Fuel Cells Power Data Centers in 2025: The AI Boom

Fuel Cells Emerge as Critical Infrastructure for AI-Driven Data Centers

Fuel cells have transitioned from a niche clean energy alternative to a critical, mainstream solution for powering data centers, driven by the urgent need for reliable, scalable, and rapidly deployable energy to support the AI boom. This shift is underscored by massive deployments in 2025, including a strategic collaboration led by Fuel Cell Energy for up to 360 MW of off-grid power, a landmark 100 MW utility order from American Electric Power for Bloom Energy’s fuel cells, and Equinix’s expansion past the 100 MW milestone. The dominant theme for 2025 is the strategic adoption of behind-the-meter (BTM) and grid-independent power to circumvent public utility constraints and accelerate time-to-market for high-density computing infrastructure.

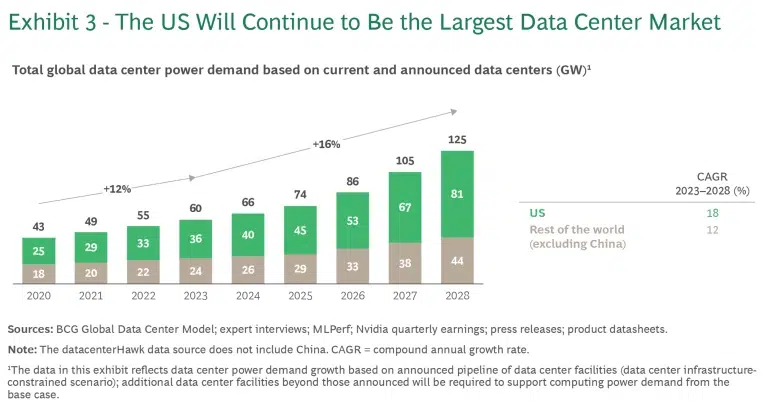

Data Center Power Demand to Double by 2028

This forecast shows the dramatic growth in power consumption driving the need for alternative energy sources. The U.S. is projected to lead this surge, creating a critical need for solutions like fuel cells.

(Source: Boston Consulting Group)

1. Fuel Cell Energy’s Off-Grid Methane-to-Power Project

Company/Partners: Fuel Cell Energy, Inc., Diversified Energy Company PLC, TESIAC

Capacity: Up to 360 MW

Application: Creating a development company to convert coal mine methane and natural gas into reliable, off-grid power for U.S. data centers.

Source: Diversified Energy, Fuel Cell Energy, and TESIAC Collaborate …

2. Equinix’s Multi-State Fuel Cell Expansion

Company/Partners: Equinix, Bloom Energy

Capacity: Over 100 MW (104 MW contracted)

Application: Providing primary power for critical digital infrastructure across more than 19 data centers in six U.S. states.

Source: Powering a Sustainable Future: Energy Innovation for …

3. AEP’s Landmark Utility Order for Data Center Support

Company/Partners: American Electric Power (AEP), Bloom Energy

Capacity: 100 MW (initial order)

Application: Deploying fuel cells as a behind-the-meter power solution for large data center customers facing grid constraints within AEP’s service areas.

Source: Generational Shift—Data Centers Bring Change to Energy …

4. Core Weave’s AI Cloud Data Center Power Project

Company/Partners: Core Weave, Bloom Energy

Capacity: 14 MW

Application: Supplying primary, on-site power for a specialized AI cloud data center to ensure high uptime and meet high-density power needs.

Source: Fuel Cell Installations in Data Centers: Top 10 Projects & …

5. Fuel Cell Energy’s Repowering Agreement for Grid Support

Company/Partners: Fuel Cell Energy, CGN

Capacity: 10 MW

Application: Repowering an existing site with a scalable energy platform explicitly cited as supporting surging power demand from data centers.

Source: Fuel Cell Energy and CGN Reach 10 MW Repowering …

6. Microsoft’s Hydrogen Backup Power Demonstration

Company/Partners: Microsoft, Caterpillar, Ballard Power Systems

Capacity: 1.5 MW

Application: Demonstrating a Proton Exchange Membrane Fuel Cell (PEMFC) system as a zero-emission backup power source to replace diesel generators.

Source: Microsoft, Caterpillar and Ballard data center partnership …

7. Core Site’s Hybrid Power Architecture Deployment

Company/Partners: Core Site, Bloom Energy

Capacity: Undisclosed

Application: Implementing solid oxide fuel cells to create a hybrid power system, combining utility and on-site generation for enhanced reliability at key data centers.

