China Mobile’s AI Data Center Energy Efficiency Strategy 2026

China Mobile Commercial Scale Projects Target Data Center Energy Use 2026

China Mobile is deploying artificial intelligence not only to power new services but to actively manage the massive energy consumption of its rapidly expanding data center infrastructure, shifting from network optimization trials to commercial-scale energy-saving solutions.

- Between 2021 and 2024, the company focused on foundational AI applications, such as the 2021 live trials with Nokia of an AI-powered Radio Access Network (RAN) to enhance network efficiency.

- This focus evolved into direct energy management with the launch of an “AI-Driven Green Telco Cloud” in November 2024 in partnership with ZTE, a solution capable of reducing single-machine energy consumption by up to 25%.

- By 2025, the strategy became integral to new infrastructure, with the company launching massive AI computing centers that require these advanced energy management systems to remain cost-effective and sustainable.

- The company’s “AI+NETWORK” strategy, unveiled in March 2025, formalizes this approach, integrating AI to create autonomous and energy-efficient systems across its entire network fabric, a necessary step to support its goal of tripling AI computing power by 2028.

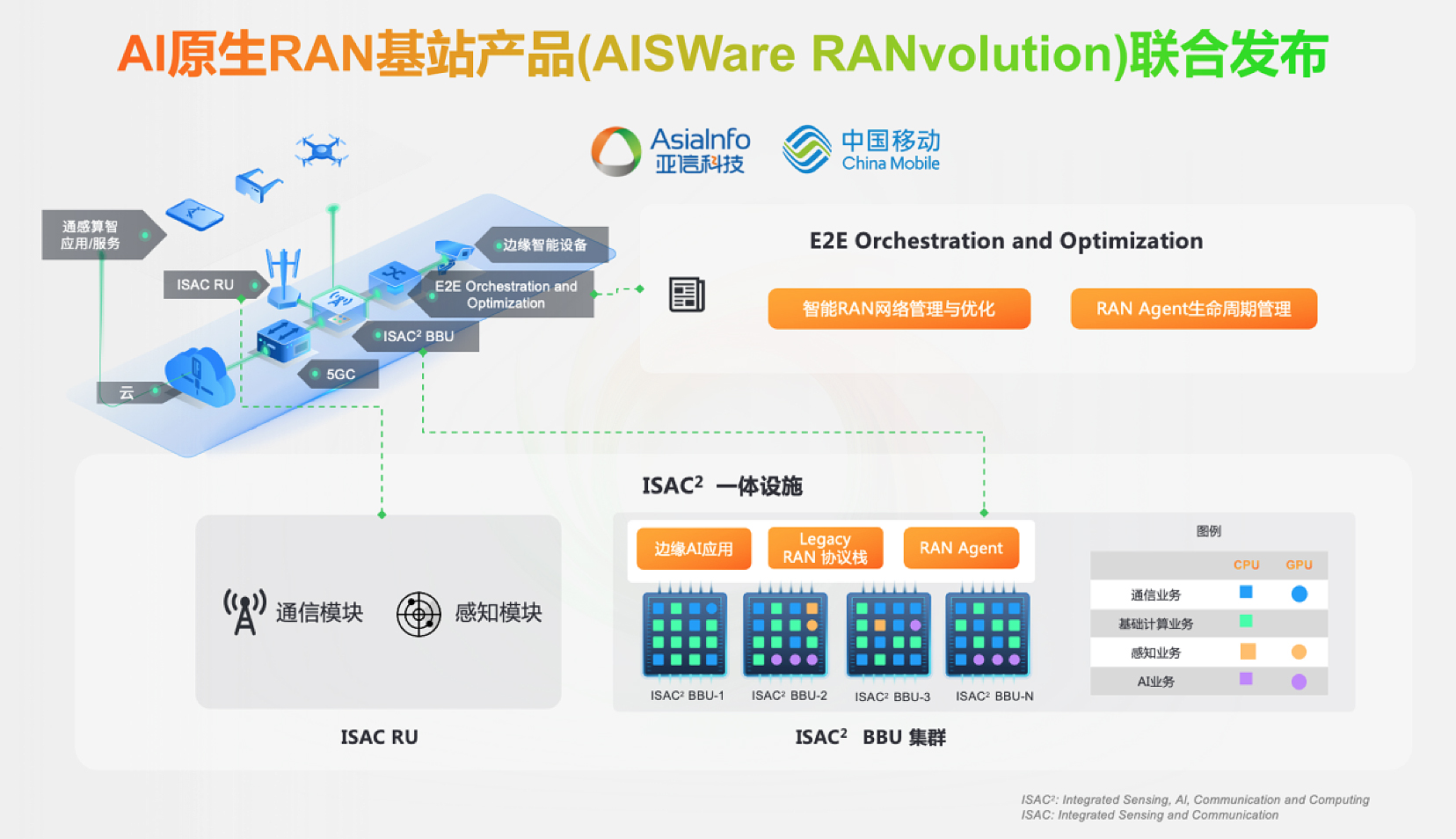

China Mobile’s AI-Native RAN Architecture

This diagram illustrates the architecture of an AI-native Radio Access Network (RAN), a technology China Mobile trialed starting in 2021 as a foundational step in its AI-driven efficiency strategy.

(Source: 亚信科技)

China Mobile Investment Analysis: Funding a Greener AI Future

China Mobile is coupling its multi-billion-dollar investments in raw computing power with strategic allocations toward energy-efficient technologies, recognizing that managing operational expenditure is critical to the long-term financial viability of its AI ambitions.

- The company’s enormous capital outlay in 2024, including a $4.3 billion order for AI servers and a $2.6 billion purchase of data center equipment, created an urgent need for advanced energy management to control the resulting surge in power demand.

- While competitors like China Telecom also increased AI spending, China Mobile‘s concurrent development of solutions like the AI-Driven Green Telco Cloud demonstrates a dual strategy of scaling capacity while actively managing its energy costs.

- By H 1 2025, the company reported a CAPEX of RMB 58.4 billion, a portion of which supports the continued build-out of its energy-aware intelligent computing network, reinforcing the link between infrastructure growth and efficiency investments.

- This financial strategy is validated by the rapid growth of its digital transformation revenue, which hit RMB 156.9 billion in the first half of 2025, providing the financial returns necessary to sustain these large-scale, efficiency-focused investments.

China Mobile Stock Rallies on AI Strategy

