Moonshot AI Infrastructure: How AI is Driving Unprecedented Energy Demand in 2026

Moonshot AI Commercial Projects Drive a Tectonic Shift to Energy-Intensive Infrastructure

The rapid scaling of artificial intelligence models, exemplified by Moonshot AI, has shifted the industry’s strategic focus from software innovation to the massive physical and energy infrastructure required to support it.

- Between 2023 and 2024, the primary focus was on foundational model development. After its founding in March 2023, Moonshot AI launched its Kimi Chatbot, initially differentiating itself with a 200, 000-character context window and relying heavily on cloud partners like Alibaba Cloud for computational resources. During this period, the International Energy Agency’s projection that AI data center electricity demand could grow more than tenfold by 2026 was a forward-looking warning about the energy implications of this software race.

- From 2025 to today, the strategy pivoted to a large-scale physical infrastructure build-out. Moonshot AI entered a joint venture with Qumulus AI and IXP.us to deploy a distributed AI compute platform across 125 locations in the United States, supported by a new manufacturing hub in Lewisville, Texas. This move to deploy physical “AI Pods” at the network edge corresponds with the release of the 1-trillion parameter Kimi K 2.5 model, whose immense computational requirements necessitate this specialized, energy-demanding hardware.

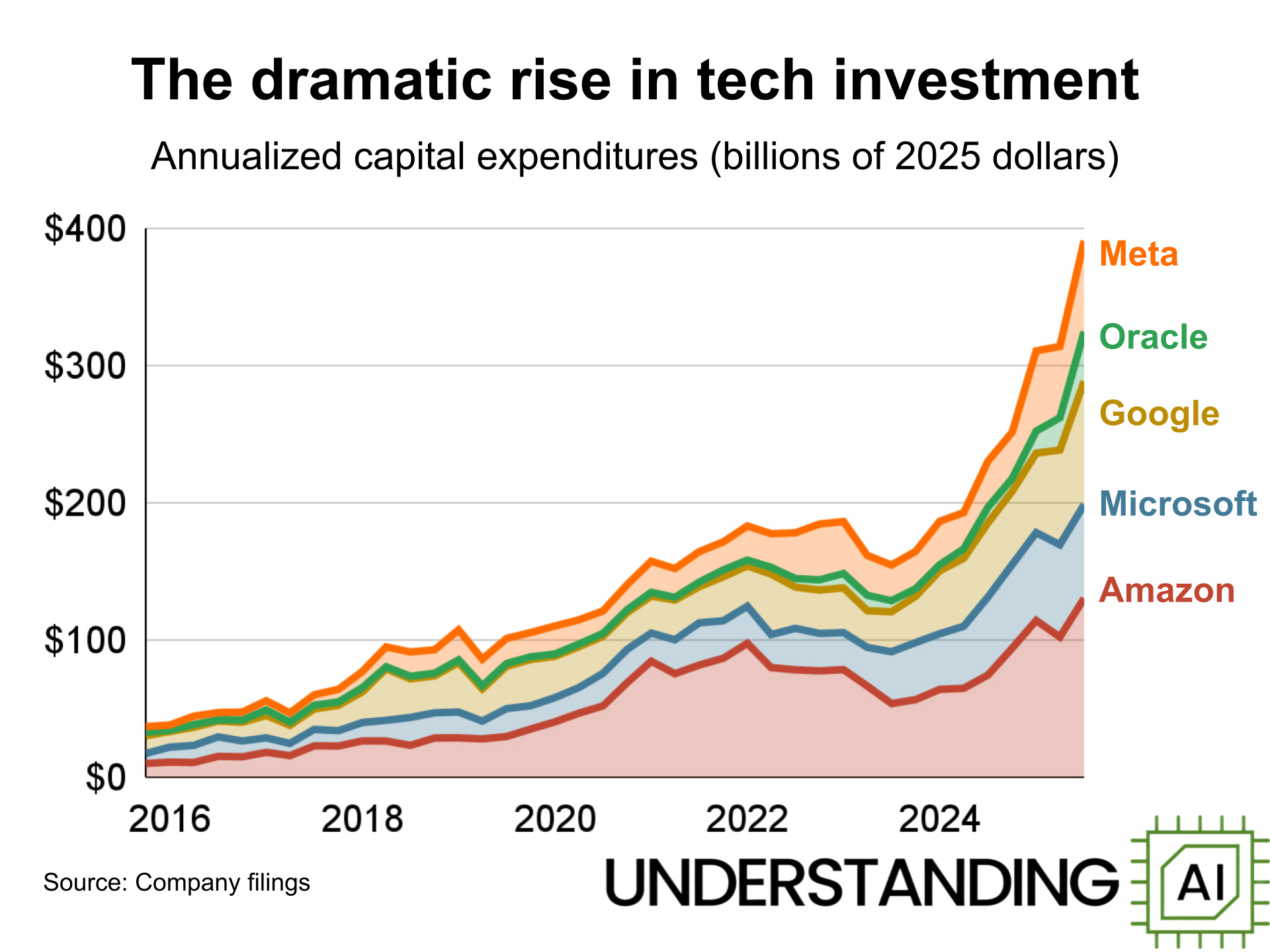

AI Infrastructure Spending Skyrockets Among Tech Giants

This chart illustrates the massive increase in capital expenditures on AI infrastructure by major tech companies, directly supporting the section’s theme of a “tectonic shift” towards energy-intensive hardware.

(Source: Understanding AI)

Moonshot AI Investment Analysis: Capital Infusion Fuels AI Energy and Infrastructure Race

Massive capital injections into Moonshot AI are being strategically deployed to secure the expensive computational and energy resources needed to sustain its technological lead and fund its ambitious infrastructure expansion.

- The company’s valuation has grown exponentially, fueled by investor confidence in its dual strategy of model innovation and infrastructure development. The valuation surged from $300 million in 2023 to $2.5 billion in early 2024, and later reached $4.8 billion by January 2026.

- Each major funding round has been explicitly tied to scaling capabilities. The $1 billion round in February 2024 was pivotal for securing GPU access, while the $500 million Series C in January 2026 was earmarked specifically for accelerating its AI infrastructure investment plans.

