Grid Constraints and Power Demand: The 2026 Drivers for Space-Based Data Centers

The exploration of space-based computing infrastructure is a direct strategic response to severe, quantifiable, and escalating constraints on terrestrial power, land, and water resources. The primary driver is the untenable power demand of AI, which is overwhelming grid capacity and creating multi-year delays for new connections. This bottleneck, compounded by competition for land and water, forms a robust techno-economic case for investing in orbital alternatives as a long-term solution to Earth’s finite capacity to support the AI revolution.

From Concept to Strategic Imperative: Industry Adoption of Space-Based Computing Driven by Terrestrial Grid Failures

Industry adoption of space-based computing has shifted from theoretical R&D between 2021-2024 to strategic project development from 2025 onward, driven by the failure of terrestrial power grids to meet AI-driven demand.

- In the 2021-2024 period, activity was marked by feasibility studies like the European Space Agency’s ASCEND project and development of enabling technologies like space-resilient computing from firms such as Ramon.Space. This work validated the concept but lacked immediate commercial application for data centers.

- From 2025, major technology players initiated targeted projects to address the escalating AI workload crisis. Google launched Project Suncatcher in November 2025 to explore satellite-based TPUs and optical links, a direct response to terrestrial power density and grid connection challenges.

- This shift prompted specialized startups to target aggressive commercial deployment timelines. Starcloud (formerly Lumen Orbit), backed by NVIDIA, now plans to deploy an orbital public cloud by 2027, while Axiom Space is partnering with Spacebilt to place a data center node on the ISS in the same year.

- The focus has moved from general space-resilient hardware to specific data center applications, a change driven by acute business constraints like the seven-year wait times for terrestrial grid interconnections, a problem that has become a primary barrier to AI infrastructure growth.

