Orbital Data Center Investment 2026: Capital Shifts from Venture to Infrastructure

From Concept to Commercial Projects: Analyzing Capital Allocation for Space Data Centers

Adoption of space-based data centers has shifted from conceptual research funded by early-stage ventures to tangible commercial projects backed by strategic corporate capital and government contracts. This transition signals that the market is moving past initial feasibility studies and toward building operational infrastructure, driven by the intense compute demands of artificial intelligence.

- Between 2021 and 2024, market activity was defined by small, speculative investments in startups with ambitious plans, such as Lumen Orbit’s $2.4 million pre-seed round and Lonestar Data Holdings’ $5 million seed round. From 2025 onward, the scale of capital and the nature of the projects changed, marked by large-scale funding for integrated systems like K 2 Space’s $250 M round and strategic corporate initiatives like Google’s Project Suncatcher.

- The market’s focus evolved from theoretical applications, like Lonestar’s lunar archival concept, to validated, in-orbit operations. The pivotal moment occurred in December 2025, when Nvidia-backed Starcloud successfully trained an AI model in space using commercial Nvidia H 100 GPUs, providing the first concrete proof that orbital AI computing is technically viable.

- The range of applications has broadened, attracting different types of capital. While early investment targeted general-purpose data centers, funding since 2025 has diversified into specialized segments, including edge AI compute for satellites (EDGX), sovereign satellite platforms (Enduro Sat), and high-capacity connectivity networks (Blue Origin’s Tera Wave), indicating a maturing and segmenting market.

