Qatar Energy’s AI Strategy 2026: Fueling Global AI with LNG and Securing Market Dominance

Qatar Energy’s AI Projects: Shifting from Concept to Commercial Scale by 2026

Qatar Energy has transitioned its AI strategy from foundational partnerships and national frameworks between 2021 and 2024 to direct, large-scale commercial applications aimed at managing its massive LNG expansion and capturing future energy demand from the AI sector. The company is now actively embedding AI into core operations to de-risk tens of billions in capital expenditure and position its LNG as an indispensable energy source for the next technological revolution.

- In the 2021-2024 period, the strategy focused on building a foundation, marked by the 2021 rebranding from Qatar Petroleum and partnerships with technology giants like Microsoft and GE to develop frameworks for digital transformation and carbon capture. This period established the national infrastructure, including the ‘Fanar’ AI data project in May 2024.

- From 2025 onwards, the focus shifted to direct commercial execution. CEO Saad Sherida Al-Kaabi explicitly linked the immense power requirements of AI to a future surge in LNG demand, projecting an increase from 400 million to 700 million tons annually, justifying the monumental North Field expansion.

- This shift is demonstrated by the deployment of specific AI solutions, including AI-powered reservoir simulators with QASR Technologies, AI-driven drones for methane leak detection, and a landmark $20 billion joint venture with Brookfield announced in December 2025 to build dedicated AI infrastructure.

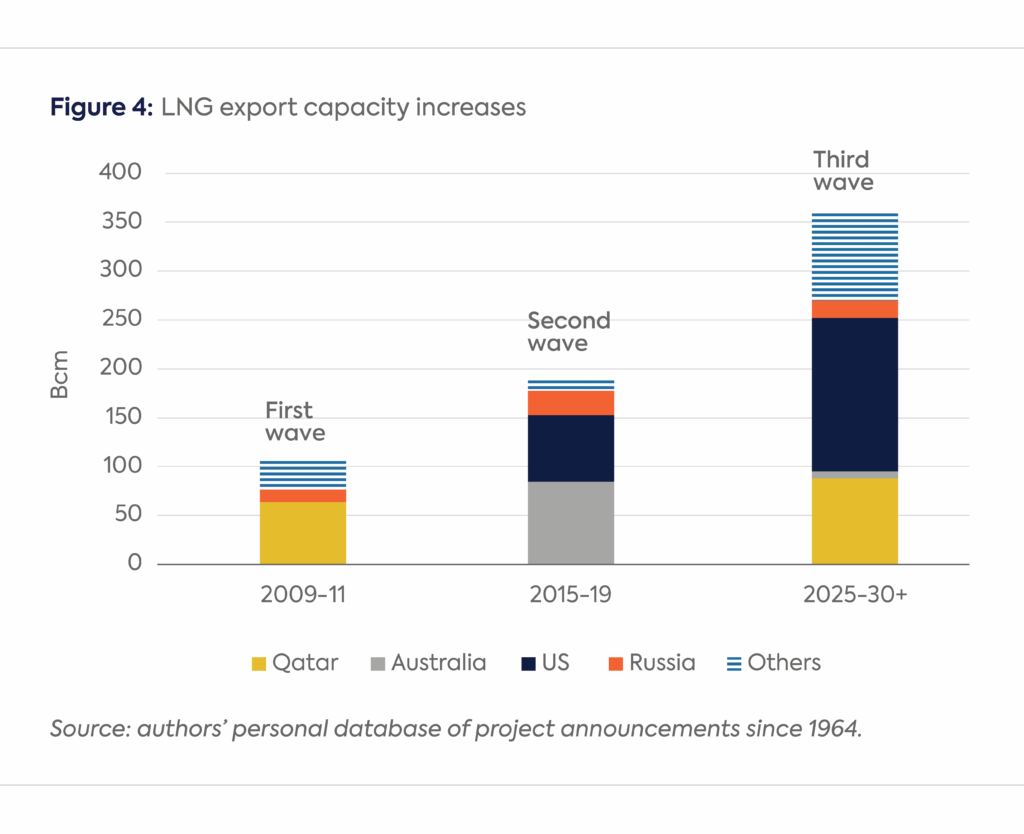

Qatar to Dominate Next Wave of LNG Expansion

This chart visualizes the massive scale of Qatar’s LNG expansion, which underpins the strategic shift to commercial AI applications needed to manage and de-risk the new production.