- The consistent attraction of nine- and ten-figure investments from major backers like Alibaba and Tencent demonstrates that the market views access to high-performance, energy-intensive compute as the primary bottleneck and key competitive advantage in the AI sector.

Table: Moonshot AI Investment Timeline

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| New Funding Round | January 2026 | A funding round valued Moonshot AI at $4.8 billion, an increase of $500 million in just weeks, highlighting intense investor demand for its Kimi chatbot and the underlying infrastructure strategy. | CNBC |

| Series C Funding | January 2026 | Raised $500 million in a Series C round led by IDG Capital, bringing its valuation to $4.3 billion. The capital is explicitly for accelerating AI infrastructure investment plans. | Entrepreneur Loop |

| Series B Extension | August 2024 | Raised over $300 million in a round that included Tencent and Alibaba, pushing the company’s valuation to $3.3 billion and providing further capital for computational resources. | Bloomberg |

| Series B Funding | February 2024 | Secured over $1 billion in a round led by Alibaba Group and Hong Shan, valuing the startup at $2.5 billion. A significant portion of this was tied to accessing cloud infrastructure. | Tech Crunch |

| Angel Round | June 2023 | Raised approximately $280 million in an angel round from investors including Hong Shan (Sequoia China) and Zhen Fund, which valued the new company at $300 million. | Pandaily |

Moonshot AI Partnership Strategy: Alliances Secure Critical Cloud and Compute Resources

Moonshot AI has constructed a strategic ecosystem of partnerships that provide not just capital, but direct access to the cloud infrastructure and network interconnections essential for deploying its energy-intensive AI models at scale.

- The company’s core partnerships provide the foundational compute layer. The strategic relationship with Alibaba, formalized by a massive investment and the provision of cloud computing credits, gave Moonshot AI the initial infrastructure needed to train its models.

- Recent collaborations signal a strategic pivot from relying on third-party clouds to building proprietary infrastructure. The January 2026 joint venture with modular infrastructure firm Qumulus AI and network provider IXP.us is a definitive move to build and control a distributed, low-latency compute network in the U.S.