AI Power Demand Overwhelms Grids

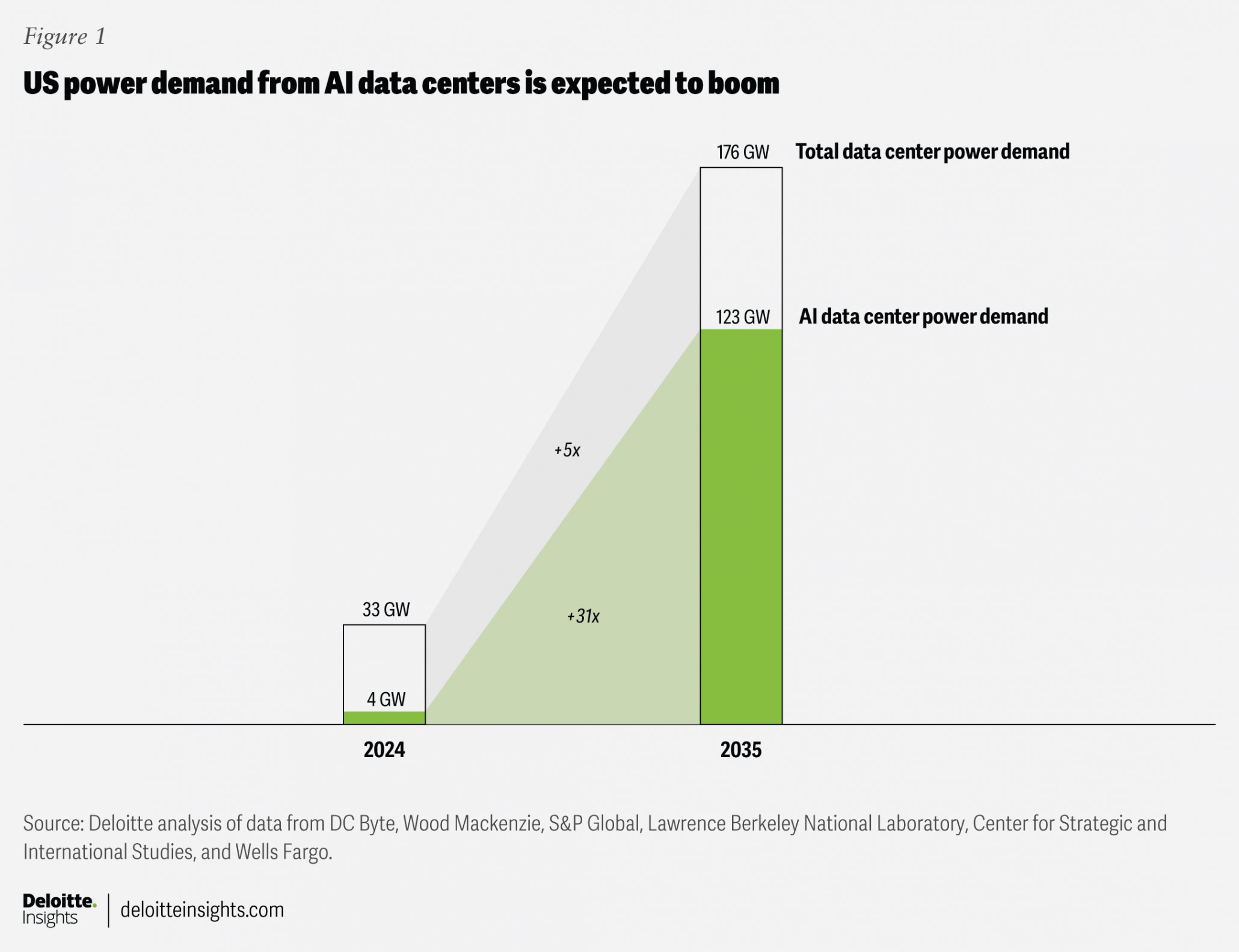

This chart quantifies the ‘terrestrial grid failures’ driving the shift to space, showing US AI data center power demand is projected to surge 31x by 2035.

(Source: Deloitte)

Investment Analysis: Funding Shifts from Terrestrial Stopgaps to Orbital Computing Infrastructure

Investment patterns show a strategic pivot from mitigating terrestrial data center constraints to funding foundational orbital computing infrastructure, validated by significant capital injections and ambitious corporate valuations post-2024.

- Before 2025, early-stage funding focused on enabling components. A key example is Ramon.Space‘s $26 million raise in June 2023, which targeted the development of radiation-hardened computing infrastructure necessary for any space application.

- A significant escalation in targeted investment occurred in late 2024 and beyond. Lumen Orbit (now Starcloud) secured over $10 million in October 2024 specifically for deploying AI training data centers in space, directly linking venture capital to the orbital computing thesis.

- The market’s perceived long-term potential is reflected in Space X‘s reported ambition in late 2025 to seek a $1.5 trillion valuation to help fund its vision for orbital data centers, signaling a shift from venture-scale funding to large-scale strategic capital allocation.

- Governmental validation provides further financial de-risking for investors. In September 2025, Canada’s Department of National Defence awarded a $2.5 million contract to Galaxia to advance the country’s sovereign space data infrastructure.

Table: Key Investments in Space-Based Computing Infrastructure

| Company / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Intellistake & Orbit AI | Jan 2026 | Strategic investment by Intellistake into Orbit AI to develop the ‘trust layer’ for space-based data centers, addressing security and reliability for enterprise services. | MSN |

| Galaxia | Sep 2025 | Awarded a $2.5 million contract by Canada’s Department of National Defence to advance national space data infrastructure, signaling sovereign interest in orbital compute capabilities. | Galaxia |

| Lumen Orbit (now Starcloud) | Oct 2024 | Raised over $10 million in a seed round to deploy orbital data centers specifically for training AI models, representing one of the first major venture investments in the sector. | Data Center Dynamics |

| Ramon.Space | Jun 2023 | Raised $26 million to develop space-resilient computing systems, providing the foundational radiation-hardened hardware required for reliable data processing in orbit. | Ramon.Space |

Strategic Alliances Forge the Path for Space-Based Data Centers Amid Power Grid Constraints

Strategic partnerships formed since 2025 are integrating launch providers, space station operators, and AI hardware leaders to build a viable ecosystem for orbital computing, directly addressing the power and infrastructure limitations of terrestrial data centers.

- A key development demonstrating a practical deployment path is the collaboration between commercial space station operator Axiom Space and Spacebilt, which aims to place the Ax ODC orbital data center node on the International Space Station by 2027.

- The backing of startup Starcloud by NVIDIA is critical, as it aligns a leading AI hardware provider with an orbital cloud platform. This signals that next-generation chips with extreme power densities, like the NVIDIA GB 200, are being considered for space applications where power is abundant but cooling is a challenge.

- Investment partnerships are establishing the business framework for orbital services. Intellistake’s strategic investment in Orbit AI, announced in January 2026, focuses on developing the trust and security layers necessary to offer enterprise-grade data services from space.

- This marks a strategic evolution from the pre-2025 era. Earlier partnerships, like Microsoft Azure Space’s work in 2022 to integrate with satellite providers, were focused on extending cloud services *to* space-based assets, whereas post-2025 alliances are focused on building sovereign compute infrastructure *in* space.