AI Boom Drives Need for Space Data Centers

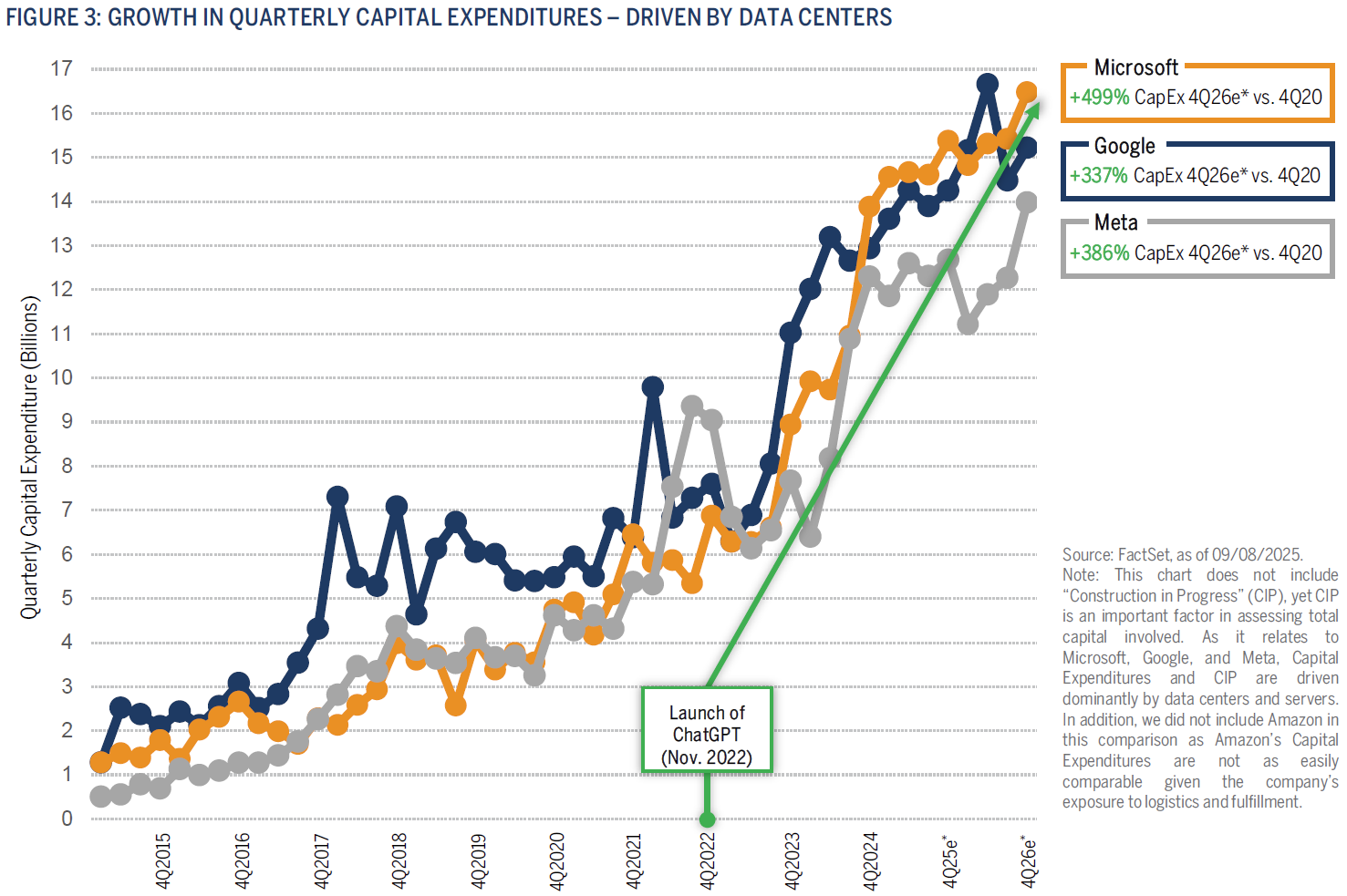

This chart illustrates the massive AI-driven spending on terrestrial data centers, providing essential context for why the market is looking to space for future infrastructure.

(Source: Brown Advisory)

Venture Funding Signals Market Acceleration for In-Orbit Computing

Early-stage venture capital investment has accelerated significantly since 2025, with larger and more frequent funding rounds validating the technology and de-risking the market for subsequent, larger institutional investors. This influx of high-risk capital is crucial for financing the foundational hardware and software innovations before massive infrastructure capital can be deployed.

- Total capital raised by startups has increased dramatically, moving from seed rounds under $15 million before 2025 to significant growth rounds afterward. Notable deals include K 2 Space raising $250 M, Loft Orbital securing a $170 M Series C, and Enduro Sat closing a $104 M round, all indicating growing investor confidence in the sector’s long-term viability.

- The participation of high-profile venture investors provides powerful validation signals to the broader market. The involvement of firms like Y Combinator, Google Ventures (GV), Lux Capital, and Andreessen Horowitz scout funds in startups like Starcloud and Enduro Sat lends credibility and attracts further investment.

- Venture funding has expanded beyond core data center startups to include enabling technologies, creating a more robust ecosystem. The $104 M investment in Enduro Sat to expand satellite production and the $13 M Series A for imagery marketplace Sky Fi demonstrate that capital is flowing into the entire value chain required to support orbital computing.

Table: Select Venture Capital and Early-Stage Investments (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Sky Fi | Jan 2026 | Raised $13 M in a Series A round to expand its satellite imagery access platform, an end-user for in-space data processing. | Sky Fi Raises $13 M in Series A Round to Expand … |

| Take Me 2 Space | Jan 2026 | Secured $5 M in seed funding to develop India’s first orbital data center, signaling geographic expansion of the market. | Space startup targets India’s first orbital data centre in … |

| K 2 Space | Dec 2025 | Raised $250 M to develop large-scale satellite platforms capable of hosting data center-like payloads. | The Week’s 10 Biggest Funding Rounds: Security And … |

| Enduro Sat | Oct 2025 | Raised $104 M from investors including GV and Lux Capital to expand satellite production, a key enabler for deploying orbital compute. | Enduro Sat Raises $104 M to Expand Satellite Production … |

