US vs. China Clean Energy Policy 2026: How New Tax Credit Limits Reshape Supply Chains and Competitiveness

Project Risk Skyrockets in 2026 as US Clean Energy Policy Shifts from Subsidy to Protectionism

The US clean energy policy framework has fundamentally shifted from fostering growth through broad incentives to forcing a rapid, high-risk decoupling from Chinese supply chains, creating a “valley of death” for projects planned under the previous regime. The 2025 “One Big Beautiful Bill Act” (OBBBA) reversed the stable, long-term subsidy environment of the 2022 Inflation Reduction Act (IRA), replacing it with abrupt deadlines and severe restrictions that elevate project cancellation risk to its highest level in a decade.

- Between 2022 and 2024, the IRA stimulated a historic boom, with over $126 billion in announced private-sector investments for clean energy manufacturing, driven by long-term tax credits like the §45 X production credit, which was available through 2032. In contrast, the OBBBA, effective July 4, 2025, creates a hard subsidy cliff by making new wind and solar projects ineligible for key credits if they begin construction after July 4, 2026, invalidating financial models based on a 10-year credit window.

- The IRA’s Foreign Entity of Concern (FEOC) rules, which limited entities with 25% or more Chinese ownership, were a known compliance challenge. The OBBBA’s expanded “Prohibited Foreign Entity” (PFE) rules, effective 2026, are far more stringent, making tax credits “near-impossible to use” for technologies like batteries and solar, where China controls over 80% of the manufacturing supply chain.

- The termination of the 30% Residential Clean Energy Credit (§25 D) under OBBBA directly increases customer acquisition costs and shrinks the serviceable market for residential solar, a sector that saw significant growth under the IRA. This policy change directly threatens the financial viability of residential installers and reduces the net present value of solar ownership for homeowners.

- The OBBBA also rescinded billions in federal clean energy funding, including the $27 billion Greenhouse Gas Reduction Fund and $5 billion for clean energy loan programs, removing critical sources of low-cost capital that were instrumental in de-risking projects between 2022 and 2024.

