Occidental Petroleum’s Direct Air Capture Strategy: Commercializing DAC in 2025

Occidental Petroleum’s Commercial Scale Projects Define the Direct Air Capture Market in 2025

Occidental Petroleum has transitioned its Direct Air Capture (DAC) initiative from a conceptual, technology-focused venture into a core commercial business line, underpinned by the commissioning of its first large-scale plant and the establishment of a bankable revenue stream through major offtake agreements. The company is no longer just developing DAC technology; it is building a market for carbon removal by directly targeting the decarbonization needs of the energy-intensive AI sector.

- Between 2021 and 2024, Occidental’s strategy centered on acquiring foundational technology, exemplified by its $1.1 billion purchase of Carbon Engineering, and securing federal support through Department of Energy grants. In 2025, the strategy has shifted decisively to commercial execution with the commissioning of the STRATOS plant, moving from planning to active operations.

- The STRATOS facility in Texas, designed to capture 500, 000 tonnes of CO₂ annually, represents the first major proof point of the company’s ability to execute industrial-scale DAC projects. Its operational start in 2025 serves as the physical anchor for Occidental’s entire carbon management business.

- Occidental has validated the commercial demand for its DAC services by securing carbon dioxide removal credit agreements with major corporations. Deals with firms including JPMorgan and Palo Alto Networks in 2025 demonstrate a repeatable sales model beyond initial agreements with companies like Amazon and AT&T.

- The company is leveraging artificial intelligence for both its traditional and new ventures. It uses AI to optimize the STRATOS plant’s performance via a digital twin while simultaneously positioning its carbon removal services as a solution for the massive energy footprint of the growing AI industry.

Investment Analysis: Divestitures and Strategic Capital Fuel Occidental’s DAC Pivot

Occidental is executing a disciplined financial strategy to fund its capital-intensive Direct Air Capture ambitions, using large-scale divestitures of stable assets to reduce debt and channel capital into its new low-carbon ventures, while attracting significant third-party investment to de-risk project development.

