Huawei’s AI for Energy Efficiency: Commercial Projects & Strategy 2026

Huawei AI Energy Efficiency Projects Scale Up in 2026

Huawei has transitioned its AI strategy from foundational network efficiency pilots to full-scale commercial deployments in heavy industry and telecom operations, using its Pangu models to drive energy and operational savings.

- In the period from 2021 to 2024, Huawei focused on validating its technology through targeted industrial partnerships. A key commercial validation was the July 2023 launch of the Pangu Mining Model with Shandong Energy, the first large AI model for the energy sector, which aimed to improve safety and operational efficiency in mining.

- Foundational collaborations with telecom operators also began in this earlier period, such as the February 2024 Memorandum of Understanding with Turkcell to explore green energy solutions and AI-based networks.

- The period from 2025 to today shows a shift toward broader, system-level efficiency products. Huawei launched its AI Core Network in March 2025, a generative network designed for self-optimization and self-O&M, providing robust computing resources for telecom operators to enhance efficiency.

- This strategy expanded with the upgraded AI WAN Solution in October 2025, which helps carriers manage computing-network resources more effectively, as commercially demonstrated by China Telecom Shanghai’s launch of intelligent computing private lines.

- The application of these efficiency principles is now expanding into new sectors and geographies, evidenced by the deployment of AI-enabled data center technology for the Cooperative Bank of Oromia in October 2025.

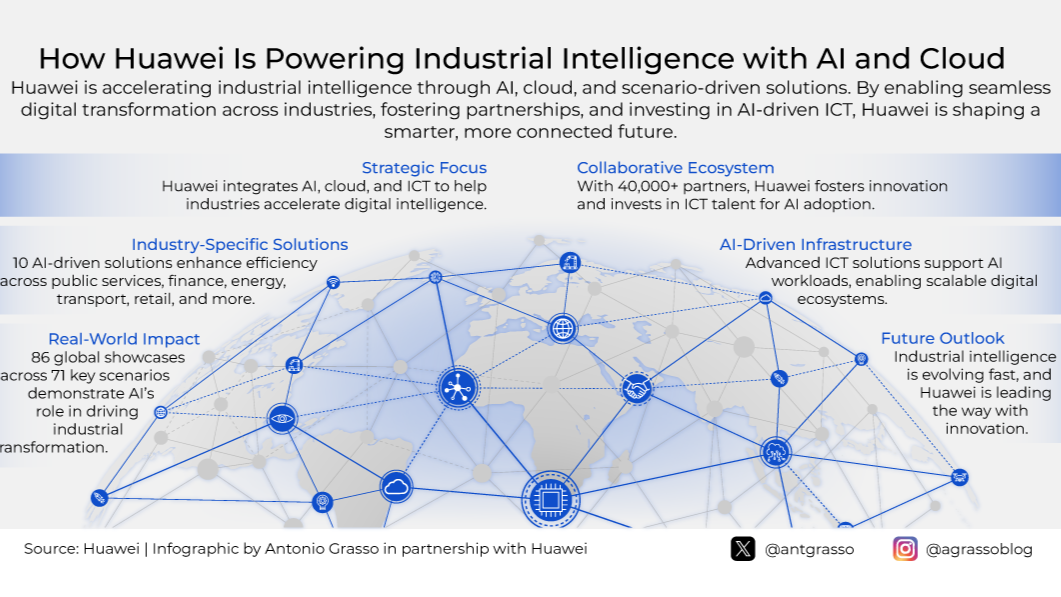

Huawei’s AI Strategy for Industrial Intelligence

This infographic illustrates Huawei’s strategy for deploying AI solutions in key industries like energy. It highlights the partner ecosystem and real-world showcases that underpin the commercial-scale projects discussed in this section.

(Source: LinkedIn)

Huawei’s Strategic Investments in AI Infrastructure Fuel Energy Efficiency 2026

Huawei directs its massive R&D and strategic capital toward building a self-sufficient, full-stack AI infrastructure, which serves as the foundation for its energy-efficient industrial and network solutions.

- Huawei’s commitment to R&D is the primary driver of its technology development, with spending reaching CNY 96.9 billion (approx. $13.4 billion) in the first half of 2025 alone, representing nearly 23% of its revenue.