- Ecosystem partnerships are expanding the market reach of its models. The January 2026 integration of Kimi K 2.5 into the Together AI platform makes its technology available to a wider developer base, creating demand for the underlying specialized infrastructure.

Mapping the Complex AI Infrastructure Ecosystem

This market map visualizes the broad ecosystem of technology partners, from hardware to MLOps, that Moonshot AI must navigate to secure critical cloud and compute resources.

(Source: Next Big Teng – Substack)

Table: Moonshot AI Strategic Partnership Timeline

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Together AI | January 2026 | Integrated the 1-trillion-parameter Kimi K 2.5 model into its platform, expanding Moonshot AI‘s reach within the developer ecosystem and driving adoption of its advanced models. | Tip Ranks |

| Qumulus AI & IXP.us | January 2026 | Formed a joint venture to design and deploy a nationally distributed AI compute and internet exchange platform in the U.S., aiming to bring inference workloads closer to the edge to reduce latency. | Business Wire |

| Tencent Holdings | August 2024 | Participated in a $300 million+ financing round, providing Moonshot AI with further capital and a strategic alliance with another of China’s tech and cloud infrastructure giants. | PYMNTS |

| Alibaba Group | February 2024 | Led a $1 billion+ funding round that included providing essential cloud computing credits, securing the high-cost computational resources needed for LLM training and operation. | bobsguide |

Geographic Expansion: Moonshot AI Shifts from China-Centric Development to U.S. Infrastructure Build-Out

Moonshot AI‘s operational footprint has decisively expanded from a China-centric model development phase to a major physical infrastructure deployment in the United States, targeting the world’s largest AI market.

- Between 2023 and 2024, the company’s activities were almost exclusively focused on China. It was founded in China, its major investors like Alibaba and Tencent were domestic, and its Kimi Chatbot was initially optimized for processing Chinese characters, establishing its presence within the national market.

- Beginning in 2025 and accelerating into 2026, Moonshot AI executed a significant strategic expansion into the U.S. This is not just a market entry, but a physical build-out, evidenced by the joint venture to create a national network of 125 distributed AI compute sites across U.S. universities and municipalities, anchored by a new manufacturing facility in Lewisville, Texas.

Technology Maturity: Moonshot AI Progresses from Model R&D to Commercially Deployed Hardware

The technology underpinning Moonshot AI‘s strategy has rapidly matured from foundational model research and development to the deployment of commercially scaled, energy-intensive physical infrastructure designed for edge computing.

- During its initial phase in 2023-2024, the technology was at the R&D and early product stage. The core focus was on creating the Kimi Chat LLM and progressively increasing its context window from 200, 000 to 2 million characters, with the underlying infrastructure remaining virtual and dependent on third-party cloud services.

- The period from 2025 to 2026 marks a transition to commercial hardware deployment. The development of modular “AI Pods” represents a physical product designed for scaled manufacturing. The partnership with IXP.us validates this shift, as it focuses on deploying this hardware at 125 network interconnection points to create a new layer of AI infrastructure. This hardware is necessary to support the extreme computational demands of models like the 1-trillion parameter Kimi K 2.5.

Kimi K2 Model Demonstrates Top-Tier Performance

This chart shows Moonshot AI’s Kimi K2 model achieving leading scores against major competitors, validating the technological maturity and successful R&D efforts described in the section.

(Source: ThursdAI)

SWOT Analysis: Moonshot AI’s Strengths, Weaknesses, Opportunities, and Threats

Moonshot AI is capitalizing on its core strength in capital-efficient model development to pursue the significant market opportunity in distributed AI infrastructure, though this strategy is exposed to high operational costs and intense competitive threats.

Moonshot AI Competes on Cost-Efficiency

This chart highlights a key strength from the SWOT analysis by showing Moonshot AI’s competitive token pricing, a direct result of its capital-efficient model development.

