Semiconductor Scarcity 2026: How AI Data Centers Are Deprioritizing Automotive Supply Chains

AI vs. Auto: Analyzing the Commercial Risks of the 2026 Semiconductor Supply Shift

A structural and permanent reallocation of semiconductor manufacturing capacity is underway, creating a new scarcity crisis that sidelines the automotive industry. Unlike the demand-shock shortages of 2021-2024, this new crisis stems from the explosive, high-margin growth of Artificial Intelligence, which has positioned data centers as the semiconductor industry’s priority customer. The evidence indicates automakers face a sustained period of supply volatility, where securing chip capacity is now as critical as battery technology.

- Between 2021 and 2024, the automotive chip shortage was driven by pandemic-related demand shifts and fragile just-in-time supply chains, causing an estimated $500 billion in global losses. From 2025 onward, the conflict is structural; AI data centers are projected to consume 70% of all memory chips produced by 2026, directly competing with and deprioritizing automotive orders.

- The AI data center market’s demand for high-margin, advanced chips is a primary factor. The data center semiconductor market is forecasted to grow from $179.85 billion in 2025 to over $500 billion by 2030, accounting for over 50% of the entire chip market.

- The automotive industry’s exposure is magnified by its reliance on older, less profitable “foundational” chips, which constitute about 95% of the chips used in vehicles. As foundries pivot investment toward advanced AI chips, capacity for these legacy nodes is at risk, with S&P Global Mobility warning of looming shortages.

- This supply diversion has tangible consequences, with analysts forecasting that up to 600, 000 fewer vehicles may be built in 2026. UBS predicts disruptions could begin as early as the second quarter of 2026, escalating into significant production halts by 2027 and 2028.

AI-Driven Capital Allocation: Semiconductor Investment and Automotive Capacity Risks

Semiconductor capital expenditure is overwhelmingly flowing toward the advanced nodes and packaging technologies required by AI, creating a critical investment deficit for the mature-node capacity that automakers depend on. Hyperscalers are outbidding and out-prioritizing automakers for foundry capacity due to their superior margins and aggressive growth roadmaps.

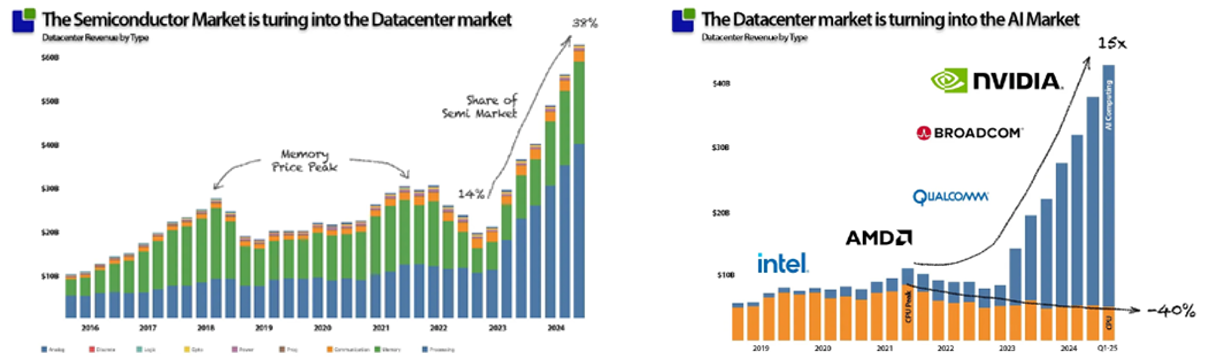

AI Demand Drives Data Center Dominance

This visualizes the capital reallocation toward data centers, showing their revenue share growing to 39% of the semiconductor market, driven entirely by AI demand.

(Source: Global Semiconductor Alliance)

- Hyperscaler spending on data centers and AI capacity, already over $150 billion annually, is projected to exceed $1 trillion by 2028. This financial power gives them immense leverage with foundries like TSMC, which controls over 90% of the world’s most advanced chip manufacturing.

- While the industry plans to invest $400 billion in 300 mm fab equipment between 2025 and 2027, this capital is primarily targeting the advanced nodes and technologies like High-Bandwidth Memory (HBM) demanded by AI, not the legacy nodes that form the backbone of automotive electronics.

