Schneider Electric’s Top 10 AI Projects for 2025 and 2026: The Data Center Power Strategy

In 2025 and 2026, Schneider Electric pivoted its artificial intelligence strategy from internal optimization and software services to becoming the indispensable infrastructure architect for the AI revolution. The company now focuses on building the entire physical ecosystem for power-hungry AI data centers, securing its position by solving AI’s primary bottleneck: energy and cooling. This strategic shift is validated by multi-billion-dollar supply agreements and deep co-development partnerships with technology giants.

Schneider Electric’s Commercial-Scale Projects Define AI Infrastructure Adoption 2026

Schneider Electric‘s AI project portfolio has matured from exploratory software applications to a dominant focus on deploying and scaling the physical infrastructure required by AI data centers. This transition is marked by a clear shift from internal process optimization and sustainability software to securing large-scale, high-value commercial agreements for power and cooling hardware, driven by the exponential growth of AI workloads.

- Between 2021 and 2024, Schneider Electric‘s AI adoption centered on software and internal efficiency, establishing a global AI Hub, investing in analytics platforms like Ai DASH, and launching programs such as the Zero Carbon Project to help suppliers. The focus was on using AI for grid resilience, sustainability reporting, and operational improvements, reflecting a technology in an advanced pilot and early commercialization phase.

- From 2025 to today, the strategy aggressively transitioned to commercial hardware dominance, evidenced by landmark agreements to build the backbone of AI data centers. This includes a $1.9 billion supply capacity deal with Switch for its AI factories and a broader $2.3 billion series of deals with U.S. data center operators announced in November 2025.

- The application of AI has also expanded from analytics to tangible product integration. In 2025, the company launched an industrial AI Copilot with Microsoft and an AI-powered energy management platform. This was followed by a project to upgrade Rogers Arena with AI-driven energy systems in January 2026, demonstrating the practical application of its technology in real-world environments.

- This evolution from software-based optimization to providing the critical physical layer for AI shows the market is moving past experimentation. The demand is for validated, scalable, and energy-efficient hardware solutions that can be deployed rapidly to meet the AI boom, a demand Schneider Electric is positioned to meet.