Source: Power! Behind-the-Meter Power Systems for Data Centers

8. Oracle Cloud’s Rapid On-site Power Initiative

Company/Partners: Oracle, Bloom Energy

Capacity: Undisclosed

Application: Deploying fuel cell systems to provide clean, reliable on-site power at a rapid pace (as little as 90 days) to match AI infrastructure growth.

Source: Oracle & Bloom Energy Team Up for Data Center Efficiency

9. Aspire Energy’s Pipeline for Fuel Cell Enablement

Company/Partners: Aspire Energy Express LLC, Bloom Energy

Capacity: Undisclosed (enabling infrastructure)

Application: Constructing a $10 million natural gas pipeline specifically to serve a new fuel cell facility that will power a data center in Ohio.

Source: Gas utilities in the US advance data center deals as power …

10. Vantage Data Centers’ Large-Scale BTM Deployment

Company/Partners: Vantage Data Centers, Volta Grid

Capacity: Over 1 GW (of total BTM gas power solutions)

Application: Deploying behind-the-meter gas power solutions, which increasingly include fuel cells, to provide high-reliability power across multiple U.S. campuses.

Source: Behind-the-meter generation is picking up traction

Table: Top Fuel Cell Applications in U.S. Data Centers (2025)

| Company/Partners | Capacity | Application | Source |

|---|---|---|---|

| Fuel Cell Energy, Inc., Diversified Energy Company PLC, TESIAC | Up to 360 MW | Off-grid power for data centers from waste methane and natural gas | Link |

| Equinix, Bloom Energy | 104 MW contracted | Primary power for 19+ colocation data centers | Link |

| American Electric Power (AEP), Bloom Energy | 100 MW (initial order) | Behind-the-meter power for utility’s data center customers | Link |

| Core Weave, Bloom Energy | 14 MW | Primary power for a specialized AI cloud data center | Link |

| Fuel Cell Energy, CGN | 10 MW | Repowering agreement to support data center power demand | Link |

| Microsoft, Caterpillar, Ballard Power Systems | 1.5 MW | Demonstration of hydrogen fuel cells for backup power | Link |

| Core Site, Bloom Energy | Undisclosed | Hybrid power architecture combining utility and on-site generation | Link |

| Oracle, Bloom Energy | Undisclosed | Rapidly deployable, clean on-site power for cloud infrastructure | Link |

| Aspire Energy Express LLC, Bloom Energy | Undisclosed (enabling infrastructure) | Dedicated natural gas pipeline to serve a data center fuel cell facility | Link |

| Vantage Data Centers, Volta Grid | Over 1 GW (total BTM solutions) | Large-scale, behind-the-meter gas power solutions incorporating fuel cells | Link |

From Hyperscalers to Utilities: A Widening Adoption Spectrum

The 2025 project landscape reveals a remarkably broad adoption pattern for fuel cells, confirming their move from a niche technology to a core component of the data center power ecosystem. The diversity of adopters is telling. We see colocation giants like Equinix and Core Site using fuel cells for primary power and enhanced reliability, offering it as a premium feature to their customers. Hyperscale cloud providers Microsoft and Oracle are integrating fuel cells directly to ensure their own operational uptime and accelerate expansion. Even specialized, high-growth players like AI cloud operator Core Weave are leveraging on-site fuel cells to power their unique high-density infrastructure. Most significantly, a major utility, American Electric Power, is now procuring fuel cells on behalf of its data center customers. This represents a systemic shift where utilities themselves recognize on-site generation as a viable, and necessary, solution to grid-scale constraints, rather than a threat. This diversification—from end-users to infrastructure enablers—proves that fuel cells are now integral to the industry’s strategic planning.

Powering Growth Beyond Silicon Valley

While traditional technology hubs like Silicon Valley remain important, as evidenced by Core Site’s SV 9 deployment, the 2025 installations highlight a significant geographic diversification of fuel cell adoption. The landmark AEP deal, targeting its service territories in the U.S. Midwest and South, is a powerful indicator that the data center construction boom—and its associated power crisis—is a national phenomenon. The Aspire Energy pipeline project in Ohio further cements this trend, showing that capital-intensive enabling infrastructure is being built in states not traditionally viewed as primary tech centers. This geographic spread suggests that fuel cell adoption is now following the path of data center demand, which is increasingly moving to regions with available land and a clearer path to new energy infrastructure, rather than being confined to congested coastal markets.

