China Unicom Green Data Center Strategy 2026: AI Drives Energy Efficiency and Investment

China Unicom’s Commercial Scale Projects for Green AI Infrastructure 2026

China Unicom has transitioned from foundational investments in energy-saving data center technologies to large-scale commercial deployments that use AI to optimize power consumption across its expanding infrastructure.

- In the period from 2021 to 2024, China Unicom focused on pilot projects and technology partnerships to establish energy-efficient practices, such as the November 2022 collaboration with Intel to use AI models for forecasting and optimizing data center energy use. This phase also included deploying Huawei’s i Cooling@AI solution in its Guangzhou data center in October 2023 to match cooling supply with IT load.

- From 2025 onward, the strategy shifted to applying these energy-saving principles at a massive commercial scale, driven by the need to support its “AI-first” pivot. This is evident in the development of the $390 million AI data center in Qinghai, which, while focused on compute power, incorporates efficiency by design to manage the immense energy needs of its nearly 23, 000 AI chips.

- The collaboration with ZTE and Trina Solar in November 2025 to create a “5 G-A + AI + Digital Twin” solution for green energy digitalization shows the company is now exporting its AI and efficiency expertise to other industrial sectors. Achieving an 80% increase in operational efficiency in a factory setting demonstrates that the adoption of these technologies extends beyond its own data centers to external enterprise clients.

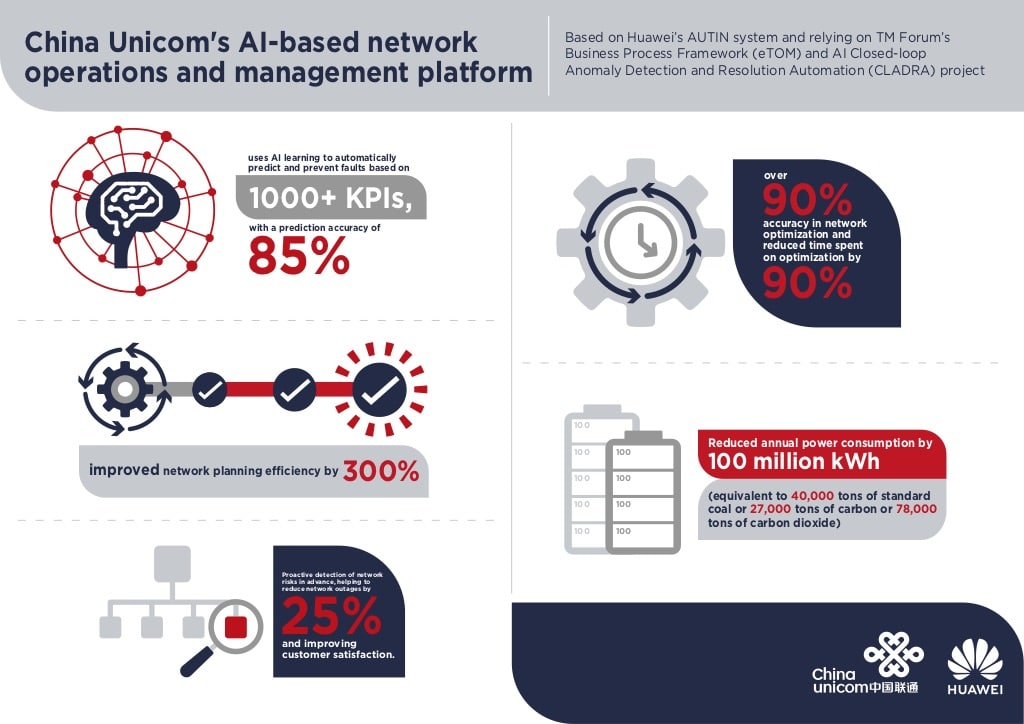

- Beyond data centers, AI-driven network automation with partners like Huawei has become a core part of its efficiency strategy. This integration cut annual power consumption by 100 million k Wh, equivalent to 78, 000 tons of CO 2, showing that energy efficiency is being applied across the entire network infrastructure.