| EDGX | Aug 2025 | Secured a €2.3 M ($2.6 M) seed round to develop satellite edge AI compute technology. | EDGX sees €2.3 m seed round for satellite Edge AI … |

| Sophia Space | May 2025 | Raised $3.5 M in a pre-seed round to develop software for managing orbiting data centers. | Sophia Space raises $3.5 million for orbiting data centers |

| Starcloud (formerly Lumen Orbit) | Mar 2025 | Raised a total of $21 M in seed funding from Y Combinator and others to build a network of in-orbit data centers. | Lumen Orbit is Now Starcloud—And It Just Raised Another … |

| Loft Orbital | Jan 2025 | Raised a $170 M Series C to scale its “satellite-as-a-service” model, which can host compute payloads. | Announcing Loft’s $170 M Series C |

Strategic Alliances Shape the Orbital Data Center Value Chain

Strategic partnerships have become the primary mechanism for integrating the complex value chain of orbital data centers, combining compute hardware, satellite platforms, and cloud services into viable commercial offerings. These alliances allow companies to share risk and stack core competencies to deliver a service that no single entity could provide alone.

Mapping the AI Data Center Value Chain

This chart maps the complex ecosystem of the data center value chain, directly illustrating the need for the strategic partnerships discussed in this section.

(Source: Brown Advisory)

- In late 2023, the partnership between Axiom Space, Kepler Space, and Skyloom to create an orbital data center on Axiom Station established an early model for infrastructure collaboration. This was followed by more focused commercial partnerships, such as Crusoe’s agreement with Starcloud in October 2025 to establish the first public cloud platform in space, directly connecting a terrestrial AI cloud provider with an orbital compute startup.

- Technology providers are acting as key enablers through strategic partnerships. Nvidia’s collaboration with Starcloud provided not only the essential GPU hardware but also critical marketing and validation by profiling the startup and its successful in-orbit AI model training, significantly de-risking the technology for other investors.

- Large technology corporations are using partnerships to execute their own strategic initiatives. Google’s Project Suncatcher, a “moonshot” to develop space-based AI infrastructure, relies on a partnership with satellite imagery firm Planet to launch its first trial equipment, demonstrating a preference for external collaboration over entirely internal development for these novel systems.

Table: Key Strategic Partnerships in Space-Based Computing

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google and Planet | Dec 2025 | A partnership under Project Suncatcher to launch trial AI infrastructure equipment in 2027. This validates the concept with a major technology player. | Google CEO Sundar Pichai: Data centers in space will be … |

| Crusoe and Starcloud | Oct 2025 | A strategic partnership to launch the first public cloud platform in space. This creates a direct commercial path for orbital computing services. | Crusoe is first cloud in space: Starcloud partnership for AI … |

| Nvidia and Starcloud | Pre-2025 | A technology and investment partnership where Nvidia provided H 100 GPUs and public validation for Starcloud’s successful in-orbit AI model training. | The NVIDIA-Backed Startup That Wants to Put Data … |

| Axiom Space, Kepler Space, and Skyloom | Dec 2023 | A strategic partnership to operationalize the world’s first orbital data center aboard the commercial Axiom Station. | Axiom Space Partners with Kepler Space and Skyloom to … |

Global Capital Deployment: US Leads While Europe and Asia Build Sovereign Capabilities

While the United States dominates private venture and corporate investment in orbital data centers, European and other international governments are strategically allocating public funds to foster sovereign industrial bases and prevent technological dependency. This creates a global landscape with a US-led commercial front and government-backed initiatives elsewhere focused on building foundational capacity.

- The United States is the clear leader in private capital allocation, with the majority of high-value venture funding and all major corporate initiatives originating there. Companies including Space X, Google, Blue Origin, Starcloud, K 2 Space, and Loft Orbital are driving market development through private investment and internal R&D.

