic Power project, a joint venture between ORLEN Group and Northland Power, is a landmark installation, critical to Poland’s strategic pivot away from coal. The parallel development of the 390 MW BC-Wind farm further cements the Baltic as the next major growth frontier for the industry. Meanwhile, the Îles d’Yeu et de Noirmoutier project reaching full operation in 2025 signifies France’s growing commitment to catching up in the sector.

Map Shows North Sea Project Dominance

This map perfectly illustrates the geographic points made in this section. It visually confirms the North Sea as the ‘undisputed heartland’ by showing the high density of projects off the UK and German coasts.

(Source: La Tene Maps)

Fixed-Bottom Scales Up, Floating Tech Arrives

The projects of 2025 reveal two parallel tracks of technological maturity. First is the hyper-scaling of proven, bottom-fixed technology. Projects like Dogger Bank (3.6 GW) and Nordlicht I & II (1.6 GW) are pushing the limits of what was thought possible, deploying turbines of 15 MW and larger to maximize output from a single foundation. These multi-gigawatt installations represent the peak of commercialized technology. The second, and perhaps more groundbreaking, trend is the commercial arrival of floating offshore wind. The success of the Erebus (100 MW) and Pentland (92.5 MW) projects in the UK’s highly competitive AR 7 auction is a watershed moment. By winning contracts against cheaper, established bottom-fixed projects, these developments prove that floating wind is becoming economically viable. This breakthrough unlocks vast, deep-water areas previously inaccessible, particularly in the Celtic Sea and the Atlantic, marking a crucial step from demonstration to commercial-scale deployment.

Mega-Turbines to Power Future Wind Farms

This chart directly supports the section’s claim about the ‘hyper-scaling’ of fixed-bottom technology. It shows the clear trend toward turbines over 12 MW and 16 MW, validating the article’s focus on larger, more powerful machines.

(Source: Rystad Energy)

A Dual-Track Future: Scale and Innovation

The installations of 2025 send a clear signal: the future of European offshore wind is advancing on two powerful fronts. On one hand, the industry will continue to pursue relentless industrialization of bottom-fixed projects, with developers like RWE—who secured a staggering 6.9 GW of capacity in a single UK auction—locking in a dominant market position through aggressive, large-scale plays. This drive for scale will continue to push down costs and cement offshore wind as a cornerstone of Europe’s energy system. On the other hand, the commercial validation of floating wind opens an entirely new chapter. The success of Erebus and Pentland provides the blueprint for unlocking new geographies and vastly expanding Europe’s renewable energy potential. The market is no longer just about who can build the biggest fixed-bottom farm, but also who can successfully commercialize the next wave of floating technology, promising an even more dynamic and expansive decade ahead.

Chart Shows Dual-Track Market Growth

This forecast quantifies the ‘dual-track future’ of scale and innovation described in the conclusion. It shows the large overall market growth for fixed systems alongside a higher growth rate for emerging floating technology, confirming both trends.

(Source: Credence Research)

Frequently Asked Questions

What are the largest offshore wind projects defining Europe in 2025?

The largest projects highlighted are the Dogger Bank Wind Farm (Phases A, B, C) with a 3.6 GW capacity, followed by Dogger Bank South (East & West) at 3.0 GW. Other multi-gigawatt projects include Germany’s Nordseecluster (1.6 GW) and Nordlicht I & II (1.6 GW), showcasing the industry’s move towards massive-scale installations.

Which companies are the major players in Europe’s offshore wind sector?

The article identifies several key developers, with RWE being particularly dominant, involved in projects like Dogger Bank South, Nordseecluster, and Sofia. Other powerhouse companies mentioned include Ørsted (developer of Hornsea 2), Equinor (a partner in Dogger Bank), Vattenfall (Nordlicht), and joint ventures such as Ocean Winds and Vårgrønn.

What is the ‘cluster strategy’ mentioned in the article?

The ‘cluster strategy’ refers to the industry trend of developing multiple wind farm phases within a large, secured seabed area instead of building standalone projects. As seen with the Dogger Bank and Nordseecluster zones, this approach creates economies of scale, streamlines supply chains and operations, and significantly drives down the overall cost of energy, marking a shift towards full industrialization.

Is offshore wind development only happening in the North Sea?

No. While the North Sea (led by the UK and Germany) remains the dominant region, 2025 marks the significant rise of new markets. The Baltic Sea is emerging as the next major frontier, with Poland’s 1.2 GW Baltic Power project being a key example. France is also increasing its activity, with the Îles d’Yeu et de Noirmoutier farm becoming fully operational.

What is the significance of floating offshore wind in 2025?

2025 is a breakthrough year for floating offshore wind. The success of the Erebus (100 MW) and Pentland (92.5 MW) projects in a competitive UK government auction proves that this technology is becoming commercially and economically viable. This is significant because it unlocks the potential to build wind farms in deep-water areas that were previously inaccessible to traditional fixed-bottom turbines.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.