AI Infrastructure in 2025: How GPU and Cloud Dominance Shapes Corporate Decision-Making

AI Adoption Risks in 2025: Infrastructure Dependencies Define Commercial Scale

The corporate transition to AI-native decision-making is critically dependent on a highly concentrated supply of specialized hardware and cloud infrastructure, creating a systemic risk for enterprises seeking to achieve commercial scale. This dependency on a few foundational providers has become the central constraint shaping the pace and structure of AI adoption. The primary risk is no longer a lack of AI tools, but a lack of access to the underlying computational power required to run them effectively.

- Between 2021 and 2024, enterprises adopted AI as a software application to optimize discrete processes, exemplified by UPS using its ORION platform for route logistics. The focus was on layering AI tools onto existing systems, making infrastructure a secondary consideration.

- From 2025 onward, the paradigm shifted to AI-native models where the infrastructure stack is a core component of business strategy. The overwhelming majority of C-level executives, 96%, now believe AI will transform decision-making, elevating the importance of the underlying hardware and cloud platforms.

- This shift has exposed a critical vulnerability: market concentration. NVIDIA holds an estimated 92% market share in the data center GPU segment, the essential hardware for training and deploying advanced AI. This gives a single company immense influence over the entire ecosystem.

- A similar concentration exists at the cloud platform layer, where Microsoft and Amazon Web Services (AWS) are market leaders in foundation models and management platforms. Enterprises increasingly access AI capabilities through these providers, making them gatekeepers to innovation.

- The result is a new strategic risk profile for enterprises. Their ability to deploy AI-driven decision systems is now tied to the supply chain stability, pricing, and strategic priorities of a small number of US-based technology giants.

