The AI-Native Moat: Why Structural Advantages Define Market Leadership in 2025

AI-Native Adoption Risks: How the 2025 Performance Gap Creates Commercial Barriers

The primary risk for incumbents is not a failure to use artificial intelligence, but a failure to adopt an AI-native operating model, which is creating an irreversible performance and cost structure disadvantage. While most companies are experimenting with AI, only a small fraction are achieving the deep, structural integration that unlocks compounding competitive advantages, leaving the rest to face diminishing returns and escalating competitive pressure.

- In the period from 2021 to 2024, corporate AI adoption was characterized by bolting AI tools onto legacy systems and running pilot programs. However, a 2025 MIT report reveals that approximately 95% of these generative AI pilots stall and fail to deliver meaningful revenue, indicating a systemic failure to move beyond experimentation.

- The market has shifted in 2025 from peripheral automation to core business model transformation. AI-native disruptors and forward-thinking incumbents like Goldman Sachs are not just using AI tools; they are rebuilding their core architecture and workflows around intelligent, agentic automation.

- The outcome is a clear bifurcation. A 2025 MIT report indicates only 5% of enterprises have deeply integrated AI at scale. This small group is achieving non-linear scalability, accelerated innovation, and superior cost structures that are structurally unattainable for companies treating AI as a simple add-on.

- Companies that successfully scale AI report 20–30% productivity improvements and 15–25% EBITDA growth. This demonstrates a quantifiable performance gap that is widening as early adopters compound their data and operational advantages.

