Mini Max’s AI Infrastructure Strategy: A 2026 Blueprint for Managing AI’s Massive Energy Consumption

Mini Max Commercial Projects Reveal Shift to AI Infrastructure Efficiency 2026

Mini Max has strategically shifted from foundational model development to the commercialization of computationally efficient AI applications, a move designed to manage the high energy consumption and immense costs of its underlying infrastructure.

- Between 2021 and 2024, the company focused on building its core AI models and securing foundational capital, including a $250 million round involving a Tencent-backed entity and a $600 million round led by Alibaba. It launched the consumer app Talkie to prove a viable path to monetization, generating significant revenue.

- From 2025 to 2026, the strategy pivoted to capital efficiency, marked by the launch of cost-effective models like the Mini Max-M 2, which uses a sparse Mixture-of-Experts design with only 10 B active parameters. The successful January 2026 IPO, raising $619 million, was explicitly intended to fund infrastructure expansion and R&D for more efficient models.

- The company’s application portfolio, spanning consumer products like Talkie and Hailuo AI to enterprise-grade APIs, demonstrates that managing computational cost is a critical strategic requirement for scaling across diverse and energy-intensive markets.

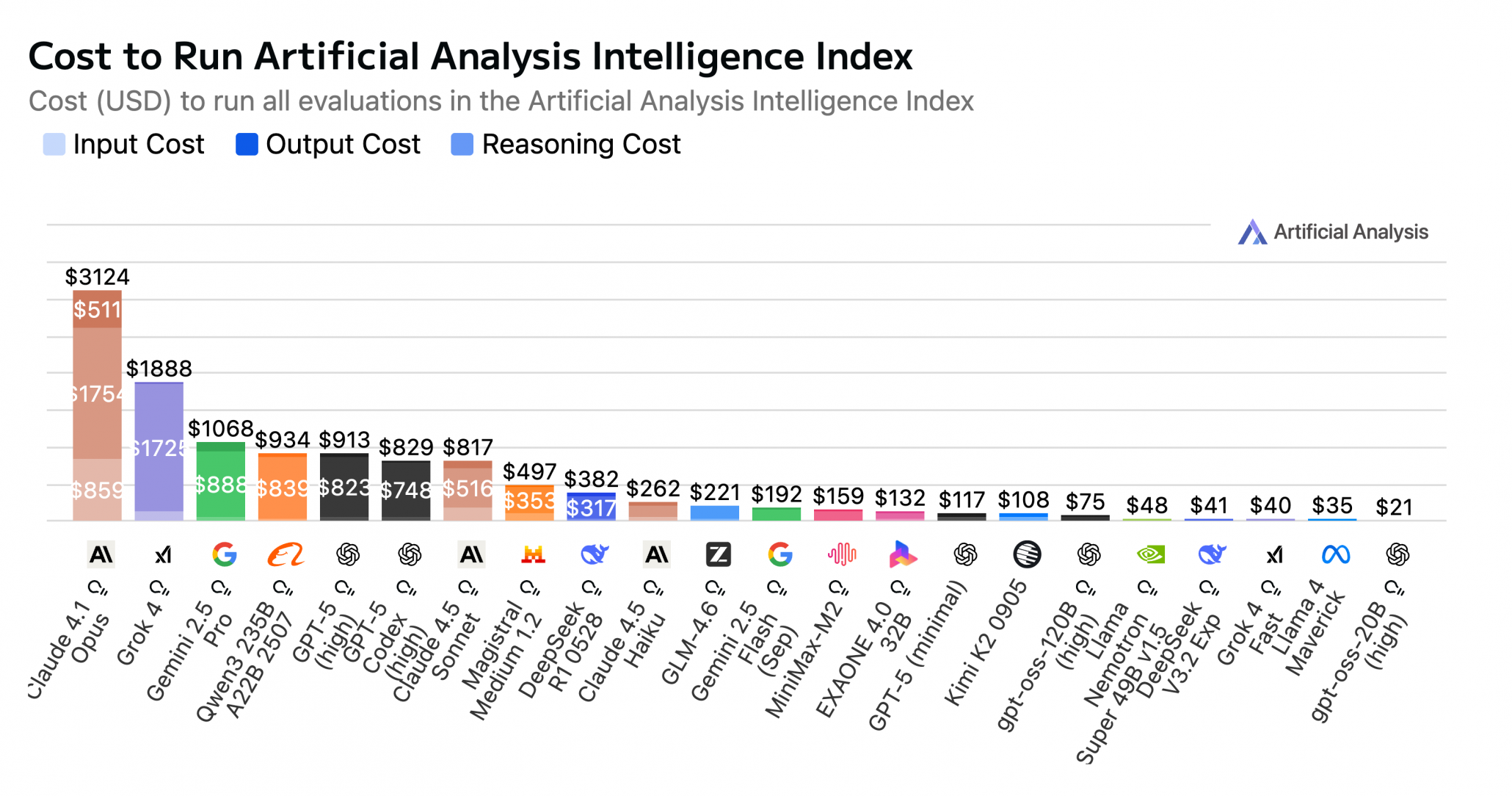

MiniMax-M2 Model Ranks High for Cost-Efficiency

This chart quantifies Mini Max’s strategic shift to efficiency by showing its M2 model is significantly more cost-efficient than competitors, directly addressing the article’s focus on managing high infrastructure costs.

(Source: Artificial Analysis)

Mini Max Investment Analysis: Funding the High Energy Cost of AI Infrastructure

Mini Max’s funding trajectory, which culminated in its 2026 IPO, was structured to finance the massive capital expenditures required for its energy-intensive AI compute and data center infrastructure.

- Early-stage funding rounds, including a major investment from Alibaba in March 2024, established a capital base of over $850 million, which was essential for securing the initial high-cost AI infrastructure needed to compete with established players.

- The January 2026 Hong Kong IPO successfully raised $619 million, with the proceeds explicitly earmarked for R&D, foundation model development, and infrastructure expansion. This public offering validated investor confidence in its high-cost, high-growth business model.

- With total capital raised surpassing $1.5 billion, Mini Max highlights the immense financial barrier to entry in the AI sector, a barrier primarily defined by the escalating costs of computation and the physical infrastructure that supports it.