AI’s Evolving Role Drives Infrastructure Demand

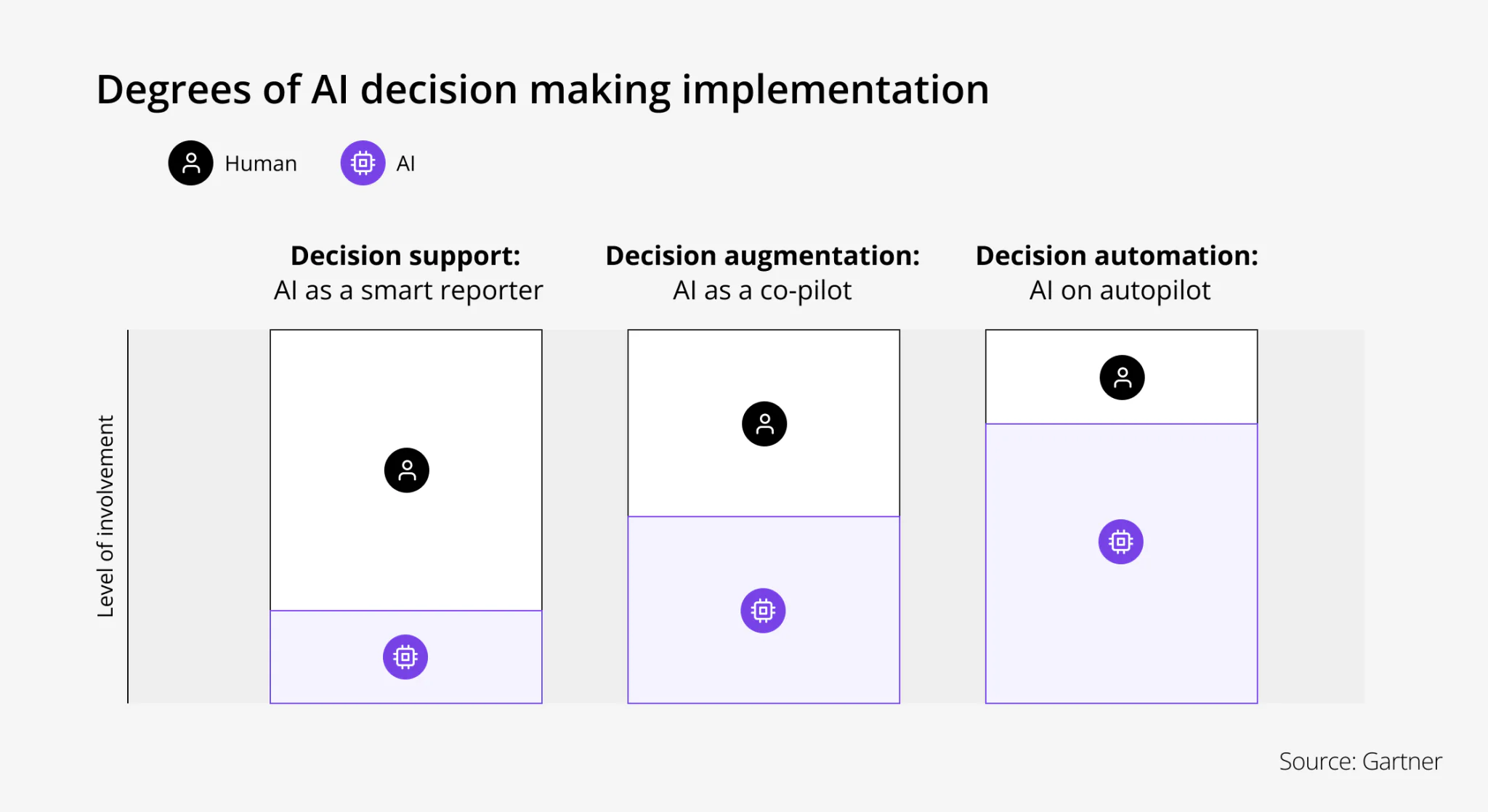

This chart illustrates the progression toward AI decision automation. This evolution requires the at-scale infrastructure discussed in the section, creating the dependency risks at the commercial level.

(Source: Euristiq)

Strategic AI Investments: Cloud and Platform Partnerships Dominate Capital Allocation

Enterprise capital for AI is increasingly directed toward strategic partnerships with foundational cloud and platform providers, signaling a clear “build-on” rather than “build-it-yourself” approach to accessing critical infrastructure. This trend is driven by the recognition that developing proprietary, at-scale AI infrastructure is unfeasible for most organizations, making large-scale service agreements the primary vehicle for transformation.

Cloud-Based AI Market to Exceed $140B

The chart quantifies the massive market for cloud-based AI, validating the section’s point that enterprise capital is consolidating around strategic cloud partnerships.

(Source: Market.us)

- The five-year, $1.1 billion partnership between The Coca-Cola Company and Microsoft, announced in April 2024, exemplifies this strategy. It commits Coca-Cola to the Azure Open AI ecosystem to drive business operations, a clear financial validation of dependency on a single vendor’s infrastructure.

- Palantir’s reported 36% revenue growth in 2025, driven by its Artificial Intelligence Platform (AIP), further demonstrates the market’s high valuation of integrated, decision-centric AI systems. Customers are paying a premium for platforms that abstract away the complexity of managing underlying data and models.

- The finding that CEOs are becoming the primary AI decision-makers, with their share of this role doubling to 72% by 2026, confirms that infrastructure and platform choices are now core strategic issues. These are no longer delegated IT decisions but are central to corporate growth and risk management.

