Baichuan Intelligence AI Infrastructure Strategy 2026: Analyzing Commercial Investments and Strategic Partnerships

Baichuan Intelligence Commercial Projects Show Strategic Pivot to Vertical AI Infrastructure

Baichuan Intelligence has transitioned its commercial strategy from building general-purpose foundational models to deploying specialized, high-value AI infrastructure in targeted verticals, most notably healthcare.

- In the 2023-2024 period, Baichuan focused on broad industry adoption by releasing open-source models like the Baichuan-7 B and Baichuan-13 B series, providing a general infrastructure layer for developers and enterprises.

- Beginning in 2025, the company executed a decisive pivot, marked by the March 2025 disbanding of its financial and education teams to concentrate resources on healthcare AI infrastructure.

- This strategic shift was validated by the January 2026 launch of Baichuan-M 3, a medical-specific LLM, and its real-world deployment through a partnership with Beijing Children’s Hospital to create a pediatric health model.

- While specializing, Baichuan maintains a fintech presence through a January 2026 collaboration with ANT GROUP to integrate its LLM technology into intelligent risk control systems, demonstrating targeted application of its infrastructure in a different high-value sector.

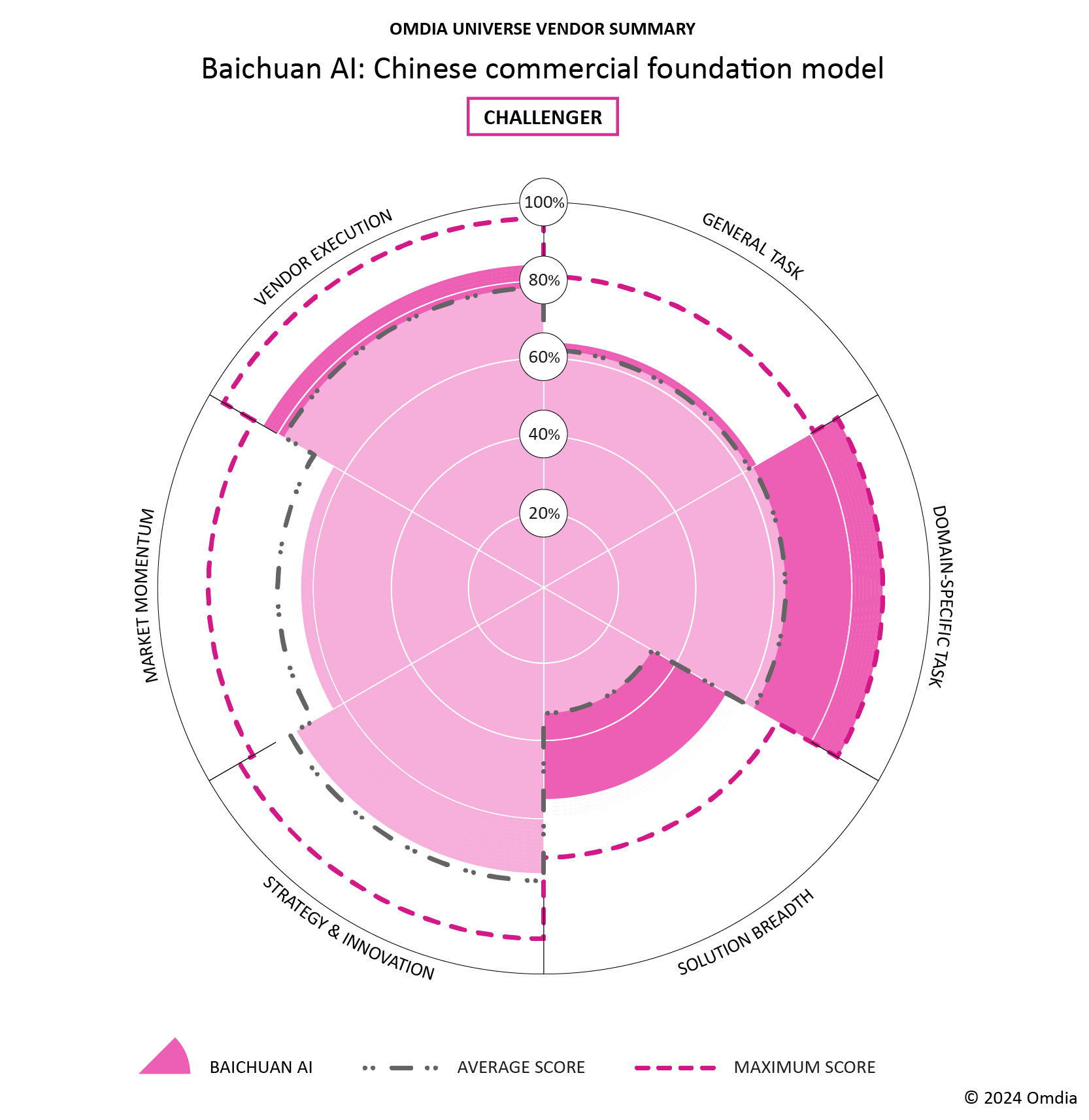

Baichuan Excels in Vertical-Specific AI

This chart validates the section’s point about a successful pivot to vertical AI, showing Baichuan’s exceptional performance in ‘Domain-Specific Task’ relative to its peers.

(Source: Omdia – Informa)

Baichuan Intelligence Investment Analysis: Fueling Compute Infrastructure with Strategic Capital

Baichuan Intelligence secured over $1 billion in strategic funding to acquire the extensive computing resources necessary to build and maintain its AI infrastructure, leveraging capital from China’s largest technology corporations.

- The company rapidly achieved unicorn status by securing a $300 million Series A 1 round in October 2023 from backers including Alibaba, Tencent, and Xiaomi.

- This was followed by a massive RMB 5 billion (~$691 million) Series A round in July 2024, which elevated its valuation to approximately $2.7 billion and provided the capital for large-scale model training.

