Saudi Aramco’s Top 10 AI Initiatives: Analyzing the 2025-2026 Strategy for Saudi Arabia’s Tech Dominance

Saudi Aramco is executing a strategic pivot from an energy producer to a technology-driven industrial conglomerate, using its immense capital to build a national Artificial Intelligence (AI) ecosystem. The company projects its digital technology investments will yield $3 billion to $5 billion in value by 2025. This transformation is not merely about optimizing oil and gas operations; it is a core component of Saudi Arabia’s Vision 2030, aimed at establishing the Kingdom as a global AI leader through a series of foundational projects and strategic alliances.

Saudi Aramco’s AI Projects Signal a Shift to Commercial Ecosystem Building in 2026

Saudi Aramco’s approach to AI has fundamentally evolved from internal optimization to building a full-scale, commercial AI ecosystem. This strategic shift is defined by the development of foundational infrastructure and proprietary models designed for external markets, moving far beyond the efficiency-focused pilots of the past.

- Prior to 2025, Aramco’s AI initiatives were internally focused on operational efficiency. Key projects included the in-house development of the i 4 Safety 2.0 hazard prediction tool in June 2022 and deployments at its 4 IR Center to optimize facilities like the Uthmaniyah Gas Plant, all aimed at reducing costs and improving safety within its own operations.

- Starting in 2025, the strategy expanded to creating commercial-grade, foundational technologies. The launch of aramco METABRAIN, a 250-billion parameter generative AI model in March 2024, and the partnership with Groq to build the world’s largest AI inferencing data center, signal a clear intent to provide AI infrastructure and services to external customers.

- The range of AI applications has broadened significantly, covering the entire technology stack. Collaborations now include foundational hardware with NVIDIA and Groq, industrial process control with Yokogawa, edge computing with Qualcomm, and next-generation quantum AI with Sandbox AQ, demonstrating a comprehensive strategy to build a self-sustaining technology market in Saudi Arabia.