This chart shows China Mobile’s stock significantly outperforming its telecom peers, validating the financial viability of its multi-billion-dollar investments in AI and data center infrastructure mentioned in the section.

(Source: Bloomberg.com)

Table: China Mobile AI Infrastructure Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Long-term AI Investment Plan | 2025-2028 | Plan to double total AI investment by 2028, with a core focus on building a technologically advanced and efficient intelligent computing network. | China Mobile to double down on AI investment |

| Procurement of Huawei Ascend AI Chips | November 2025 | A $22 Million purchase of Huawei‘s Ascend AI chips, supporting the national goal of technological self-sufficiency and building infrastructure with domestic, potentially more customized, hardware. | China Mobile buys Huawei AI chips worth $22 million over Nvidia … |

| Intelligent Data Center Gear | July 2024 | A $2.6 billion order for intelligent data center equipment from local suppliers to expand its computing power infrastructure, necessitating energy-efficient management solutions. | China Mobile orders up $2.6 B in intelligent data center gear |

| AI Server Procurement | May 2024 | A $4.3 billion order for AI servers to boost its nationwide computing capacity to 17 Eflops, creating a massive energy footprint that requires AI-driven optimization. | China Mobile orders $4.3 B in servers as it ramps up AI infrastructure |

China Mobile Strategic Partnerships Drive AI and Energy Efficiency Goals

China Mobile is forming targeted alliances with domestic and international technology leaders to co-develop and deploy AI solutions that directly address the operational and energy challenges of its next-generation infrastructure.

- The partnership with ZTE, culminating in the November 2024 launch of the AI-Driven Green Telco Cloud, is the most direct validation of its energy efficiency strategy, moving from concept to a deployable solution with proven energy savings.

- In June 2025, China Mobile and ZTE won the Asia Mobile Award for their green 5 G core network, further recognizing their joint success in applying AI to reduce the carbon footprint of network infrastructure.

- Collaboration with Huawei extends beyond chip procurement to network architecture, with the large-scale deployment of “Intelligent RAN” across over 500, 000 sites by November 2025, integrating AI to create a more autonomous and efficient wireless network.

- International partnerships, such as the one with Asia Phos announced in 2026 to build data centers in Southeast Asia, indicate a plan to export this model of building and operating energy-efficient AI infrastructure to new markets.

Semiconductor Hurdles Drive Domestic Partnerships

This infographic highlights China’s dependence on foreign technology for semiconductor production, explaining the strategic imperative behind China Mobile’s alliances with domestic partners to build a self-sufficient tech ecosystem.