- Strategic regional investments, such as the $400 million commitment to a Saudi Arabia cloud region in February 2025 and the $430 million plan for Northern Africa announced in October 2023, build the necessary infrastructure to deploy energy-efficient AI cloud services in key growth markets.

- The company invests in next-generation AI through its Habo investment arm, with stakes in startups like Giga AI in November 2025 for physical AI and Seeds AI in January 2026 for embodied AI, indicating a long-term focus on robotic and automated efficiency.

- In 2022, the Chinese government awarded Huawei grants worth Rmb 6.55 billion ($948 million), double the amount from the previous year, to support its R&D in critical technologies that underpin its efficiency-focused solutions.

Table: Huawei’s Strategic AI and R&D Investments (2023-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Investment in Seeds AI | January 2026 | A Huawei-linked startup in the embodied AI and robotics sector, signaling strategic interest in automated industrial efficiency. | autonews.gasgoo.com |

| Investment in Giga AI | November 2025 | Investment via its Habo arm into a startup focused on physical AI and “world model” research for robotics and autonomous systems. | pandaily.com |

| H 1 2025 R&D Spending | August 2025 | R&D expenditure climbed to CNY 96.9 billion ($13.4 B), representing 22.9% of revenue, funding core technology for AI efficiency. | investing.com |

| Saudi Arabia Cloud & AI Investment | February 2025 | $400 million investment to build a cloud region and AI ecosystem in Saudi Arabia, providing a platform for energy-efficient digital services. | middleeastbriefing.com |

| Northern Africa Cloud Infrastructure | October 2023 | Announced a $430 million investment over five years to build cloud computing infrastructure and support digital skills in the region. | fdiintelligence.com |

Huawei’s Global Partnerships Drive Adoption of AI for Energy Efficiency 2026

Huawei leverages strategic partnerships with global telecom operators and industrial giants to deploy and validate its AI-driven efficiency solutions, expanding its ecosystem from China to emerging markets in Africa, the Middle East, and Asia.

- Recent partnerships, like the one with AXIAN Telecom in February 2026, focus on modernizing African networks with AI-driven operations and cloud-based systems, directly targeting efficiency gains in digital infrastructure.

- The collaboration with e& UAE in October 2025 to launch an Optical Innovation Center aims to create zero-outage, zero-touch network solutions, a core tenet of improving network reliability and energy efficiency.

- The commercial agreement with China Mobile Guangdong in February 2026 for a $22 million computing power platform demonstrates strong domestic adoption of Huawei’s efficiency-focused architecture, including its Ascend chips.

- The partnership with Indosat announced in October 2024 to establish a $200 million AI facility in Indonesia is focused on developing AI infrastructure and fostering digital innovation, creating a hub for energy-efficient solutions in the region.

- Earlier collaborations, including the February 2024 MOU with Turkcell on green energies and AI-based networks, laid the groundwork for these recent, more concrete commercial deployments.

AI Pyramid Strategy Highlights Global Alliances

This chart visualizes Huawei’s AI strategy, specifically emphasizing its ‘Global telco AI alliance.’ This directly supports the section’s focus on partnerships with global operators like e& to drive AI adoption.

(Source: Huawei BLOG)

Table: Huawei’s Key AI Efficiency Partnerships (2024-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| AXIAN Telecom | February 2026 | Partnered to modernize networks across Africa, deploying AI-driven operations and cloud-based networks to boost efficiency. | techafricanews.com |

| e& UAE | October 2025 | Launched an Optical Innovation Center to jointly drive AI infrastructure development, focusing on zero-touch, high-efficiency network solutions. | economymiddleeast.com |

| Indosat | October 2024 | Partnered to establish a $200 million AI facility in Indonesia to develop AI infrastructure and provide training. | manufacturingdigital.com |

| Turkcell | February 2024 | Signed MOUs covering joint innovation in 5.5 G, green energy solutions, and the development of AI-based networks for operational efficiency. | huawei.com |

| Shandong Energy | July 2023 | Jointly launched the world’s first commercial large AI model for the energy sector to improve mining safety and operational efficiency. | prnewswire.com |

Huawei Expands AI Energy Efficiency Solutions from China to Emerging Markets 2026

While solidifying its domestic market in China as a proving ground, Huawei Technologies has strategically expanded its AI-driven energy efficiency solutions into emerging markets across Africa, the Middle East, and Southeast Asia.