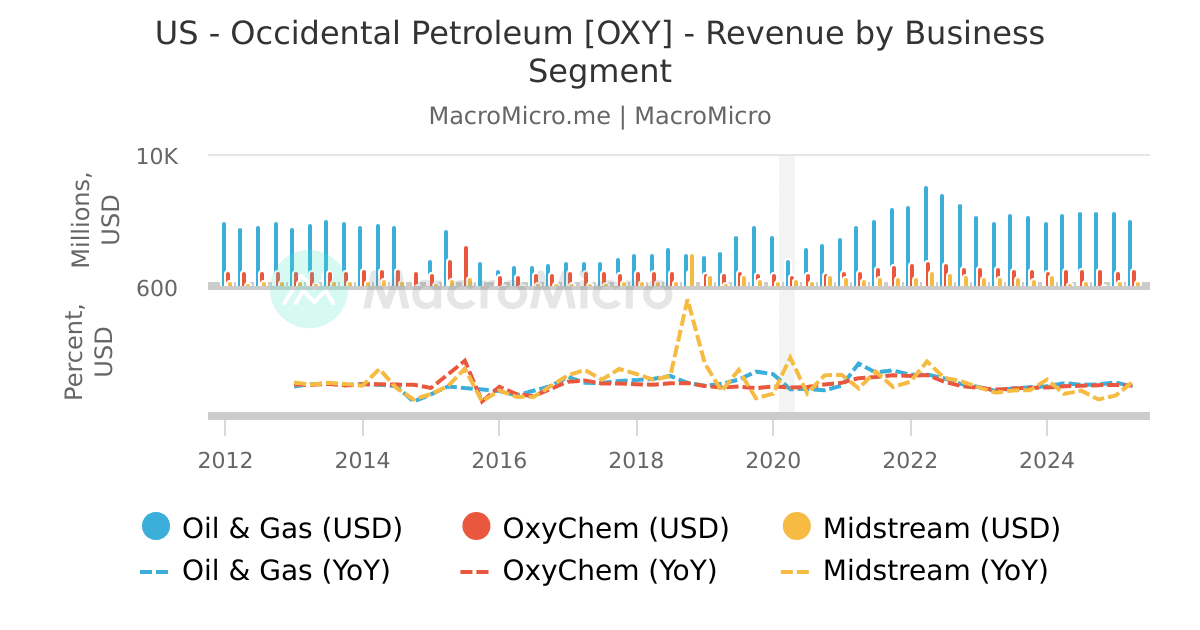

Occidental Petroleum’s Revenue by Business Segment

This chart from MacroMicro breaks down Occidental Petroleum’s revenue by business unit, highlighting the contributions from its Chemical (OxyChem) division. This visualizes the financial scale of the division divested to fund the company’s Direct Air Capture pivot.

(Source: MacroMicro)

- The most critical financial maneuver was the October 2025 sale of the cash-generating Oxy Chem division to Berkshire Hathaway for $9.7 billion. This transaction provided capital to reduce debt below its $15 billion target and fund its energy transition projects.

- In May 2025, investment firm Black Rock provided crucial third-party validation by agreeing to invest $550 million into the development of the STRATOS DAC plant. This move supplies necessary project capital and signals confidence from a major institutional investor in the commercial viability of the project.

- Occidental is expanding its funding sources internationally through a potential investment from the UAE’s ADNOC, which is considering up to $500 million to support the development of a joint DAC facility in South Texas.

- To further streamline its portfolio and raise capital, the company also completed a $1.2 billion divestiture of unspecified upstream oil and gas assets in February 2025, reinforcing its focus on its core E&P and carbon management businesses.

Table: Occidental Petroleum’s Key Strategic Investments and Divestitures (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Oxy Chem | 2025-10-02 | Divestiture of the chemicals division to Berkshire Hathaway for $9.7 billion to reduce debt and fund carbon management projects. | JPT |

| ADNOC (XRG) | 2025-05-20 | Potential investment of up to $500 million to co-develop a DAC facility in South Texas, expanding the partnership ecosystem internationally. | Carbon Credits |

| Black Rock | 2025-05-19 | Investment of $550 million to fund the construction of the STRATOS DAC plant, providing key third-party capital and validation. | The Motley Fool |

| Unspecified Upstream Assets | 2025-02-19 | Divestiture of $1.2 billion in upstream assets to streamline the company’s portfolio and raise capital for strategic priorities. | Offshore Technology |

Partnership Strategy: Occidental Forges Alliances to Build the DAC Value Chain

Occidental has constructed a comprehensive partnership network to control its core technology, secure project financing, and create market demand, effectively building the entire Direct Air Capture value chain from technology development to commercial offtake.

- The cornerstone of its strategy was the 2024 acquisition of Carbon Engineering for $1.1 billion. This move vertically integrated the critical DAC technology, giving Occidental direct control over the intellectual property essential for cost reduction and future plant deployment.

- The 2024 carbon removal deal with Microsoft established a symbiotic relationship between the energy and tech sectors. The agreement, potentially worth hundreds of millions, positions Oxy’s DAC business as a key enabler for offsetting the carbon footprint of AI data centers.

- Occidental’s partnership with Black Rock, which resulted in a $550 million investment, provides the financial backing needed for its capital-intensive projects and serves as a powerful signal of institutional confidence in the DAC business model.

- The strategic collaboration agreement with ADNOC to evaluate a joint DAC facility in the UAE marks the first major step in exporting Occidental’s carbon management model globally and tapping into international capital and markets.

Table: Occidental Petroleum’s Key Technology and Commercial Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| JPMorgan & Palo Alto Networks | 2025 | Signed carbon dioxide removal credit agreements, expanding the customer base and building a recurring revenue stream for the STRATOS plant. | Occidental Petroleum |

| Microsoft | July 2024 | A record carbon removal deal to offtake credits from the STRATOS plant, specifically to offset emissions from AI operations. | World Oil |

| Black Rock | November 2023 | Formed a joint venture with a $550 million investment from Black Rock to develop the STRATOS DAC plant. | ai-CIO |

| ADNOC | August 2023 | Signed a strategic collaboration agreement to evaluate joint investment in DAC and sequestration hubs in the U.S. and the UAE. | ADNOC |

| Carbon Engineering | August 2023 | Acquired the DAC technology provider for $1.1 billion to own the core IP for its carbon capture business. | Reuters |

Geographic Expansion: Occidental Establishes Texas as its DAC Hub with Global Ambitions

Occidental has strategically centered its initial Direct Air Capture operations in Texas to capitalize on its existing operational footprint, favorable geology for CO₂ sequestration, and established infrastructure, creating a replicable model before expanding internationally.

