Orbital Data Centers in 2026: Why Terrestrial Constraints Are Pushing AI Infrastructure into Space

From Theory to Orbit: Tracking the Adoption of Space-Based Data Centers

Commercial activity confirms the orbital data center market has decisively moved from theoretical studies to an early exploration phase, driven by the escalating energy, land, and water constraints of terrestrial AI infrastructure. The progression from isolated, government-backed research to commercially funded, in-orbit hardware launches by multiple private firms validates that space is now viewed as a viable solution to Earth-based infrastructure limits.

- Between 2021 and 2024, market activity was defined by feasibility assessments and technology tests aboard existing platforms. The EU’s ASCEND study confirmed the concept’s viability, while Hewlett Packard Enterprise’s Spaceborne Computer-2 on the ISS proved that commercial off-the-shelf hardware could function in a microgravity environment.

- The period from 2025 to today marks a fundamental shift toward deploying purpose-built, independent orbital infrastructure. Power Bank & Orbit AI launched their first dedicated compute satellite in December 2025, Kepler Communications followed with its initial satellites in January 2026, and Axiom Space launched a prototype to the ISS in August 2025 specifically for its orbital data center program.

- The range of applications has diversified, signaling early market segmentation. Ventures are targeting high-margin workloads including AI model training and blockchain (Orbit AI), enterprise disaster recovery on the Moon (Lonestar), and general-purpose edge computing (Axiom Space and Red Hat), demonstrating a move beyond generic research toward specific commercial use cases.

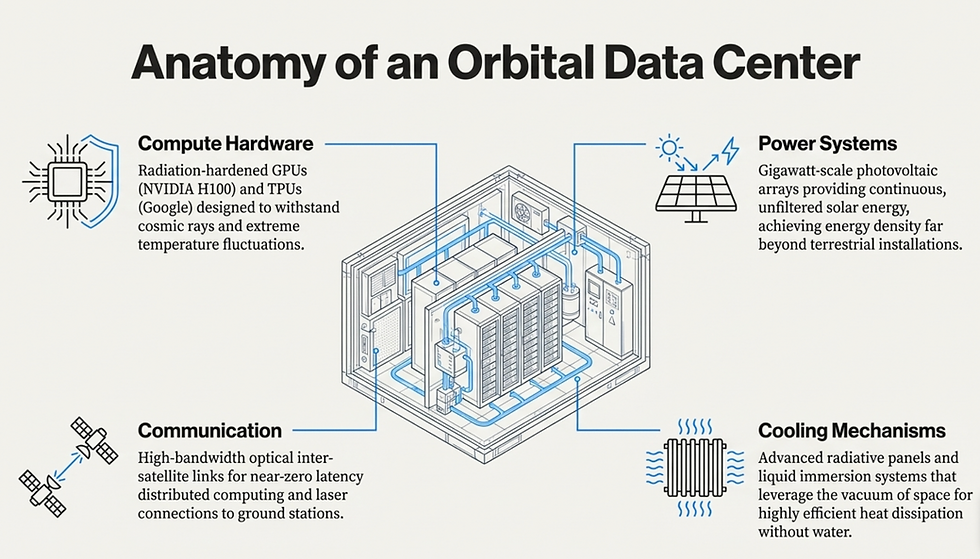

Anatomy of the In-Orbit Data Center

This chart illustrates the core hardware systems being adopted as the market moves from theoretical concepts to tangible, in-orbit platforms.

(Source: AI News Hub)

Capital Flows into Orbit: Unpacking the Investment Surge in Space-Based Data Centers

Investment patterns have matured from small, speculative seed rounds into substantial, strategic capital injections from corporate VCs, institutional funds, and aerospace leaders. This financial escalation signals that investors now recognize orbital data centers as a distinct asset class with a credible, long-term growth trajectory driven by the unsustainable economics of terrestrial data center expansion.