AI-Native Models Reshape Corporate Structures

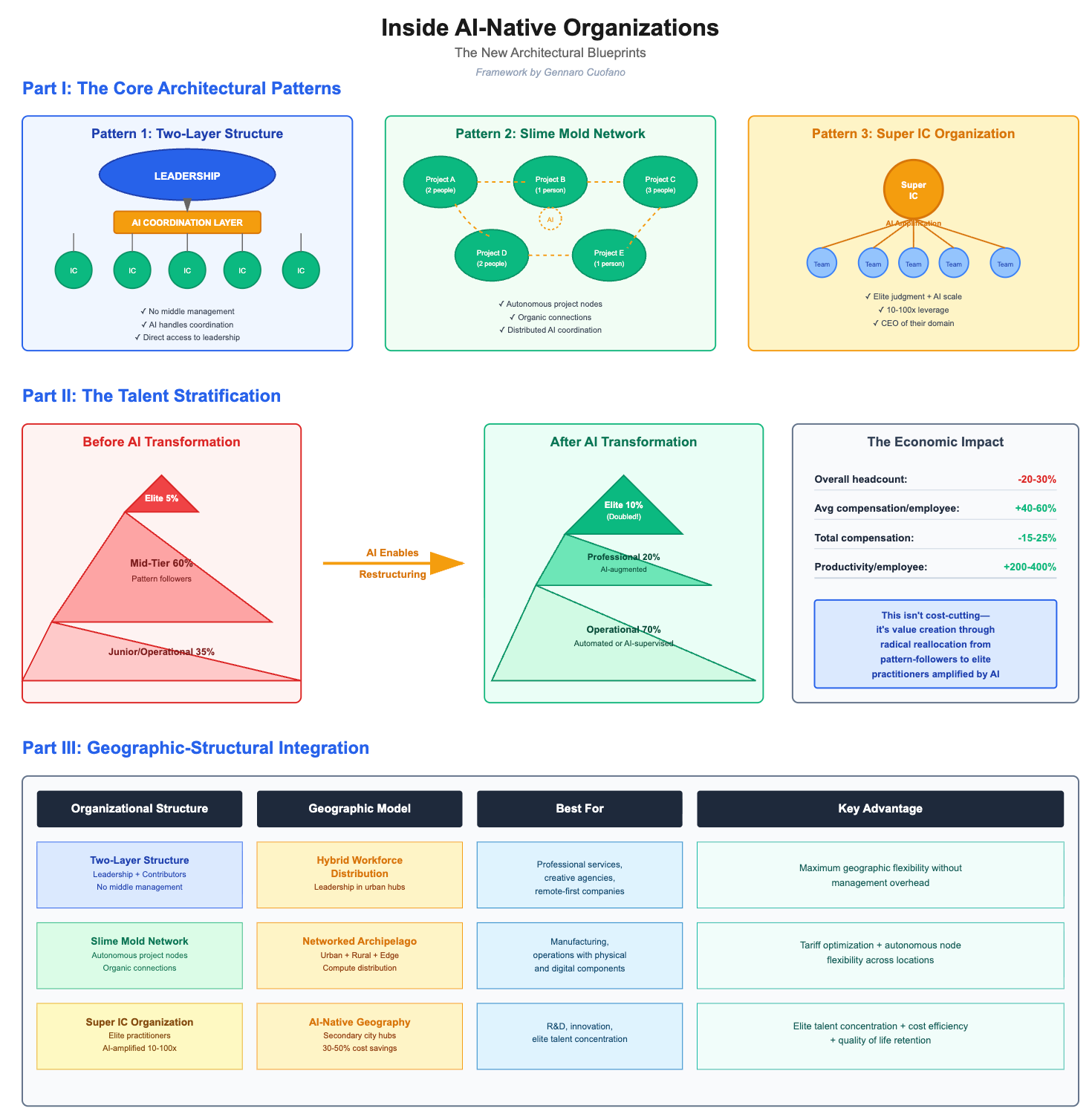

This chart visualizes the new AI-native operating model discussed in the section. It illustrates the structural shift away from traditional hierarchies that creates the performance and cost disadvantage for laggards.

(Source: The Business Engineer)

Strategic AI Investments in 2025: Capital Flows Signal a Widening Divide

Major capital expenditures and venture funding in 2025 are directed toward the fundamental re-architecting of corporate structures, decisively favoring AI-native models over incremental upgrades. Investment patterns show that capital is flowing not just to develop new AI products but to build the computational and organizational backbone required to operate as an AI-native entity, a transition that is prohibitively expensive for laggards.

Enterprise AI Market Explodes to $37B

This chart quantifies the massive capital flows into AI described in the section. The exponential market growth to $37 billion by 2025 directly reflects the strategic investments being made in AI-native architecture.

(Source: Menlo Ventures)

- Hyperscale incumbents are making massive structural investments, exemplified by Microsoft’s planned ~$80 billion in AI-related capital expenditures. This spending is not for incremental product features but to build the computational foundation for the entire AI economy and rewire its own enterprise operations.

- Venture capital firms like General Catalyst are channeling billions into funding and scaling new AI-native companies. This strategy bypasses incumbents entirely, instead building a new generation of competitors designed from the ground up to leverage AI for non-linear growth.

- The difficulty and cost for legacy companies to adapt is highlighted by the billions being invested by firms like Deloitte and Mc Kinsey into AI partnerships. These initiatives are designed to bridge the chasm between existing enterprise structures and the requirements of an AI-native model, signaling a complex and expensive transformation that few can manage independently.

Table: Strategic AI Investments and Initiatives in 2025

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Microsoft Capital Expenditures | 2025 onwards | An estimated $80 Billion is planned for AI-related capex to build the computational backbone for the AI revolution and integrate AI across all internal business functions. | The AI Supercycle: Top 15 AI Companies – by Sergey |

| NVIDIA / Nokia Strategic Partnership | October 2025 | Develop and deploy next-generation AI-native 6 G mobile networks and AI services, embedding AI into the core of future telecommunications infrastructure. | NVIDIA and Nokia to pioneer the AI platform for 6 G |

| Big Five Consulting Partnerships | April 2025 | Consulting giants are investing billions in partnerships with AI providers to bridge the gap between AI technology and enterprise implementation, helping legacy clients transform. | Big Five Consulting: Betting Billions on AI Partnerships |

| General Catalyst AI Investments | October 2025 | The venture capital firm is investing billions to fund and scale AI-native companies designed to transform industries like healthcare and finance from the ground up. | Unveiling Percepta |

| Amazon Investment in Anthropic | March 2024 | Amazon invested $2.75 billion as part of a $4 billion commitment to strengthen its AWS AI offerings and provide customers access to leading AI models, competing directly with Microsoft. | The Opportunities, Risks, And Rewards Of AI Acquisitions |

| Microsoft Investment in Open AI | January 2023 | A multi-year, $10 billion investment to integrate cutting-edge AI models across its ecosystem and secure a long-term competitive advantage. | AI Investors: Act Fast, Act Wisely |

Global AI-Native Leadership: US Tech Giants Solidify Dominance in 2025

The United States continues to lead the AI-native transition, as its hyperscale technology companies control the foundational infrastructure, capital, and partnerships that define the market. While adoption is global, the core technology development and economic value capture remain highly concentrated within a few US-based firms, creating dependencies for companies in other regions.

