NVIDIA’s Data Center Power Flexibility Strategy 2025: Architecting the Grid-Aware AI Factory

NVIDIA’s Project Evolution: How Power Flexibility Became a Commercial Strategy in 2025

NVIDIA has strategically shifted from being a passive hardware supplier to an active architect of energy solutions, making data center power flexibility a cornerstone of its plan to sustain the AI revolution. This transition from concept to commercial pilot is a direct response to the massive grid strain created by its own high-density processors.

- Between 2021 and 2024, NVIDIA’s approach was foundational, focusing on external grid intelligence through partnerships like the one with Utilidata to deploy AI modules on the electric grid. The creation of the EPRI DCFlex initiative in October 2024, involving partners like Google and Meta, formalized this effort by establishing a collaborative framework to study how data centers could support grid stability.

- The strategy reached a commercial inflection point in 2025 with direct backing of pilot projects designed to prove the model at scale. The partnership with startup Emerald AI in October 2025 to develop the “Aurora” power-flexible AI data center is the primary example, creating a reference design intended to unlock 100 GW of grid capacity.

- This progression from broad industry consortiums to targeted commercial pilots signals that power flexibility is maturing from an academic concept into a required feature for next-generation AI infrastructure. The goal is to transform data centers from purely consumptive loads into dynamic, grid-supportive assets that can modulate power use in real time.

Investment Analysis: The Capital Behind NVIDIA’s Power Flexibility and Infrastructure Push

NVIDIA is leveraging its significant financial position to fund the infrastructure ecosystem required to support its technology, with a clear focus on enabling power-flexible and scalable AI data centers. While direct investments in flexibility software are not always disclosed, its participation in major infrastructure funds and strategic financing for data center innovators reveals a multi-pronged capital strategy.

Table: NVIDIA’s Key Strategic Investments in Data Center Infrastructure (2024-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Aligned Data Centers Acquisition | Oct 2025 | An investor consortium including NVIDIA, BlackRock, and Microsoft will acquire Aligned Data Centers for $40 billion. This gives NVIDIA direct influence over 50 data center sites, securing physical infrastructure for its chips. | Nvidia-Backed Group Drops $40B on Aligned Data Centers |

| Redwood Materials Investment | Oct 2025 | NVIDIA’s venture arm participated in a $350 million Series E round for Redwood Materials. The strategic goal is to secure a supply chain for repurposed batteries for grid-scale energy storage, a critical component for power flexibility. | Redwood Announces $350 Million Series E Funding |

| Global AI Infrastructure Partnership (GAIIP) | Sep 2024 | NVIDIA is a technology partner in an initiative with BlackRock, Microsoft, and MGX that includes a $30 billion fund. The capital is aimed at financing energy infrastructure, including renewables, to meet AI’s power requirements. | BlackRock, Microsoft, Nvidia Launch $30 Billion AI Fund |

| Applied Digital Investment | Sep 2024 | NVIDIA joined a $160 million strategic financing round for Applied Digital, an NVIDIA Cloud Partner that builds power-efficient, high-density data centers. This supports the development of infrastructure capable of handling next-gen AI. | Nvidia Invests $160M in Data Center Builder Applied Digital |

Partnership Analysis: NVIDIA’s Ecosystem for Grid Integration and Flexibility

NVIDIA is building a coalition of utilities, grid operators, and technology startups to create the software and operational frameworks for power-flexible data centers. These partnerships are critical for transforming AI factories from a grid problem into a grid solution.

Table: NVIDIA’s Top Power Flexibility and Grid Integration Partnerships (2024-2025)

Power and Data Center Sectors Join Forces to Resolve …

Power and Data Center Sectors Join Forces to Resolve … – POWER Magazine

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Emerald AI & Partners | Oct 2025 | NVIDIA is backing Emerald AI to build the “Aurora” power-flexible AI factory. The project aims to create a reference design to unlock 100 GW of grid capacity by enabling data centers to adjust energy use in real time. | Emerald AI Teams with NVIDIA and Partners to Develop… |

| EPRI’s Open Power AI Consortium | Mar 2025 | NVIDIA is a key member of this consortium, using its H100 GPUs to develop an open AI model for power systems. This initiative uses AI to solve the grid complexity problems that AI itself creates. | EPRI, NVIDIA and Collaborators Launch Open Power AI… |