- Founder Wang Xiaochuan confirmed in January 2026 that the company maintains cash reserves of 3 billion RMB (~$420 million), indicating a strong financial position to execute its focused strategy without immediate need for an IPO.

Table: Baichuan Intelligence Investment Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Series A Funding | July 2024 | Raised RMB 5 billion (~$691 million) in a Series A round, reaching a valuation of ~$2.7 billion. The funding from Alibaba, Tencent, and Xiaomi was allocated to securing compute resources for model development. | Silicon Angle |

| Series A 1 Strategic Financing | October 2023 | Secured over $300 million in a strategic financing round led by Alibaba, Tencent, and Xiaomi, officially achieving unicorn status with a valuation over $1 billion. | Maginative |

| Initial Seed Funding | April 2023 | Founder Wang Xiaochuan established the company with $50 million of his own funds and backing from industry friends. | Yicai Global |

Baichuan Intelligence Partnership Ecosystem: Building a Diversified AI Infrastructure Network

Baichuan Intelligence has constructed a multi-layered partnership ecosystem to secure access to compute power, integrate with massive datasets, and accelerate commercialization, avoiding the high cost of building proprietary physical infrastructure.

- To secure foundational compute, Baichuan partnered with state-affiliated China Mobile on the “Bai Chuan computing force grid platform” and uses infrastructure providers like Infinigence AI, which aggregates resources from 53 data centers.

- For on-device AI infrastructure, a key collaboration with Qualcomm initiated in 2024 aims to optimize Baichuan’s smaller LLMs to run on smartphones and computers, mitigating reliance on centralized data centers and navigating US chip sanctions.

- To drive vertical application, Baichuan partnered with Beijing Children’s Hospital in 2025 for healthcare AI and with ANT GROUP in January 2026 to apply its models to fintech risk control, leveraging the partners’ vast, proprietary datasets.

Baichuan’s Role in China’s AI Stack

The chart illustrates the partnership ecosystem described in the section, positioning Baichuan as an LLM provider that leverages foundational infrastructure from strategic partners.