Qatar Energy’s Multi-Billion Dollar AI and Energy Investments Signal Strategic Pivot

Qatar Energy and the State of Qatar are executing a capital-intensive, dual-track investment strategy, dedicating tens of billions to both physical LNG expansion and the foundational digital infrastructure required to manage it and power the global AI economy. These investments are not separate initiatives but form a self-reinforcing cycle where energy assets fund digital ambitions, which in turn create new demand for energy.

- The company’s core investments are in its massive LNG expansion, including the $28.75 billion North Field East (NFE) project and a $10 billion EPC contract for the North Field South (NFS) project, aimed at increasing production capacity to 126 million tons per year by 2027.

- Parallel to this, the state is making significant direct investments in the AI ecosystem. This includes a $2.5 billion national fund for AI projects under Qatar’s Digital Agenda 2030 and a cornerstone $20 billion joint venture with Brookfield to establish Qatar as a leading AI hub.

- The Qatar Investment Authority (QIA) is also making strategic downstream investments in the AI supply chain, such as participating in a major February 2026 funding round for d-Matrix, a US-based leader in AI inference hardware, securing a stake in the technology that will drive future data centers.

Table: Qatar State-led and Qatar Energy Investments (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| d-Matrix Funding Round | February 2026 | The Qatar Investment Authority (QIA) invested in AI hardware leader d-Matrix to gain a strategic foothold in the global AI infrastructure ecosystem. | GCC Business Watch |

| AI Infrastructure Joint Venture | December 2025 | Qatar’s AI company, Qai, and Brookfield launched a $20 billion joint venture to build advanced AI compute centers in Qatar and internationally, positioning the nation as a global AI hub. | Yahoo Finance |

| Digital Agenda 2030 Fund | June 2025 | The State of Qatar allocated a $2.5 billion fund to accelerate AI adoption across various sectors, including energy and government services, creating a robust domestic market for AI solutions. | Latitude Media |

| North Field Expansion Projects | 2022 – 2026 | Multi-billion dollar investments, including $28.75 billion for NFE and $10 billion for an NFS contract, to increase LNG production capacity to meet projected energy demand from AI and data centers. | Energy Connects |

Qatar Energy’s Partnership Ecosystem: Securing Technology and Market Access for AI-Driven Growth

Qatar Energy has constructed a strategic partnership network to acquire world-class AI technology and secure long-term offtake agreements, effectively de-risking its massive expansion projects and creating a captive market for its LNG. This ecosystem connects technology providers, infrastructure developers, and major energy consumers in a cohesive strategy.

- Technology partnerships have evolved from foundational agreements, such as the 2022 collaboration with Microsoft for cloud infrastructure, to specialized initiatives in 2025. These include a partnership with Scale AI to enhance government services and a collaboration with QASR Technologies to develop advanced reservoir simulators.

- Infrastructure development is anchored by the $20 billion joint venture with Brookfield, a critical move to build the physical high-performance compute centers necessary to become a regional AI leader, shifting from being a user of AI to an enabler of the AI economy.

- Market access is being locked in through multi-decade supply deals signed in 2026. These include a 27-year agreement with Japan’s Jera and a 20-year deal with Malaysia’s Petronas, securing demand from technology-intensive economies and validating the AI-driven energy demand thesis.

QatarEnergy Retains Majority Stake in NFE Expansion

This chart directly illustrates the partnership ecosystem for the North Field East project, showing how QatarEnergy leads the consortium, which is central to the section’s theme of strategic partnerships.

Table: Key Qatar Energy and State of Qatar Partnerships (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Jera (Japan) | February 2026 | A landmark 27-year LNG supply agreement to provide 3 million tons annually, securing a key market in a major technology and industrial economy. | Reuters |

| Brookfield | December 2025 | A $20 billion joint venture via the Qatar Investment Authority to develop global AI infrastructure and compute centers, creating a new revenue stream and strategic capability. | Yahoo Finance |

| Qatar Shell / QASR Technologies | July 2025 | A research collaboration to develop AI-powered reservoir simulators, aimed at transforming oil and gas analysis to enhance upstream efficiency and decision-making. | Middle East AI News |

| Scale AI | February 2025 | A strategic partnership to leverage AI for government services as part of a $2.5 billion national AI fund, deepening the country’s AI expertise and application capabilities. | Precedence Research |

Qatar Energy’s Global AI Footprint: Expanding from Domestic Digitalization to International Markets

Qatar Energy’s AI-related activities have expanded from a domestic focus on national infrastructure between 2021 and 2024 to a global strategy that includes international partnerships, investments, and securing energy supply contracts in key technology markets across Asia, Europe, and North America from 2025 onward.

