Space-Based Data Centers 2026: How Policy and Defense Frameworks Shape Growth Constraints

SBDC Adoption Risks 2026: Navigating the Conflict Between Defense Needs and Commercial Hurdles

The adoption of space-based data centers (SBDCs) is bifurcating into two distinct tracks: a rapidly accelerating defense sector driven by strategic imperatives, and a slow-moving commercial sector constrained by unfavorable economics and profound regulatory uncertainty. The trajectory of the SBDC market is no longer a single path but a fractured one, where government demand is pulling technology forward while commercial business cases remain unproven at scale.

- Prior to 2025, industry adoption was characterized by foundational technology development, supported by indirect policies like the U.S. Inflation Reduction Act, which lowered component costs, and early-stage NASA programs that funded general space capabilities.

- From 2025 onward, adoption accelerated dramatically within the defense and national security sector. This shift is confirmed by Axiom Space’s announcement to build orbital data center nodes for government clients and Sidus Space’s $120 million agreement with Lonestar to support space-based data infrastructure.

- In contrast, commercial adoption is being actively suppressed. State-level policies, such as Virginia’s $1.6 billion annual tax abatement for terrestrial data centers, distort the market by artificially lowering the operating costs of SBDC competitors, delaying the economic crossover point for commercial customers.

- International regulatory moves, such as the proposed EU Space Act, further inhibit broad commercial adoption by creating costly compliance barriers that protect regional players and limit the serviceable market for U.S. providers.

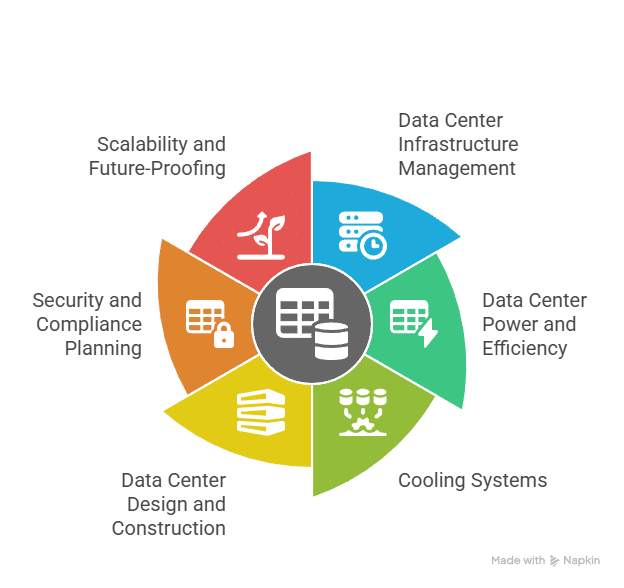

Terrestrial Data Center Strategies Highlight SBDC Hurdles

This infographic details the mature strategies of terrestrial data centers, illustrating the significant commercial and operational hurdles that space-based alternatives must overcome to compete.

(Source: The Network Installers)

SBDC Investment Analysis: Defense Contracts Outpace Venture Capital in De-Risking Early-Stage Growth

Direct government and defense-related contracts have become the most critical financial mechanism for de-risking SBDC technology, providing the non-dilutive funding and anchor tenancy needed to overcome immense upfront capital expenditures. This government backing is proving more decisive than traditional venture capital in validating the market and funding the transition from concept to operational hardware.

- The primary investment driver is the alignment of SBDCs with national security objectives, as the global space militarization market is projected to reach $116.1 billion by 2034. This creates a large and motivated customer willing to fund high-risk, high-reward technology.

- A key inflection point occurred after January 2025, with investments shifting from smaller, generalized NASA grants to large, mission-specific agreements. The $120 million agreement between Sidus Space and Lonestar exemplifies this trend toward significant, targeted capital deployment for SBDC infrastructure.

- The U.S. Executive Order on data center permitting from July 2025, while focused on terrestrial sites, signals a national strategic priority that lowers the perceived political risk for investors in the entire compute infrastructure sector, including space-based assets.

Table: Key Investments and Financial Frameworks for SBDC Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Virginia State Tax Abatement | Jan 2026 | A $1.6 billion annual state-level tax abatement for terrestrial data centers creates a major financial headwind for SBDCs by subsidizing their direct competitors. | Cardinal News |

| EU Space Act Compliance Costs | Dec 2025 | The proposed act is estimated to impose €253 million to €387 million in annual compliance costs on U.S. companies, acting as a direct financial constraint on entering the European market. | Space News |

| Sidus Space / Lonestar | Jun 2025 | Sidus Space advanced a $120 million agreement with Lonestar to support space-based data center services, signaling a significant financial commitment to building out the SBDC ecosystem. | Sidus Space |

| Axiom Space | Apr 2025 | Axiom Space announced plans to develop and launch orbital data center nodes specifically to support national security customers, confirming the Do D as a key anchor tenant. | Axiom Space |

| NASA Communications Services Project (CSP) | Apr 2022 | NASA awarded a combined $278.5 million to six companies, including Space X ($69.95 million) and Amazon’s Project Kuiper ($67 million), to develop foundational communication services. | Puget Sound Business Journal |

Strategic Partnerships: How Alliances Shape SBDC Deployment Amid Regulatory Constraints

Strategic partnerships are forming along two primary axes to overcome market barriers: technology integration to meet demanding defense requirements and novel legal structures to mitigate the risk of data sovereignty regulations. These alliances are crucial for assembling the complex capabilities and business models required for SBDC viability.