Hyperscalers Dominate 2025 Generative AI Market

This chart provides direct evidence for the section’s claim of US tech giant dominance. It shows the significant market share controlled by hyperscalers like NVIDIA and Microsoft in the foundational AI market of 2025.

(Source: IoT Analytics)

- Between 2021 and 2024, US tech giants like Microsoft, Amazon, and Alphabet made strategic, multi-billion dollar investments in foundation model companies like Open AI and Anthropic. These moves secured their market position and were significant enough to trigger an FTC inquiry in January 2024 over market concentration.

- By 2025, these early investments have translated into clear market dominance. Microsoft now commands 39% of the generative AI market, while NVIDIA holds a commanding 92% share of the datacenter GPU market, creating a powerful duopoly at the infrastructure and platform layers.

- International firms demonstrate successful adoption but also reliance on this US-led ecosystem. For example, the Danish company Topsoe achieved an impressive 85% AI adoption rate by deeply integrating Microsoft’s AI tools, highlighting how global innovation is often powered by US technology.

- Asian companies like Rakuten Mobile in Japan exemplify the successful application of AI-native principles by building a fully virtualized network from the ground up. However, this model still relies on the broader AI infrastructure and hardware provided by leaders like NVIDIA and cloud platforms.

AI-Native Model Maturity 2025: From Pilot Programs to Scaled Commercial Advantage

AI-native models have matured from conceptual pilots into commercially proven systems that deliver quantifiable and compounding advantages in speed, efficiency, and scalability. The key differentiator is no longer access to AI technology, which is becoming commoditized, but the organizational ability to build a business model around it, a capability that has been validated by the rapid success of AI-native firms in 2025.

AI Startups Show Unprecedented Growth Speeds

Illustrating the ‘scaled commercial advantage’ of mature AI models, this chart shows AI startups reaching $100M in revenue at a record pace. This validates the section’s point about the rapid, proven success of AI-native firms.

(Source: Bessemer Venture Partners)

- The period of 2021-2024 was defined by widespread AI experimentation, but its limitations are now clear, with 95% of generative AI pilots in legacy firms failing to scale. This signals that the technology’s value is locked without a corresponding change in the operating model.

- The commercial viability of the AI-native approach was validated in 2025, with data showing that AI-native companies can achieve $1 B in annual recurring revenue in just over one year. This is a pace that traditional Saa S companies, which often take over four years to reach the same milestone, cannot match.

- The technology has matured beyond simple automation to enable new organizational structures like the “agentic operating model, ” where AI agents execute complex, cross-functional workflows. This represents a fundamental shift in how corporations can be structured and managed for real-time decision-making.

- Real-world case studies in 2025 confirm the technology’s maturity for enterprise-wide deployment. Topsoe’s ability to achieve 85% adoption among office employees in seven months, saving 800 hours per month and accelerating decisions by 50%, proves the tangible business outcomes of a deeply integrated AI strategy.

SWOT Analysis: Competitive Dynamics of AI-Native Business Models

The primary strength of the AI-native model is its compounding data flywheel and superior operational efficiency, which create durable competitive moats. However, its core weakness is the high organizational barrier to entry for incumbents, which are struggling to retrofit their legacy structures, creating a stark and widening bifurcation in the market.

- Strengths are validated by hyper-efficiency, with AI-native adopters reporting 20-30% productivity improvements and non-linear scalability, as seen in their ability to reach $1 B ARR in record time.

- Weaknesses are exposed by the 95% failure rate of generative AI pilots in traditional firms, proving the bottleneck has shifted from technology access to organizational and structural inertia.

- Opportunities lie in creating entirely new, defensible business models, such as agentic AI advisors and autonomous service delivery, allowing innovators to capture new markets before incumbents can react.

- Threats include increasing market consolidation by a few hyperscalers like Microsoft and NVIDIA, growing regulatory scrutiny evidenced by the FTC’s inquiry, and the ultimate risk of permanent competitive irrelevance for laggards.

