Data Center Power Crisis 2025: Why Grid Constraints Will Cap AI Growth

Data Center Project Risks: How Power Scarcity Replaced Component Shortages as the Primary Growth Constraint in 2025

The primary risk to data center projects has decisively shifted from managing component lead times to securing fundamental power availability, a constraint that intensified significantly after 2024. While equipment supply chains are elastic, the inability of grid infrastructure to meet exponential demand now represents the most critical and enduring bottleneck for the industry’s growth trajectory through 2026.

- Between 2021 and 2024, the industry focused on navigating supply chain disruptions for components like GPUs and managing volatile material costs. Long lead times for transformers, often exceeding 52 weeks, were a significant challenge, but projects were still primarily gated by equipment procurement and construction timelines.

- From 2025 onward, the focus has pivoted to energy procurement as the critical path for project viability. A survey by Turner & Townsend revealed that 48% of industry leaders now identify power availability as the primary obstacle to delivering projects, a clear signal that energy has surpassed all other constraints.

- This shift has forced hyperscalers to secure multi-gigawatt energy supplies years in advance. Strategic deals like Google’s 1.17 GW PPA with Clearway Energy Group in January 2026 and Meta’s 1.1 GW nuclear agreement in June 2025 highlight a new reality where energy sourcing dictates development schedules.

- The competition for power is now so intense it is reshaping corporate strategy. Amazon‘s agreement with Rio Tinto to integrate a dedicated copper supply into its U.S. data center buildout is a direct response to the compounded demand from both data centers and the urgent need for grid upgrades.