- Europe is pursuing a strategy of public-private partnerships to build sovereign capabilities. The European Space Agency (ESA) committed over $169 million to Swissto 12 to develop next-generation satellites, and regional funds supported Belgium’s EDGX. This approach aims to create a competitive European industrial base.

- Australia and India are making strategic investments to secure national space access and capabilities. The Australian Government’s $141 million investment in Gilmour Space Technologies is aimed at sovereign launch, a critical prerequisite for deploying national assets, while India’s Take Me 2 Space secured $5 M for a domestic orbital data center project.

- Other nations like Canada are using targeted grants to support their domestic ecosystems. The Canadian Space Agency’s (CSA) $14.2 million in contributions to 18 companies helps smaller firms develop component technologies that can be integrated into larger space infrastructure projects.

From R&D to In-Orbit Operations: Space Data Center Technology Reaches Key Milestones

The technology for space-based data centers has progressed from theoretical concepts before 2025 to validated in-orbit demonstrations and initial commercial operations, driven by tangible hardware deployments and successful test missions. This rapid maturation has significantly reduced technical risk and unlocked larger pools of capital.

- The period between 2021 and 2024 was characterized by early-stage R&D and planning. Activities included Lonestar’s work on its lunar data center concept and Axiom Space’s strategic plan to host a data center, both of which were primarily conceptual.

- A critical technological turning point was reached in December 2025 when Starcloud successfully trained a Google Gemma AI model in orbit. This demonstration using commercial-grade Nvidia H 100 GPUs was the first definitive proof that complex AI workloads could be executed in space, shifting the technology’s status from experimental to proven.

- The market has matured from focusing on the compute payload alone to addressing the entire infrastructure stack. The development of dedicated connectivity constellations like Blue Origin’s Tera Wave and the availability of commercial platforms like Axiom Station and Enduro Sat satellites show that the ecosystem required to support orbital data centers is being built out.

- Government-backed demonstration projects provided early validation. NASA’s sponsorship of an orbital data center on the International Space Station (ISS) to test edge computing capabilities served as an important precursor, de-risking key technical challenges before the major commercial push.

SWOT Analysis: Assessing Capital Allocation for Orbital Data Centers

The strategic landscape for orbital data centers is defined by the strength of its compelling economic drivers and vertically integrated leaders, offset by significant capital risk and the threat of a market dominated by a single player. The rapid shift from venture-funded concepts to large-scale corporate roadmaps has reshaped the sector’s opportunities and threats in a very short period.

Framework for Data Center Investment Strategy

This infographic provides a strategic framework for data center investing, outlining the key drivers and risks that are central to the SWOT analysis in this section.

(Source: Global Data Center Hub)

Table: SWOT Analysis for Capital Allocation in Space-Based Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Strong VC interest in a novel concept (e.g., Lumen Orbit’s funding). Backing from incubators like Y Combinator. | Massive corporate validation from Google (Project Suncatcher) and Space X. Successful in-orbit tech demo by Starcloud/Nvidia. Diversified capital from VCs, corporations, and governments. | The market thesis was validated by big tech entering the race and a successful in-orbit AI training demonstration, proving technical feasibility and attracting serious capital. |

| Weaknesses | High technical risk and unproven business models. High launch costs created a significant barrier to entry. | Immense capital requirements for build-out (Space X targeting $1.5 trillion IPO valuation). Heavy reliance on a few launch providers, creating potential bottlenecks. | The scale of ambition grew exponentially, transforming the weakness from technical uncertainty to the financial challenge of funding trillion-dollar infrastructure roadmaps. |

| Opportunities | To solve terrestrial constraints of power, land, and water for data centers. First-mover advantage in a new market. | Address the $6.7 trillion data center infrastructure market by 2030. Create a new asset class for infrastructure investors. Circumvent terrestrial political and environmental issues. | The AI boom supercharged the market opportunity, turning the “niche solution” narrative into a “strategic necessity” to meet projected compute demand. |

| Threats | Market skepticism and long development timelines. Competition from more efficient terrestrial data center technologies. | Market centralization and dominance by a single vertically integrated player (Space X). Public market volatility could derail large-scale funding plans like the Space X IPO. | The primary threat shifted from market failure to market capture, with Space X’s vertical integration creating a formidable competitive moat that could stifle competition. |