Table: China Mobile Energy Efficiency and AI Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Asia Phos | February 2026 | A strategic partnership to build AI and data center infrastructure in Southeast Asia, providing an opportunity to deploy and monetize its energy-efficient operational model abroad. | Asia Phos, China Mobile to build strategic AI and Data Centre … |

| Huawei | November 2025 | Deployed co-developed “Intelligent RAN” solution across 500, 000+ sites, using AI to optimize wireless network operations and energy consumption at a massive scale. | China Mobile Partners with Huawei for Large-Scale Intelligent RAN … |

| ZTE | June 2025 | Won the Asia Mobile Award 2025 for a jointly developed AI-driven green and energy-saving 5 G cloudified core network, validating the commercial and technical success of the technology. | China Mobile and ZTE win the Asia Mobile Award 2025 with AI … |

| ZTE | November 2024 | Launched the “AI-Driven Green Telco Cloud, ” a commercial solution achieving up to 25% energy savings on core network hardware, directly tackling data center operational costs. | China Mobile and ZTE launch AI-Driven Green Telco Cloud |

| Nokia | January 2021 | Completed successful live trials of an AI-powered RAN over its 5 G network, representing an early-stage exploration of using AI for network optimization and efficiency. | Nokia and CMCC trial AI-powered radio access on live 5 G network |

China Mobile Geographic Focus: Domestic Scale Enables Global Ambition

China Mobile‘s strategy is rooted in achieving massive domestic scale for its energy-efficient AI infrastructure, creating a proven and exportable model for international expansion.

- Between 2021 and 2024, activity was concentrated within mainland China, with the construction of major intelligent data centers in locations like Hohhot and Beijing serving as the primary hubs for its AI capacity build-out.

- The establishment of these massive domestic hubs, part of China’s national computing strategy, made energy efficiency a critical issue at both a corporate and regional level, accelerating the development of solutions like the Green Telco Cloud.

- From 2025 onwards, China Mobile began leveraging this domestic expertise for global reach, initiating projects in Malaysia and signing a strategic agreement with Asia Phos in February 2026 to develop data centers in Indonesia, Malaysia, and Singapore.

- This geographic progression shows a clear pattern: perfect the technology and operational model for energy-efficient AI infrastructure at home, then export it to high-growth regions like Southeast Asia.

China’s National Data Center Strategy

This map of the ‘East Data, West Computing’ project perfectly illustrates the national computing strategy mentioned in the text, providing the geographic context for China Mobile’s data center build-out.

China Mobile Technology Maturity: From Pilot Phase to Commercial Deployment

China Mobile has successfully advanced its AI-driven energy efficiency technology from the experimental pilot phase to full-scale commercial deployment, where it is now a core component of its infrastructure strategy.

- The period from 2021 to 2024 represented the technology’s development and validation stage, highlighted by the 2021 AI-powered RAN trials with Nokia, which proved the concept of using AI for network efficiency.

- A significant maturity milestone was reached in November 2024 with the commercial launch of the AI-Driven Green Telco Cloud with ZTE, which moved the technology from a trial to a productized solution with quantifiable energy savings of up to 25%.

- By 2025, the technology reached commercial scale, demonstrated by its integration into Level 4 autonomous network operations and its application across a 5 G-A network spanning over 500, 000 sites, proving its reliability and effectiveness in a massive, live environment.

- The plan to triple AI computing power by 2028 confirms that AI-driven energy management is no longer an emerging technology but a mandatory, commercially mature component required to operate its future infrastructure sustainably.

China’s AI Growth Nears US Levels by 2026

This chart projects China’s rapid AI growth, providing a national context for the technology maturity described in the section, where China Mobile’s own solutions advanced from pilot to commercial scale.

(Source: Capital Economics)

SWOT Analysis of China Mobile’s AI Energy Efficiency Strategy 2026

China Mobile‘s dominant market position and state alignment provide a powerful foundation for its AI energy efficiency strategy, though its heavy reliance on domestic partners presents execution risks.

- The company’s core strengths are its immense scale and financial power, which allow it to make multi-billion-dollar infrastructure investments while simultaneously developing proprietary efficiency solutions.

- A key opportunity is to establish a global standard for green telecommunications and data center operations, leveraging its partnerships in Southeast Asia to export its proven domestic model.

- Its primary weakness is a deep dependency on a concentrated group of domestic technology partners, which could create vulnerabilities if these suppliers face their own production or innovation challenges.

- The main threat remains the high and volatile cost of energy, which could potentially outpace the gains from its AI-driven efficiency measures as its computing infrastructure scales exponentially.