Table: Baichuan Intelligence Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| ANT GROUP | January 2026 | Collaboration to integrate LLM technology with ANT GROUP’s massive data from 28.5 million enterprises to build intelligent risk control systems. | Longbridge |

| Infinigence AI | November 2025 | Baichuan became a client of Infinigence AI to access its heterogeneous computing platform, which aggregates compute resources from 53 data centers across China. | Caixin Global |

| Beijing Children’s Hospital | February 2025 | Deep collaboration to deploy AI-driven pediatric solutions and medical assistants, representing a real-world application of Baichuan’s specialized healthcare AI infrastructure. | China Daily |

| China Mobile | January 2025 | Associated with China Mobile’s “Bai Chuan platform, ” a national initiative to build a unified, intelligent computing power network, providing access to large-scale infrastructure. | World Economic Forum |

| Qualcomm | September 2024 | Partnership to integrate and optimize smaller Baichuan LLMs (e.g., Baichuan-7 B) to run on devices in China powered by Qualcomm chips, developing on-device AI infrastructure. | Calcalistech |

Geographic Focus: Baichuan Intelligence Deepens AI Infrastructure Dominance in China

Baichuan Intelligence’s operations and strategic partnerships are almost exclusively concentrated within China, a deliberate focus driven by access to domestic capital, national infrastructure partners, and the need to serve the local market.

- From its inception, Baichuan’s funding has been sourced from Chinese tech giants like Alibaba, Tencent, and Xiaomi, anchoring its growth within the domestic ecosystem.

- Key infrastructure partnerships with China Mobile on a national computing grid and collaborations with entities like ANT GROUP and Beijing Children’s Hospital solidify its presence and reliance on the Chinese market.

- The strategy of developing on-device AI with Qualcomm for the Chinese market further illustrates a focus on adapting its technology for local deployment, partly in response to geopolitical factors like US trade restrictions on advanced AI chips.

Baichuan Ranked in China’s AI Market

This chart reinforces the section’s focus on the Chinese market by benchmarking Baichuan’s strategy and capabilities against domestic competitors like Alibaba and Baidu.

(Source: Omdia – Informa)

Technology Maturity: Baichuan Intelligence Advances from Foundational Models to Commercial-Grade Vertical AI

Baichuan’s technology has rapidly matured from developing open-source, general-purpose models to creating highly specialized, commercially-deployed AI systems that demonstrate superior performance in specific, high-barrier industries.

- Between 2023 and 2024, Baichuan focused on establishing its foundational technology by releasing open-source models like the Baichuan 2 series, trained on 2.6 trillion tokens, which served as a public R&D and community-building tool.

- In 2025, the company’s technology demonstrated increased maturity with the release of Baichuan-Audio, a unified framework for speech interaction, indicating a move toward multi-modal capabilities.

- The launch of the medical-specific Baichuan-M 3 in January 2026 marks the highest level of technological maturity, with the model outperforming generalist models like GPT-5.2 on specific medical benchmarks and achieving real-world deployment at Beijing Children’s Hospital.

Baichuan’s Models Lead in Context Length

This chart provides a concrete example of the technological maturity discussed, showing how Baichuan’s model significantly outperforms competitors on a key technical metric.

(Source: Maginative)

SWOT Analysis: Assessing Baichuan Intelligence’s Strategic Position in AI

Baichuan Intelligence’s primary strength lies in its strategic pivot to a defensible niche, backed by substantial capital, but this focus introduces risks related to market size and execution in a complex industry.

- Strengths have evolved from rapid fundraising to demonstrated technological superiority in a chosen vertical.

- Weaknesses have shifted from general market competition to the specific challenges of the healthcare sector and internal strategic alignment.

- Opportunities now center on dominating a high-barrier market rather than just participating in the broader AI race.

- Threats remain consistent, revolving around intense competition and regulatory hurdles, now specified to the healthcare domain.

