Space Data Center Thermal Management: The 2026 Scalability Bottleneck for Orbital AI

Orbital Data Center Projects Pivot to Validate Thermal Management Solutions

The recent wave of orbital data center projects signals a strategic shift from broad conceptual exploration between 2021 and 2024 to focused, in-orbit validation of critical thermal management systems from 2025 onward. These systems represent the primary bottleneck to achieving the commercial-scale computational density required to support space-based AI. The industry is moving from proving the idea is feasible to proving the specific hardware can survive and perform under the extreme thermal loads of modern AI processors.

- Before 2024, initiatives were largely focused on high-level concepts and feasibility studies, such as the European Commission’s ASCEND project which concluded that year. These efforts established the theoretical benefits of constant solar power and a vacuum environment for cooling.

- Starting in 2025, the focus has sharpened to hardware validation. Starcloud’s initial launch is explicitly designed to test its proprietary thermal management techniques in orbit. This mission directly addresses the core engineering challenge of radiating immense waste heat from high-power GPUs in a vacuum.

- Similarly, Power Bank is supplying the thermal control solutions for the Orbit AI satellite network, which launched its first satellite on December 10, 2025. This demonstrates a move toward integrating specialized subsystems to handle the thermal demands of compute-intensive orbital nodes.

- This pivot is driven by the extreme demands of terrestrial AI, where rack power densities have surged past 60 k W. The terrestrial AI Datacenter Liquid Cooling Market is now forecast to reach $15.3 billion by 2035, and the advanced direct-to-chip and immersion cooling technologies developed for it are being directly adapted for space applications.

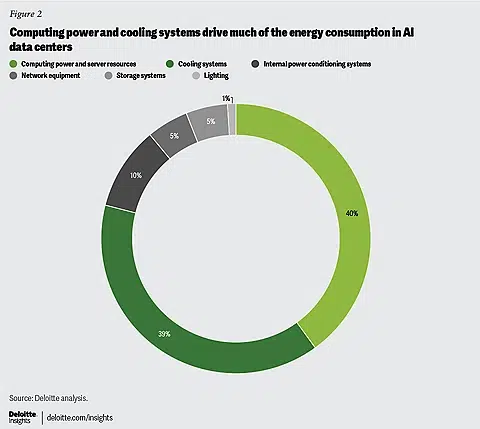

Cooling is a Top AI Data Center Cost

This chart shows that cooling systems are a primary driver of energy use in AI data centers, directly explaining why validating thermal management is the critical focus mentioned in the section.

(Source: Deloitte)

Investment Surges for Orbital Infrastructure, Underpinning Thermal and Power System Development

Recent investment trends, particularly since 2024, show a marked acceleration in funding for companies building the core infrastructure for space-based data centers. This flow of capital into full-stack orbital platforms indicates rising investor confidence that the fundamental power and thermal engineering challenges are solvable. The focus of investment has shifted from speculative concepts to companies with near-term plans for hardware deployment.

- The successful fundraising by Lumen Orbit in 2024, securing a $2.4 million pre-seed round followed by an $11 million seed round, signals strong early-stage investor belief in the viability of the orbital data center model. This capital is targeted for deploying a constellation of data centers in very low Earth orbit.

- Strategic corporate investment is also materializing, highlighted by Microsoft’s decision to lead a $40 million Series A round for Armada in July 2024. While focused on mobile data centers integrated with Space X’s Starlink network, it demonstrates a hyperscaler’s commitment to integrating space and cloud infrastructure.

- This contrasts with earlier, more conceptual investments, such as the $40 million Series A for Lyte Loop in 2021. That funding supported a novel plan to store data using light beamed between satellites, a different model than the current focus on in-orbit power-intensive computation and its associated thermal challenges.