- Between 2021 and 2024, Occidental’s geographic focus was on securing land and regulatory approvals within the United States, particularly in Texas and Louisiana, which were identified as ideal locations for federally supported DAC hubs.

- In 2025, this strategy materialized with the commissioning of the STRATOS plant in Ector County, Texas. This facility solidifies the Permian Basin as the epicenter of the company’s and the world’s commercial-scale DAC industry.

- The company is deepening its commitment to Texas with plans for the King Ranch Hub in South Texas. This project demonstrates an intent to build a network of DAC facilities within the state to achieve economies of scale.

- Occidental’s partnership with ADNOC to evaluate a DAC plant in the UAE represents the company’s first concrete step toward international expansion. This move signals a long-term plan to export its integrated DAC model to other strategic energy regions.

Technology Maturity: Occidental Advances DAC from Pilot to Commercial Scale in 2025

Occidental is pushing Direct Air Capture technology across the threshold from pilot and demonstration phases to its first commercial-scale application, a transition validated by the operational launch of the STRATOS plant, although its long-term economic maturity remains dependent on future cost reductions.

- The period from 2021 to 2024 was characterized by pre-commercial activities, including the acquisition of Carbon Engineering’s technology and securing DOE grants. These actions were foundational steps to prepare for large-scale deployment.

- The year 2025 marks the critical inflection point, with the commissioning of the STRATOS plant. With a design capacity of 500, 000 tonnes per year, this facility moves DAC from a theoretical solution to an operating industrial asset.

- Despite this operational progress, Occidental’s own executives have stated the current DAC model “isn’t bankable” on its own. This confirms that while the technology is functional at scale, its economic viability is not yet proven and relies on carbon credit sales, subsidies, and further innovation.

- The company’s use of AI to create a digital twin for the STRATOS plant is a key initiative aimed at accelerating the path to profitability. This tool allows for continuous process optimization to drive down operational costs, which is essential for achieving long-term economic maturity.

SWOT Analysis: Occidental’s High-Risk, High-Reward DAC Strategy

Occidental’s strategic pivot into Direct Air Capture leverages its core competencies in subsurface management and large-project execution but exposes it to significant market and technology risks, which it is actively mitigating through strategic divestitures and partnerships.

- The company’s primary strength is its decades of experience in E&P and CO₂ handling, which it is now applying to DAC plant operations and sequestration.

- Its main weakness remains the high capital intensity and unproven unit economics of DAC technology, creating a heavy reliance on external funding and subsidies.

- The explosive energy demand from the AI industry has created a powerful new opportunity, providing a motivated and well-capitalized customer base for its carbon removal credits.

- The principal threat is economic and political, as the business model’s success hinges on sustained regulatory support and achieving significant cost reductions to make DAC competitive.

Table: SWOT Analysis for Occidental Petroleum’s DAC Strategy

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Expertise in E&P, CO₂ handling for Enhanced Oil Recovery, and large-scale project management. | Operational excellence demonstrated by top-producing Permian wells; application of subsurface expertise to secure EPA permits for CO₂ sequestration at STRATOS. | Core competencies in oil and gas were successfully transferred and validated in the new carbon management business line through regulatory approvals and project execution. |

| Weaknesses | High debt load following the Anadarko acquisition; DAC technology was pre-commercial and highly capital-intensive. | Company openly states the current DAC model “isn’t bankable, ” highlighting dependency on subsidies and carbon credit prices. The $9.7 B Oxy Chem sale was required to de-lever. | The financial risk of the DAC strategy became the central, acknowledged challenge, necessitating major strategic divestitures to strengthen the balance sheet. |

