Microsoft’s AI Energy Strategy 2025: Powering Data Centers with Clean Tech Investments

Microsoft’s AI Energy Projects 2025: From Funding Innovation to Building Infrastructure

Microsoft has strategically pivoted its energy focus from funding third-party climate solutions to directly investing in and developing the power infrastructure required to support its own massive AI data center expansion. This shift indicates that securing reliable and scalable energy is now the primary driver of the company’s climate and energy-related commercial activities, moving from a supporting role to a core operational imperative.

- Between 2021 and 2024, Microsoft’s primary energy-related initiative was its $1 billion Climate Innovation Fund, which backed external AI solutions aimed at solving broad societal and climate challenges. This approach positioned Microsoft as a venture-style investor in the clean tech ecosystem.

- Beginning in 2025, the strategy changed to direct infrastructure development. A key example is the partnership with Black Rock and MGX, which aims to raise $30 billion to build new data centers and the “enabling infrastructure” to power them, transforming Microsoft into an active developer of its own energy supply chain.

- This new focus is driven by immense internal demand. Microsoft’s fiscal year 2025 capital expenditure reached $88.7 billion, primarily for AI-optimized data centers that require vast amounts of electricity, making energy acquisition a critical path for growth.

- The variety of projects, from funding climate AI startups to co-investing in global power infrastructure, shows a maturation of strategy. The company now recognizes that its AI ambitions are entirely dependent on its ability to secure and control its energy sources at a global scale.

Microsoft’s Strategic Energy Partnerships Fuel AI Data Center Expansion in 2025

Microsoft is constructing a powerful ecosystem of financial, sovereign, and technology partners to accelerate and de-risk the development of the energy and data center assets required to execute its AI strategy. These alliances provide the necessary capital, regional access, and technological components to build a global, power-intensive AI network.

- The most critical energy-focused alliance is the partnership with Black Rock, Global Infrastructure Partners, and MGX, formed in 2025. This collaboration combines Microsoft’s technical needs with elite financial and infrastructure expertise to fund and build the power generation and data center capacity essential for AI workloads.

- Microsoft’s partnership with the UAE’s sovereign AI company, G 42, extends beyond software to infrastructure. The collaboration to bring AI infrastructure to new markets like Kenya demonstrates a strategy to secure both technological and physical footprints in globally strategic regions with growing energy needs.

- The company’s deep ties with NVIDIA directly influence its energy requirements. The deployment of tens of thousands of power-hungry NVIDIA GPUs, such as the 23, 000 units planned for a UK supercomputer, dictates the scale of energy infrastructure Microsoft and its partners must build.

- In Canada, Microsoft’s investment of over $7.5 billion explicitly includes a focus on the country’s “AI power grid.” This shows a clear pattern of engaging directly with regional power systems to secure the electricity needed for its data center operations.

Table: Microsoft’s Key AI and Energy Infrastructure Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Black Rock, Global Infrastructure Partners, MGX | 2025 | Formed a partnership to raise $30 billion, with a potential of $100 billion, to invest in data centers and supporting power infrastructure. This secures capital and execution capability for building the energy supply chain for AI. | Black Rock, Global Infrastructure Partners, Microsoft, and MGX … |

| G 42 | 2025 | A partnership involving a $1.5 billion investment from Microsoft to deploy AI infrastructure in the UAE and new markets like Kenya. This establishes a strategic presence and infrastructure base in a key international energy and technology hub. | The golden opportunity for American AI – Microsoft On the Issues |

| NVIDIA | 2025 | A technology collaboration to accelerate AI performance on Azure, including the use of advanced GPUs like the H 200. This partnership drives the computational power that necessitates massive energy consumption. | Microsoft and NVIDIA accelerate AI development and … |

Microsoft’s Global AI Energy Footprint Expands Beyond North America in 2025

While the United States remains its core market, Microsoft’s energy and infrastructure investments in 2025 have expanded aggressively into the United Kingdom, India, Canada, and the United Arab Emirates, reflecting a global strategy to secure power and data center capacity wherever it can be found.

- Between 2021 and 2024, Microsoft’s infrastructure build-out was primarily concentrated in its established Azure cloud regions in North America and Europe, aligning with existing data center footprints.

- The year 2025 marked a significant global diversification. A $30 billion commitment was made to the UK, with half dedicated to capital expenditures for cloud and AI infrastructure, explicitly linking investment to physical assets that require power.

- Further expansion includes a $17.5 billion investment in India and over $7.5 billion in Canada, with the Canadian plan specifically referencing the development of the national “AI power grid” to support this growth.

- The partnership with Abu Dhabi-based G 42 and the joint initiative to build a data center in Kenya underscore Microsoft’s strategy to enter new strategic regions, securing both market access and the necessary energy resources for future AI services.

AI-Driven Energy Demand Reaches Commercial Scale as Microsoft Builds Global Infrastructure

The technology underpinning Microsoft’s energy strategy has matured from funding early-stage AI climate applications to deploying power-intensive AI infrastructure at a global, commercial scale. This progression confirms that the central technological challenge has shifted from model development to powering the hardware that runs those models.