Table: Recent Investments in Orbital Data Infrastructure

| Company | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Lumen Orbit | Dec 2024 | Raised an $11 Million seed round to build data centers in space designed to power AI and other high-demand technologies, indicating significant venture interest. | Tech Crunch |

| Armada | Jul 2024 | Secured $40 Million in a Series A round led by Microsoft. The funding is for developing mobile data centers that connect via Space X’s Starlink network, linking terrestrial edge compute with space-based connectivity. | Space News |

| Lumen Orbit | Mar 2024 | Raised $2.4 Million in a pre-seed round for its initial plan to deploy a constellation of data centers in very low Earth orbit. | Data Center Dynamics |

| Lonestar Data Holdings | Mar 2023 | Completed a $5 Million seed round to fund its proof-of-concept for establishing data centers on the moon, targeting the ultra-secure data archiving market. | w.media |

| Lyte Loop | Feb 2021 | Raised $40 Million in a Series A round to develop a satellite network that stores data by circulating light between orbital nodes. | Data Center Knowledge |

Strategic Alliances Form to Tackle Space Data Center Power and Cooling Challenges

Recent partnerships formed from 2025 onward demonstrate a strategic focus on integrating specialized technologies to solve the system-level power and thermal challenges of orbital data centers. This marks a departure from the broader feasibility studies of the prior period, as companies now form targeted alliances to build and deploy operational hardware. These collaborations are essential for combining expertise in AI hardware, spacecraft engineering, and thermal management.

- The Crusoe / Starcloud partnership, announced in 2025, is a critical development that directly links an energy-first AI cloud company with an orbital platform. With backing from NVIDIA, this alliance aims to launch the first public cloud in space by 2027, explicitly tying high-performance GPUs to dedicated solar arrays and the necessary thermal solutions.

- Aetherflux’s partnership with Rendezvous, announced in late 2025, is focused specifically on scaling orbital power and cooling systems. This alliance is a direct enabler for Aetherflux’s plan to have its first commercial orbital data center operational by Q 1 2027.

- The collaboration between Power Bank and Smartlink AI on the Orbit AI project, which launched its first satellite in December 2025, shows a modular supply chain emerging. Power Bank’s role in providing thermal control solutions highlights the need for specialized suppliers to address the critical cooling challenge.

Table: Key Partnerships for Orbital Data Center Deployment

| Partners / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Aetherflux / Rendezvous | Q 1 2027 (Planned) | Partnering to scale orbital power and cooling systems for Aetherflux’s first commercially operational data center. The focus is on enabling infrastructure. | Data Center Dynamics |

| Crusoe / Starcloud | 2027 (Planned) | A partnership with NVIDIA to launch a public cloud in space. This project combines Crusoe’s energy-focused AI strategy with Starcloud’s orbital platform, directly addressing power and cooling for high-end GPUs. | Crusoe AI |

| Power Bank / Orbit AI | Dec 2025 | Power Bank provides thermal control solutions for the Orbit AI satellite network launched with Smartlink AI, demonstrating a supplier relationship focused on a critical subsystem. | Power Bank Corp |

| Axiom Space / Kepler Space / Skyloom | Dec 2023 | An early implementation-focused partnership to operationalize the world’s first orbital data center, moving beyond feasibility studies toward execution. | Axiom Space |

Europe and US Drive Competing Approaches to Orbital Data Center Development

While North America leads in private-sector-driven, commercially-focused orbital data center projects, Europe is pursuing a government-backed, strategic approach focused on data sovereignty and environmental goals. The US ecosystem is characterized by venture-funded startups racing to deploy hardware, whereas the European approach is more centralized and policy-driven, shaping different developmental pathways for power and thermal technologies.

- The United States is the clear hub of commercial activity, with a dense cluster of startups and established technology companies. Firms like Starcloud, Aetherflux, Axiom Space, and Lone Star Data Holdings are all US-based and are driving the planned deployment timelines between 2025 and 2028. This is supported by deep venture capital markets and active exploration by hyperscalers like Google.

- Europe’s strategy is exemplified by the European Commission’s ASCEND study, conducted by the French-Italian aerospace firm Thales Alenia Space. The study’s positive conclusion in June 2024 was framed around achieving net-zero emissions and ensuring European “data sovereignty, ” linking the infrastructure to continent-level strategic objectives.

- This geographical divergence became clear after 2024. The 2021-2023 period involved more globally dispersed conceptual work. The current era shows the US accelerating toward commercially-led pilots, while Europe focuses on establishing a strategic and regulatory framework before committing to large-scale deployment.