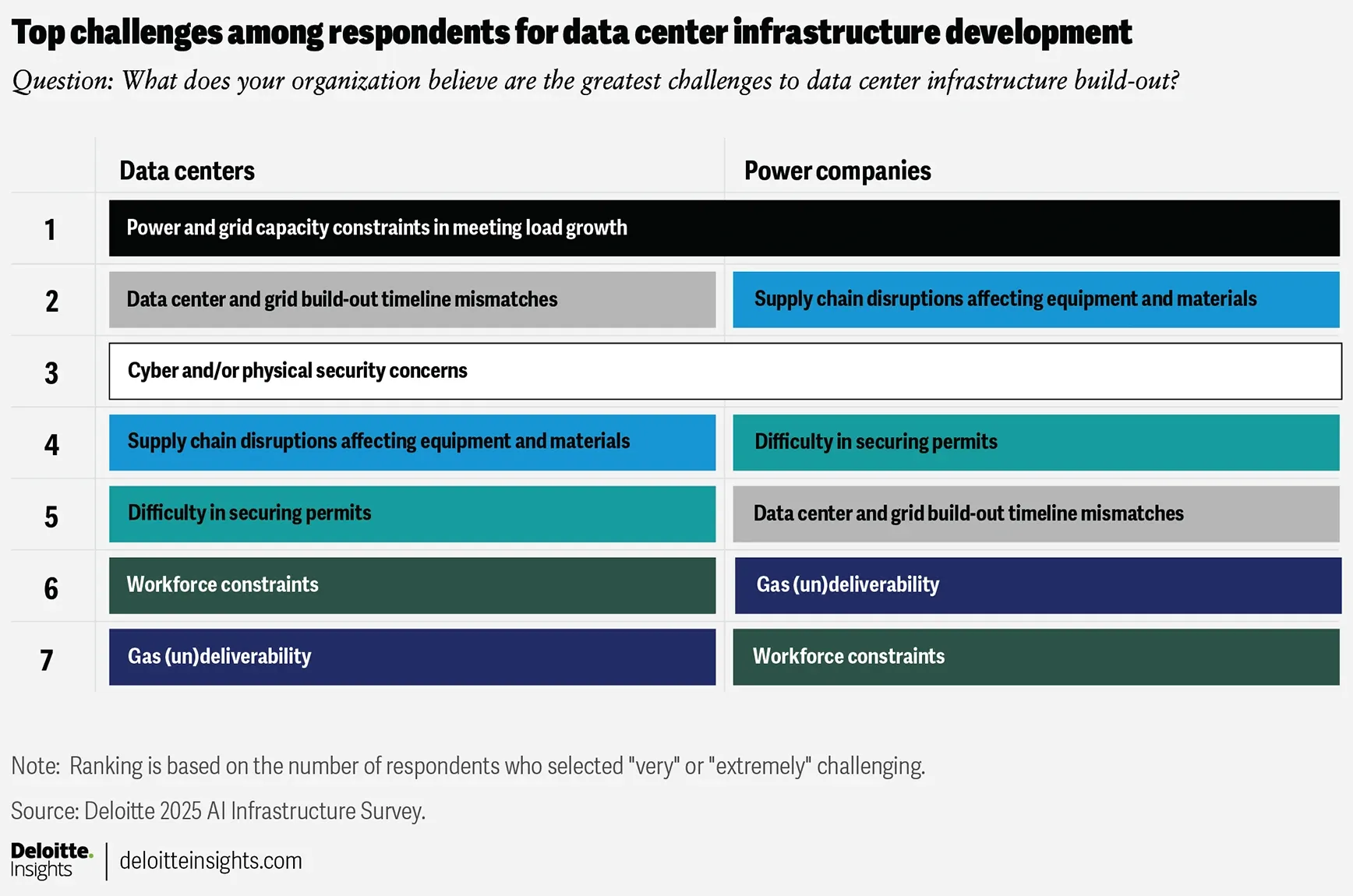

Power Constraints Emerge as Top Challenge

This chart directly validates the section’s thesis that power constraints have replaced supply chain disruptions as the number one challenge for data center operators in 2025.

(Source: Insights2Action – Deloitte)

Energy Partnerships: How Hyperscalers Are Securing Megawatts to Fuel Data Center Expansion

Hyperscalers have accelerated their strategy from being passive energy consumers to becoming active partners in large-scale power generation, signing unprecedentedly large and diverse Power Purchase Agreements (PPAs) in 2025-2026 to bypass congested grid interconnection queues and secure the massive energy blocks required for AI.

Hyperscalers Drive Surge in Power Demand

This chart quantifies the immense and growing power demand from hyperscalers, providing the context for why they are pursuing the large-scale energy partnerships described in the text.

(Source: Boston Consulting Group)

- Before 2025, PPAs were common but typically smaller and focused on incremental renewable capacity to meet sustainability goals. The scale and technological diversity of these agreements have expanded dramatically as securing reliable power has become the top priority.

- In January 2026, Google executed agreements for 1.17 GW of wind and solar capacity with Clearway Energy Group, locking in power across multiple U.S. grid markets (SPP, ERCOT, and PJM) to support its distributed data center fleet and mitigate regional grid limitations.

- Signaling a strategic pivot to ensure 24/7 reliability for power-intensive AI workloads, Meta signed a 20-year PPA in June 2025 with Constellation for 1.1 GW of baseload power from a nuclear plant, a move that prioritizes uptime over intermittent renewable sources.

- The market is now structuring itself around this demand, as evidenced by Brookfield‘s plan to develop over 10.5 GW of new renewable capacity, commencing in 2026, explicitly to serve tech clients like Microsoft. This shows that energy developers are building entire project pipelines around data center demand.

Table: Major Corporate Power Purchase Agreements for Data Centers (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google & Clearway Energy Group | Jan 2026 | Secured 1.17 GW of wind and solar capacity to power data centers across three major U.S. grid markets, ensuring diversified energy supply. | Data Center Dynamics |

| Switch & Ormat Technologies | Jan 2026 | A 20-year PPA for 13 MW of baseload geothermal capacity, demonstrating a strategy to secure carbon-free, 24/7 power. | Global Renewable News |

| Brookfield for Microsoft (Implied) | Sep 2025 | Announced development of over 10.5 GW of new renewable capacity starting in 2026, directly targeting demand from large corporate customers like Microsoft. | Brown Advisory |

| Meta & Constellation | Jun 2025 | A 20-year PPA for 1.1 GW from a nuclear power plant, a strategic move to secure a massive source of reliable, carbon-free baseload electricity for AI infrastructure. | Trellis |

Data Center Geography: Power Availability Dictates Site Selection Over Land Costs in 2025

The geographic expansion of data centers has fundamentally shifted from a model prioritizing proximity to fiber and low land costs to one dictated by the availability of reliable power. This is forcing development into secondary and tertiary markets and away from power-constrained primary hubs.