- From 2021-2024, Huawei’s key commercial projects demonstrating efficiency gains, like the Pangu Mining Model with Shandong Energy, were concentrated in China. This period also saw foundational partnerships in Turkey (Turkcell) and the UAE.

- The focus shifted significantly from 2025 to the present with major infrastructure deployments in Africa. This includes deploying AI data center technology for the Cooperative Bank of Oromia in Ethiopia in October 2025 and a network modernization partnership with AXIAN Telecom in February 2026 across the continent.

- The Middle East remains a critical growth region, evidenced by the $400 million investment in a Saudi Arabia cloud region and partnerships with entities like e& UAE to develop high-efficiency AI infrastructure.

- Huawei is also targeting Southeast Asia, exemplified by the $200 million AI center with Indosat in Indonesia and plans to introduce its next-generation AI processors to the South Korean market in 2026.

Huawei Captures Key Market Share in Thailand

This chart shows Huawei’s significant 26.1% IaaS market share in Thailand for 2024. It provides a concrete example of the successful expansion into emerging Southeast Asian markets described in the section.

(Source: PR Newswire)

Huawei’s AI for Energy Efficiency Reaches Commercial Scale in 2026

Huawei Technologies’ AI solutions for energy and operational efficiency have matured from industry-specific pilots to commercially available, full-stack network and cloud platforms.

- The period from 2021-2024 was characterized by the commercial launch of highly specialized AI models. The Pangu Mining Model with Shandong Energy in July 2023 was a key validation point, proving AI’s value in a specific industrial application.

- From 2025 onward, the technology has scaled into broader, more standardized platforms. The launch of the AI Core Network in March 2025 marked a shift from custom models to an autonomous, generative network solution applicable across the telecom industry for self-optimization.

- The introduction of hardware like the Cloud Matrix 384 server in July 2025 and the Xinghe AI Fabric 2.0 interconnect in September 2025 provide the underlying infrastructure optimized for efficiency at a massive scale, moving beyond just software solutions.

- The successful training of Zhipu AI’s image model on Ascend chips in January 2026 provides critical third-party validation that Huawei’s hardware is mature enough to support large-scale AI workloads efficiently, a prerequisite for its own energy-efficient AI services.

Diagram Shows Huawei’s Unified AI Platform

This diagram details Huawei’s ‘Omni-Dataverse,’ a full-stack platform for managing the entire AI data lifecycle. It visually represents the shift from specific pilots to the standardized, commercial platforms mentioned in this section.

(Source: Blocks and Files)

SWOT Analysis: Huawei’s Position in AI for Energy Efficiency 2026

Huawei’s primary strength lies in its vertically integrated, full-stack AI ecosystem, which faces a significant opportunity in emerging markets but is constrained by geopolitical sanctions and competition from established players like Nvidia.

- Strengths: Huawei’s end-to-end control over hardware (Ascend chips, Atlas clusters) and software (Pangu models, Mind Spore) enables optimized performance and efficiency for its solutions.

- Weaknesses: Ongoing US sanctions limit access to certain global markets and advanced semiconductor manufacturing, forcing reliance on a domestic supply chain. The break with Deutsche Telekom in February 2026 highlights commercial headwinds in Europe.

- Opportunities: Growing demand for AI and digital sovereignty in emerging markets across Africa, the Middle East, and Asia creates a large, addressable market receptive to Huawei’s integrated solutions.

- Threats: Nvidia remains the dominant global player in AI hardware. Geopolitical tensions could lead to further restrictions or persuade potential partners in US-allied nations to avoid Huawei technology.