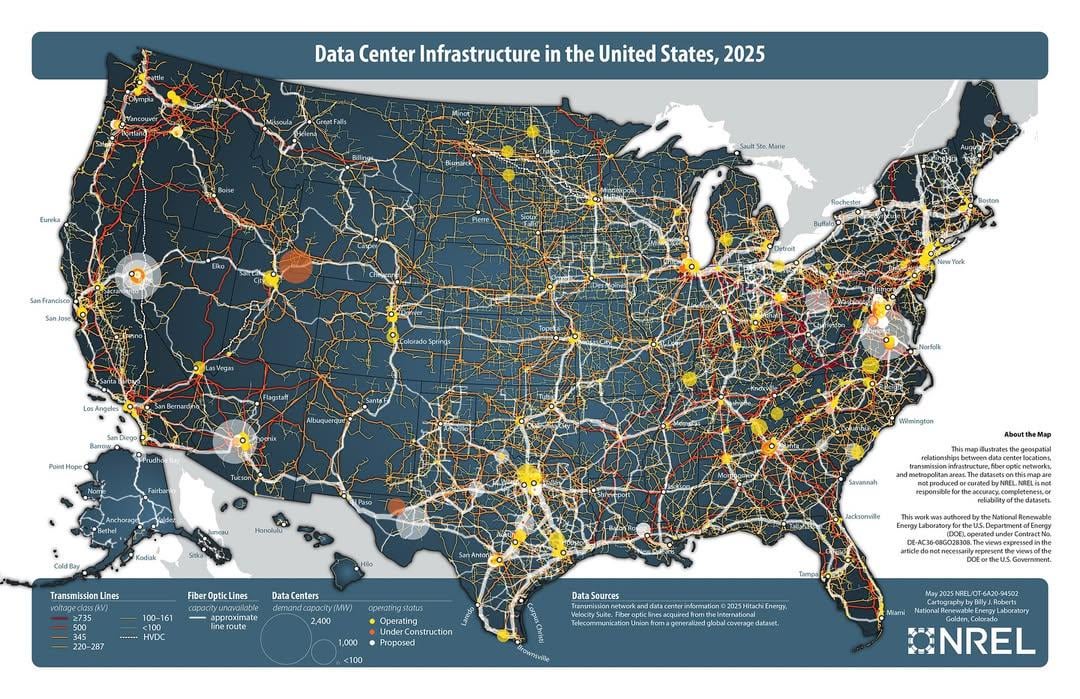

Map Shows U.S. Data Centers vs. Grid

This map visualizes the national scope of the data center boom, showing new facilities emerging far beyond traditional tech hubs. It highlights the growing tension between data center locations and the capacity of existing grid infrastructure.

(Source: Reddit)

SOFCs Scale Commercially While PEMFCs Prove Their Mettle

The project data provides a clear snapshot of technology maturity and market segmentation. Solid-Oxide Fuel Cells (SOFCs), supplied predominantly by Bloom Energy, are unequivocally in a commercial, mass-deployment phase. The sheer scale of the Equinix (over 100 MW), AEP (100 MW), and Core Weave (14 MW) projects demonstrates that SOFCs are a proven, bankable technology for primary, always-on data center power. In contrast, Proton Exchange Membrane Fuel Cells (PEMFCs) are being validated for a different but equally critical application. The 1.5 MW Microsoft demonstration with Ballard Power Systems positions PEMFCs as a potential zero-emission replacement for diesel backup generators. Although at a smaller scale, this successful hyperscale pilot is a crucial step toward commercializing hydrogen-powered resiliency. Meanwhile, Fuel Cell Energy’s molten carbonate technology is being strategically leveraged for a unique, utility-scale application: converting waste gas like coal mine methane into power, as seen in its 360 MW initiative, showcasing a distinct value proposition in the market.