Thermal Management for Orbital AI: From Terrestrial Adaptation to In-Orbit Validation

The core thermal management technologies for space-based data centers are moving from the adaptation of mature terrestrial systems to critical in-orbit validation. The period from 2025 onward marks the first real-world tests of integrated systems designed to handle the heat from high-density AI workloads in a vacuum. The success of these initial missions will determine the technical viability of the entire sector.

Comparing Thermal Storage System Readiness

This radar chart compares thermal storage options on Technology Readiness Level (TRL), perfectly illustrating the section’s theme of moving from adapted terrestrial systems to in-orbit validation.

(Source: Frontiers)

- Between 2021 and 2024, the technological foundation was largely theoretical, relying on adapting proven spacecraft thermal control like heat pipes and radiators. A key validation in this period was Caltech’s successful wireless power transmission in 2023, which confirmed a critical power system enabler but did not test an integrated thermal solution for a data center.

- The current period (2025 to today) is defined by proof-of-concept missions specifically targeting thermal management. Starcloud’s initial launch is explicitly designed to validate its proprietary cooling techniques, and Power Bank is supplying thermal controls for the Orbit AI network. These are the first integrated system tests under real orbital conditions.

- The technology is not yet commercially proven at scale. Its success depends on these initial missions confirming that advanced liquid cooling loops can efficiently transport heat from GPU loads exceeding 60 k W to external radiators. The primary engineering challenge remains the efficiency of radiating this heat into space, making radiator performance a critical metric.

- The sector’s rapid progress is enabled by its ability to leverage parallel advancements in terrestrial technology. The use of high-efficiency Silicon Carbide (Si C) and Gallium Nitride (Ga N) power components and advanced liquid cooling methods, like direct-to-chip cooling, shows a direct technology transfer from the terrestrial data center industry.

SWOT Analysis: Thermal Management in Space-Based Data Centers

While access to continuous solar energy and a natural heat sink provide fundamental advantages, the viability of orbital data centers is constrained by the immense technical challenge of thermal radiation and a high dependency on launch costs. The sector’s strengths are based on physics, but its weaknesses and threats are rooted in engineering and economics. Opportunities are created by the urgent and growing unsustainability of terrestrial AI energy consumption.

AI Racks Demand Ten Times the Power

This chart quantifies the explosive power demand of AI hardware, which directly supports the ‘Opportunity’ described in the SWOT analysis: the growing unsustainability of terrestrial AI.

(Source: Hanwha Data Centers)

- The core strength of the concept is leveraging the space environment: constant, high-intensity solar power and the near-absolute zero temperature of deep space for passive heat rejection via radiation.

- The primary weakness is the physics of heat transfer in a vacuum. The lack of convection forces reliance on large, heavy, and potentially vulnerable radiator panels, which directly limit the computational power that can be packed into a satellite.

- The main opportunity is the terrestrial AI energy crisis. With data centers projected to consume up to 10% of global electricity by 2030, space offers a solution that bypasses strained terrestrial power grids and water resources.

- The most significant threat is economic. The entire business model is tethered to the high and volatile cost of launch. A failure in one of the early, critical thermal validation missions could halt investment and delay progress by years.

Table: SWOT Analysis for Space-Based Data Center Thermal Management

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Theoretical advantage of constant solar power and a passive cooling environment in the vacuum of space. | Economic models from startups like Starcloud project 10 x lower energy costs. The EU’s ASCEND study confirmed technical and economic feasibility. | The advantage has moved from a theoretical concept to an economically modeled value proposition, validated by independent government-backed studies. |

| Weaknesses | Cooling concepts for high-density compute in space were unproven and largely conceptual. | Thermal management via radiation is now identified as the primary limiting factor on computational density. Radiator size and efficiency are the key engineering bottlenecks. | The general challenge of “cooling” has been resolved into a specific engineering problem: maximizing heat radiation efficiency, which is now the focus of pilot missions. |

| Opportunities | General market need to offload the growing energy consumption of terrestrial data centers. | The acute energy crisis driven by AI, with rack densities surpassing 60 k W, creates a high-value, urgent market pull for an alternative infrastructure solution. | The market need has intensified from a long-term sustainability goal to a near-term crisis, significantly increasing the potential value of a viable space-based solution. |

| Threats | High general launch costs were seen as a major barrier to economic viability for any large-scale space infrastructure. | The economic case for orbital data centers is now explicitly dependent on the continued cost reduction of reusable launch vehicles like those from Space X. Early validation flights carry high financial and programmatic risk. | The threat has been clarified from a general market condition (high launch costs) to a specific dependency on a handful of launch providers and the success of high-risk technology demonstration missions. |