- Company-specific results confirm this trend. In Q 3 2025, NVIDIA reported its data center revenue surged to $30.8 billion, a 112% year-over-year increase, demonstrating the profitability that attracts foundry investment.

- In contrast, an automaker’s order for millions of $5 microcontrollers is far less attractive to a foundry than a hyperscaler’s order for tens of thousands of $30, 000 GPUs. This economic disparity is the core of the capacity reallocation.

Table: Semiconductor Market Investment & Growth Forecasts

| Forecast Entity / Market | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Hyperscaler Spending | By 2028 | Collective capital expenditures on data centers and AI are projected to grow from $150 B annually to over $1 T, funneling investment into high-performance compute capacity. | Fusion Worldwide |

| Data Center Semiconductors | 2025 – 2030 | The market is projected to reach $500 B and account for over 50% of the entire semiconductor market, solidifying its position as the industry’s center of gravity. | Semi Engineering |

| Overall Semiconductor Market | By 2030 | The overall market is forecast to surpass $1 trillion, with AI and automotive cited as key drivers, setting the stage for direct competition for resources. | Pw C |

| Data Center Semiconductors | 2025 – 2030 | A more conservative forecast projects market growth from $179.85 B in 2025 to $230.75 B by 2030, reflecting a 5.11% CAGR. | Mordor Intelligence |

Automotive Strategic Alliances: Countering Semiconductor Scarcity with New Partnerships

In response to being deprioritized, proactive automakers are abandoning traditional, multi-tiered procurement models. They are now forging direct, high-value partnerships with semiconductor manufacturers to secure long-term supply and co-develop the critical technologies needed for next-generation vehicles.

Long Fab Timelines Drive New Alliances

This Gantt chart illustrates the multi-year process for building semiconductor fabs, explaining why automakers must forge long-term, direct partnerships to secure future capacity.

(Source: Bain & Company)

Data Center Semi Market Nears $500B

This chart quantifies the explosive growth forecast in the section’s table, projecting the data center semiconductor market to approach half a trillion dollars by 2030.

(Source: Signal Integrity Journal)

- The previous model, dominant through 2024, relied on just-in-time purchasing from Tier-1 suppliers with little to no direct automaker-foundry interaction. The new strategy involves direct, multi-year, multi-billion dollar agreements for chip capacity and joint R&D.

- Tesla established a blueprint for this new model with its $16.5 billion agreement with Samsung, securing production of its next-generation AI chips at a Texas facility through 2033. To further diversify, Tesla is also splitting production of its new AI 5 chip between TSMC and Samsung.

- Ecosystem development has become a key defensive strategy. Hyundai Mobis initiated a coalition with over 20 companies to build a resilient and collaborative semiconductor supply chain within South Korea.

- Automakers are also partnering to accelerate technology adoption. General Motors (GM) and NVIDIA are collaborating on autonomous driving development, while Qualcomm and Google are working together on in-vehicle AI experiences.

Table: Key Automotive and Semiconductor Partnerships (2025-Today)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Tesla / TSMC & Samsung | Jan 2026 | Tesla is splitting production of its new AI 5 chip between the two foundries. This dual-sourcing strategy is designed to diversify its supply chain and mitigate risk for a critical component. | Digitimes |

| Qualcomm & Google | Jan 2026 | Expanded collaboration to accelerate the development of software-defined vehicles (SDVs) and in-vehicle, agentic AI. This partnership focuses on creating integrated hardware and software platforms. | Qualcomm |

| Hyundai Mobis / 20+ Partners | Sep 2025 | Launched a broad alliance to foster the Korean automotive semiconductor industry. The goal is to create a stable, regional supply chain and promote local technology development. | PR Newswire |

| Tesla / Samsung | Jul 2025 | A landmark $16.5 billion multi-year deal for Samsung to produce next-generation AI chips for Tesla. This represents a deep, long-term commitment to secure leading-edge capacity. | mlq.ai |

| General Motors / NVIDIA | Jul 2025 | Strategic partnership to accelerate development in autonomous driving, ADAS, and factory automation. This aligns GM‘s vehicle architecture with NVIDIA‘s compute roadmap. | Semiconductor Digest |

Geography: Mapping the Semiconductor Power Shift from Auto to AI

North America and Asia are the epicenters of the structural semiconductor reallocation, with North American hyperscalers driving AI demand and Asian foundries controlling the advanced manufacturing capacity that both industries require. This geographic concentration of supply and demand creates systemic risk for global automotive production.