Orbital Market Poised for Explosive Growth

This forecast, showing growth to over $75 billion, quantifies the long-term trajectory that is attracting substantial capital injections from strategic investors.

(Source: AI News Hub)

- Early-stage funding from 2021 to 2024 was characterized by modest seed rounds for conceptual companies, such as Lonestar’s $5 million seed in 2023 and Lumen Orbit’s $2.4 million pre-seed in 2024.

- From 2025 onward, the scale and source of capital changed significantly. Loft Orbital secured a $170 million Series C in January 2025, while Hungarian telco 4 i G is considering a $100 million investment into Axiom Space’s orbital data center plans.

- Strategic corporate moves now define the investment landscape. Alphabet launched Project Suncatcher in November 2025 to explore orbital AI data centers, and Space X is pursuing a 2026 IPO at a potential $1.5 trillion valuation, with orbital AI data centers cited as a primary driver.

- The financial ecosystem is solidifying, with a January 2026 SEC filing for the Tidal Trust II fund including a specific investment strategy for “space data centers, ” creating a formal mechanism for channeling institutional capital into the sector.

Table: Key Investments in the Orbital Data Center Market

| Company / Entity | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Space X | Dec 2025 | Announced plans for a 2026 IPO, seeking a $1.5 trillion valuation to fund the development of orbital AI data centers, leveraging its Starlink and Starship infrastructure. | Musk’s Next Ambition: Building a Space-Based AI Data … |

| Intellistake | Dec 2025 | Made a $500, 000 equity investment into a space-based data center project to strengthen its AI infrastructure platform. | Intellistake Strengthens AI Infrastructure Platform With Entry … |

| Alphabet (Google) | Nov 2025 | Announced Project Suncatcher, a formal R&D initiative to explore the feasibility and strategic implications of orbital AI data centers as a long-term infrastructure solution. | #487: Will Data Centers Orbit In Space?, & More |

| 4 i G | Oct 2025 | Announced consideration of a potential investment of up to $100 million into Axiom Space’s orbital data center program, signaling interest from the telecommunications sector. | 4 i G weighs $100 m investment into Axiom Space as part of … |

| EDGX | Aug 2025 | Raised a €2.3 million ($2.6 million) seed round to develop its Sterna Edge AI computer designed specifically for satellite-based data processing. | EDGX sees €2.3 m seed round for satellite Edge AI … |

| Loft Orbital | Jan 2025 | Secured a $170 million Series C funding round to advance its orbital compute modules designed to host AI and machine learning models in space. | Announcing Loft’s $170 M Series C |

| Lumen Orbit (Starcloud) | Dec 2024 | Raised an oversubscribed $11 million seed round at a $40 million valuation to build a constellation of very low Earth orbit (VLEO) data centers. | 200 VCs wanted to get into Lumen Orbit’s $11 M seed round |

Building the In-Orbit Ecosystem: Strategic Partnerships Driving Space Data Center Development

Partnerships have matured from simple service agreements to complex, multi-layered collaborations aimed at building a complete orbital data ecosystem. These alliances now integrate launch providers, satellite manufacturers, communications networks, and terrestrial data center operators, creating the foundational infrastructure required for a functioning space-based economy.

Key Players Building the Orbital Ecosystem

This infographic maps the key commercial and government entities whose partnerships are creating the integrated ecosystem required for a space-based economy.

(Source: AI News Hub)

- Early partnerships focused on connecting cloud platforms to space assets, such as Microsoft Azure Orbital and AWS Ground Station, which established the ground segment for data downlinking.

- A key shift occurred in December 2023 when Axiom Space, Kepler Communications, and Skyloom partnered to develop an integrated orbital data center on the future Axiom Station, combining habitation, compute, and high-speed optical communications.

- In January 2025, the partnership between terrestrial provider Flexential and space infrastructure company Lonestar demonstrated the need to create seamless data management between Earth and space, bridging the gap for enterprise customers.