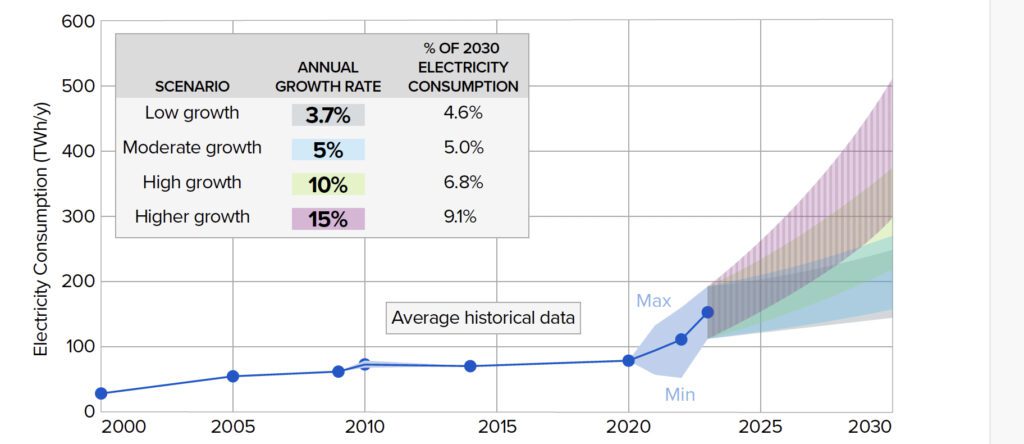

| EPRI DCFlex Initiative | Oct 2024 | NVIDIA joined EPRI, Google, Meta, and utilities to launch a project to establish 5-10 “flexibility hubs.” The goal is to demonstrate how data centers can provide grid services and manage consumption, projected to hit 9% of U.S. generation by 2030. | EPRI’s DCFlex initiative |

| Southern California Edison | Oct 2024 | This collaboration focuses on leveraging NVIDIA’s technology to reimagine the electric grid. It aims to develop new approaches for managing power infrastructure to meet future demand from data centers. | Tech Collaboration Designed to Power the Future |

| Utilidata | Jun 2024 | NVIDIA partnered with Utilidata to deploy custom AI modules directly on the grid. This early-stage initiative enhances grid visibility and operational efficiency at the grid’s edge. | As NVIDIA, IBM and others apply AI to boost utilities… |

Geographic Focus: NVIDIA’s Power Flexibility Initiatives Target the Strained U.S. Grid

While NVIDIA’s hardware is deployed globally, its most advanced strategic initiatives in power flexibility are concentrated in the United States, targeting mature grid systems facing the most immediate strain from AI-driven power demand.

- Between 2021 and 2024, NVIDIA’s early-stage grid collaborations were primarily U.S.-based. The partnership with Utilidata and the launch of the EPRI DCFlex initiative with American tech giants and utilities established a foundation for testing grid-aware technologies within the U.S. regulatory and infrastructure context.

- This U.S. focus intensified in 2025, with flagship projects directly engaging American grid operators. The Emerald AI “Aurora” facility is being developed in coordination with PJM, a major U.S. regional transmission organization, while the collaboration with Southern California Edison tackles grid modernization in one of the nation’s largest power markets.

- This contrasts with NVIDIA’s approach to securing power supply in other regions, such as the $4.3 billion investment in the solar-powered YTL Green Data Center Park in Malaysia. It suggests a dual strategy: deploying sophisticated grid-flexibility software in established, congested markets like the U.S. while pursuing direct renewable integration in high-growth international markets.

Technology Maturity: From R&D to Commercial Pilots for Power Flexibility

Data center power flexibility has rapidly advanced from a research concept to a commercially-driven pilot phase, a progression necessitated by NVIDIA’s need to create a viable operating environment for its increasingly power-dense hardware.

- In the 2021-2024 period, the technology was in the research and consortium-building stage. The EPRI DCFlex initiative, launched in October 2024, exemplifies this phase, focusing on establishing frameworks and proving feasibility with a broad group of industry stakeholders.

- The technology matured to the pilot implementation stage in 2025. The Emerald AI “Aurora” project, announced in October 2025, represents the first concrete, commercial-intent application, with plans for an initial 96 MW facility and a replicable reference design for the industry.

- This transition from broad consortiums to specific pilot projects with defined deliverables validates that the software and operational models for flexible data centers are now ready for real-world deployment. The explicit goal of unlocking 100 GW of grid capacity shows this is no longer a theoretical exercise but a strategic imperative.

SWOT Analysis: NVIDIA’s Strategic Position in Data Center Power Flexibility

Table: SWOT Analysis of NVIDIA’s Power Flexibility Strategy (2021-2025)

Nvidia: Data Center Dominance Has Only Just Begun (NASDAQ …

Nvidia: Data Center Dominance Has Only Just Begun (NASDAQ … – Seeking Alpha

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Leadership in GPU efficiency gains; foundational AI software capabilities. | Massive financial resources ($30B GAIIP fund); 25x efficiency improvement with Blackwell platform; direct backing of key flexibility projects (Emerald AI). | NVIDIA shifted from a passive efficiency provider to an active ecosystem architect, using its capital and market position to directly shape the energy market. |