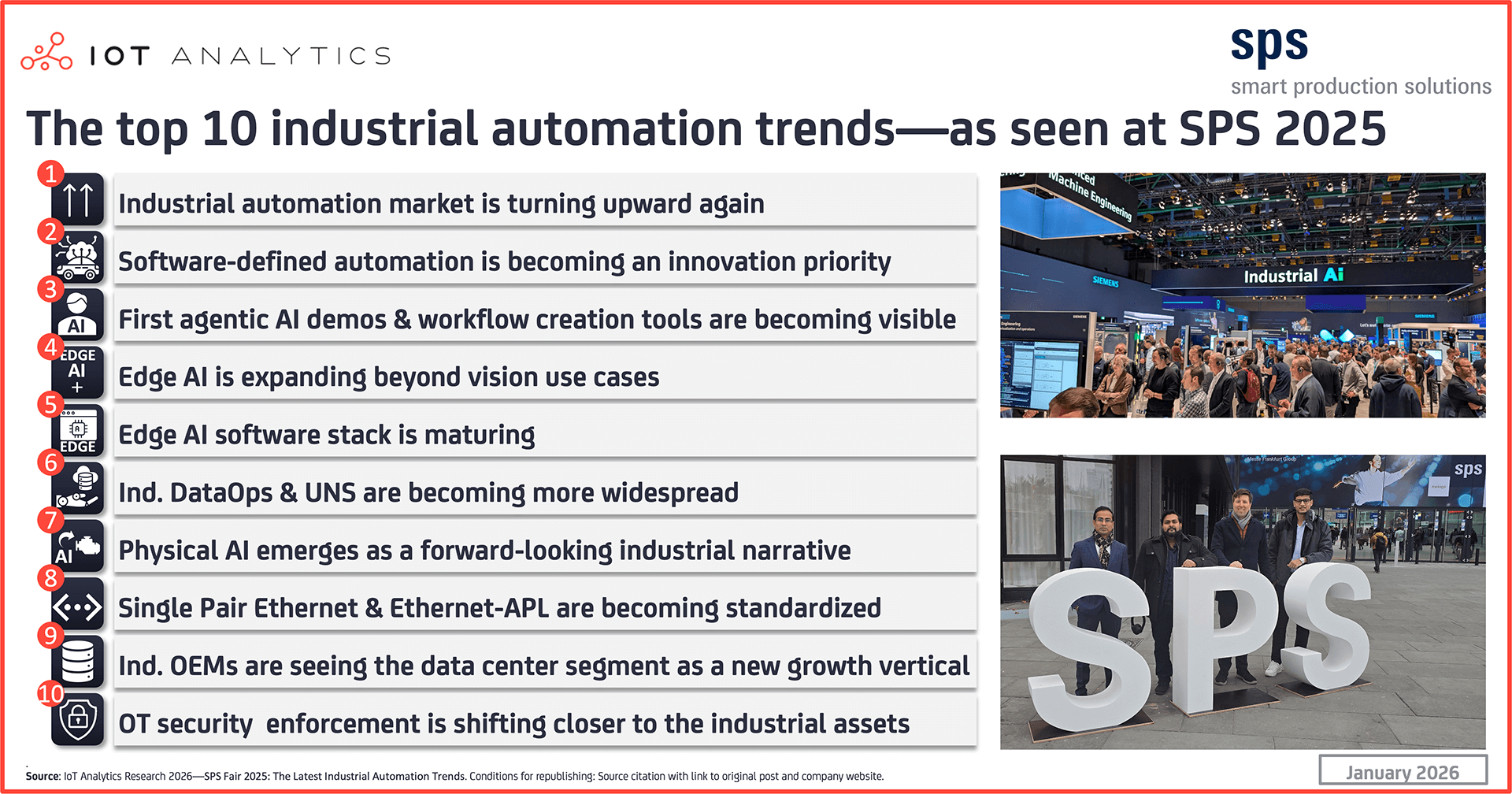

Industrial OEMs Target Data Centers as Growth Vertical

This chart shows the market trend of industrial companies entering the data center segment, providing context for Schneider’s strategic focus on AI infrastructure projects.

(Source: IoT Analytics)

Schneider Electric’s AI Investment Strategy: A Multi-Billion Dollar Commitment

Schneider Electric‘s investment strategy has evolved from broad R&D funding to targeted, high-value capital commitments aimed at capturing the AI data center infrastructure market. The company is directing hundreds of millions of dollars into its manufacturing capabilities and making strategic acquisitions to bolster its technology portfolio, directly aligning its financial power with the most critical chokepoints of the AI industry.

- A landmark commitment was the March 2025 announcement to invest over $700 million in its U.S. operations through 2027. This investment is specifically targeted at strengthening the energy infrastructure and domestic manufacturing capacity needed to support AI growth.

- The company’s acquisition strategy became more focused on the AI hardware stack. In 2025, Schneider Electric acquired a controlling interest in Motivair, a specialist in liquid cooling technology, enhancing its ability to service high-density AI data centers.

- These direct investments are complemented by a multi-year initiative announced in May 2025 to build an AI-native software ecosystem. This project focuses on developing “Agentic AI” that can autonomously optimize energy and sustainability, representing a significant R&D investment to create a new class of intelligent software.

Schneider Electric Financials Show Strong Growth

This chart validates Schneider’s multi-billion dollar investment strategy by showing its strong financial growth and revenue projections, underscoring its capacity for large-scale capital commitments.

(Source: Kontra Investments – Substack)

Table: Key Schneider Electric AI-Related Investments and Acquisitions

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Operations Expansion | 2025-2027 | Invested $700 million to bolster U.S. manufacturing and supply chains for AI data center infrastructure, including a new R&D lab in Massachusetts for advanced power systems. | Reuters |

| Acquisition of Motivair | 2025 | Acquired a controlling interest in a liquid cooling technology specialist to enhance capabilities for cooling high-density AI workloads. | ARC |

| AI-Native Ecosystem Initiative | May 2025 | Launched a multi-year R&D initiative to build an “Agentic AI” software ecosystem for autonomous energy and sustainability management. | PR Newswire |

| Strategic Investment in Ai DASH | November 2022 | SE Ventures made a strategic investment in Ai DASH to support its satellite and AI-powered platform for improving electric grid resilience. | Ai DASH |

Schneider Electric’s Partnership Ecosystem: Building the AI Value Chain

Schneider Electric has systematically built an ecosystem of strategic partnerships that position it as the central nervous system for the AI industry’s physical infrastructure. The collaborations have shifted from technology integration for software services to deep, co-development alliances with AI leaders and multi-billion-dollar supply agreements with data center operators, solidifying its market dominance from the grid to the chip.

- The most critical alliance is the strategic partnership with NVIDIA, which evolved significantly in 2025. This is not a simple supplier relationship but a co-development initiative to create the first publicly available reference designs for “AI Factories, ” optimizing power and liquid cooling to accelerate deployment.

- The commercial weight of these partnerships is demonstrated by massive supply agreements. In November 2025, Schneider Electric announced a $1.9 billion deal with Switch and a nearly $2.3 billion package of deals with U.S. data center operators to provide the essential power and cooling infrastructure for AI.

- Partnerships also extend across the software and services stack. A collaboration with Microsoft announced in May 2025 led to an industrial “AI Copilot, ” while a February 2026 partnership with CGI focuses on delivering AI-enabled grid solutions for utilities.