- Technology-focused collaborations are also critical, exemplified by Axiom Space’s work with Red Hat to test open-source software in orbit and Lumen Orbit’s entry into Nvidia’s Inception Program to access advanced GPU technology for its space-based AI data centers.

Global Ambitions: North America and Europe Lead the Race for Orbital Data Infrastructure

While North American private enterprise and capital markets currently dominate the development of orbital data centers, European public-private initiatives are creating a strong, policy-driven framework to ensure regional data sovereignty and technological competitiveness. The geographic focus has expanded from a few U.S.-based ventures to a transatlantic ecosystem with distinct strategic priorities.

- North America remains the center of commercial activity, hosting vertically integrated leaders like Space X, well-funded startups such as Loft Orbital and Canada’s Kepler Communications, and the commercial space station developer Axiom Space. This leadership is reinforced by supportive federal policy, including White House executive orders in 2025 aimed at accelerating data center permitting and ensuring space superiority.

- Europe is executing a strategic, government-backed approach to build its own capabilities. The European Space Agency’s In Cubed program actively funds startups like Re Orbit, while the ASCEND study, led by Thales Alenia Space, provided a formal government endorsement of the concept’s feasibility in June 2024.

- This regional divergence is creating two parallel tracks: a U.S. model driven by large-scale private investment and vertical integration, and a European model focused on public-private partnerships, open standards, and data sovereignty.

From R&D to In-Orbit Pilots: Assessing the Technology Maturity of Space-Based Data Centers

The technology for orbital data centers has progressed from the research and development phase, focused on hardware survivability, to the pilot and demonstration phase, centered on validating purpose-built systems and their economic models. This shift from testing terrestrial components in space to launching dedicated orbital compute platforms marks the most significant validation of the market’s technical readiness.

New Capabilities Enabled by Orbital Computing

As technology matures from R&D to pilot missions, it validates key applications like real-time earth observation and autonomous satellite management.

(Source: AI News Hub)

- The 2021-2024 period focused on answering a fundamental question: can commercial, off-the-shelf hardware operate in space? Hewlett Packard Enterprise’s Spaceborne Computer-2 project on the ISS successfully demonstrated this, validating the use of conventional servers and SSDs in a microgravity environment.

- Starting in 2025, the objective evolved to testing purpose-built orbital systems and their specific use cases. The launch of Power Bank & Orbit AI’s first satellite in December 2025, designed for an orbital cloud network, and Axiom Space’s prototype launch in August 2025, developed with Red Hat, represent the first wave of these in-orbit demonstrators.

- This progression confirms the technology has moved beyond basic feasibility to an active, early-stage market exploration where companies are now focused on optimizing performance, proving reliability, and establishing a clear return on investment for specific orbital computing workloads.

SWOT Analysis: Market Dynamics of Orbital Data Centers

Recent activities have validated the core opportunity for orbital data centers in solving terrestrial constraints while simultaneously clarifying the significant financial and competitive hurdles. The market’s strengths and opportunities have become more tangible, while its weaknesses and threats have shifted from theoretical to practical challenges.

Forces Shaping the Space Data Market

This strategic analysis identifies the market’s primary drivers and restraints, providing a framework that directly aligns with a SWOT assessment.

(Source: MarketsandMarkets)

Table: SWOT Analysis for Orbital Data Center Market Exploration

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Theoretical environmental benefits: access to constant solar power and the vacuum of space for cooling. | Reduced launch costs via providers like Space X. Established partnerships bridging terrestrial and orbital infrastructure (Flexential and Lonestar). | The business case has been partially de-risked. Lower launch costs make deployment more economically feasible, and partnerships validate a clear route to market for enterprise customers. |

| Weaknesses | Prohibitively high launch costs. Unproven technology and reliability in the space environment. Lack of a clear economic model. | High capital expenditure for manufacturing and deployment. Latency for data transmission back to Earth remains a bottleneck for certain applications. | While launch costs have decreased, the overall capital intensity of building and operating space infrastructure remains a significant barrier to entry for all but the most well-funded players. |