- Between 2021 and 2024, development was heavily concentrated in primary markets like Northern Virginia, where supply grew by 34% year-over-year in 2024. However, these markets began reporting severe power constraints and project backlogs toward the end of this period.

- From 2025 onward, the lack of grid capacity in these mature markets has become a hard stop on new development. Reports from outlets like the Financial Times confirm multi-year waits for new grid connections, effectively freezing large-scale growth in previously booming zones.

- This power gridlock is forcing a migration to secondary and tertiary markets where utilities can offer interconnection agreements. The industry’s site selection calculus has changed from building where land is cheap to building where megawatts are available.

- The strategic sourcing of raw materials, such as Amazon‘s agreement for copper from Rio Tinto’s Utah mine, reinforces this geographic realignment. It indicates a focus on securing entire supply chains within specific, power-rich regions of the U.S. to support localized construction.

Power Infrastructure Maturity: Why Grid Technology Lags Decades Behind Data Center Demand

The core supply chain crisis for data centers stems from a fundamental maturity mismatch. While data center and AI technology iterate in months, the underlying power generation and transmission infrastructure operates on a 5-to-15-year development cycle, creating an inelastic and enduring bottleneck that manufacturing efficiencies cannot solve.

AI Chips Drive Exponential Power Density

This chart illustrates the technological root of the ‘maturity mismatch,’ showing how rapidly advancing AI chips exponentially increase power density, creating demand that grid infrastructure cannot match.

(Source: Dell’Oro Group)

- From 2021-2024, the industry focused on optimizing mature data center technologies for efficiency through server consolidation and improved cooling. The grid was largely viewed as a reliable utility, though signs of strain were becoming apparent with rising energy prices.

- The post-2025 AI supercycle has exposed the grid’s technological and regulatory immaturity as a critical failure point. While high-density AI workloads require advanced cooling, 83% of industry leaders state that local supply chains are not prepared to support these new systems.

- The supply chains for components like GPUs and high-bandwidth memory, while strained, are fundamentally elastic. Manufacturing capacity can be scaled within a 2-3 year horizon. In contrast, the process for permitting and building high-voltage transmission and new power plants is governed by intractable regulatory and land-use challenges.

- As a result, the most critical “technology” for data center growth in 2026 is not the AI chip but the grid interconnection agreement. This has driven interest in alternative on-site power technologies like Small Modular Reactors (SMRs) and geothermal, evidenced by Switch’s PPA with Ormat, as a way to circumvent the limitations of the traditional grid.

SWOT Analysis: Data Center Supply Chain Risks and Opportunities in 2025

The data center industry’s primary strength, its massive capital infusion driven by insatiable AI demand, is simultaneously creating its greatest threat: outstripping the capacity of inelastic power infrastructure. This dynamic defines the sector’s strategic challenges and opportunities heading into 2026.

Data Center Market to Exceed $1T

This chart quantifies the ‘massive capital infusion’ and ‘investment supercycle’ identified as the primary strength in the SWOT analysis, illustrating the scale of the opportunity.

(Source: IoT Analytics)

- Strengths have evolved from general cloud growth to a historic AI-driven investment “supercycle, ” validating enormous capital expenditures.

- Weaknesses have shifted from manageable equipment lead times to an intractable power availability crisis, altering the fundamental risk profile of projects.

- Opportunities now lie in power-led geographic expansion and direct partnerships in energy generation, moving beyond traditional real estate strategies.

- Threats have escalated from margin compression due to rising costs to a hard ceiling on growth imposed by grid limitations.