Table: Key Partnerships Driving Orbital Computing

| Partners | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Axiom Space & Spacebilt | 2027 (Planned) | Collaboration to deploy the Ax ODC, an orbital data center node, on the ISS. This partnership creates a near-term, tangible platform for testing and operating compute hardware in orbit. | Embedded.com |

| Starcloud (NVIDIA-backed) | 2025-Present | As an NVIDIA Inception startup, Starcloud benefits from technical and go-to-market support, aligning the world’s leading AI chipmaker with a dedicated orbital computing platform. | NVIDIA Blogs |

| Intellistake & Orbit AI | Jan 2026 | A strategic investment partnership aimed at building the security and trust infrastructure for space-based data, a critical enabler for commercial and government customers. | MSN |

| Microsoft Azure Space | 2022 | Partnered with space infrastructure-as-a-service providers to extend cloud capabilities to orbit, demonstrating early hyperscaler interest in integrating terrestrial and orbital digital infrastructure. | Tech Monitor |

Global Race for Orbital Dominance: US and China Lead Space-Based Computing Initiatives to Bypass Terrestrial Grid Limits

While the United States leads in private sector initiatives for space-based computing, China has demonstrated significant state-led progress, establishing a global competition to overcome terrestrial power and land constraints through orbital infrastructure.

- Between 2021-2024, geographic activity was concentrated in the US and Europe. It was characterized by corporate R&D and government-funded feasibility studies, such as the European Space Agency’s ASCEND program, which primarily served to validate the technical concept.

- Since May 2025, China has emerged as a major state-level actor. The launch of the first 12 satellites for a planned 2, 800-satellite AI space computing constellation, led by startup ADA Space, marks the most significant national commitment to orbital computing to date.

- The US maintains leadership through corporate “moonshot” projects driven by private industry. Initiatives from Google (Project Suncatcher) and Space X are a direct market response to the acute power grid and permitting crises in key domestic data center hubs.

- Other nations are now entering the domain. Canada’s $2.5 million government contract awarded to Galaxia in September 2025 indicates that allied nations recognize the strategic importance of developing sovereign space-based data infrastructure to ensure long-term compute capacity.

Technology Readiness for Space Data Centers: Moving from Component R&D to System-Level Integration as Power Constraints Escalate

The technology for space-based data centers has advanced from component-level R&D during 2021-2024 to system-level design and pilot project planning from 2025 to today, though full-scale commercial viability hinges on reducing launch costs and solving in-orbit maintenance challenges.

- The 2021-2024 period focused on foundational technologies that proved hardware could function in space. This was exemplified by firms like Ramon.Space developing radiation-hardened processors, a necessary building block for any orbital system.

- From 2025 onward, the focus shifted to system architecture. Google’s Project Suncatcher is exploring distributed machine learning across an entire satellite constellation, while the extreme power density of new hardware like NVIDIA’s GB 200 NVL 72 systems underscores the need for an environment with abundant power and no water-cooling constraints.

- A key unresolved technical hurdle is thermal management. While space eliminates the need for water, effectively radiating heat from dense AI hardware in a vacuum requires large, complex radiators and novel system designs, which remain a significant engineering challenge.

- The primary metric for economic maturity remains launch cost. Internal estimates from Google suggest a target of under $200 per kilogram is required for orbital data centers to become viable, a threshold that remains a future goal and a key dependency for the entire business case.

SWOT Analysis: Assessing the Drivers and Hurdles for Space-Based Data Centers in 2026

The strategic position of space-based data centers has strengthened significantly since 2024, as escalating terrestrial power, land, and water constraints have transformed the high upfront cost of orbital systems from a weakness into a justifiable long-term investment opportunity.

Data Center Growth vs. Grid Stability

This visualizes the core tension in the SWOT analysis, showing the direct trade-off between data center growth and the stability of terrestrial electricity grids and water security.

(Source: Nature)

- Strengths: The core advantages of space, primarily near-continuous solar power and zero water consumption for cooling, have become more valuable as terrestrial grid delays and water scarcity worsen, turning theoretical benefits into solutions for pressing economic problems.

- Weaknesses: High launch costs and the low Technology Readiness Level (TRL) for in-orbit maintenance and repair remain the primary barriers. However, the economic viability threshold is now quantified (under $200/kg), providing a clear target for the industry.

- Opportunities: The projected $6.7 trillion investment required to scale terrestrial data centers by 2030 creates a massive Total Addressable Market (TAM) for disruptive alternatives. The projected $39.09 billion Serviceable Obtainable Market (SOM) for in-orbit centers by 2035 reflects this opportunity.

- Threats: The primary threat is economic rather than technical. If terrestrial energy solutions like small modular reactors or significant grid modernization projects accelerate faster than launch costs decrease, the business case for migrating compute to orbit could be delayed.