- The initial phase (2021-2024) centered on building capabilities within Qatar. This included the KAHRAMAA AI platform to modernize the national utility grid, the Tawteen program’s partnership with Microsoft to digitalize the local energy supply chain, and the launch of the national ‘Fanar’ AI project.

- Beginning in 2025, the strategy became global. Long-term LNG supply agreements were signed with tech-heavy economies like Japan (Jera) and Malaysia (Petronas), directly linking Qatar’s energy to markets with high AI-driven power needs.

- International investments now target the AI supply chain directly, including the Qatar Investment Authority’s backing of US-based AI hardware firm d-Matrix and the Brookfield joint venture’s mandate to build AI centers globally, not just in Qatar.

- Upstream energy operations are also expanding internationally, including a new exploration license in Libya with Eni and the Golden Pass LNG joint venture with Exxon Mobil in the USA, diversifying its portfolio.

Qatar’s LNG Exports Increasingly Target Asia

This chart supports the section’s narrative of global expansion by showing the regional destination of LNG exports, highlighting the focus on key technology markets in Asia.

AI in Energy: Qatar Energy Advances from R&D to Commercial Deployment

Qatar Energy has rapidly matured its use of AI from early-stage collaborations and framework development between 2021 and 2024 to the deployment of commercially critical AI applications in predictive maintenance, asset management, and project execution for its multi-billion dollar LNG projects. The company is now a sophisticated user of AI, applying it to solve high-value operational challenges.

- The 2021-2024 period focused on enabling technologies. This included partnering with GE to develop a carbon capture roadmap using AI for complex modeling and launching national data projects like ‘Fanar’ to provide the high-quality data needed for industrial AI.

- From 2025, the focus shifted to direct commercial application. The development of AI-powered reservoir simulators with QASR Technologies is designed to directly improve exploration and production outcomes, while the use of AI-driven drones for methane detection targets operational sustainability and emissions reduction.

- A 2025 job posting for a Senior Digital Architect for generative AI reveals a move to integrate advanced AI into the company’s core digital framework, indicating a shift from using off-the-shelf AI to building a bespoke, enterprise-wide AI architecture.

- The progression is clear: from exploring AI’s potential to deploying it for operational efficiency, and now to building the infrastructure that will power the global AI economy.

Qatar Energy SWOT Analysis: Leveraging LNG Strength for AI Market Dominance

The analysis shows Qatar Energy is successfully leveraging its immense strength in low-cost LNG production to capitalize on the opportunity presented by the AI industry’s energy demand, while facing threats from the pace of renewable energy adoption and intensifying global LNG market competition.

- Strengths in LNG production and state backing are being used to fund and de-risk its strategic pivot into AI and AI-related energy supply.

- A primary Weakness is the continued deep reliance on a single fossil fuel commodity, though this is mitigated by framing it as a necessary bridge fuel for the technology sector.

- The exponential growth in energy demand from AI data centers represents a massive strategic Opportunity that the company has been one of the first to identify and build a strategy around.

- Key Threats include intensifying competition from other LNG producers, notably the US, and the long-term risk that renewable energy and battery storage scale faster than anticipated to meet data center power needs.

US LNG Capacity Surge Intensifies Competition

The section identifies intensifying competition as a key threat, and this chart quantifies that threat by showing the rapid growth of US LNG export capacity, Qatar’s primary rival.