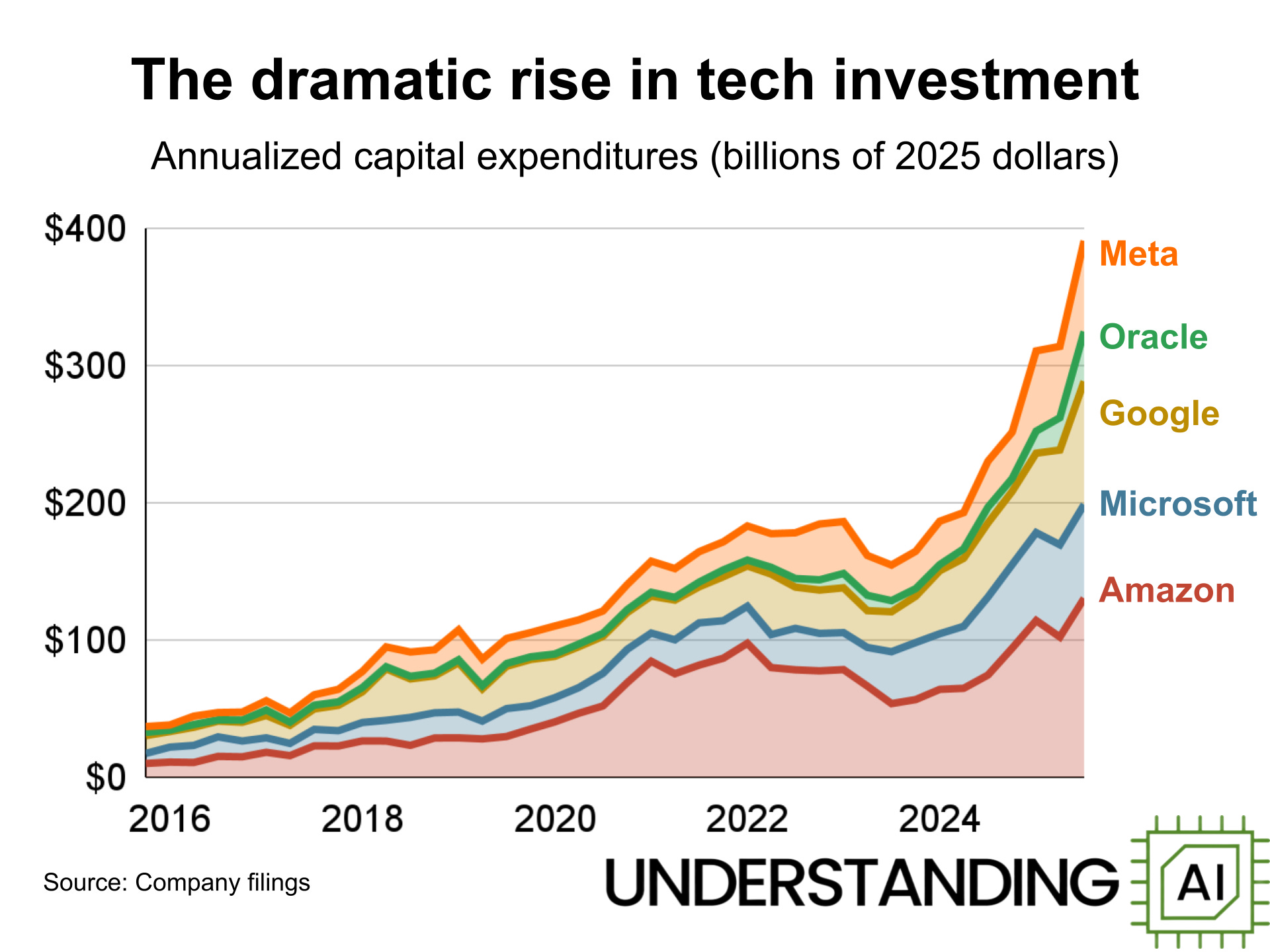

AI Compute Usage Shows Exponential Growth

This chart illustrates how the computing power required to train AI models has been doubling approximately every six months. This exponential growth in compute directly correlates with the surging energy demand needed to power AI data centers.

(Source: Understanding AI)

- In the 2021–2024 period, the technology focus was on R&D and pilot-stage projects funded by the $1 billion Climate Innovation Fund. This involved supporting external startups using AI for climate solutions, representing an early, exploratory phase.

- By 2025, the focus moved to the commercial-scale deployment of AI hardware. The launch of Microsoft’s first “AI Superfactory” and the plan to build a UK supercomputer with over 23, 000 NVIDIA GPUs validate that the company is now operating at a massive industrial scale.

- This technological shift from software-centric funding to hardware-centric building demonstrates that the energy demand from AI is no longer theoretical. It is a present and escalating operational reality that requires mature, large-scale energy infrastructure to sustain.

SWOT Analysis: Microsoft’s AI and Energy Strategy in 2025

Microsoft’s integrated AI and software ecosystem provides a powerful market advantage, but its unprecedented growth creates an extreme dependency on energy availability and a few key technology partners, exposing it to significant operational and geopolitical risks.