Table: Mini Max Key Investments and Strategic Purpose

| Investor / Event | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| IPO on Hong Kong Stock Exchange | Jan 2026 | Raised $619 million to fund R&D, infrastructure expansion, and working capital, achieving a market valuation over $11.5 billion. Key investors included Alibaba and Abu Dhabi’s ADIA. | Silicon Angle |

| Series B Funding Round | Dec 2025 | The company’s largest private round raised $600 million, contributing to over $850 million raised before its IPO. This capital was critical for scaling compute resources. | Tracxn |

| Alibaba-Led Funding Round | Mar 2024 | Raised at least $600 million in a round led by Alibaba Group, pushing its valuation to over $2.5 billion. The investment was intended to finance the development of its large language models and associated infrastructure. | Silicon Angle |

| Tencent-backed Funding Round | Jun 2023 | Raised over $250 million from investors including a Tencent-backed entity. This funding provided the initial capital to scale its AI solutions and build its foundational technology stack. | Reuters |

Mini Max Strategic Partnerships: Outsourcing Infrastructure to Control AI Energy Costs 2026

Mini Max mitigates the immense cost and complexity of its AI infrastructure by forming strategic alliances with specialized providers, which allows the company to focus its resources on model efficiency rather than building a complete vertical stack.

- Between 2021 and 2024, an early partnership with Juice FS was crucial for establishing a cost-effective storage layer. This was a foundational move for managing massive datasets required for model training while controlling operational expenses.

- During 2025 and 2026, post-IPO partnerships expanded aggressively to offload infrastructure burdens. Alibaba Cloud now provides the core scalable compute platform, while Zilliz Cloud delivers specialized vector search capabilities, reducing the need for in-house development of this complex component.

- Platform partners such as Agora, fal.ai, and Together AI function as distribution channels, embedding Mini Max‘s efficient models into broader ecosystems. This reduces the friction and cost of adoption for developers and expands market access without direct infrastructure investment.

AI Infrastructure Market Map Shows Crowded Ecosystem

This market map illustrates the ecosystem of specialized providers that Mini Max partners with, visually supporting the section’s theme of outsourcing infrastructure to control costs.