(Source: Forbes)

Table: SWOT Analysis for Qatar Energy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Established LNG leadership (77 MTPA capacity); rebranded from Qatar Petroleum to Qatar Energy to signal a new strategic focus on technology and sustainability. | Massive production expansion underway (to 126 MTPA); secured multi-decade supply deals with key Asian markets (Jera, Petronas). | The company validated its ability to convert its production capacity into secured, long-term revenue streams, effectively de-risking its expansion plans. |

| Weaknesses | High dependency on hydrocarbon revenue; sustainability strategy in early stages with initial solar projects and a carbon capture partnership with GE. | The strategy doubles down on LNG, increasing exposure to long-term energy transition risk despite parallel investments in solar and CCS. | The core dependency on fossil fuels remains and grows. The strategy attempts to rebrand this weakness as a strength by positioning LNG as vital for the AI revolution. |

| Opportunities | General alignment with Qatar National Vision 2030 to build a knowledge-based economy; initial AI partnerships to build foundational capabilities. | Explicitly targeting the AI sector’s immense power demand as a primary driver for LNG expansion; launched a $20 B AI infrastructure JV with Brookfield. | A theoretical opportunity (AI’s energy needs) became a core, articulated corporate strategy with massive capital allocation, creating a new, high-growth demand narrative. |

| Threats | General threat from the global energy transition and competition from other LNG producers like Australia and the US. | The rise of US LNG as a primary competitor is confirmed by market analysis. The risk that renewables could meet data center demand faster than projected remains a long-term threat. | The competitive threat has become more specific and acute. Qatar Energy is mitigating this by locking in customers on multi-decade contracts before the full supply glut hits the market. |

2026 Outlook for Qatar Energy: Validating the AI-Driven LNG Demand Thesis

The most critical development for Qatar Energy in 2026 will be the operational start of the North Field East project, which will serve as the first major market test of its central strategic thesis: that the global AI boom will absorb its massive new LNG supply.

- The first LNG cargo from the North Field East expansion is scheduled to be produced in mid-2026. This milestone will be the ultimate validation point for the multi-billion-dollar investments and the AI-driven demand narrative the company has constructed.

- Market participants will watch for the first concrete projects from the $20 billion Brookfield joint venture to break ground. The speed and scale of this rollout will determine Qatar’s success in transforming from an energy exporter into an AI infrastructure hub.

- The finalization of international equity partners for the next phase of the North Field expansion will be a key indicator of global investor confidence in Qatar Energy’s long-term strategy and the future of LNG.

- Expect to see additional long-term supply agreements with technology-focused economies in Asia and Europe, as Qatar Energy continues to lock in demand and reinforce the linkage between its LNG and the power-hungry AI sector.

Long-Term Contracts Validate North Field Expansion

This chart directly validates the 2026 outlook by showing the secured, long-term contracted LNG volumes from the North Field expansion, which is the ‘market test’ described in the text.

Frequently Asked Questions

What is the core idea behind Qatar Energy’s AI Strategy for 2026?

The core idea is a dual-track strategy to dominate the future energy market. First, Qatar Energy is massively expanding its Liquefied Natural Gas (LNG) production to meet future energy needs. Second, it is investing billions to build the AI infrastructure (like data centers) that will create this new energy demand. This creates a self-reinforcing cycle where its energy assets fund digital ambitions, which in turn secure long-term demand for its LNG.

How did Qatar Energy’s strategy change from the 2021-2024 period to the 2025-2026 period?

Between 2021 and 2024, the strategy was foundational, focusing on partnerships with companies like Microsoft and GE to build digital frameworks. From 2025 onwards, the focus shifted to direct commercial execution. This includes deploying AI for specific operational goals (like reservoir simulation) and making massive investments, such as the $20 billion joint venture with Brookfield, to directly build and power the global AI economy.

What are the most significant investments Qatar is making in its AI and energy strategy?

Key investments include the $28.75 billion North Field East (NFE) project to expand LNG production, a $20 billion joint venture with Brookfield to build AI compute centers, and a $2.5 billion national fund for AI projects under Qatar’s Digital Agenda 2030. Additionally, the Qatar Investment Authority (QIA) is making strategic investments in the AI supply chain, such as funding AI hardware firm d-Matrix.

Who are Qatar Energy’s most important partners in this initiative?

Qatar Energy’s partnership network includes technology providers like Scale AI and QASR Technologies, infrastructure developers like Brookfield (for the $20 billion AI infrastructure venture), and major energy consumers. To secure market access, it has signed long-term LNG supply agreements with technology-intensive economies, including a 27-year deal with Japan’s Jera.

What is the main weakness or threat to Qatar Energy’s strategy?

The primary weakness is its increased dependency on a single fossil fuel, LNG, which exposes it to long-term energy transition risks. The main threats include intensifying competition from other LNG producers, particularly the United States, and the long-term risk that renewable energy sources could scale faster than expected to meet the power demands of AI data centers, potentially undermining the projected demand for LNG.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.