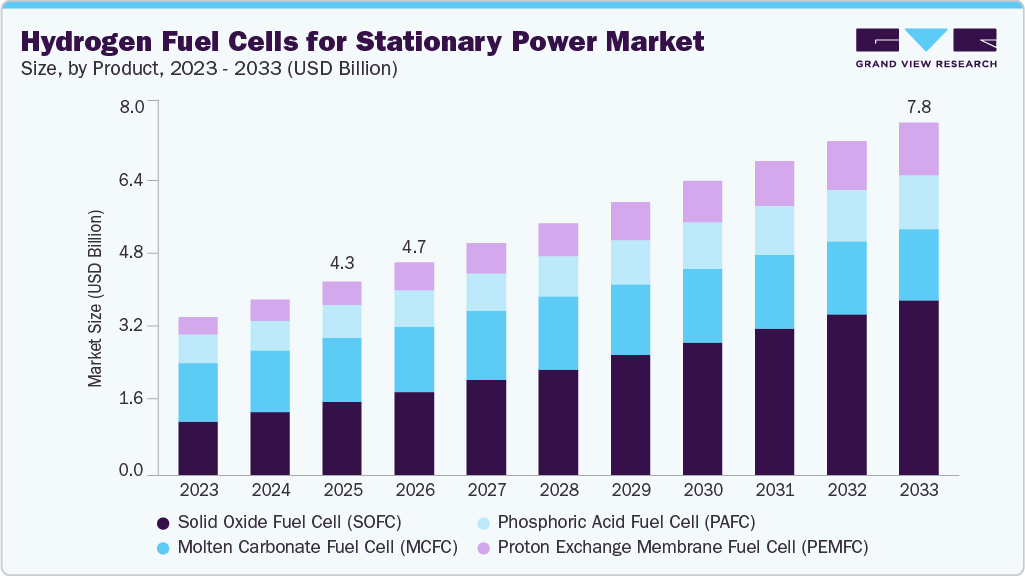

SOFCs to Dominate Stationary Fuel Cell Market

This forecast highlights the commercial maturity of Solid Oxide Fuel Cells (SOFCs) for stationary power. The chart projects SOFCs will be the largest and fastest-growing segment, reinforcing their role as a primary power solution for data centers.

(Source: Grand View Research)

The Future is Fast, Flexible, and Fuel-Powered

The 2025 fuel cell deployments signal a permanent shift in how the data center industry sources its power. The central insight is that speed-to-market and reliability have eclipsed reliance on traditional utility development timelines. The ability of partners like Oracle and Bloom Energy to deploy critical power capacity in as little as 90 days is a decisive competitive advantage in the AI arms race. Looking ahead, this trend will accelerate, driven by three key developments. First, hybrid power solutions combining fuel cells with other technologies like natural gas engines, as hinted at in the massive 1 GW Vantage Data Centers deployment, will become more common to optimize for cost, emissions, and reliability. Second, the focus on fuel security will intensify, leading to more infrastructure projects like the Aspire Energy pipeline and waste-to-energy initiatives. Finally, fuel cells are no longer merely a “green” alternative; they are a pragmatic tool for business continuity and a primary enabler of the digital economy. Their adoption is now a strategic imperative for any serious competitor in the data center industry.

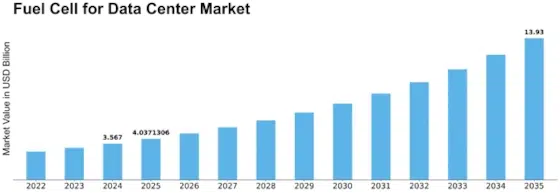

Data Center Fuel Cell Market to Exceed $13B

This projection quantifies the future growth of fuel cells in the data center industry, forecasting a market of nearly $14 billion by 2035. This strong growth underscores the technology’s permanent shift to a mainstream power solution.

(Source: Market Research Future)

Frequently Asked Questions

Why are data centers suddenly turning to fuel cells?

The rapid growth of AI has created an urgent need for reliable, scalable, and quickly deployable power that traditional public utilities often cannot provide on time. The article states that fuel cells are being adopted to circumvent these utility constraints, accelerate the time-to-market for new data centers, and ensure the high uptime required for high-density computing.

Which companies are the main players in this shift to fuel cell power?

The key fuel cell technology providers mentioned are Bloom Energy (supplying SOFCs), Fuel Cell Energy (molten carbonate technology), and Ballard Power Systems (PEMFCs). Adopters are diverse, including colocation giants like Equinix and CoreSite, hyperscale cloud providers like Microsoft and Oracle, specialized AI operators like Core Weave, and even utilities like American Electric Power (AEP).

Are all the fuel cells mentioned in the article the same technology?

No, the projects highlight different types of fuel cells for different applications. Solid-Oxide Fuel Cells (SOFCs) from Bloom Energy are being deployed at a large commercial scale for primary, always-on power. In contrast, Proton Exchange Membrane Fuel Cells (PEMFCs) from Ballard are being demonstrated as a zero-emission replacement for diesel backup generators. Fuel Cell Energy’s molten carbonate technology is being used for unique waste-to-energy projects, such as converting coal mine methane into power.

Are fuel cells being used for primary power or just as a backup?

They are being used for both. The article highlights that companies like Equinix and Core Weave are using fuel cells for primary, continuous power for their data centers. At the same time, Microsoft’s project with Ballard is specifically focused on demonstrating fuel cells as a zero-emission backup power source to replace traditional diesel generators.

What is ‘behind-the-meter’ (BTM) power and why is it important?

Behind-the-meter (BTM) refers to power generation that occurs on-site, at the data center, rather than being drawn from the public utility grid. The article identifies this as a dominant theme for 2025 because it gives data center operators control over their power supply. This allows them to avoid grid connection delays, ensure reliability, and rapidly deploy the energy capacity needed to support the AI boom.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Equinix: Fuel Cell & AI Power Strategy for 2025

- Fuel Cells Data Centers: 2025 AI Power Trends Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.