Top AI Companies See Major Revenue Growth

This chart highlights the significant growth of leading AI companies, providing context for why Schneider’s strategic partnerships with these players are critical to its AI value chain.

(Source: Compounding Your Wealth – Substack)

Table: Top Schneider Electric AI Partnerships and Alliances

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| CGI | February 2026 | Collaborated to deliver end-to-end solutions for energy providers, using AI to improve process efficiency and support decarbonization for utility clients. | Newswire.ca |

| Switch | November 2025 | Secured a $1.9 billion supply capacity agreement to provide power and cooling solutions for Switch‘s large-scale “AI Factories” in North America. | PR Newswire |

| NVIDIA | June-September 2025 | Formed a global strategic partnership to co-develop reference designs for “AI Factories, ” optimizing power, cooling, and control systems for NVIDIA‘s accelerators. | Financial Post |

| Microsoft | May 2025 | Developed and launched an industrial AI Copilot powered by Microsoft Azure AI to enhance productivity and efficiency in manufacturing and automation. | ARC |

| NTT DATA | February 2024 | Formed a strategic partnership to create a combined Edge, Private 5 G, and Io T solution to accelerate AI adoption in industrial environments. | NTT DATA |

Schneider Electric’s Geographic Focus: Concentrating Capital in North America

Schneider Electric‘s geographic strategy for AI has sharpened from a globally distributed approach to a concentrated focus on North America, driven by massive capital investments and commercial deals to build out the region’s AI data center capacity. While maintaining a global presence, the company’s most significant activities in 2025 and 2026 are centered in the United States, aligning with the epicenter of AI development and demand.

- From 2021 to 2024, Schneider Electric‘s AI-related activities were geographically diverse, including partnerships in Europe (Hi! PARIS Center) and launching grid resilience tools in the US with Ai Dash. The focus was on deploying software and digital services across multiple regions.

- A major strategic shift occurred in March 2025 with the announcement of a $700 million investment through 2027 to expand U.S. manufacturing and R&D facilities in locations like Tennessee, Kentucky, and Massachusetts, directly aimed at serving the American AI market.

- This U.S. focus was reinforced by nearly $2.3 billion in supply agreements with U.S. data center operators announced in November 2025, including the landmark $1.9 billion deal with Switch to power its North American AI factories.

- While North America is the clear priority for capital-intensive projects, Schneider Electric continues to pursue strategic projects elsewhere, such as the AI data center build-out with SK Telecom in South Korea and a manufacturing expansion in the UAE to serve the Middle East.

Schneider Electric’s Technology Maturity: From AI Pilots to Validated Infrastructure

The technology maturity of Schneider Electric‘s AI portfolio has advanced from early-stage analytics and internal pilots to commercially scaled, market-validated infrastructure solutions. The period from 2025 to today marks a definitive transition where AI is no longer just a feature in software but the core driver for designing and selling entire physical systems for data centers and industrial automation.

- Between 2021 and 2024, the company was in an advanced development and early commercialization phase. It established its AI Hub, invested in AI analytics firms like Ai DASH, and used AI to power sustainability platforms. The technology was largely focused on data analysis and process optimization.

- In 2025, the technology reached commercial scale with the launch of AI-native products. The “Industrial AI Copilot” developed with Microsoft and the “Agentic AI-Native Ecosystem” initiative signaled a move toward autonomous, intelligent systems that act on behalf of users.

- The partnership with NVIDIA in 2025 to create AI data center reference designs represents a critical validation point. This elevated Schneider Electric‘s technology from components to a validated blueprint for building entire AI factories, significantly reducing deployment risk for customers.

- By 2026, the technology is being deployed in large-scale commercial projects, such as the $1.9 billion supply agreement with Switch. The ability to secure such contracts confirms that Schneider Electric‘s power and cooling solutions are considered mature, reliable, and essential for the AI industry.

Schneider Electric’s SWOT Analysis: Capitalizing on the AI Energy Challenge

Schneider Electric has successfully leveraged its strengths in energy management to seize the opportunity presented by AI’s immense power demands, though it faces threats from industrial competitors pursuing similar strategies. The company’s strategic pivot in 2025 validated its business model, converting the challenge of AI’s energy consumption into a multi-billion dollar revenue stream.

- The company’s core strength is its established leadership in energy management and industrial automation, which it has successfully paired with strategic partnerships.

- A key opportunity is the exponential growth in demand for AI data centers, which require specialized, high-density power and cooling solutions that Schneider Electric is now co-developing with leaders like NVIDIA.

- The primary threat comes from other industrial giants like Siemens and ABB, who are also investing heavily in AI and data center solutions, creating a competitive environment.

AI Electricity Use Forecasted to Surge Sharply

This chart perfectly quantifies the ‘AI Energy Challenge,’ visualizing the immense, surging power demand that Schneider’s business strategy is positioned to capitalize on.