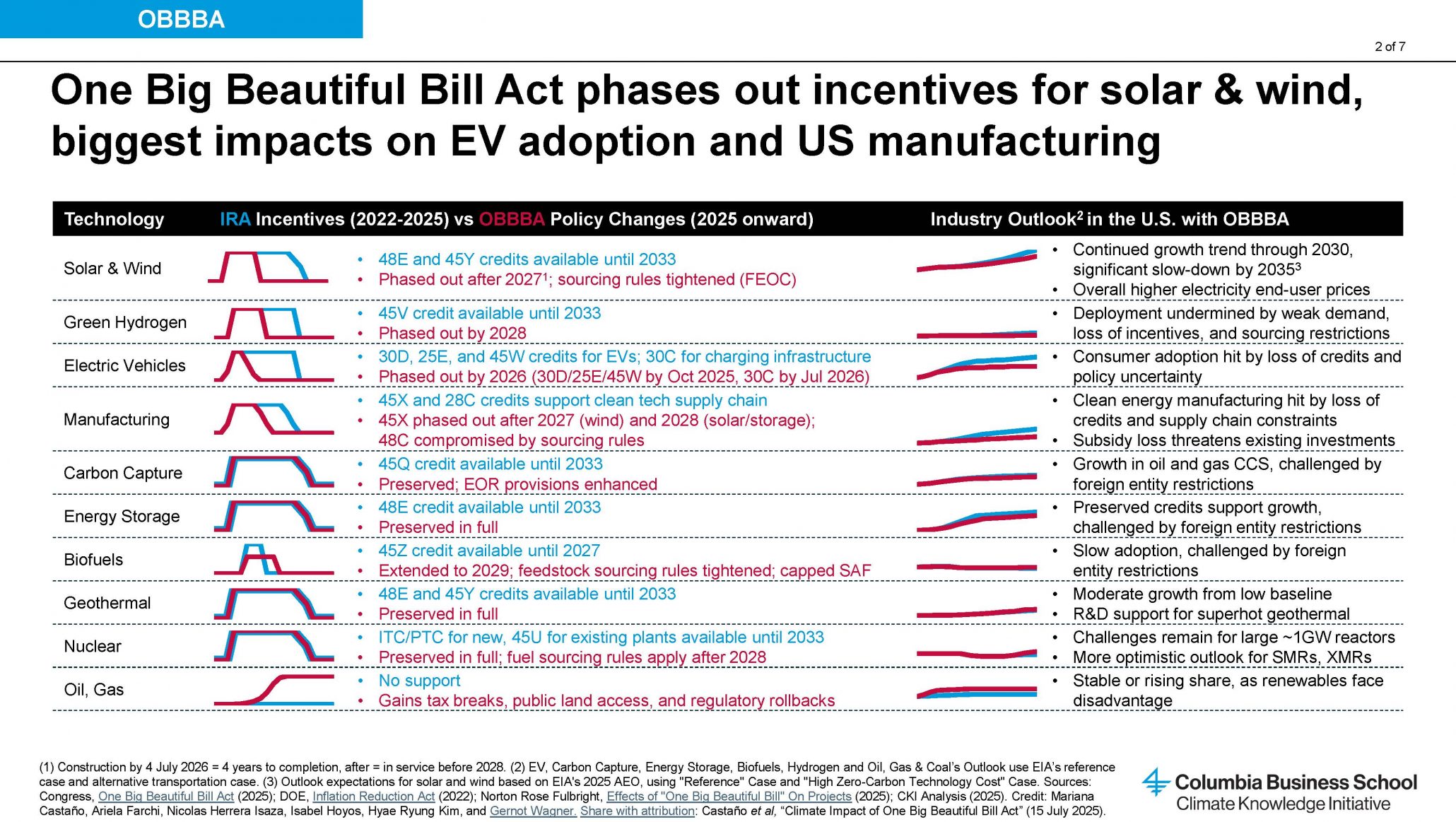

OBBBA Reverses IRA-Era Incentives

This chart directly illustrates the policy shift from the IRA to the OBBBA, showing the specific incentive phase-outs that are the primary driver of the skyrocketing project risk mentioned in the heading.

From Boom to Bust: OBBBA Triggers Project Cancellations and Investment Uncertainty in 2026

The OBBBA’s repeal of key IRA provisions and accelerated timelines has frozen new investment and threatens billions in planned projects, reversing the investment boom seen from 2022 to 2024. This abrupt policy reversal has introduced an unacceptable level of subsidy and supply chain risk for capital allocators, leading to project pauses and cancellations as developers reassess financial viability without long-term federal support.

Investors Signal Major Investment Decrease

This chart perfectly quantifies the “bust” and “investment uncertainty” described in the heading, showing that a majority of investors plan to decrease their clean energy investments in response to the policy change.

(Source: American Council on Renewable Energy)

- The accelerated sunset clauses for the Clean Electricity Production Tax Credit (§45 Y) and Investment Tax Credit (§48 E) are projected to result in 237 GW less clean energy deployment by 2040, directly impacting the pipeline of utility-scale wind, solar, and storage projects.

- Political risk has become a primary driver of investment decisions. Chinese manufacturer Trina Solar, which stood to receive an estimated $1.8 billion in §45 X tax credits, paused its planned Texas factory project following the 2024 election, signaling a broader freeze on foreign investment in US clean energy manufacturing.

- The shortened investment window for the Clean Hydrogen Production Tax Credit (§45 V), with the “begin construction” deadline moved up five years to December 31, 2027, jeopardizes the development of a US clean hydrogen economy, a key objective of the original IRA.

- The ambiguity surrounding the new PFE rules has left developers “flying blind” since July 2025. This regulatory uncertainty has stalled final investment decisions for manufacturing and generation projects that cannot confirm supply chain compliance.