| Opportunities | Growing global demand for data processing. Niche applications in disaster recovery and secure data storage. | Explosive energy and land demand from AI. Supportive government policy (White House EOs in 2025). New financial instruments emerging (Tidal Trust II fund). | The primary market driver, AI’s insatiable resource demand, has become an urgent, global-scale problem, creating a powerful and immediate need for alternative infrastructure solutions like orbital data centers. |

| Threats | Competition from innovations in terrestrial data center cooling and power efficiency. Geopolitical risks. | Market dominance by vertically integrated players like Space X, creating high barriers to entry. Growing concerns over space debris and the need for new regulations. | The primary competitive threat is shifting from terrestrial alternatives to the risk of market consolidation under a single provider with an insurmountable structural advantage (launch + network + compute). |

Forward Outlook: Key Signals for the Orbital Data Center Market in 2026

If the current demonstrator missions successfully validate performance and cost models for high-margin workloads, watch for an acceleration in funding for second-generation hardware and strategic partnerships between orbital providers and major AI companies seeking to offload their most intensive compute tasks.

In-Orbit Market Forecasted for Rapid Acceleration

Supporting a positive forward outlook, this forecast projects the market will grow to nearly $40 billion, confirming the potential for acceleration.

(Source: Yahoo Finance)

- If this happens: Initial in-orbit demonstrators from companies like Power Bank & Orbit AI and Kepler Communications report positive uptime and performance metrics through 2026. Watch this: The announcement of Series B and C funding rounds specifically earmarked for scaling constellations, not just for further R&D.

- These could be happening: Established hyperscalers like Alphabet and Amazon could move from internal R&D (Project Suncatcher) to acquiring or forming deep integration partnerships with a leading startup to secure first-mover access to orbital capacity.

- The most critical signal gaining traction is the strategy of vertical integration. Space X’s plan to leverage Starship and Starlink for its orbital data center ambition creates a powerful competitive moat that other players cannot easily replicate, positioning it as the market’s anchor and potential kingmaker.

Frequently Asked Questions

Why are companies considering building data centers in space?

The primary driver is that terrestrial data centers are facing escalating constraints on energy, land, and water, largely due to the explosive growth of AI. Space offers potential solutions like constant solar power and the vacuum of space for cooling, making it a viable alternative to overcome these Earth-based infrastructure limits.

Is this just a theoretical concept, or is hardware actually being sent to orbit?

The market has moved from theory to an early deployment phase. While large-scale orbital data centers are not yet fully operational, multiple companies have launched initial hardware. For instance, Power Bank & Orbit AI launched a dedicated compute satellite in December 2025, and Axiom Space launched a prototype to the ISS in August 2025 for its data center program.

Who are the major companies involved in this new market?

The market includes a mix of specialized startups, aerospace leaders, and tech giants. Key players mentioned are SpaceX, which plans to leverage its Starship and Starlink infrastructure; commercial space station developer Axiom Space; startups like Loft Orbital, Kepler Communications, and Lonestar; and major tech companies like Alphabet (Google) with its “Project Suncatcher”.

How are these expensive space projects being funded?

Investment has matured from small seed rounds to substantial, strategic capital injections. For example, Loft Orbital secured a $170 million Series C round in 2025, and Hungarian telco 4iG is considering a $100 million investment in Axiom Space’s program. Additionally, major corporations like Alphabet are launching internal R&D projects, and new financial instruments like the Tidal Trust II fund are emerging to channel institutional capital into the sector.

What are the biggest challenges or weaknesses for orbital data centers?

The main challenges include the extremely high capital expenditure required to manufacture and launch the infrastructure. Data transmission latency (the delay in sending data to and from Earth) remains a bottleneck for certain applications. There is also a significant competitive threat from vertically integrated players like SpaceX, whose control over launch and communications could create high barriers to entry for others.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.