Table: Key Strategic AI Investments and Commitments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| The Coca-Cola Company / Microsoft | April 2024 | A five-year, $1.1 billion commitment to use Microsoft’s cloud and Azure Open AI services. The purpose is to co-develop generative AI use cases to improve marketing, manufacturing, and supply chain operations. | The Coca‑Cola Company and Microsoft announce five … |

| Palantir Revenue Growth | 2025 | The company’s Artificial Intelligence Platform (AIP) drove a 36% revenue growth. This validates strong market demand for enterprise-grade, decision-making AI platforms. | Top 10: AI Companies |

| CEO-Led AI Investment | 2026 (Projected) | 72% of CEOs are projected to be the primary decision-makers for AI strategy and investment. This indicates a strategic shift where AI infrastructure is viewed as a core business asset. | As AI Investments Surge, CEOs Take the Lead on Decision … |

AI Partnership Ecosystem: How Alliances with Cloud Giants Shape Decision-Making Capabilities

The AI ecosystem is consolidating around a few core technology providers, with strategic alliances becoming the primary mechanism for enterprises to access advanced decision-making capabilities. These partnerships reveal a clear power structure where platform owners like Google, Microsoft, and Palantir provide the infrastructure and models, while other firms integrate them to deliver specialized solutions.

Partnerships Enable AI-Augmented Decision-Making

The section describes how alliances provide decision-making capabilities. This chart visualizes one such capability: a framework where AI suggestions augment human judgment.

(Source: Django Stars)

- The expanded global partnership between Accenture and Palantir in December 2025 is designed to scale AI for operational decision-making. This alliance combines Palantir’s data integration platform with Accenture’s implementation services, creating a go-to-market channel built on Palantir’s core infrastructure.

- The partnership between S&P Global and Google Cloud in December 2025 focuses on combining S&P’s extensive datasets with Google’s AI infrastructure. This model enables large-scale enterprise transformation by connecting proprietary data directly to a powerful computational backbone.

- Open AI’s partnership with Cisco, announced in January 2026, embeds its AI agents into enterprise engineering workflows to automate tasks like defect fixes. This shows how foundational model providers are extending their reach into specific business processes through partnerships with established enterprise vendors.

- The collaboration between SAP and NVIDIA in June 2024 aims to embed generative AI across SAP’s cloud portfolio. This alliance leverages NVIDIA’s technology to fine-tune AI models for specific business functions, demonstrating how even large software companies rely on specialized hardware providers.

Table: Notable AI Infrastructure and Platform Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Cisco and Open AI | Jan 2026 | Integration of Open AI’s AI software agents into enterprise engineering workflows to automate complex tasks like software defect fixes. This aims to increase development speed and reduce manual effort. | Cisco and Open AI redefine enterprise engineering with AI … |

| Accenture and Palantir | Dec 2025 | Expanded global partnership to help enterprises scale AI and improve operational decision-making. Combines Palantir’s data integration platform with Accenture’s implementation expertise. | Accenture and Palantir Expand Global Strategic … |

| S&P Global and Google Cloud | Dec 2025 | Strategic partnership to leverage advanced AI and data distribution. The goal is to combine S&P Global’s datasets with Google’s AI infrastructure to drive large-scale enterprise transformation. | S&P Global Advances AI-Powered Enterprise Transformation … |

| SAP and NVIDIA | Jun 2024 | Partnership to embed generative AI capabilities into SAP’s cloud solutions. Leverages NVIDIA’s AI technology to fine-tune large language models for domain-specific business tasks. | SAP’s New AI Innovations and Partnerships Deliver Real- … |

Geographic Concentration: US Tech Giants Control the Global AI Infrastructure Layer

The foundational infrastructure for AI-driven decision systems, from semiconductor design to cloud platforms, is overwhelmingly concentrated within a small number of United States-based technology corporations. This geographic consolidation gives the region a decisive structural advantage and creates a significant dependency for global companies seeking to adopt leading-edge AI capabilities.

- Between 2021 and 2024, AI software development occurred globally, but the key platform providers were already consolidating in the U.S. Companies like AWS and Google Cloud became the default platforms for many machine learning projects worldwide.

- From 2025 onward, this concentration has solidified into clear market dominance. U.S. companies including NVIDIA (hardware), Microsoft, AWS, Google (cloud platforms), Open AI (foundational models), and Palantir (decision intelligence) form the critical infrastructure stack for the global economy.