Data Governance Model Visualizes SBDC Partnership Drivers

This model breaks down the technical, legal, and security components of data governance, highlighting the complex regulatory hurdles that strategic partnerships aim to resolve.

(Source: Digital Regulation Platform)

- Post-2025 partnerships reflect a maturing market by focusing on operational deployment. The Sidus Space and Lonestar agreement is a clear example of combining manufacturing and service capabilities to deliver an end-to-end SBDC solution.

- Partnerships are also being used to directly address regulatory constraints. The alliance between KIO Data Centers and Lonestar to create “digital consulates” is a strategic attempt to frame legal ambiguity as a feature, offering data havens theoretically outside any single nation’s jurisdiction.

- This represents a significant evolution from the pre-2025 period, where partnerships were broader and more foundational, such as NASA’s CSP awards to develop general-purpose satellite communications networks rather than specific data center applications.

Table: Notable SBDC-Related Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| KIO Data Centers / Lonestar | Sep 2025 | Partnership to pioneer space-based data security and offer “digital consulates, ” a business model designed to navigate the legal vacuum surrounding data jurisdiction in space. | JSA |

| Sidus Space / Lonestar | Jun 2025 | A $120 million agreement for Sidus Space to support Lonestar’s SBDC constellations, creating a key manufacturing and support partnership. | Sidus Space |

| NASA / Multiple Satcom Providers | Apr 2022 | NASA awarded $278.5 million across six companies to develop commercial satcom capabilities, providing foundational infrastructure for future in-space services, including data transfer. | Puget Sound Business Journal |

Geographic Divergence: Why U.S. Defense Policy and EU Regulation are Creating Separate SBDC Markets

The global SBDC market is fracturing along geopolitical lines, with the United States solidifying its position as the primary development hub while the European Union establishes a regulatory framework that risks isolating its market. This divergence is driven by conflicting policy priorities: U.S. promotion of infrastructure for strategic advantage versus EU protectionism centered on digital sovereignty.

US Counterspace Doctrine Drives SBDC Defense Demand

The U.S. Space Force’s counterspace operations framework demonstrates the strategic importance of space assets, driving demand for resilient infrastructure like SBDCs for defense applications.

(Source: DefenseScoop)

- The U.S. is creating a favorable environment through federal action. The July 2025 Executive Order accelerating data center permitting and the DOE’s allocation of federal sites for ground infrastructure provide a powerful political tailwind for SBDC operators.

- Conversely, the EU is building regulatory walls. The proposed EU Space Act from June 2025 introduces significant compliance costs, estimated between €253 million and €387 million annually for U.S. firms, functioning as a non-tariff barrier to protect EU companies.

- This policy split creates two distinct market dynamics. In the U.S., the primary challenge is competition with subsidized terrestrial data centers. In the EU, the challenge is the high cost of market entry and a regulatory preference for domestic providers.

- A November 2025 report highlighted the risk of Europe falling behind in the SBDC race, confirming that its regulatory approach may inhibit innovation and deployment compared to the defense-driven acceleration in the U.S.

SBDC Technology Maturity: From Component R&D to Integrated Systems for Defense Applications

SBDC technology has progressed from component-level research before 2025 to the development and procurement of integrated orbital systems today, a leap in maturity driven almost entirely by the demanding requirements of national security customers. While the technology is now viable for specialized government missions, its readiness for broad commercial deployment remains constrained by cost and legal risks.

Legacy Architecture Shows Need for Integrated SBDCs

This diagram of traditional ground-based processing illustrates the legacy architecture that new, integrated space-based data center systems are designed to replace, highlighting a leap in technological maturity.

(Source: NASA)

- In the 2021-2024 period, technology maturity was measured by improvements in foundational components like solar panels and batteries, with their development aided by policies such as the U.S. Inflation Reduction Act.

- The period from 2025 to today is defined by a shift to system-level maturity. The announcement from Axiom Space in April 2025 to build and launch complete orbital data center nodes marks a critical transition from developing parts to delivering a service.

- The ultimate validation of technological maturity is the willingness of a sophisticated customer like the U.S. Department of Defense to commit significant capital. These contracts confirm that SBDC technology has reached a Technology Readiness Level sufficient for high-stakes, specialized applications.

- However, technologies for the commercial market, which must be cost-competitive and compliant with divergent global regulations, are at a much lower level of maturity and have not yet demonstrated a viable business case.

SWOT Analysis: Policy and Regulatory Factors Driving SBDC Viability

The viability of space-based data centers hinges on a central tension: their greatest strength, alignment with national defense priorities, is directly threatened by unresolved international legal frameworks and powerful domestic economic policies that favor terrestrial incumbents. The market’s future will be determined by whether the opportunities in defense can overcome the formidable threats in the commercial and regulatory arenas.