(Source: Schneider Electric Blog)

Table: SWOT Analysis for Schneider Electric’s AI Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong brand in energy management; established digital ecosystem (Eco Struxure); growing software and services revenue. | Deep partnership with NVIDIA for AI Factory reference designs; established leadership in data center solutions; proven ability to secure multi-billion dollar supply deals. | The company’s strength shifted from a broad digital portfolio to a specialized, defensible position as the physical infrastructure provider for the AI boom. |

| Weaknesses | AI strategy was still in development and not yet proven at massive commercial scale; reliance on partnerships for cutting-edge AI software capabilities. | Heavy capital expenditure required for manufacturing expansion; potential execution risk in delivering on large, complex data center projects on tight timelines. | The weakness of an unproven strategy was resolved as the company secured major commercial wins, validating its approach. However, this has been replaced by the execution risk that comes with large-scale projects. |

| Opportunities | Growing demand for sustainability and decarbonization solutions; early adoption of AI for energy efficiency. | Explosive growth in AI data center construction (projected 33% CAGR through 2030); demand for liquid cooling and high-density power solutions; development of “Agentic AI” for autonomous energy management. | The opportunity crystallized from a general trend into a specific, addressable market: powering AI factories. The $700 M U.S. investment is a direct response to this. |

| Threats | Competition from industrial peers (e.g., Siemens, ABB) in digital solutions; rapid technological change in AI making some solutions obsolete. | Intensified competition from rivals also targeting the AI data center market; grid instability and energy shortages potentially slowing data center build-outs; supply chain constraints for critical components. | The threat became more focused and intense. While competition always existed, it is now centered on the highly lucrative AI infrastructure market, as seen with Siemens‘ own AI copilot launch. |

Forward-Looking Insights: The Race to Power Intelligence in 2026

Schneider Electric‘s primary focus for the remainder of 2026 and beyond will be the execution of its multi-billion-dollar backlog of AI infrastructure projects and the scaling of its “Agentic AI” ecosystem. The company has successfully positioned itself at the center of the AI energy challenge; now it must deliver on its promises while fending off intensified competition.

- Watch for the financial impact of the massive data center deals signed in late 2025 to appear in quarterly results through 2026. The company’s ability to meet its accelerated growth target of 7% to 10% will depend on its capacity to deliver these complex projects on time and on budget.

- The evolution of the NVIDIA partnership remains critical. Expect announcements of new, jointly-developed reference designs for even more powerful and efficient liquid cooling solutions, further cementing Schneider Electric‘s role as a key enabler of next-generation AI hardware.

- The rollout of the AI-native ecosystem and its “Agentic AI” will be a key differentiator. Monitor for client adoption metrics and case studies demonstrating quantifiable energy savings, as this will be crucial to validating the company’s dual narrative of powering AI growth while solving its sustainability problem.

- With Gartner predicting that 40% of enterprise applications will embed task-specific AI agents by the end of 2026, Schneider Electric‘s push into this area is well-timed. The success of its industrial copilots and sustainability agents will determine its ability to move up the value chain from hardware supplier to an indispensable intelligence provider.

Frequently Asked Questions

What is Schneider Electric’s primary AI strategy for 2025-2026?

For 2025-2026, Schneider Electric’s primary AI strategy shifted from software services to becoming the leading infrastructure architect for the AI revolution. The company is focusing on providing the entire physical ecosystem—specifically power and cooling solutions—for energy-intensive AI data centers, addressing the industry’s main bottleneck.

What are some of the major commercial deals that validate this new strategy?

The strategy is validated by significant commercial agreements, including a $1.9 billion supply capacity deal with Switch to equip its “AI Factories” and a broader $2.3 billion series of deals with other U.S. data center operators, both announced in November 2025.

How is Schneider Electric partnering with major tech companies like NVIDIA and Microsoft?

Schneider Electric formed a deep co-development partnership with NVIDIA to create the first publicly available reference designs for “AI Factories,” optimizing power and liquid cooling. With Microsoft, it launched an industrial “AI Copilot” in May 2025 to enhance productivity in manufacturing and automation.

What specific investments has Schneider Electric made to support the AI data center market?

Schneider Electric is making significant capital commitments, including a $700 million investment (from 2025-2027) to expand its U.S. manufacturing and supply chains for AI infrastructure. Additionally, in 2025, it acquired a controlling interest in Motivair, a specialist in liquid cooling technology, to better service high-density AI data centers.

How has Schneider Electric’s AI focus evolved from previous years?

Between 2021 and 2024, the company’s AI adoption centered on internal efficiency and software, such as analytics platforms and sustainability reporting. Starting in 2025, the focus aggressively transitioned to commercial hardware dominance, securing large-scale agreements to provide the critical physical power and cooling infrastructure required by the AI boom.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.