- This creates a dependency for companies outside the U.S. For example, the German software corporation SAP now actively partners with U.S. firms like Google Cloud, Microsoft, and NVIDIA to embed generative AI into its own product portfolio, underscoring its reliance on U.S.-based infrastructure.

- Global strategic alliances reinforce this dynamic. The partnership between Ireland-based Accenture and U.S.-based Palantir, and the collaboration between S&P Global and Google Cloud, illustrate how access to advanced AI is often brokered through U.S. technology leaders.

Technology Maturity: Foundational AI Infrastructure Reaches Commercial Scale, Creating New Dependencies

The underlying hardware and cloud platforms for AI are now commercially mature and scalable, but this maturity has created a new set of strategic challenges. The core problem for enterprises has shifted from developing functional AI technology to securing access to the dominant infrastructure platforms and managing the resulting vendor dependency.

Analytics Matures From Reporting to AI Intelligence

This chart directly aligns with the section’s ‘Technology Maturity’ theme, mapping the evolution from basic analytics to the sophisticated AI-driven intelligence now reaching commercial scale.

(Source: tkxel)

- In the period from 2021 to 2024, the primary focus was on maturing AI models and proving their return on investment in specific applications. The infrastructure, while important, was largely treated as a utility to support these experiments.

- By 2025, the infrastructure itself has become a mature, commercially dominant product layer. NVIDIA’s GPUs, such as the Blackwell B 200, and AI services from Microsoft Azure and AWS are no longer experimental. They represent the industry standard required for any serious enterprise AI initiative.

- Evidence of this maturity is the widespread adoption, with 88% of enterprises actively advancing their decision intelligence capabilities. The conversation has moved from “if” to “how, ” focusing on building “AI-native” architectures that presuppose a robust infrastructure layer.

- The new bottleneck is integration and access, not invention. The fact that only 1% of companies believe they have reached a mature stage of AI integration highlights this challenge. The difficulty now lies in re-architecting the business around these powerful but concentrated platforms without ceding too much strategic control.

SWOT Analysis: The Infrastructure Powering AI-Native Decision Systems

The consolidated power of foundational AI infrastructure providers offers enterprises immense strength through scalable, mature platforms but simultaneously introduces significant weaknesses and threats related to vendor dependency, cost, and market access. This duality defines the strategic landscape for any company pursuing an AI-native transformation.

AI’s Role in Decisions Nears 80% by 2026

This projection highlights the immense opportunity in AI-powered decisions, providing critical context for the SWOT analysis by quantifying the high stakes of the market.

(Source: Euristiq)

- Strengths have evolved from discrete tools to fully scaled, powerful platforms that enable entirely new business models.

- Weaknesses have shifted from internal skill gaps to external dependencies on a concentrated group of hardware and cloud vendors.

- Opportunities have expanded from task automation to the creation of hyper-efficient, AI-native companies.

- Threats are now more systemic, involving supply chain risks and the pricing power of a few dominant infrastructure providers.

Table: SWOT Analysis for AI Decision-Making Infrastructure

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Growing ecosystem of AI tools for specific tasks; initial cloud offerings for machine learning (e.g., AWS Sage Maker). | Highly scalable and powerful infrastructure from leaders like NVIDIA (B 200 GPU), Microsoft (Azure AI), and AWS (Bedrock) enables real-time, AI-native decision models. | The infrastructure layer has matured from a collection of tools into a dominant, commercially-scaled platform that enables new business models with high capital efficiency. |

| Weaknesses | High cost of specialized AI talent; internal data silos preventing effective model training; long development cycles for custom AI. | Extreme market concentration in critical hardware (NVIDIA’s 92% share) and cloud platforms. High “legacy system drag” prevents traditional companies from integrating new systems. | The primary weakness shifted from internal organizational challenges to external structural dependencies on a few key vendors, creating a new form of systemic risk. |