Table: SWOT Analysis for SBDC Regulatory and Policy Frameworks

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Indirect policy support (IRA for components), foundational NASA PPPs, potential to avoid carbon pricing (EU CBAM). | Direct Do D funding and anchor tenancy (Axiom Space), high-value contracts (Sidus/Lonestar), federal executive support for compute infrastructure. | Government support transitioned from indirect and foundational to direct, mission-specific, and financially significant, validating the national security use case. |

| Weaknesses | Extremely high CAPEX, low TRL of integrated systems, reliance on government funding for R&D. | High customer concentration risk (over-reliance on Do D), ITAR export controls limiting commercial market size, inability to compete with subsidized terrestrial rivals. | As the defense market solidified, the weakness shifted from technological immaturity to the business risk of dependency on a single customer segment. |

| Opportunities | Serving niche markets requiring high security; marketing carbon-free processing as an advantage against regulations like CBAM. | Forming public-private partnerships on federal land for ground stations; marketing “digital consulates” to address data sovereignty concerns (KIO/Lonestar). | Opportunities became more specific, with companies developing concrete business models and partnerships to exploit regulatory gaps or leverage government initiatives. |

| Threats | General data governance complexity (NIST SP 800-171), potential for future regulations on data in space. | Quantified, high-cost regulatory barriers (EU Space Act), massive terrestrial subsidies (Virginia’s $1.6 B), persistent legal vacuum on data jurisdiction. | Threats evolved from abstract risks into tangible, quantified financial and legal barriers that actively constrain commercial market entry. |

2026 Outlook: Tracking the Bifurcation of SBDC Markets

If the U.S. Department of Defense and intelligence community continue to award high-value, multi-year contracts for orbital data processing through 2026, watch for a further acceleration of defense-focused SBDC deployments while the broader commercial market remains stalled, confirming a two-speed industry trajectory.

- The most critical signal to monitor is the announcement of new, large-scale government contracts for SBDC services. Such awards would validate the defense-first market hypothesis and attract further private capital into companies aligned with the national security sector.

- A key counter-signal would be a major commercial enterprise, particularly from a regulated industry like finance or healthcare, signing a significant, long-term SBDC contract. This event would indicate a breakthrough in resolving the legal and jurisdictional risks that currently deter commercial adoption.

- The political and economic sustainability of massive terrestrial data center subsidies, such as Virginia’s $1.6 billion annual program, is another indicator to watch. Any significant political pushback or scaling back of these subsidies would improve the relative economic viability of SBDCs for commercial customers.

- Finally, watch for any international effort, perhaps through the United Nations or a coalition of space-faring nations, to establish a preliminary legal framework for data in orbit. The initiation of such a process would be the first step toward reducing the legal uncertainty that is the single greatest constraint on the long-term commercial market.

Frequently Asked Questions

Why is the space-based data center (SBDC) market developing in two separate directions?

The market is bifurcating because the defense and commercial sectors have vastly different drivers and constraints. The defense sector’s adoption is rapidly accelerating due to strategic national security needs, with government contracts providing significant funding. In contrast, the commercial sector is stalled by unfavorable economics, as it must compete with heavily subsidized terrestrial data centers, and faces profound regulatory uncertainty, such as the proposed EU Space Act.

What is the most significant factor funding SBDC growth today?

Direct government and defense contracts have become the most critical financial driver. These agreements, like the $120 million deal between Sidus Space and Lonestar or Axiom Space’s plan to serve national security clients, provide the non-dilutive funding and anchor tenancy needed to cover the immense upfront capital costs. This government backing is proving more decisive in de-risking the technology than traditional venture capital.

How are U.S. and E.U. policies creating different SBDC markets?

The U.S. and E.U. are creating divergent market conditions. U.S. federal policy, such as the July 2025 Executive Order on data center permitting, provides a political tailwind for all compute infrastructure. Conversely, the E.U.’s proposed Space Act is a regulatory wall, estimated to impose €253 million to €387 million in annual compliance costs on U.S. firms, effectively functioning as a non-tariff barrier to protect regional players.

What are the biggest threats to the commercial success of SBDCs?

The primary threats are economic and regulatory. Economically, massive state-level subsidies for terrestrial competitors, like Virginia’s $1.6 billion annual tax abatement, make it difficult for SBDCs to compete on price. Regulatorily, the lack of a clear international legal framework for data jurisdiction in space, combined with high-cost compliance barriers like the EU Space Act, creates significant risk and uncertainty that deters commercial customers.

What is a key indicator to watch for in 2026 that would signal a major shift in the SBDC market?

A key counter-signal to the current defense-first trend would be a major commercial enterprise, especially from a highly regulated industry like finance or healthcare, signing a significant, long-term SBDC contract. Such an event would indicate a breakthrough in resolving the legal, jurisdictional, and cost issues that are currently suppressing broad commercial adoption.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.