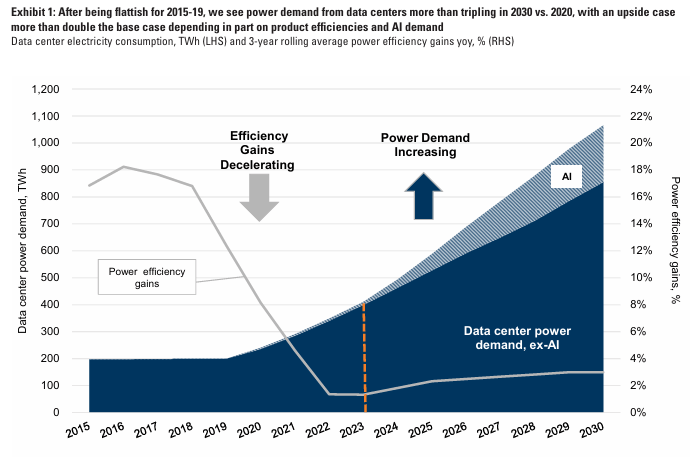

| Weaknesses | Business model directly causes the power crisis through high-density GPUs; complete dependence on external utility infrastructure. | Hardware power demand continues to grow exponentially (120-130 kW/rack for Blackwell). The problem’s scale is demonstrated by new data centers in Santa Clara sitting empty for lack of power. | The problem NVIDIA’s hardware creates has outpaced traditional infrastructure, making these strategic energy initiatives a necessity to protect its core business. |

| Opportunities | Potential to use AI to optimize grid operations; lead industry collaborations on energy efficiency. | Transform data centers into revenue-generating grid assets (Emerald AI, EPRI DCFlex); vertically integrate into the energy supply chain (Redwood Materials for storage, TerraPower for nuclear). | The opportunity evolved from selling software tools for grid management to orchestrating and financing the entire energy value chain required for AI compute. |

| Threats | Rising electricity demand and grid constraints were projected to stall future AI growth. | The threat became a present-day reality, quantified by demand projections of 123 GW in the U.S. by 2035 and physical infrastructure gaps appearing now. | The threat moved from a future forecast to an immediate business constraint, compelling NVIDIA into multi-billion dollar infrastructure deals to secure its market’s future. |

2025 Forward Look: Proving the Commercial Case for Grid-Aware AI

NVIDIA’s primary strategic objective in the year ahead is to prove the commercial and technical viability of power-flexible AI factories at scale, transitioning them from pilots into a bankable, industry-standard solution.

- The performance of the Emerald AI “Aurora” project will be the most critical validation point. Its ability to demonstrate real-time load shifting during peak grid stress without compromising AI workload performance will determine if the “power-flexible” model is adopted by the wider market.

- The evolution of the EPRI Open Power AI Consortium is the next key signal. As the open AI model for power systems develops on NVIDIA hardware, it is expected to become the de facto software backbone that enables data centers to interact intelligently and automatically with the grid.

- A convergence of flexibility software and physical energy storage represents the next frontier. NVIDIA’s investment in Redwood Materials is an early indicator of a future where AI data centers use repurposed batteries not just for backup but as active, revenue-generating assets in grid flexibility programs.

Frequently Asked Questions

What is NVIDIA’s power flexibility strategy and why is it important?

NVIDIA’s power flexibility strategy aims to transform AI data centers from purely consumptive power loads into dynamic, grid-supportive assets that can adjust their energy use in real time. This is critical for NVIDIA because the massive power demand of its own high-density GPUs is straining electric grids, and ensuring a stable power supply is necessary to sustain the future growth of the AI industry.

What is the “Aurora” project mentioned in the report?

The “Aurora” project is a key commercial pilot initiated in October 2025. It is a partnership between NVIDIA and the startup Emerald AI to build a ‘power-flexible AI factory’. Its primary goal is to create a scalable reference design for the industry that demonstrates how data centers can support the grid, with an ambitious target of unlocking 100 GW of grid capacity.

How is NVIDIA financially backing its push into energy and infrastructure?

NVIDIA is leveraging its financial resources through a multi-pronged investment strategy. Key examples include being a technology partner in a $30 billion Global AI Infrastructure Partnership (GAIIP) to fund energy projects, joining a consortium to acquire Aligned Data Centers for $40 billion to secure physical sites, and making strategic investments in companies like Redwood Materials for battery storage components.

Who are NVIDIA’s main partners in this grid integration effort?

NVIDIA is collaborating with a diverse ecosystem. Key partners include technology startups like Emerald AI and Utilidata; major tech companies like Google and Meta; industry research groups like EPRI (Electric Power Research Institute) through the DCFlex and Open Power AI initiatives; and utility providers such as Southern California Edison.

How did NVIDIA’s strategy evolve from 2024 to 2025?

In 2024, NVIDIA’s strategy was in a foundational phase, focused on research and forming broad industry consortiums like the EPRI DCFlex initiative. By 2025, the strategy matured to a commercial pilot phase, with NVIDIA directly backing specific projects like the Emerald AI “Aurora” facility. This signifies a shift from academic concepts to developing replicable, commercial-intent solutions.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.