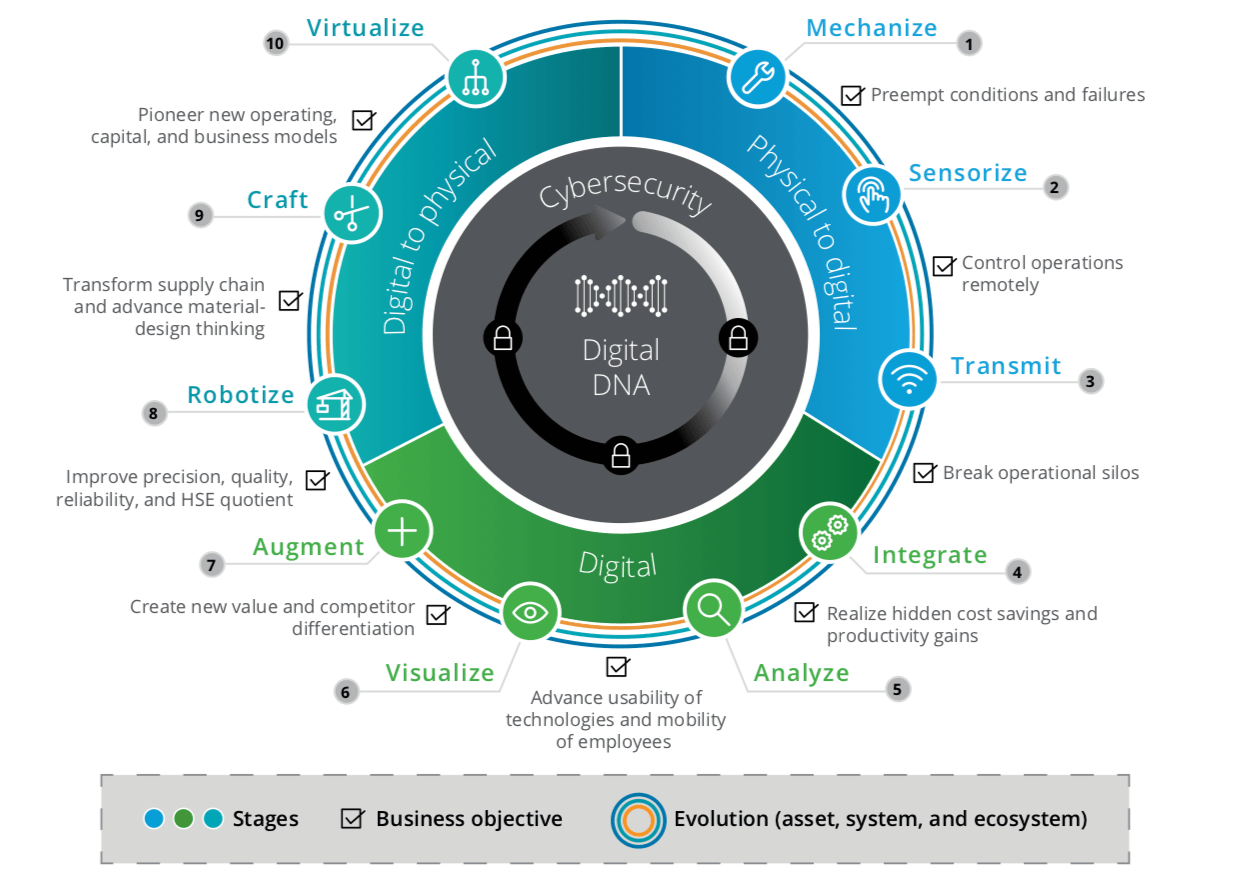

Aramco Follows 10-Step Transformation Plan

This chart’s 10-stage framework for digital transformation visually represents the strategic shift from internal optimization to building a commercial ecosystem described in the section.

(Source: Digital Data Design Institute at Harvard)

Aramco’s External Venture Capital Deployments Drive AI Strategy Post-2024

Saudi Aramco’s investment strategy has pivoted from internal R&D funding to a large-scale external venture capital and strategic acquisition model. This shift is designed to accelerate technology acquisition, foster a domestic startup ecosystem, and secure a leadership position in the global AI market.

- The company’s financial strategy was redefined in January 2024 with the expansion of its global venture capital program to $7.5 billion. This was followed by the allocation of a dedicated $100 million fund by its Wa’ed Ventures arm in October 2024 specifically to support early-stage AI startups in Saudi Arabia.

- In 2025, this strategy materialized through direct strategic investments to secure technology and market position. Aramco acquired a significant minority stake in HUMAIN, the PIF-backed AI company, in October 2025 to consolidate the Kingdom’s AI development efforts under a single entity.

- This external focus contrasts with the pre-2024 period, where investment was largely directed through internal R&D budgets, such as the $3.5 billion spent in 2023 on digitalization and operational enhancements. The current model prioritizes building an external ecosystem through strategic capital deployment.

Table: Saudi Aramco Key AI Investments and Financial Projections (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Projected Realized Value | Jan 2026 (for 2025) | Aramco projects $3 B – $5 B in financial gains from AI and digital technology deployment in 2025, reflecting cost savings and efficiency improvements. | ITP.net |

| Aramco Ventures Europe Office | Nov 2025 | Established a Paris office to drive investments into European AI, cybersecurity, and quantum computing startups, expanding its global technology sourcing. | Reuters |

| Acquisition of Stake in HUMAIN | Oct 2025 | Acquired a significant minority stake to unify Aramco’s and the Public Investment Fund’s (PIF) AI programs, accelerating national AI development. | PIF |

| Wa’ed Ventures AI Fund | Jul 2025 | Earmarked $100 million from its $500 million fund to invest in and cultivate a domestic AI startup ecosystem in Saudi Arabia. | Enki AI |

| Groq Partnership | Feb 2025 | Initial investment of $1.5 million to design AI cloud capabilities, with the long-term goal of building the world’s largest AI-inferencing data center. | Coin Geek |

Aramco’s Global Alliances Build Foundational AI Infrastructure in 2025-2026

In 2025 and 2026, Saudi Aramco executed a series of high-impact partnerships across the entire AI value chain, shifting from targeted operational collaborations to building the foundational pillars of a national AI infrastructure.

- The strategy solidified in February 2026 with a Memorandum of Understanding (Mo U) with Microsoft. This alliance is designed to build industrial AI solutions on the Azure cloud platform and co-develop commercial systems for the global energy market.

- Before 2025, partnerships were more specialized, such as the 2023 collaboration with Insilico Medicine to use AI for developing sustainable fuels. While strategic, these were focused on specific R&D outcomes rather than broad infrastructure.

- The partnerships established in 2025 are foundational. The collaborations with NVIDIA for AI computing infrastructure, Groq for a massive AI-inferencing data center, and Qualcomm for edge AI are designed to create the core hardware and platform layers for the entire Saudi AI ecosystem.

Saudi Arabia’s National AI Strategy Sets Stage

This timeline shows Saudi Arabia’s 2020 national AI strategy, providing the strategic government-level context for Aramco’s push to build national AI infrastructure through global alliances.