North America and Asia Lead AI Growth

This chart supports the section’s geographic analysis by identifying North America and Asia-Pacific as the largest and fastest-growing regions for AI data center investment.

(Source: Grand View Research)

- During the 2021-2024 shortage, the problem was a global logistical failure, but from 2025 onward, the issue is a strategic concentration of power. North America drives AI demand, with networking and communications accounting for 38.8% of its semiconductor market.

- Asian foundries in Taiwan (TSMC) and South Korea (Samsung) are the undisputed gatekeepers of leading-edge semiconductor manufacturing. Their decisions on capacity allocation will directly determine which industries and companies can execute their product roadmaps.

- The U.S. CHIPS Act is an attempt to mitigate this geographic risk by incentivizing domestic manufacturing. The Samsung facility in Texas, slated to produce Tesla‘s chips, is a direct outcome of this policy, aiming to re-shore critical production for a U.S. automaker.

- Japanese automakers like Toyota, Nissan, and Honda recognized this regional vulnerability and formed a collaboration in May 2024 to jointly develop advanced semiconductors, pooling resources to increase their leverage with foundries.

Technology Maturity: Advanced AI Chips Collide with Legacy Automotive Nodes

The supply chain conflict is defined by a technology maturity mismatch, where the AI industry’s voracious demand for commercially-scaled, leading-edge technologies is diverting capital and R&D focus away from the mature-node capacity that is still essential for the automotive sector.

- Between 2021 and 2024, the primary issue was insufficient production capacity for existing, mature-node automotive chips like microcontrollers. From 2025 onward, the crisis is two-fold: a continued risk of underinvestment in those legacy nodes plus a new, direct competition for advanced nodes as vehicles become high-performance computers on wheels.

- AI is consuming the most advanced, high-margin technologies at scale. This includes NVIDIA’s GPUs, High-Bandwidth Memory (HBM), and advanced packaging like TSMC‘s Co Wo S, creating bottlenecks that also affect high-end automotive systems-on-a-chip (So Cs).

- This technological pressure forces automakers to accelerate their own roadmaps. They are now collaborating on chiplet platforms (like with Intel) and next-generation So Cs (like Media Tek and NVIDIA) to design vehicles that align with foundry technology roadmaps, making them more attractive customers.

- Memory chips have become a key battleground. The projection that AI data centers will consume 70% of all memory by 2026 signals a direct resource conflict for increasingly data-intensive vehicles that require more memory for ADAS, infotainment, and software-defined architectures.

SWOT Analysis: Strategic Outlook for the AI vs. Automotive Semiconductor Conflict

The automotive industry’s strength in production volume is being systematically undermined by its weakness in profit margins and long design cycles. This creates an opportunity for strategically agile automakers to build resilient supply chains, while the existential threat of being deprioritized by AI’s explosive growth remains acute for the unprepared.

AI Growth Squeezes the Non-AI Market

This chart visualizes the primary threat described in the SWOT analysis, showing the AI chip market’s explosive growth is projected to shrink the non-AI segment.

(Source: PRADEEP’s TECHPOINTS – WordPress.com)

- The primary strategic shift is from reactive procurement to proactive supply chain orchestration, a change forced upon the auto industry by the AI sector’s emergence as a more profitable and technologically demanding customer.

Table: SWOT Analysis for the Automotive Semiconductor Supply Chain

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High-volume, predictable orders for legacy chips. Established relationships with Tier-1 suppliers. | Direct foundry partnerships (e.g., Tesla/Samsung). Growing internal chip design capabilities. | The crisis validated that high volume alone is not enough; strategic partnerships and technological alignment are now the key strengths. |

| Weaknesses | Fragile “just-in-time” inventory models. Lack of visibility beyond Tier-1 suppliers. Long automotive design cycles. | Lower profit margins per chip compared to AI customers. Continued reliance on mature nodes facing underinvestment. | The fundamental weakness of being a lower-margin customer was exposed and amplified by the high-profitability AI market. |

| Opportunities | Forced investment in supply chain visibility tools. Initial moves to standardize components. | Co-development of custom silicon with foundries. Building regional ecosystems (e.g., Hyundai Mobis). Using chiplets for modular design. | The opportunity shifted from merely surviving a shortage to fundamentally re-architecting the supply chain for long-term competitive advantage. |

| Threats | Pandemic-driven demand shocks and logistical disruptions leading to production halts. | Structural deprioritization by high-margin AI data center customers. A two-front squeeze on both mature and advanced node capacity. | The threat evolved from a temporary, logistical problem to a permanent, structural conflict over manufacturing priority and capital allocation. |