(Source: Next Big Teng – Substack)

Table: Mini Max Strategic Partnerships and Infrastructure Collaborations

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Agora | Jan 2026 | Deepened collaboration to integrate Mini Max‘s TTS and multimodal models with Agora‘s real-time delivery network, enabling low-latency conversational AI on a global scale. | Newswire |

| Alibaba Cloud | Jan 2026 | Leveraged Alibaba Cloud to build a scalable, cloud-native Data + AI platform. This provides the core infrastructure to power multimodal model training and support global user growth. | Alibaba Cloud |

| Zilliz Cloud | Aug 2025 | Utilized Zilliz Cloud to power high-performance vector search and data deduplication for its consumer app Talkie and its trillion-token AI training datasets, offloading a specialized infrastructure task. | Zilliz |

| Juice FS | Sep 2024 | Built its foundational AI platform using Juice FS Enterprise Edition to create a cost-effective, high-performance storage infrastructure for managing massive datasets for model training. | Juice FS |

Mini Max’s Global Expansion Strategy: Balancing High-Growth Markets and Infrastructure Costs

Mini Max is executing an aggressive international strategy, generating the majority of its revenue from overseas markets, which necessitates a globally distributed and highly efficient infrastructure to remain cost-competitive at scale.

- In the period from 2021 to 2024, Mini Max established its base in Shanghai but quickly targeted global markets. The launch of its consumer app Talkie proved highly successful in the U.S., validating its international product-market fit early on.

- From 2025 to 2026, the company solidified its international focus, with its Hong Kong IPO providing capital explicitly for global expansion. Financial disclosures confirmed this strategy, revealing that over 70% of its revenue is now generated from markets outside mainland China.

- The practice of testing new, computationally efficient models like M 2.5 in overseas markets first indicates a deliberate effort by Mini Max to validate its infrastructure’s efficiency under the pressure of high user volumes and global latency requirements.

North America to Drive AI Infrastructure Growth

This chart validates Mini Max’s global strategy by highlighting the significant growth in the AI infrastructure market, with North America’s 49% share underscoring the importance of its success in the U.S.

(Source: PR Newswire)

Mini Max AI Technology Maturity: From Foundational Research to Commercially Scaled Efficiency

Mini Max’s technology has rapidly matured from developing general-purpose AI models to deploying highly specialized, computationally efficient architectures that are commercially viable at a global scale.

- Between 2021 and 2024, the primary focus was on building foundational multi-modal capabilities and proving technical credibility. This phase culminated in the launch of its viral Hailuo AI text-to-video model, which established Mini Max as a significant innovator.

- From 2025 to 2026, the technological focus pivoted decisively toward operational efficiency and cost reduction. The launches of the Mini Max-M 2 model, with its sparse design, and the Mini Max-M 1 model, which saves 75% of FLOPs, are direct evidence of this strategic shift.

- This progression demonstrates that Mini Max‘s technology has advanced beyond the R&D challenge of creating powerful models to the commercial-scale challenge of deploying them cost-effectively to hundreds of millions of users, a critical validation of its business model.

MiniMax-M2 Model Benchmarked Against Major Competitors

This chart demonstrates Mini Max’s technology maturity by benchmarking its M2 model against industry leaders, proving its evolution from foundational research to a commercially competitive offering.

(Source: Jose S. Gomez-Olea – Medium)

SWOT Analysis: Mini Max’s Strategic Position in the AI Infrastructure Race 2026

Mini Max’s strengths in developing efficient model architectures and achieving early commercialization have been validated by its successful IPO, yet the company faces intense competition and the high operational costs inherent to its infrastructure-heavy business model.

- The company’s key strengths are its proven ability to generate significant consumer revenue and its focus on creating computationally efficient models, which directly addresses the high cost of AI operations.

- Its primary weakness is its high cash burn rate, which is necessary to fund heavy R&D and infrastructure investments, creating a dependency on continuous capital access.

- Major opportunities lie in expanding its enterprise client base and continuing its successful international growth, particularly in markets receptive to cost-effective AI solutions.

- Threats include intense competition from other heavily funded “AI Tigers” like Zhipu AI and Moonshot AI, as well as the ever-escalating global demand and cost for AI compute resources.

Big Tech Capital Expenditures Skyrocket Amid AI Boom

This chart highlights the intense competition and high costs in the AI infrastructure race, visually representing the primary threats and weaknesses discussed in Mini Max’s SWOT analysis.