Table: SWOT Analysis for Data Center Supply Chain Constraints

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Robust demand driven by enterprise cloud adoption and digital transformation. | An unprecedented AI-driven “supercycle” of investment, projected to reach $3 trillion by 2030, with hyperscaler Cap Ex hitting $500 billion in 2026. | Demand drivers shifted from general-purpose cloud to power-intensive AI, validating massive capital allocation and confirming long-term growth signals. |

| Weaknesses | Long lead times for equipment like switchgear and servers; skilled labor shortages. | Power grid availability is now the definitive bottleneck, with multi-year delays for new connections in primary markets. | The primary constraint shifted from manufacturable goods with elastic supply to inelastic public infrastructure, a problem capital alone cannot solve quickly. |

| Opportunities | Expansion into secondary geographic markets to secure cheaper land and labor. | Co-location of data centers with new power generation (nuclear, geothermal, renewables) to bypass grid constraints, as demonstrated by Meta‘s nuclear PPA. | Geographic strategy has become power-led, not cost-led. This opens opportunities for vertical integration with energy developers and utilities. |

| Threats | Rising operational costs from inflation and increasing energy prices, leading to margin compression. | Systemic project delays and cancellations due to the inability to secure power, creating a hard cap on physical growth. Fierce competition diverts resources from other sectors. | The threat evolved from a financial risk (margin pressure) to an existential one (inability to build), with power scarcity as the ultimate arbiter of growth. |

Forward Outlook: Why Power Interconnection Will Define Data Center Success in 2026

For 2026, the success of any data center project will be determined less by securing a purchase order for AI accelerators and more by securing a power interconnection agreement from a utility. This reality is forcing a permanent strategic realignment toward direct partnerships in power generation and a geographic focus on energy-rich regions.

Power Availability Dictates 2026+ Colocation Strategy

This infographic’s forward-looking strategic trends directly mirror the section’s conclusion that securing power and focusing on energy-rich regions will define data center success in 2026.

(Source: Data Center Knowledge)

- If this happens: Hyperscalers and data center operators continue to announce multi-gigawatt PPAs that include direct equity or development partnerships with energy producers for new-build generation assets, effectively becoming anchor tenants for new power plants.

- Watch this: A noticeable increase in data center announcements in regions not previously known as hubs but which possess surplus power, favorable regulatory environments, or streamlined utility permitting processes. Also, watch for the first firm announcements of data centers being co-located with SMRs or advanced geothermal projects.

- These could be happening: A wave of project cancellations or indefinite delays will be confirmed in power-constrained primary markets like Northern Virginia and Silicon Valley. Concurrently, companies like Brookfield will successfully fund and commence construction of new renewable capacity specifically contracted to hyperscalers, validating the “build-where-the-power-is” model. The ultimate signal remains the quoted timeline from utilities for new high-voltage interconnections, which will continue to be the longest lead-time item for any project.

Frequently Asked Questions

What is the biggest challenge for building new data centers in 2025?

The single biggest challenge has shifted from component shortages to securing reliable power. While supply chains for equipment like GPUs have improved, the inability of the electrical grid to meet the exponential demand from AI has become the primary bottleneck, with 48% of industry leaders identifying power availability as the main obstacle to delivering new projects.

How are companies like Meta and Google securing power for their new data centers?

They are shifting from being passive energy consumers to becoming active partners in power generation. They are signing unprecedentedly large and diverse Power Purchase Agreements (PPAs) years in advance. For example, Meta signed a 1.1 GW deal for nuclear power to ensure 24/7 reliability, and Google secured 1.17 GW of wind and solar capacity to diversify its energy sources across different grid markets.

Why are data centers being built in new, secondary locations instead of established hubs like Northern Virginia?

Established hubs like Northern Virginia are facing severe power constraints, with multi-year waits for new grid connections. This power gridlock has made it nearly impossible to build new large-scale facilities there. Consequently, developers are forced to move to secondary and tertiary markets where utilities have available power capacity, making energy availability the new primary driver for site selection over land cost or fiber connectivity.

The article mentions a ‘maturity mismatch’ between data centers and the power grid. What does this mean?

This refers to the vast difference in development speed. Data center and AI technology evolves in months, whereas the power infrastructure (generation plants, transmission lines) operates on a 5-to-15-year development cycle due to complex regulatory and construction processes. This means the grid is fundamentally too slow and inelastic to keep up with the rapid growth of AI, creating a long-term structural bottleneck.

What will be the most critical factor for a data center project’s success in 2026?

In 2026, the most critical factor for success will be securing a power interconnection agreement from a utility, not just a purchase order for AI chips. The ability to physically connect to the grid and draw the necessary power has become the longest lead-time item and the ultimate gatekeeper for growth, forcing a strategic shift toward direct partnerships with energy producers.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.