2026 Outlook: Success of Thermal Validation Flights Will Determine Sector’s Trajectory

The commercial trajectory of space-based data centers hinges entirely on the success of the thermal management validation missions scheduled from late 2025 through 2027. The data from these initial flights will either confirm the economic models and trigger a new wave of investment or force a significant strategic realignment toward less demanding applications.

AI Will Triple Data Center Power Use by 2030

This forecast of surging energy consumption provides the essential context for the 2026 outlook, showing the scale of the problem that successful validation flights aim to solve.

(Source: Deloitte)

Visualizing Orbital Power System Trade-offs

This plot of energy vs. power density visualizes the core engineering trade-offs for orbital power storage, a key technical challenge and strength mentioned in the SWOT table.

(Source: NASA)

- If missions by companies like Starcloud and Power Bank successfully demonstrate efficient heat rejection from high-density GPUs in orbit, then watch for an immediate acceleration of investment into second-generation platforms and the entry of new competitors. This could be happening if follow-on funding rounds are announced shortly after successful mission reports or if more hyperscalers formalize partnerships beyond initial exploratory projects.

- If these initial flights reveal that radiator efficiency is lower than modeled or that liquid cooling systems are unreliable in microgravity, then watch for a strategic pivot across the sector. The focus would likely shift away from high-performance AI compute and toward lower-density, high-margin applications like the ultra-secure disaster recovery and data archiving market pioneered by Lone Star. This could be happening if companies like Aetherflux and Crusoe publicly push back their operational timelines beyond 2027.

- The momentum of the space-based data center market is currently gaining traction based on strong projections and a clear market need. However, this momentum will either be powerfully validated or significantly reset by the empirical performance data from the first orbital thermal management systems.

Frequently Asked Questions

What is the biggest technical challenge preventing large-scale AI data centers in space?

The primary bottleneck is thermal management. While space is cold, the vacuum prevents heat from escaping through convection. Companies must use large, efficient radiators to radiate the massive amounts of waste heat generated by high-power AI processors (GPUs). The effectiveness of these radiator systems is the main engineering challenge being tested in current and upcoming missions.

Why is there a sudden surge of interest and investment in orbital data centers?

The surge is driven by the “terrestrial AI energy crisis.” The power demands for training and running AI models on Earth are becoming unsustainable, with rack densities exceeding 60 kW and data centers projected to consume a significant portion of global electricity. Space offers a potential solution with constant solar power and a natural environment for cooling, creating an urgent market pull for an alternative infrastructure.

Are there any commercial AI data centers operating in space right now?

No, not on a commercial scale for high-performance computing. The current period, starting in 2025, is focused on in-orbit validation. Projects like the Orbit AI satellite (launched Dec 2025) and Starcloud’s initial missions are proof-of-concept flights designed to test the critical thermal management hardware. The first commercially operational data centers are planned for 2027 by companies like Aetherflux and the Crusoe/Starcloud partnership.

How do the US and European approaches to space data centers differ?

The US approach is primarily led by the private sector, with venture-funded startups like Starcloud, Lumen Orbit, and Aetherflux racing to deploy commercial hardware. In contrast, Europe’s strategy, exemplified by the European Commission’s ASCEND study, is more government-backed and policy-driven, focusing on strategic goals like European data sovereignty and achieving net-zero emissions before committing to large-scale deployment.

What happens if the initial thermal management test missions are not successful?

A failure in these critical validation flights would likely cause a strategic pivot in the industry. The focus would shift away from power-intensive AI computing and toward less demanding, high-margin applications. An example would be the ultra-secure data archiving and disaster recovery market, a model being pursued by companies like Lonestar Data Holdings.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.