(Source: Nature)

Table: Saudi Aramco’s Key AI Partnerships (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Korean AI Consortium | Feb 2026 | Signed a tentative agreement to leverage South Korea’s advanced AI technologies for joint business opportunities in Saudi Arabia’s energy and manufacturing sectors. | The Korea Times |

| Microsoft | Feb 2026 | An Mo U to accelerate industrial AI deployment using Microsoft Azure, co-develop commercial solutions, and train the local workforce in AI and data science. | Aramco |

| Yokogawa | Oct 2025 | Successfully deployed autonomous AI control agents at the Fadhili Gas Plant, achieving up to a 15% reduction in energy consumption and improving process stability. | Yokogawa |

| Sandbox AQ | Jul 2025 | A collaboration with the Google spin-off to apply quantum AI for developing methods to convert captured carbon into valuable materials, accelerating green R&D. | Rest of World |

| NVIDIA | May 2025 | An Mo U to develop advanced industrial AI computing infrastructure, including an AI Hub and enterprise platforms to support Aramco’s digital transformation. | JPT |

| Groq | Feb 2025 | A partnership to design AI cloud capabilities and build the world’s largest AI-inferencing data center in Saudi Arabia. | Coin Geek |

Aramco’s AI Strategy Goes Global, Sourcing Tech from US, Asia, and Europe

While anchored in Saudi Arabia, Saudi Aramco’s AI strategy has become aggressively global, sourcing technology, partnerships, and investments from established and emerging tech hubs in North America, Asia, and Europe to accelerate its national objectives.

- Between 2021 and 2024, AI activities were predominantly concentrated within Saudi Arabia, focused on deploying technology inside Aramco’s own industrial facilities. The primary goal was internal optimization rather than external technology acquisition.

- In 2025 and 2026, the United States became a critical source of foundational technology. Aramco established key partnerships with a slate of leading US firms, including Microsoft (cloud), NVIDIA (computing), Groq (inference hardware), Qualcomm (edge AI), and Sandbox AQ (quantum AI).

- Simultaneously, Aramco expanded its reach into Asia. It invested in South Korean AI chipmaker Rebellions, participated in a funding round for Chinese firm Zhipu AI, adopted technology from China’s Deep Seek, and signed an agreement with a South Korean AI consortium.

- Europe emerged as a new strategic region in late 2025. The opening of an Aramco Ventures office in Paris in November 2025 to target European AI startups and a partnership with French quantum computing firm Pasqal in January 2026 marks a deliberate expansion to capture European innovation.

Aramco’s AI Moves from Application to Foundational Technology Creation in 2025

Saudi Aramco’s AI initiatives have matured rapidly from applying existing tools for operational gains to developing and deploying foundational, commercial-scale technologies. This progression marks a strategic shift from being a technology consumer to becoming a technology creator and provider.

- In the 2021-2024 period, the technology was in an application phase. Aramco deployed proven AI for specific industrial tasks, such as the i 4 Safety 2.0 predictive safety tool and AI-driven predictive maintenance at its gas plants, demonstrating the use of mature AI to solve targeted business problems.

- The period from 2025 to today shows a leap to the creation of foundational technology. The launch of aramco METABRAIN, a proprietary 250-billion parameter industrial LLM, and the ambitious project with Groq to build the world’s largest AI-inferencing data center represent a move to own and operate core AI infrastructure.

- Aramco is now operating at the commercial and R&D frontier. Its exploration of quantum AI through partnerships with Sandbox AQ and Pasqal is not for immediate operational gains but to secure a long-term position in next-generation computing, indicating a fully developed, forward-looking technology strategy.

SWOT Analysis: Saudi Aramco’s AI Transformation

Saudi Aramco’s AI strategy capitalizes on its immense financial strength and data assets while navigating the challenges of technological dependency and geopolitical tensions. The company’s recent actions show a clear move to mitigate its weaknesses and seize the opportunity to become a regional AI powerhouse.

- Strengths: Aramco successfully converted its massive capital reserves into active strategic assets, funding a $7.5 billion venture program and developing proprietary technology like aramco METABRAIN.

- Weaknesses: While partnerships with Accenture address the talent gap, the strategy remains heavily dependent on foreign technology partners like NVIDIA and Microsoft, creating a potential point of vulnerability.

- Opportunities: The company’s ambition has expanded from internal efficiency to creating a new non-oil revenue stream by becoming the dominant provider of AI infrastructure and industrial solutions in the Middle East.

- Threats: Strategic risks have evolved from oil price volatility to geopolitical tech restrictions and intense global competition for AI leadership.

Aramco’s Massive Profitability Funds AI Push

The SWOT analysis highlights Aramco’s immense financial strength as a key advantage, and this chart directly visualizes that strength by showing its quarterly profit dwarfing that of major tech companies.