Table: SWOT Analysis for AI-Native Business Models and Structural Advantages

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Validated |

|---|---|---|---|

| Strengths | Productivity gains from AI tools; early signs of cost savings. | Compounding data advantages; non-linear scalability ($1 B ARR in 1-2 years); superior cost structures (15-25% EBITDA growth); accelerated innovation cycles. | The advantage shifted from incremental efficiency gains to a durable, systemic competitive moat built on a superior operating model. |

| Weaknesses | High cost of AI development; scarcity of specialized AI talent. | Extreme difficulty of retrofitting legacy systems; 95% of Gen AI pilots stalling; organizational resistance to deep structural change. | The primary constraint evolved from a technological or financial challenge to a deeply entrenched organizational one. |

| Opportunities | Automating existing tasks; enhancing existing software and services with AI features. | Creating entirely new business models (agentic AI); “refounding” companies around AI (e.g., Goldman Sachs); capturing new markets with AI-first products. | The strategic focus shifted from optimizing what exists to inventing what is next, a far more valuable proposition. |

| Threats | Rapid commoditization of AI algorithms; new startup competition. | Market domination by hyperscalers (NVIDIA’s 92% GPU share, Microsoft’s 39% Gen AI share); regulatory scrutiny (FTC inquiry); permanent competitive irrelevance for laggards. | The threat moved from competition over features to systemic lock-in at the platform and infrastructure level. |

2026 Outlook: The Widening Moat and the Imperative for Structural Change

The critical path forward for incumbents is to pursue fundamental organizational “refounding” around AI; otherwise, the performance gap with AI-native leaders will become insurmountable by 2026. Merely buying more AI tools will not close the gap. The focus must shift to rebuilding the operating model, talent stack, and decision-making processes from the ground up.

Framework Outlines AI-Native Business Transformation

This chart provides a clear ‘path forward’ for the structural change mandated in the section’s outlook. It details the key components required for the ‘fundamental organizational refounding’ around AI.

(Source: The Business Engineer)

- If this happens: Hyperscale infrastructure providers like Microsoft and NVIDIA continue their massive capital expenditures, further strengthening their control over the foundational AI stack.

- Watch this: An increase in acquisitions of smaller AI-native firms by large, slow-moving incumbents. This will be a signal that legacy companies have failed to build their own capabilities and are now forced to buy their way into relevance, often at a high premium.

- These could be happening: The “Gen AI Divide” will solidify into a permanent market structure. Gartner’s prediction that AI-first firms will achieve 25% better business outcomes will become a baseline expectation, forcing laggards into a cycle of declining profitability and market share as their cost structures and innovation speed fall irreversibly behind.

Frequently Asked Questions

What is the difference between just using AI and being ‘AI-native’?

According to the article, simply using AI involves ‘bolting AI tools onto legacy systems’ for peripheral automation. In contrast, being AI-native means rebuilding a company’s core architecture and workflows around intelligent automation. It’s a deep, structural integration that transforms the entire business model, not just adding a new tool.

Why are 95% of corporate generative AI pilots failing to scale?

The text states that these pilots fail because they represent a ‘systemic failure to move beyond experimentation.’ Companies are not undertaking the deep structural changes required to integrate AI into their core operating model. The primary bottleneck has shifted from a technological challenge to an ‘organizational and structural inertia,’ which prevents these pilots from delivering meaningful revenue or scaling effectively.

What is the ‘performance gap’ created by AI-native models?

The performance gap is the quantifiable and widening difference in business outcomes between AI-native companies and others. The article quantifies this gap with metrics like 20–30% productivity improvements and 15–25% EBITDA growth for companies that successfully scale AI. This advantage compounds over time, making it structurally unattainable for companies treating AI as a simple add-on.

Which companies are leading the AI-native market in 2025?

The article identifies US hyperscale technology companies as the dominant leaders. Specifically, it highlights Microsoft, with 39% of the generative AI market, and NVIDIA, with a 92% share of the datacenter GPU market, as a powerful duopoly at the infrastructure layer. Other firms like Goldman Sachs and international companies like Topsoe are mentioned as successful adopters, but often rely on the technology provided by these US leaders.

Is it too late for companies that are behind to catch up?

The article suggests it is extremely difficult but not impossible, though the window is closing. The path forward is not to simply buy more AI tools but to pursue a ‘fundamental organizational “refounding” around AI,’ which involves rebuilding the operating model, talent, and decision-making processes. The text warns that without this deep, structural change, the performance gap will become ‘insurmountable by 2026,’ leading to permanent competitive irrelevance.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.