| Opportunities | Emerging carbon credit markets and broad corporate ESG goals provided a potential future revenue stream. | The AI boom created a specific, high-growth demand driver for carbon removal, validated by the landmark Microsoft offtake agreement. | A vague, long-term opportunity (ESG) transformed into a specific, near-term, and high-value market opportunity (powering AI growth). |

| Threats | Uncertainty around future carbon pricing, regulatory frameworks, and the high cost of DAC technology. | Continued risk of economic non-viability if cost-down targets are missed; political risk to subsidies and carbon policies, as evidenced by potential DOE cuts. | The primary threat shifted from whether the technology would function at scale to whether its unit economics can ever become self-sustaining without heavy government support. |

Forward-Looking Insights: Proving the DAC Economic Model is Occidental’s Critical 2025 Test

Occidental Petroleum’s success in the coming year is tied directly to its ability to prove the economic viability of its flagship STRATOS Direct Air Capture plant and leverage that performance to secure a pipeline of future projects and offtake agreements.

- The most critical indicator for the remainder of 2025 will be the operational and cost-per-ton data emerging from the newly commissioned STRATOS plant. This data will determine investor confidence and the bankability of future DAC facilities.

- The irreversible commitment to this new model, marked by the $9.7 billion sale of the stable Oxy Chem business, places immense pressure on the carbon management division to begin generating significant free cash flow, with the company projecting $1 billion in improvement in 2026 from its non-oil and gas projects.

- The ability to convert partnership frameworks, such as the one with ADNOC, into fully funded projects will be a key test of the strategy’s global scalability. Progress on the South Texas hub will be closely watched.

- Sustaining momentum in signing large-scale carbon removal agreements, particularly with the technology and AI sectors, is essential. The size and pricing of these future deals will signal whether the market is willing to pay the premium required to support the DAC industry.

Frequently Asked Questions

What is the significance of the STRATOS plant in Occidental’s strategy?

The STRATOS plant, commissioned in Texas in 2025, is the centerpiece of Occidental’s strategy. It is the company’s first commercial-scale Direct Air Capture (DAC) facility, designed to capture 500,000 tonnes of CO₂ annually. Its operational start marks the shift from planning to active commercial operations, serving as the primary proof point of Occidental’s ability to execute large-scale DAC projects and anchoring its entire carbon management business.

How is Occidental funding its expensive Direct Air Capture (DAC) projects?

Occidental is financing its DAC projects through a dual strategy of major asset divestitures and securing third-party investments. Key financial moves in 2025 include the $9.7 billion sale of its Oxy Chem division to Berkshire Hathaway and a $1.2 billion divestiture of upstream assets. This is supplemented by attracting external capital, such as the $550 million investment from BlackRock to help fund the STRATOS plant.

Who are the customers for Occidental’s carbon removal credits?

Occidental is targeting major corporations, especially in the energy-intensive AI sector, to purchase its carbon dioxide removal credits. The company has secured a repeatable sales model with deals in 2025 from firms like JPMorgan and Palo Alto Networks, building on earlier agreements with companies such as Amazon, AT&T, and a landmark carbon removal deal with Microsoft to offset emissions from its AI operations.

Is Occidental’s Direct Air Capture technology profitable yet?

No, according to the text, the technology’s economic model is not yet self-sustaining. While the STRATOS plant proves DAC is functional at a commercial scale, Occidental executives have stated the current model ‘isn’t bankable’ on its own. Its economic viability currently relies heavily on revenue from carbon credit sales, government subsidies, and the success of future cost-reduction innovations.

Besides the STRATOS plant in Texas, is Occidental planning to expand its DAC operations elsewhere?

Yes, Occidental has both domestic and international expansion plans. The company is deepening its commitment in Texas with plans for the King Ranch Hub in South Texas. Furthermore, its strategic collaboration with the UAE’s ADNOC to evaluate a joint DAC facility represents the company’s first major step toward exporting its integrated DAC model globally.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.