(Source: Sherwood News)

Table: SWOT Analysis for Saudi Aramco’s AI Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Massive capital from oil revenue; vast proprietary operational data; strong government backing. | Active deployment of capital ($7.5 B VC fund); development of proprietary LLMs (aramco METABRAIN); large-scale infrastructure projects (Groq data center). | Aramco validated its ability to convert latent financial strength into tangible, large-scale technology development and strategic investments. |

| Weaknesses | Limited indigenous AI talent pool; bureaucratic structure of a state-owned enterprise; high dependency on the oil sector. | Heavy reliance on foreign partners (Microsoft, NVIDIA) for core technology; potential cultural resistance to rapid transformation. | The talent weakness is being actively addressed (Accenture partnership), but the strategic dependency on foreign technology has become more pronounced and critical. |

| Opportunities | Leverage proprietary data to optimize core business efficiency; diversify into adjacent technology sectors. | Establish regional market dominance as an AI infrastructure-as-a-service provider; create new, non-oil revenue streams; export industrial AI solutions. | The strategic opportunity expanded from internal optimization to external market creation and regional technological leadership. |

| Threats | Global energy transition; oil price volatility; slow pace of internal digital adoption. | Geopolitical tech restrictions (US-China tech tensions); intense global competition for AI talent and compute resources; execution risk on massive infrastructure projects. | Threats shifted from market-based risks (oil prices) to significant geopolitical and execution risks tied to the global technology supply chain. |

Aramco’s 2026 Outlook: Focus Shifts to Commercialization and Monetization

For 2026, Saudi Aramco’s primary challenge and key indicator of success will be the transition from building infrastructure and announcing partnerships to the commercial operation and monetization of its significant AI investments.

- The most critical milestone to watch is the operational launch of the Groq AI-inferencing data center. Success will be measured by its available capacity, the onboarding of its first major enterprise and government clients, and its demonstrated impact on the cost and speed of AI computation in the region.

- Market focus will be on the quantifiable ROI delivered by aramco METABRAIN. This includes its successful integration into large-scale industrial projects to deliver and report specific, multi-million dollar cost savings or new revenue generation, proving the commercial viability of the proprietary model.

- The initial investment announcements from the new Aramco Ventures office in Paris will be a key signal of the company’s European strategy. The size and focus of these first deals will indicate its approach to capturing innovation in the European AI, cybersecurity, and quantum computing markets.

- Progress on the strategic investment in HUMAIN will be crucial. Its ability to effectively unify the Kingdom’s disparate AI initiatives and begin producing nationally significant AI applications will validate the consolidation strategy and serve as a barometer for the success of Saudi Arabia’s broader AI ambitions.

Ready to track the companies transforming the energy industry? Enki’s AI-powered platform provides real-time intelligence on projects, partnerships, and investments. Request a demo to see how you can stay ahead of the competition.

Investment Growth Signals AI Monetization Opportunity

This chart’s projection of strong future investment growth in AI provides the market context for Aramco’s 2026 outlook and its strategic shift towards commercialization.

(Source: InnovateEnergy)

Frequently Asked Questions

What is the main goal of Saudi Aramco’s AI strategy for 2025-2026?

The primary goal is to pivot from being an energy producer to a technology-driven industrial conglomerate by building a full-scale, commercial AI ecosystem. This involves creating foundational technologies, such as the aramco METABRAIN model and a massive AI data center with Groq, to serve external markets and establish Saudi Arabia as a global AI leader, moving beyond just internal operational efficiency.

How much financial value does Aramco expect its AI and digital initiatives to create?

Saudi Aramco projects that its investments in digital technology and AI will yield between $3 billion and $5 billion in financial value by 2025. This value is expected to come from cost savings and significant efficiency improvements across its operations.

What is aramco METABRAIN?

aramco METABRAIN is a proprietary, 250-billion parameter generative AI model developed by Saudi Aramco. Launched in March 2024, it is a foundational industrial Large Language Model (LLM) designed to support Aramco’s digital transformation and be offered as a commercial service to external customers.

Who are some of Saudi Aramco’s key international partners in its AI strategy?

Aramco has established a series of strategic partnerships with leading global tech firms, including NVIDIA for AI computing infrastructure, Groq to build the world’s largest AI-inferencing data center, Microsoft for cloud-based industrial AI solutions, Qualcomm for edge AI, and Sandbox AQ for quantum AI applications.

How has Saudi Aramco’s AI investment strategy evolved?

Aramco’s investment strategy has shifted from primarily funding internal R&D to a large-scale external venture capital and acquisition model. This is highlighted by the expansion of its global venture capital program to $7.5 billion in 2024, the creation of a $100 million Wa’ed Ventures fund for local AI startups, and the strategic acquisition of a stake in HUMAIN.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.