AI Platform Drives Major Efficiency Gains

This infographic quantifies the success of China Unicom’s large-scale AI deployment, showing a 100 million kWh power reduction, which directly supports the section’s focus on commercial-scale green infrastructure.

(Source: TM Forum Inform)

China Unicom’s Investment Analysis: Capital Shifts to Power-Intensive AI Infrastructure

China Unicom is reallocating capital expenditure from mature 5 G network rollouts to power-intensive AI computing infrastructure, making energy efficiency a critical factor in managing operational costs and ensuring the profitability of these new investments.

- The company budgeted a 28% increase in capital expenses for computing power in 2025, a strategic pivot to meet the surging demand for AI services. This investment underpins the construction of massive facilities like the $390 million Qinghai AI data center, where managing energy consumption is essential for financial viability.

- In 2023 and 2024, China Unicom began reducing overall CAPEX, with a forecast of RMB 65 billion for 2024 down from RMB 73.9 billion in 2023. This reduction is not a pullback but a strategic shift, redirecting funds from broad 5 G buildouts to more targeted, high-value AI and cloud computing assets which have significant energy footprints.

- The joint investment with other Chinese telcos of over CNY 10 billion each in AI servers during 2024 highlights the scale of this transition. Such a massive hardware acquisition makes energy management solutions, like those developed with Intel and Huawei, essential for controlling the total cost of ownership.

Table: China Unicom Key Green Infrastructure Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Qinghai AI Data Center | September 2025 | A $390 million investment in a massive AI data center powered by nearly 23, 000 domestic chips. The project’s scale makes energy-efficient design a critical requirement for managing operational costs. | DCD |

| Annual Computing Power Capex | March 2025 | Budgeted a 28% increase in capital expenses for computing power for 2025. This shift toward power-intensive assets elevates the strategic importance of energy efficiency across the organization. | SCMP |

| AI Server Investment | 2024 | Part of a collective effort with other state-owned telcos to spend over CNY 10 billion on AI servers. This massive procurement drives the need for advanced cooling and power management solutions. | MERICS |

| Data Center Capex Growth | 2022 | Increased data center CAPEX by 46% over 2021, primarily for server acquisitions. This early investment wave laid the groundwork for subsequent energy optimization initiatives. | Omdia |

China Unicom’s Strategic Partnerships Drive Energy-Efficient Data Center Innovation

China Unicom leverages strategic partnerships with technology providers and industrial clients to develop and deploy AI-driven energy efficiency solutions, moving from internal optimization to offering green digitalization services.

- The November 2022 partnership with Intel was foundational, implementing the Intel Intelligent Energy Management solution to use AI for forecasting and reducing data center power consumption, saving an estimated 13.2 million k Wh annually at one site.

- Collaboration with Huawei on solutions like the i Cooling@AI platform, deployed in the Guangzhou data center in October 2023, further enhanced its capabilities by using AI to dynamically match cooling supply with IT load, a critical function for power-hungry AI workloads.

- By November 2025, these internal capabilities were being externalized through a partnership with ZTE and Trina Solar. The “5 G-A + AI + Digital Twin” solution developed for green energy digitalization in factories showcases China Unicom’s move into the industrial energy efficiency market.

Partnership with Huawei Boosts Network Performance

This section discusses how strategic partnerships drive innovation. The chart provides a concrete example of a partnership with Huawei that resulted in measurable performance and efficiency improvements.

(Source: TM Forum Inform)

Table: China Unicom’s Energy Efficiency Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| ZTE and Trina Solar | November 2025 | Collaborated to create a “5 G-A + AI + Digital Twin” solution for green energy digitalization in factories. This project externalizes China Unicom’s AI and efficiency expertise for industrial clients. | ZTE |

| Huawei | October 2023 | Implemented Huawei’s i Cooling@AI energy efficiency solution in its Guangzhou data center to optimize power usage by matching cooling with real-time IT load. | Huawei Digital Power |

| Intel | November 2022 | Partnered to use the Intel Intelligent Energy Management solution, which employs AI models to forecast and optimize data center energy consumption. | Intel |

Geographic Analysis: China Unicom’s Green Infrastructure Expands from Coastal Hubs to National Scale

China Unicom’s energy efficiency initiatives have expanded from established technology hubs in coastal China to large-scale, nationally strategic inland locations, supporting the country’s “Eastern Data, Western Computing” policy.