- Strengths: The company’s key advantages include its massive capital for investment, existing dominance in enterprise software, and a rapidly growing cloud platform.

- Weaknesses: Significant vulnerabilities arise from its high energy consumption, reliance on NVIDIA for cutting-edge GPUs, and the negative short-term impact of large investments on profitability.

- Opportunities: Microsoft is positioned to become the central utility for the AI economy, with major opportunities to monetize its entire ecosystem and leverage financial partners like Black Rock for growth.

- Threats: The primary threats include rising energy costs, regulatory scrutiny over market power and energy use, and intense competition from other hyperscalers who are also investing billions in AI infrastructure.

Table: SWOT Analysis for Microsoft’s AI and Energy Strategy

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Dominant enterprise software position (Microsoft 365); growing Azure cloud business; strong balance sheet for R&D. | Massive capital expenditure ($88.7 B in FY 25); deep integration of AI (Copilot) creating customer stickiness; $392 B in commercial backlog. | The 2025 data validates that Microsoft successfully converted its software dominance and capital into a massive, defensible AI infrastructure and a huge backlog of contracted revenue. |

| Weaknesses | Dependency on Open AI for foundational models; initial uncertainty on AI monetization. | Extreme energy consumption of data centers; high dependency on NVIDIA GPUs; significant short-term profit impact from investments ($1.5 B expected hit from Open AI in one quarter). | The scale of its 2025 build-out confirmed that energy is now a primary operational weakness and a major cost center, moving from a background concern to a critical vulnerability. |

| Opportunities | Leverage Azure to capture AI training workloads; integrate AI into existing products. | Become the “AI Utility” for the global economy; partner with financial giants (Black Rock) to fund infrastructure; expand into new sovereign markets (UAE via G 42). | The 2025 partnerships with Black Rock and G 42 validated the strategy of using external capital and sovereign partners to fund its global expansion and de-risk its infrastructure build-out. |

| Threats | Competition from AWS and Google Cloud in AI services; potential for AI models to become commoditized. | Rising global energy costs; regulatory scrutiny on AI energy consumption and market dominance; geopolitical tensions impacting supply chains for chips and hardware. | The explicit focus on energy infrastructure in 2025, such as the Canadian “AI power grid” project, shows that energy scarcity and cost are now recognized as primary external threats to growth. |

Outlook 2026: Microsoft’s Focus Shifts to Securing Power for AI Growth

In 2026, Microsoft’s most critical strategic objective will be the execution of its multi-billion-dollar energy infrastructure partnerships to secure the power required to deliver on its massive $392 billion backlog of contracted AI and cloud services.

- The existence of a $392 billion Remaining Performance Obligation (RPO) transforms energy acquisition from a strategic goal into a contractual necessity. Microsoft must secure the power to run the services it has already sold.

- The success of the partnership with Black Rock, GIP, and MGX will be the key indicator to monitor. The ability of this vehicle to rapidly deploy capital and complete energy and data center projects will determine Microsoft’s ability to meet its growth targets.

- Quarterly CAPEX continues to accelerate, reaching a record $34.9 billion in the first quarter of fiscal year 2026. This demonstrates that spending on power-hungry data centers is increasing, making the need for new energy sources more urgent.

- Expect future announcements to focus less on new AI model capabilities and more on securing long-term power purchase agreements (PPAs), exploring advanced energy sources like nuclear, and forming additional partnerships with energy producers and grid operators.

Frequently Asked Questions

What was Microsoft’s primary energy-related initiative before 2025?

Between 2021 and 2024, Microsoft’s main energy initiative was its $1 billion Climate Innovation Fund, which operated like a venture capital fund by backing external AI and clean tech solutions for broad climate challenges.

How did Microsoft’s energy strategy change in 2025?

In 2025, Microsoft’s strategy shifted from funding external solutions to directly investing in and developing the power infrastructure needed for its own AI data centers. This change was driven by the massive energy demands of its AI expansion, making energy acquisition a core operational imperative.

Who are Microsoft’s key partners in its plan to build new energy infrastructure?

Microsoft’s most critical energy-focused alliance is with Black Rock, Global Infrastructure Partners, and MGX. This partnership was formed to raise at least $30 billion to build new data centers and the supporting power infrastructure required for Microsoft’s AI workloads.

Why is securing energy so critical to Microsoft’s AI growth?

Securing energy is critical because Microsoft’s AI ambitions depend on vast, power-intensive data centers running tens of thousands of GPUs. With fiscal year 2025 capital expenditures reaching $88.7 billion, primarily for these centers, the company’s growth is now entirely dependent on its ability to secure and control its energy sources at a global scale.

What are the main weaknesses and threats identified in Microsoft’s 2025 AI and energy strategy?

The main weaknesses are the extreme energy consumption of its data centers and a high dependency on NVIDIA for GPUs. The primary threats include rising global energy costs, regulatory scrutiny over its energy use and market power, and geopolitical tensions that could impact hardware supply chains.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.