China’s AI Stack Built on Domestic Champions

This chart illustrates China’s distinct AI technology stack, visually reinforcing a key point from the SWOT analysis: China Mobile’s heavy reliance on domestic partners like Huawei and Baidu.

Table: SWOT Analysis for China Mobile

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Massive 5 G network investment ($13.5 B in 2022) and development of proprietary “Jiutian” AI platform. | Demonstrated ability to convert AI strategy into revenue (“billions of yuan”) and rapid growth in digital transformation services (RMB 156.9 B in H 1 2025). | The massive CAPEX in infrastructure was validated by tangible revenue growth, confirming the financial viability of the AI-centric business model. |

| Weaknesses | High CAPEX on infrastructure with unproven returns from AI services. Initial reliance on foreign tech and early-stage domestic chip adoption (33% in Beijing center). | Deepening reliance on a few domestic partners (Huawei, ZTE) for critical hardware and network solutions. Goal to use 100% domestic chips by 2028 increases dependency. | The strategy shifted from a mix of suppliers to a clear consolidation around domestic champions, increasing execution risk tied to their performance. |

| Opportunities | Leverage network scale to become a dominant cloud provider (China Mobile Cloud). Use AI to optimize network Op Ex, as shown in early trials. | Export its AI-driven, energy-efficient data center model to new markets, evidenced by the Asia Phos partnership for Southeast Asia. Monetize AI through Maa S platforms. | The opportunity evolved from domestic service provision to international expansion, as the company gained confidence in its proprietary technology and operational model. |

| Threats | Geopolitical sanctions on semiconductor supply chains. High energy costs associated with initial data center build-outs. | Intensifying competition from other state-owned telcos (China Telecom, China Unicom) who are also boosting AI investment. The success of the entire strategy hinges on the performance of domestic chips. | The threat shifted from external supply chain risk to internal execution risk. The company’s success is now inextricably linked to the success of China’s domestic semiconductor industry. |

Forward-Looking Insights: Energy Efficiency as a Core Metric for China Mobile’s AI Success

The successful scaling of AI-driven energy management solutions will be the most critical determinant of China Mobile‘s long-term profitability as it executes its ambitious plan to triple its AI computing capacity by 2028.

- The goal to reach 100% domestic AI chip usage by 2028 means that China Mobile will have greater control over hardware-software co-design, creating a significant opportunity to embed energy efficiency features at the most fundamental level of its infrastructure.

- Future progress on 6 G as an “AI-native” network will be a key indicator to watch, as this concept involves integrating computing and energy management directly into the network fabric, representing the next frontier of efficiency.

- The expansion into Southeast Asia with Asia Phos will serve as a real-world test of whether China Mobile‘s energy-efficient operational model can be successfully monetized and scaled in competitive international markets with different regulatory and energy cost structures.

- Investors and competitors should closely monitor the growth of China Mobile‘s AI-related revenue against its operational expenditures, particularly energy costs, to gauge the true return on its massive infrastructure and technology investments.

Frequently Asked Questions

What is China Mobile’s main strategy for managing the high energy use of its AI data centers?

China Mobile’s primary strategy is to use artificial intelligence itself to actively manage and reduce energy consumption. This is formalized in its “AI+NETWORK” strategy, which integrates AI to create autonomous, energy-efficient systems across its infrastructure, making its massive AI computing expansion both cost-effective and sustainable.

What specific technology has China Mobile deployed to save energy, and how effective is it?

China Mobile, in partnership with ZTE, launched the “AI-Driven Green Telco Cloud” in November 2024. This commercial solution is a key part of its strategy and has been proven to reduce single-machine energy consumption by up to 25%.

Who are China Mobile’s key partners in developing these energy-efficient AI technologies?

The main partners mentioned are ZTE, with whom China Mobile co-developed the award-winning “AI-Driven Green Telco Cloud,” and Huawei, for the large-scale deployment of an “Intelligent RAN” solution across over 500,000 sites. The company is also partnering with Asia Phos to expand its energy-efficient data center model into Southeast Asia.

How significant are China Mobile’s investments in AI infrastructure?

The investments are substantial. In 2024 alone, the company placed a $4.3 billion order for AI servers and a $2.6 billion order for intelligent data center equipment. This massive spending on raw computing power is what makes its parallel investment in energy efficiency so critical.

What is China Mobile’s long-term goal for its AI computing power and geographic reach?

China Mobile aims to triple its AI computing power by 2028. After proving its energy-efficient operational model at a massive scale within China, the company is now expanding globally, as shown by its February 2026 partnership with Asia Phos to build AI and data center infrastructure in Southeast Asia.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.