- During the 2021 to 2024 period, initial energy efficiency projects were concentrated in major economic zones, such as the deployment of Huawei’s i Cooling@AI solution in the Guangzhou data center in October 2023. The establishment of the first AI computing power clusters also occurred in key hubs like Shanghai and Hohhot.

- From 2025, the geographic focus has shifted dramatically inland with the construction of the $390 million AI data center in Xining, Qinghai province, in September 2025. This project is a core component of a national strategy to place power-intensive data centers in regions with abundant and often greener energy resources.

- While the core infrastructure buildout is domestic, China Unicom is exporting its expertise internationally. The award of “Malaysia Digital” status and a private 5 G project for Midea Group in Thailand indicate a move to offer its integrated and more efficient digital services in Southeast Asia.

Technology Maturity: China Unicom’s AI Energy Efficiency Moves from Pilot to Commercial Standard

AI-driven energy management technology within China Unicom’s operations has rapidly matured from pilot-phase solutions to a commercial-scale necessity, now integral to the viability of its massive AI infrastructure investments.

- In the 2021-2024 period, the technology was in the advanced pilot and early adoption phase. The 2022 partnership with Intel and the 2023 deployment of Huawei’s i Cooling@AI were test cases proving the technology’s effectiveness in live data center environments, achieving measurable power savings.

- From 2025, the technology is now being applied at full commercial scale as a standard operating procedure. The construction of the Qinghai AIDC, designed to host up to 20, 000 petaflops of computing power, would be economically and environmentally unfeasible without the mature energy optimization technologies developed in the preceding years.

- The strongest validation point is the externalization of this technology as a commercial offering. The project with Trina Solar and ZTE in November 2025, which achieved an 80% efficiency gain in a factory, confirms that China Unicom’s AI-driven efficiency solutions are robust enough to be a product for industrial clients.

Cloud Infrastructure Reaches Commercial Blueprint

This section describes the maturation of AI technology from pilot to a commercial standard. The chart’s detailed architectural blueprint illustrates this mature, standardized state of China Unicom’s cloud platform.

(Source: OpenInfra Foundation)

SWOT Analysis: China Unicom’s Green AI Infrastructure Position 2026

China Unicom’s strategic pivot to an “AI-first” enterprise is strengthened by its early adoption of energy-efficient technologies, but this capital-intensive strategy faces pressure on margins and depends heavily on the performance of a domestic-first technology ecosystem.

- Strengths are rooted in its state-backed status and extensive network infrastructure, now enhanced by proven AI-driven efficiency to manage operational costs.

- Weaknesses include the high capital expenditure required for the AI transition and reliance on domestic chip partners whose long-term performance against global leaders is still being validated.

- Opportunities lie in monetizing its green AI infrastructure through new services and expanding into the high-growth industrial digitalization market.

- Threats include geopolitical technology sanctions that could limit access to advanced components and intense competition from China Mobile and Alibaba.

China Unicom’s Position in Cloud Investment

This section provides a SWOT analysis of China Unicom’s position. The pie chart visualizes the competitive landscape, a key component of a SWOT, by showing the company’s 12.8% investment share relative to major rivals.