Table: SWOT Analysis for Space-Based Computing Infrastructure

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Theoretical advantage of constant solar power and a cold vacuum for cooling. | Directly bypasses multi-year grid connection queues and eliminates water consumption (e.g., 300, 000 gallons/day for a terrestrial facility). | The abstract benefits of space are now quantifiable solutions to specific, costly terrestrial bottlenecks that are actively delaying projects. |

| Weaknesses | Prohibitively high launch costs and unproven hardware reliability in a radiation-heavy environment. | Launch cost remains the key barrier, but a viability target (< $200/kg) is now defined. In-orbit maintenance is still an unsolved challenge. | The primary weakness has shifted from a general “cost” problem to a specific “launch cost per kg” metric, making the path to viability measurable. |

| Opportunities | Niche market for sovereign or scientific high-performance computing in orbit. | Addresses a portion of the $6.7 trillion terrestrial data center TAM. The projected orbital market (SOM) is $39.09 billion by 2035. | The market opportunity has expanded from a niche segment to a potential disruption of the entire mainstream data center infrastructure market. |

| Threats | Improvements in terrestrial data center efficiency (e.g., PUE) and renewable energy integration. | A race between the declining cost of space launch and the deployment speed of terrestrial solutions like small modular reactors or grid modernization. | The threat is now a direct timing competition. The business case for space depends on it solving the power problem faster than terrestrial alternatives can be built and deployed at scale. |

2026 Outlook: If Launch Costs Hit Key Thresholds, Expect Major Investment Decisions in Orbital Computing

The critical signal to watch in the next 18-24 months is the per-kilogram launch cost; if it approaches the $200/kg viability threshold identified by internal analysis, expect major tech firms to move from exploratory projects to Final Investment Decisions (FIDs) on pilot-scale orbital data centers.

Hyperscaler CapEx Signals Investment Potential

This chart validates the section’s focus on hyperscalers by showing their massive CapEx growth, providing context for the ‘Final Investment Decisions’ expected in orbital computing.

(Source: Brown Advisory)

- If this happens: A major launch provider like Space X demonstrates a consistent, commercially available launch cost below $500/kg, well on the path to the sub-$200/kg target.

- Watch this: A hyperscaler like Google, Microsoft, or Amazon will likely announce a funded partnership with a launch provider for a dedicated orbital compute module, moving beyond internal R&D like Project Suncatcher to a tangible pilot project.

- This could be happening: We could see the first AI-specific hardware, such as a modified NVIDIA GB 200 system, being tested on a commercial orbital platform like the Axiom Station ahead of the planned 2027 deployments. This would validate both the power and thermal management systems in a real-world environment.

- Conversely, if terrestrial grid connection queues shorten significantly due to regulatory reform or if new power generation technologies come online faster than expected, investment in space-based alternatives may remain focused on niche government or long-term R&D applications rather than broad commercial deployment.

Frequently Asked Questions

Why are companies considering moving data centers to space? Isn’t that incredibly expensive?

The primary driver is the severe and growing strain on Earth’s resources. The immense power required by AI is overwhelming terrestrial power grids, causing multi-year delays for new data center connections. Additionally, competition for land and water makes building on Earth increasingly difficult. While space has high upfront costs, its access to near-continuous solar power and a zero-water cooling environment offers a long-term solution to these terrestrial bottlenecks.

What is the single biggest factor pushing this shift towards space-based computing?

The single biggest factor is the “untenable power demand of AI.” Modern AI workloads require massive amounts of electricity that existing power grids are struggling to supply. The article highlights that this has become a primary barrier to AI infrastructure growth, transforming the concept of orbital data centers from a futuristic idea into a strategic necessity.

Is this just a theoretical idea, or are there real projects underway?

This has moved from theory to strategic action, particularly since 2025. The article cites several real-world examples: Google’s “Project Suncatcher” is exploring satellite-based TPUs, the NVIDIA-backed startup Starcloud aims to deploy an orbital cloud by 2027, and Axiom Space is partnering with Spacebilt to place a data center node on the International Space Station in the same year. These projects are driven by immediate business constraints on Earth.

What are the main obstacles to building large-scale data centers in space?

According to the analysis, the two biggest obstacles are high launch costs and the challenge of in-orbit maintenance and repair. The article identifies a key economic target: launch costs need to fall below $200 per kilogram for orbital data centers to become widely viable. Another significant technical hurdle is thermal management—effectively radiating the intense heat generated by dense AI hardware in the vacuum of space.

What key development should I watch for to see if this trend is accelerating?

The most critical signal to watch is the per-kilogram launch cost. If a major provider demonstrates a consistent cost approaching the $200/kg viability threshold, you should expect hyperscalers like Google or Microsoft to announce funded pilot projects for dedicated orbital compute modules. Another key indicator would be the successful testing of AI-specific hardware, like a modified NVIDIA GB200 system, on an orbital platform.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.