| Opportunities | Automating specific business processes like logistics (UPS ORION) or customer service to gain incremental efficiency. | Building “AI-native” businesses with extreme capital efficiency (e.g., reaching $500 million in revenue with under 100 employees). Leveraging partnerships (e.g., Coca-Cola/Microsoft) to accelerate transformation. | The opportunity evolved from improving existing operations to creating fundamentally new, hyper-efficient business models built with AI at their core from day one. |

| Threats | Data privacy regulations; algorithmic bias; security vulnerabilities in AI models. | Supply chain disruptions for critical hardware (GPUs). Unchecked pricing power of dominant platform providers. Geopolitical risks tied to the geographic concentration of infrastructure in the U.S. | Threats became more systemic and geopolitical, moving from software-level concerns to vulnerabilities in the physical and digital supply chain of AI. |

Forward Outlook: Will Infrastructure Bottlenecks Constrain AI-Native Growth?

If the extreme concentration in foundational AI infrastructure persists, the most critical signal to monitor will be the pricing and partnership terms set by hardware and cloud providers, as these will directly dictate the pace, cost, and accessibility of the AI-native transition for all other enterprises. The future of corporate competition may be decided not by who has the best ideas, but by who can secure affordable, at-scale access to the underlying computational power.

CEOs and CTOs Are Primary AI Decision-Makers

The forward outlook discusses AI access as a key strategic issue. This chart confirms its strategic importance by showing that C-suite executives are leading AI decisions.

(Source: The Futurum Group)

- If this happens: If NVIDIA, Microsoft, and AWS maintain or increase their market dominance through 2026…

- Watch this: Monitor for sustained price increases on GPU capacity and premium cloud AI services. Closely analyze the terms of new large-scale enterprise partnerships to see if they become more restrictive or demand greater data or intellectual property concessions.

- These could be happening: We could see a market fragmentation into two tiers. The first tier would consist of companies that can afford to partner with the dominant infrastructure providers, enabling them to become truly AI-native. The second tier would be left with less capable, lower-cost alternatives, putting them at a permanent competitive disadvantage. This pressure may also catalyze a search for viable open-source models and alternative hardware, but the dominance of the incumbents presents a formidable barrier.

Frequently Asked Questions

What is the biggest risk for companies adopting AI in 2025?

According to the article, the biggest risk is the dependency on a highly concentrated supply of specialized hardware and cloud infrastructure. The primary risk is no longer a lack of AI tools, but a lack of access to the underlying computational power from dominant providers like NVIDIA, Microsoft, and AWS, which creates a systemic risk for achieving commercial scale.

How are companies like Coca-Cola approaching AI adoption?

Companies are adopting a “build-on” rather than a “build-it-yourself” strategy. The Coca-Cola Company’s five-year, $1.1 billion partnership with Microsoft is a key example. This strategy involves committing to a foundational provider’s ecosystem (in this case, Microsoft Azure Open AI) to access critical infrastructure and co-develop AI solutions, rather than attempting to build it in-house.

Why is AI infrastructure suddenly a concern for CEOs and not just IT departments?

The paradigm has shifted from using AI to optimize discrete processes to building “AI-native” business models where infrastructure is a core strategic component. With 96% of C-level executives believing AI will transform decision-making, infrastructure choices are now central to corporate growth and risk management. This is why the share of CEOs acting as primary AI decision-makers is projected to double to 72% by 2026.

How concentrated is the AI infrastructure market?

The market is extremely concentrated. The article states that NVIDIA holds an estimated 92% market share in the data center GPU segment, the essential hardware for advanced AI. A similar concentration exists in cloud platforms, where Microsoft and Amazon Web Services (AWS) are the dominant leaders. This entire foundational stack is overwhelmingly controlled by a small number of U.S.-based technology giants.

What is the main threat to enterprises in this new AI landscape?

The threats have become more systemic and are tied to the infrastructure supply chain. The SWOT analysis identifies the key threats as potential supply chain disruptions for critical hardware (GPUs), the unchecked pricing power of dominant platform providers, and geopolitical risks stemming from the geographic concentration of AI infrastructure in the U.S.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.