Table: SWOT Analysis for Baichuan Intelligence

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Massive fundraising (~$1 B) from tech giants Alibaba and Tencent. Rapid development of open-source foundational models (Baichuan 2 series). | Demonstrated superior performance in a vertical with Baichuan-M 3. Deep integration partnerships (ANT GROUP, Beijing Children’s Hospital). Strong cash reserves (3 billion RMB). | The company validated its ability to translate capital into a specialized, high-performing technology asset rather than just competing on general model size. |

| Weaknesses | High cash burn for compute resources. Lack of a clear commercialization path beyond open-source models and consumer apps. Intense competition in the general LLM market. | Narrowed total addressable market due to healthcare focus. Exposed to long sales cycles and regulatory complexity of healthcare. Internal friction (co-founder resignations in March 2025). | The pivot solved the problem of differentiation in a crowded market but created new weaknesses related to execution in a notoriously difficult vertical. |

| Opportunities | Growing demand for generative AI in China. Building a developer ecosystem around its open-source models. | Achieve defensible market leadership and a clear path to profitability in a high-barrier-to-entry vertical. Avoid a direct, costly war over general AI supremacy. | The company exchanged the broad opportunity of general AI for the deeper, more defensible opportunity of vertical AI dominance. |

| Threats | US sanctions on high-performance AI chips. The “war of a hundred models” leading to market consolidation and price wars in China. | Intense competition from general-purpose models from peers like Zhipu AI and Deep Seek also targeting enterprise verticals. Navigating complex healthcare data and privacy regulations. | The primary threat shifted from being out-competed on general model capabilities to being out-maneuvered in commercializing a specialized solution. |

Forward-Looking Outlook: Baichuan Intelligence’s Success Hinges on Healthcare Commercialization

The critical factor for Baichuan Intelligence’s future success is its ability to translate its technological leadership in medical AI into tangible commercial contracts and revenue within the healthcare sector.

- The primary indicator to monitor is the commercial adoption of the Baichuan-M 3 model, including the number of hospital contracts signed and its performance in clinical environments.

- While competitors like Zhipu AI and Mini Max pursued IPOs, Baichuan’s substantial cash reserves of 3 billion RMB give it strategic patience, but pressure from investors like Alibaba and Tencent for an eventual exit remains a key factor.

- The stability of its leadership team and its unwavering commitment to the healthcare strategy will be crucial, especially following the departure of two co-founders in March 2025 over the strategic pivot.

Frequently Asked Questions

What is Baichuan Intelligence’s current business strategy?

Baichuan Intelligence has pivoted its strategy from creating general-purpose AI models to developing specialized, high-value AI infrastructure for specific industries. Its primary focus since March 2025 has been the healthcare vertical, marked by the launch of the Baichuan-M 3 medical LLM and a partnership with Beijing Children’s Hospital.

How did Baichuan Intelligence raise its capital?

Baichuan secured over $1 billion in funding. This includes an initial $50 million from its founder in April 2023, a $300 million Series A1 round in October 2023, and a massive ~$691 million (RMB 5 billion) Series A round in July 2024. Key investors include major Chinese tech corporations like Alibaba, Tencent, and Xiaomi.

Who are Baichuan’s key strategic partners and why are they important?

Baichuan has several key partners for different purposes: 1) Beijing Children’s Hospital and ANT GROUP for applying its AI models to specific verticals (healthcare and fintech). 2) China Mobile and Infinigence AI to secure access to essential large-scale computing power without building its own data centers. 3) Qualcomm to develop on-device AI by optimizing smaller models for smartphones and computers.

What is Baichuan’s most advanced technology and how is it being used?

Baichuan’s most advanced technology is the Baichuan-M 3, a medical-specific Large Language Model (LLM) launched in January 2026. It is being commercially deployed through a partnership with Beijing Children’s Hospital to create a specialized pediatric health model, demonstrating its real-world application in a high-value sector.

What is the biggest challenge for Baichuan Intelligence’s future success?

The most critical challenge for Baichuan is successfully commercializing its specialized technology. Its future success hinges on its ability to translate its leadership in medical AI, specifically the Baichuan-M 3 model, into tangible revenue through commercial contracts with hospitals and other healthcare entities.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.