Forward Outlook: Space X IPO as a Bellwether for the Orbital Infrastructure Asset Class

If the planned 2026 Space X IPO succeeds at its target valuation, watch for a flood of institutional and infrastructure capital to enter the sector, confirming the emergence of orbital data centers as a new, recognized asset class. This single event holds the potential to unlock the massive, long-term funding required to build out orbital infrastructure at scale.

Data Centers as a Trillion-Dollar Asset Class

This chart quantifies the terrestrial data center market as a $2.6 trillion asset class, providing context for this section’s discussion of orbital infrastructure becoming a new, recognized asset class.

(Source: Landgate)

- The success of the Space X IPO is the most critical near-term signal. A successful raise of “tens of billions of dollars” to fund orbital AI data centers would provide ultimate market validation for public investors and set a valuation benchmark for the entire sector. This would shift the risk structure from private equity to public markets.

- A successful IPO would likely trigger a wave of consolidation and M&A activity. Large, newly capitalized players would be positioned to acquire startups possessing key component technologies related to orbital compute, radiation hardening, or software management, accelerating market integration.

- Conversely, if the IPO is delayed, downsized, or underperforms, it could significantly slow large-scale capital formation. This would keep the market reliant on venture capital and strategic corporate funding for longer, pushing out the timeline for hyperscale orbital deployments and potentially creating an opening for competitors.

- Monitor the progress of major competing projects scheduled for 2027, including Google’s first Project Suncatcher trial and Blue Origin’s Tera Wave network deployment. The success of these initiatives could provide credible alternatives to a Space X-dominated ecosystem and create a more fragmented, competitive market.

Frequently Asked Questions

Why is investment in orbital data centers shifting from small venture rounds to large infrastructure-scale funding?

The shift is driven by the market’s maturation from conceptual R&D to proven, in-orbit operations. A key catalyst was the successful demonstration of AI model training in space in late 2025, which proved the technology’s viability. This milestone, combined with the immense compute demands of AI, has attracted large corporate and strategic investors like Google and Crusoe, who are now funding tangible infrastructure projects rather than just speculative concepts.

What was the key technological breakthrough that validated the concept of in-orbit computing?

The pivotal moment occurred in December 2025 when the startup Starcloud, backed by Nvidia, successfully trained a Google Gemma AI model in orbit. This was accomplished using commercial-grade Nvidia H100 GPUs, providing the first concrete proof that complex, high-value AI workloads are technically feasible in a space environment.

Who are the major companies and investors leading the development of orbital data centers?

The field is led by a mix of players. Startups like Starcloud, K2 Space, and Loft Orbital are pioneering the technology with backing from prominent VCs like Y Combinator and GV. Large corporations are also making strategic moves, such as Google with ‘Project Suncatcher’ and Nvidia through hardware partnerships. Vertically integrated giants like SpaceX and Blue Origin are also developing their own large-scale infrastructure.

What is the main opportunity or problem that space-based data centers are trying to solve?

Orbital data centers aim to solve the increasing terrestrial constraints of power, land, and water that traditional data centers face, especially with the explosive growth of AI. By moving compute infrastructure to space, companies can potentially circumvent Earth-based political and environmental issues while addressing a projected $6.7 trillion data center infrastructure market by 2030.

According to the analysis, what is the most important upcoming event to watch in the orbital data center market?

The most critical near-term event is the planned SpaceX IPO in 2026. The article identifies this as a ‘bellwether’ for the sector. A successful IPO would validate orbital infrastructure as a new asset class for public investors, likely unlocking a flood of institutional capital for large-scale build-out. Its performance could either significantly accelerate or slow down the market’s development.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.