2026 Forward Look: Key Signals for Navigating Semiconductor Supply Volatility

If a significant portion of the automotive industry fails to secure direct, long-term foundry partnerships by the end of 2025, watch for widespread announcements of production cuts and model-year delays beginning in mid-2026 as the AI capacity crunch fully materializes.

Memory and Logic Surge Toward 2026

This forecast provides data for the key signals mentioned in the section, showing explosive growth in Memory and Logic chips that power AI and divert capacity.

(Source: J2 Sourcing AB)

Lead Times Reveal Past Supply Fragility

This chart visualizes the extreme supply chain volatility from 2021-2022, validating the SWOT analysis’s point about the weakness of ‘just-in-time’ inventory models.

(Source: PR Newswire)

- If this happens: AI hyperscalers continue their massive CAPEX growth, and memory prices continue to spike over 100% for some suppliers, confirming that AI remains the priority customer. Watch this: The frequency of announcements for new, multi-billion-dollar, multi-year automotive-foundry deals. The silence from automakers who are *not* announcing such deals is a critical negative signal of their future vulnerability.

- These could be happening: The strategic pivot is already visible among market leaders. Tesla‘s $16.5 billion deal with Samsung, GM‘s deep partnership with NVIDIA, and Hyundai‘s ecosystem-building are the clear, early signals of the necessary response. These actions validate that securing silicon capacity is now a core pillar of corporate strategy.

- The critical path forward is clear. Automakers who treat semiconductor supply with the same strategic importance as battery technology and brand loyalty will secure their ability to innovate and produce. Those who maintain a business-as-usual, transactional approach will be relegated to the back of the line, facing chronic disruption and a severe competitive disadvantage.

Frequently Asked Questions

How is the predicted 2026 semiconductor shortage different from the one the auto industry faced from 2021-2024?

The 2021-2024 shortage was a demand-shock crisis caused by pandemic-related logistical failures and fragile just-in-time supply chains. The predicted 2026 crisis is structural and permanent, driven by the explosive growth of the high-margin AI data center industry, which is causing a strategic reallocation of chip manufacturing capacity away from the lower-margin automotive sector.

Why are semiconductor manufacturers prioritizing AI data centers over automakers?

The decision is primarily economic. AI data centers purchase vast quantities of advanced, high-margin chips, such as $30,000 GPUs, and their capital spending is projected to exceed $1 trillion by 2028. In contrast, automakers’ orders for lower-margin, foundational chips (like a $5 microcontroller) are far less profitable for foundries, leading them to prioritize the more lucrative and technologically demanding AI sector.

What is the expected real-world impact on vehicle production?

The supply diversion is expected to have significant consequences. Analysts forecast that as many as 600,000 fewer vehicles could be built in 2026 due to the chip scarcity. Projections from UBS suggest these disruptions could escalate into major production halts and model-year delays in 2027 and 2028 for unprepared automakers.

What are proactive automakers doing to secure their chip supply?

Proactive automakers are abandoning traditional procurement models and are forging direct, multi-billion-dollar partnerships with semiconductor manufacturers. For example, Tesla secured a $16.5 billion multi-year deal with Samsung for its AI chips. Others, like Hyundai Mobis, are building regional supply chain ecosystems, while GM is partnering with NVIDIA to align on technology roadmaps and secure future capacity.

As a car buyer, what key signal should I watch for to see how this crisis is developing?

You should watch for the frequency of announcements for new, multi-billion-dollar, multi-year partnerships between automakers and semiconductor foundries. If a major automaker is silent and not announcing such deals by the end of 2025, it is a critical negative signal. This silence may be followed by announcements of production cuts and model-year delays for that brand starting in mid-2026.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.