(Source: Understanding AI)

Table: SWOT Analysis for Mini Max

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Demonstrated ability to build powerful foundational models (e.g., Hailuo AI) and gain traction with consumer apps (Talkie). Secured backing from Alibaba and Tencent. | Launched computationally efficient models (M 1, M 2) that reduce inference costs. Achieved a successful $619 M IPO. Generated 71% of revenue from consumer apps. | The company validated its ability to not only innovate but also commercialize its technology at scale, creating a revenue stream to offset high infrastructure costs. |

| Weaknesses | High capital dependency for building foundational models and infrastructure. Unproven long-term monetization strategy beyond initial app success. | Company remains unprofitable due to heavy R&D and infrastructure spending, burning significant cash. Relies on partners like Alibaba Cloud for core infrastructure. | The IPO provided significant capital, but the underlying business model remains one of high cash burn. The reliance on partners, while efficient, introduces external dependencies. |

| Opportunities | Early success in global markets, particularly the U.S. with the Talkie app. Strong investor interest in Chinese AI startups. | Projected revenue growth of 127% in 2026. Expansion into enterprise APIs and deeper integration with partners like Agora. Aggressive overseas expansion, with 70% of revenue already from abroad. | The company validated its global appeal and has a clear path for expansion, funded by its IPO. The opportunity to capture enterprise market share is now a primary focus. |

| Threats | Intense competition from other Chinese “AI Tigers” (Moonshot AI, Zhipu AI) who are also heavily funded. Geopolitical tensions affecting global expansion. | Escalating cost of AI compute and infrastructure. Competitors are also pursuing IPOs and raising significant capital. Regulatory scrutiny in international markets. | The competitive landscape has intensified, with rivals matching Mini Max‘s funding and market moves. The cost of the AI “arms race” remains the single largest threat to profitability. |

Future Outlook: Can Mini Max’s Efficiency Strategy Sustain Growth in the AI Energy Race?

The defining factor for Mini Max’s future success will be its ability to maintain a lead in model efficiency to manage the escalating operational costs of AI compute, which serves as a direct proxy for its massive energy consumption and capital expenditure.

- The upcoming Full Year 2025 financial results, scheduled for release on March 2, 2026, will provide the first public, detailed view of its infrastructure costs relative to its strong consumer revenue streams, offering a clear indicator of its path to profitability.

- Achieving the aggressive revenue growth targets projected by analysts, including a 127% year-over-year increase for 2026, is entirely dependent on its ability to scale services without its infrastructure costs scaling at the same rate. This reinforces the strategic importance of its efficient model architecture.

- The company’s commitment to releasing powerful open-source models like M 2.5 is a critical strategy to watch. While it can accelerate market adoption and build a developer community, it also increases pressure on Mini Max to successfully monetize its premium APIs and proprietary infrastructure.

MiniMax AI Balances Intelligence and Efficiency

This chart visualizes the core of Mini Max’s future outlook, showing how its M2 model achieves high intelligence relative to its size, which is the key efficiency strategy for sustaining growth.

(Source: Artificial Analysis)

Frequently Asked Questions

Why is Mini Max focusing on AI efficiency instead of just building more powerful models?

Mini Max shifted its focus to computationally efficient AI models to manage the extremely high energy consumption and immense costs of its infrastructure. This strategy allows the company to scale its commercial applications, like the Talkie app, to millions of users in a financially sustainable way.

How much money has Mini Max raised and why did it need so much?

Mini Max has raised over $1.5 billion, including a $600 million round led by Alibaba and a $619 million IPO in January 2026. This massive amount of capital was necessary to finance the energy-intensive AI compute and data center infrastructure required to compete in the AI sector.

How does Mini Max manage the high costs of its AI infrastructure?

Mini Max uses a two-part strategy. First, it develops cost-effective models, like the sparse Mini Max-M 2, which use less computational power. Second, it outsources infrastructure burdens through strategic partnerships with companies like Alibaba Cloud for core computing and Zilliz Cloud for specialized vector search, allowing it to focus on model development.

Is Mini Max a Chinese-focused company?

No, Mini Max has a strong international focus. Despite being based in Shanghai, the company generates over 70% of its revenue from markets outside mainland China. Its consumer app, Talkie, was particularly successful in the U.S., validating its global expansion strategy.

What are the biggest risks or threats to Mini Max’s success?

The primary threats are the intense competition from other heavily funded Chinese AI companies like Zhipu AI and Moonshot AI, and the ever-escalating global cost of AI compute resources. The company also has a high cash burn rate due to heavy investment in R&D and infrastructure, making profitability a key challenge.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.