(Source: LinkedIn)

Table: SWOT Analysis for Moonshot AI

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Development of long-context LLMs (Kimi Chat). Attracted significant initial funding ($280 M Angel, $1 B+ Series B). | Demonstrated capital-efficient training (Kimi K 2 Thinking for $4.6 M). Launched superior 1-trillion parameter model (Kimi K 2.5). | The company’s technological edge was validated by outperforming competitors on key benchmarks and securing a $4.8 billion valuation, confirming its ability to innovate at a lower cost. |

| Weaknesses | High dependency on third-party cloud infrastructure (e.g., Alibaba Cloud). High cash burn rate due to computational costs. | Operational costs remain a primary concern. The business model is still dependent on large capital infusions to fund infrastructure expansion. | The weakness of dependency was partially addressed by the strategic shift to build a proprietary, distributed network, though this requires even greater upfront capital expenditure. |

| Opportunities | Monetize its long-context window technology. Expand beyond the Chinese domestic market. | Build out a proprietary, distributed compute network in the U.S. Commercialize “agent swarm” technology for low-latency edge applications. | The opportunity to build a U.S. network was validated by the concrete January 2026 joint venture with Qumulus AI and IXP.us to deploy 125 sites. |

| Threats | Intense domestic competition from other “AI tigers.” Geopolitical risks related to U.S. chip curbs. | A formal legal dispute with investors from the founder’s previous venture. Direct competition from U.S. incumbents like Open AI and Anthropic. | The threat of competition was validated as Moonshot AI‘s new models directly target the performance of GPT-5 and Claude 4.5, moving from a domestic to a global competitive arena. |

Forward-Looking Insights: Execution of U.S. Infrastructure Rollout is the Critical Test for 2026

The single most critical factor for Moonshot AI in the year ahead is the successful execution of its ambitious U.S. distributed compute network, which will determine if it can convert its model superiority into a defensible, infrastructure-based business and meet the surging energy demands of the AI industry.

- The primary focus must be on the deployment speed and operational success of the 125-site distributed AI network. Meeting this target is a key test of its joint venture with Qumulus AI and IXP.us and its ability to manage a complex hardware supply chain supported by its new Texas manufacturing hub.

- Watch for the commercial adoption of applications leveraging the “agent swarm” capability of Kimi K 2.5. The emergence of enterprise use cases requiring the low-latency, edge-based infrastructure Moonshot AI is building would validate its entire strategic pivot.

- The company’s valuation trajectory from $4.3 billion to $4.8 billion in January 2026 alone suggests a near-term IPO or another major funding round is likely. Such a move would be necessary to secure the immense capital required to scale its energy-intensive infrastructure globally and compete with hyperscalers.

Frequently Asked Questions

What was Moonshot AI’s major strategic shift between 2024 and 2026?

Between 2023 and 2024, Moonshot AI focused on developing its Kimi chatbot and relied on cloud partners like Alibaba Cloud. From 2025 to 2026, its strategy pivoted to building its own large-scale physical infrastructure. This is highlighted by its joint venture to deploy a distributed AI compute platform across 125 U.S. locations to support its newer, more computationally demanding models.

How is Moonshot AI funding its expansion into physical infrastructure?

Moonshot AI is funding its expansion through massive capital injections. Key funding events include a $1 billion round in February 2024 to secure GPU access and a $500 million Series C round in January 2026 explicitly earmarked for accelerating its AI infrastructure investment plans. These investments have raised its valuation to $4.8 billion by January 2026.

What is the significance of the partnership with Qumulus AI and IXP.us?

The January 2026 joint venture with Qumulus AI and IXP.us marks Moonshot AI’s strategic move from relying on third-party cloud providers to building and controlling its own proprietary, distributed compute network. The goal is to deploy ‘AI Pods’ at 125 network interconnection points across the U.S., bringing AI processing closer to users to reduce latency.

How has Moonshot AI’s technology evolved from its founding to 2026?

The company’s technology has matured from software research to commercial hardware deployment. In 2023-2024, the focus was on the Kimi Chat LLM and its context window, running on third-party clouds. By 2026, the focus shifted to deploying physical, modular ‘AI Pods’—specialized hardware necessary to run the extremely demanding 1-trillion parameter Kimi K 2.5 model at the network edge.

What is the most critical challenge for Moonshot AI in 2026?

According to the analysis, the single most critical factor for Moonshot AI in 2026 is the successful execution of its ambitious U.S. distributed compute network. The challenge lies in the speed and operational success of deploying its 125-site network, which will test its ability to manage a complex hardware supply chain and validate its strategy of building a defensible, infrastructure-based business.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.