(Source: AI Proem – Substack)

Table: SWOT Analysis for China Unicom

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Existing data center footprint and network infrastructure. Early partnerships with Intel and Huawei to pilot AI energy saving tools. | Proven AI-driven energy efficiency demonstrated at scale, reducing power consumption by 100 million k Wh annually across the network. | The company validated its ability to manage energy costs at scale, transforming from a simple asset owner into an efficient infrastructure operator. |

| Weakness | Rising operational expenses (OPEX) from a growing portfolio of power-hungry data centers. | Massive new capital expenditure (CAPEX), including a 28% increase for computing power and the $390 million Qinghai AIDC, puts pressure on margins. | The primary financial concern shifted from managing existing OPEX to justifying and achieving returns on massive new capital-intensive AI projects. |

| Opportunity | Focus on reducing internal energy costs and improving the power usage effectiveness (PUE) of its own data centers. | Externalizing efficiency solutions as a commercial service, demonstrated by the Trina Solar partnership that delivered an 80% efficiency gain for an industrial client. | An internal cost-center (energy management) has been validated as a potential external revenue-generating service, opening new markets. |

| Threat | Broad economic risks such as rising energy costs impacting data center profitability. | Specific geopolitical risks affecting access to advanced, energy-efficient chips and intense competition from rivals like China Mobile and Alibaba who are also building AI infrastructure. | General economic threats have narrowed to specific competitive and geopolitical pressures that could directly impact its technology supply chain and market position. |

Forward-Looking Outlook: China Unicom’s Profitability Hinges on Monetizing Green AI Infrastructure

China Unicom’s primary challenge in 2026 and beyond is to effectively monetize its massive, energy-efficient AI infrastructure by translating computing power and efficiency gains into profitable AI-as-a-Service (AIaa S) offerings.

- The success of the $390 million Qinghai data center will be measured not by its eventual computing capacity of 20, 000 petaflops, but by the revenue it generates from enterprise clients, which will depend on the performance and efficiency of its domestic Alibaba chips.

- The expansion into industrial digitalization, evidenced by the Trina Solar partnership, is a critical area to watch. This signals a move beyond selling cloud compute to providing higher-value, vertical-specific solutions for energy management and operational efficiency.

- The planned exploration of a 100, 000-GPU cluster represents the next frontier of its investment. The ability to manage the immense power and cooling requirements of such a cluster will be the ultimate test of its green data center strategy and a key determinant of its long-term market competitiveness.

Frequently Asked Questions

What is the main goal of China Unicom’s Green Data Center Strategy for 2026?

The primary goal is to use Artificial Intelligence (AI) at a large commercial scale to optimize energy consumption across its expanding data center and network infrastructure. This strategy is crucial for managing the high operational costs associated with its strategic pivot to an “AI-first” business model and massive investments in power-intensive AI computing.

How has China Unicom’s investment strategy changed recently?

China Unicom has shifted its capital expenditure (CAPEX) away from mature 5G network rollouts and towards power-intensive AI computing infrastructure. This is highlighted by a budgeted 28% increase in computing power expenses for 2025 and major projects like the $390 million Qinghai AI data center. This shift makes energy efficiency critical to the financial viability of these new investments.

Who are China Unicom’s key partners in developing its energy-efficient technologies?

China Unicom has collaborated with several major technology providers. Key partners include Intel, for its Intelligent Energy Management solution to forecast energy use; Huawei, for its iCooling@AI platform that matches cooling with IT load; and ZTE and Trina Solar, for a “5G-A + AI + Digital Twin” solution that applies its expertise to industrial clients.

What are some measurable results of China Unicom’s energy efficiency efforts?

China Unicom’s AI-driven network automation has successfully reduced annual power consumption by 100 million kWh, equivalent to 78,000 tons of CO2. Additionally, a project with ZTE and Trina Solar for an industrial client achieved an 80% increase in operational efficiency, demonstrating the commercial viability of its green technology solutions.

What is the significance of the new Qinghai AI data center project?

The $390 million Qinghai AI data center is significant for two main reasons. First, it represents China Unicom’s large-scale investment in domestic AI infrastructure, housing nearly 23,000 chips. Second, it aligns with China’s national “Eastern Data, Western Computing” strategy by placing a power-intensive facility in an energy-rich inland region, making energy-efficient design a critical requirement for its success.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.