Table: SWOT Analysis for Huawei Technologies

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Demonstrated industrial AI capability with the Pangu Mining Model. Maintained massive R&D spending and a strong IP portfolio in networking. | Launched a full-stack, vertically integrated AI ecosystem from chips (Ascend 910 C) to systems (Cloud Matrix 384). R&D spend hit 23% of revenue. | The strategy shifted from deploying specific AI models to offering a complete, commercially validated, and self-reliant AI infrastructure stack. |

| Weaknesses | US sanctions severely impacted access to global semiconductor supply chains and Western markets. | The strategic break with Deutsche Telekom confirmed continued commercial headwinds in Europe due to digital sovereignty concerns. | The challenge of market access in the West has solidified, forcing a more intense focus on emerging markets and domestic technological self-reliance. |

| Opportunities | Established foundational partnerships in the Middle East (Saudi Arabia, UAE) and Turkey (Turkcell). | Secured large-scale investments and partnerships in Africa (AXIAN, Ethiopia) and Southeast Asia (Indonesia), backed by a formal “partner-first” global policy. | The opportunity in emerging markets has moved from exploratory partnerships to large-scale capital investment and commercial infrastructure deployment. |

| Threats | Faced intense competition from Nvidia as the dominant global provider of AI hardware. | Huawei is now in direct competition with Nvidia at the system level, with its Cloud Matrix 384 positioned against the GB 200 NVL 72. | The threat has evolved from general market competition to a direct, two-front challenge: a global technology race and a battle for dominance within China. |

Outlook 2026: Huawei to Deepen AI Integration in Core Network and Industrial Operations

In the year ahead, Huawei will focus on scaling its commercially proven AI efficiency solutions deeper into telecom networks and industrial verticals, leveraging its growing partner ecosystem in emerging markets.

- The February 2026 partnership with AXIAN Telecom and the contract with China Mobile signal that Huawei will prioritize deploying its AI Core Network and other efficiency-focused telecom solutions at a commercial scale.

- Watch for further industrial partnerships modeled after the Shandong Energy project, as Huawei seeks to replicate its success in applying Pangu models to other resource-intensive sectors like manufacturing and logistics.

- The rollout of its global sales partner policies for 2026 indicates a major push to expand its international footprint for AI cloud services, targeting over 50% growth in partner-driven business and embedding its efficiency-oriented architecture worldwide.

ICT and Cloud Segments Drive Revenue Growth

This chart provides financial context for Huawei’s outlook by showing strong revenue growth in its ICT and Cloud divisions. This performance underpins the company’s ability to deepen AI integration in core network and industrial operations.

(Source: Market.us)

Frequently Asked Questions

What is Huawei’s main strategy for using AI to improve energy efficiency?

Huawei’s strategy has shifted from pilot projects to deploying full-scale, commercially available solutions. It leverages its vertically integrated, full-stack AI infrastructure, including its Pangu models and Ascend chips, to create self-optimizing systems. Key products like the AI Core Network and AI WAN Solution are designed to help telecom and industrial clients reduce energy consumption and improve operational efficiency.

What are some key examples of Huawei’s AI energy efficiency projects?

Key commercial projects include the Pangu Mining Model, launched with Shandong Energy to improve efficiency in the mining sector, and the AI Core Network, a generative network for telecom operators. Huawei has also deployed AI-enabled data center technology for the Cooperative Bank of Oromia in Ethiopia and launched intelligent computing private lines with China Telecom Shanghai.

Which geographic regions is Huawei targeting for its AI solutions?

While initially proving its technology in China, Huawei has strategically expanded into emerging markets from 2025-2026. Key regions include the Middle East (with a $400M investment in Saudi Arabia), Africa (partnering with AXIAN Telecom and investing $430M in Northern Africa), and Southeast Asia (with a $200M AI facility with Indosat in Indonesia).

How is Huawei investing to support its AI for energy efficiency strategy?

Huawei makes massive investments in R&D, spending nearly 23% of its revenue in H1 2025. It also makes strategic capital investments to build infrastructure, such as the $400 million for a cloud region in Saudi Arabia. Furthermore, its investment arm, Habo, invests in next-generation AI startups like Giga AI and Seeds AI to focus on future robotic and automated efficiency.

What are the main challenges Huawei faces in its AI strategy?

The primary challenges are geopolitical. Ongoing US sanctions limit Huawei’s access to certain Western markets and advanced semiconductor technology. This creates commercial headwinds, as seen with the break from Deutsche Telekom, and intensifies competition with global leaders like Nvidia, forcing Huawei to focus on technological self-reliance and growth in emerging markets.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.