Table: Key Policy-Driven Financial and Project Impacts (2025-2026)

| Impact Area | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Project Pipeline Reduction | 2026-2040 | The repeal of tax credits for wind, solar, and battery storage is projected to cause 237 GW less clean energy deployment. This represents a significant contraction of the development pipeline. | ACORE |

| Investment Cancellation | November 2024 | Trina Solar paused its Texas solar factory project post-election, jeopardizing a facility that could have received $1.8 billion in tax credits and highlighting the chilling effect of policy uncertainty on foreign investment. | E&E News |

| Federal Program Rescission | July 2025 | The OBBBA canceled the $27 billion Greenhouse Gas Reduction Fund and $5 billion for clean energy loan programs, eliminating major sources of catalytic capital established by the IRA. | JD Supra |

| Export Market Loss | By 2030 | The loss of subsidies under OBBBA is projected to eliminate a potential US export market for solar modules and batteries that could have reached $50 billion, ceding this growth to international competitors. | Politico.eu |

Geopolitical Reshuffle: How 2026 US China Limits Redirect Clean Energy Investment Flows

The US policy pivot from inclusive subsidies to exclusionary protectionism has fragmented the global clean energy market, reinforcing China’s dominance abroad while creating a high-cost, insulated market in North America. This geographic realignment forces a strategic choice between accessing the subsidized but restricted US market or participating in the larger, Chinese-supplied global market.

Chart Shows Scale of Decoupling Challenge

This chart’s headline and data directly address the “Geopolitical Reshuffle” by visualizing the scale of China’s manufacturing dominance, which is the core challenge of the US-China decoupling discussed in the section.

(Source: Bloomberg)

- Between 2021 and 2024, the IRA positioned the US as the premier destination for clean energy investment, attracting over $126 billion in announced manufacturing projects. Post-2025, the OBBBA is causing a market contraction, with the US projected to lose a $50 billion export opportunity by 2030 as capital and trade flows redirect.

- China is aggressively capitalizing on the US inward turn, exporting over $200 billion in clean energy technologies in 2025 and investing $80 billion in overseas projects in the past year. This strategy solidifies its position as the primary equipment supplier for Europe, Asia, Africa, and South America.

- The stringent PFE rules have elevated the strategic importance of US free-trade agreement partners. Nations like South Korea, Canada, and Mexico are emerging as critical “lifeline” suppliers, positioned to provide PFE-compliant components and materials to the US market.

- The policy shift has also exposed the US to international trade disputes. In January 2026, the World Trade Organization (WTO) faulted the US for its discriminatory subsidies, a ruling that exposes the US to retaliatory tariffs and complicates efforts to build secure supply chains with allied nations.

US Clean Energy Competitiveness at Risk: How China Policy Impacts Technology Leadership in 2026

The transition from the IRA to the OBBBA framework has shifted the US technology strategy from accelerating commercial-scale deployment to rebuilding basic supply chains, a move that risks stalling progress on mature technologies and ceding leadership in next-generation innovation to China. The policy disruption prioritizes long-term, uncertain supply chain security over near-term technological and market leadership.

US Solar Manufacturing Gains Now At Risk

This chart illustrates the surge in US solar manufacturing capacity spurred by the IRA, providing a clear visual baseline for the “US… Competitiveness at Risk” argument made in the section.

- From 2021 to 2024, the IRA’s incentives were designed to help the US achieve commercial-scale manufacturing of mature technologies like batteries and solar panels to compete with China’s established dominance. This resulted in plans for 95 new manufacturing facilities.

- Post-2025, the OBBBA’s abrupt credit phase-outs and severe PFE restrictions make it economically and logistically challenging to deploy these same technologies at scale. The policy forces the US to focus on the monumental task of recreating supply chains where China holds over 80% market share.

- While the US industry is occupied with foundational supply chain issues, China is “roaring forward” with innovation in next-generation solar, battery, and hydrogen technologies, widening its technological lead. The US risks losing its position in the global innovation race.

- The new policy environment may spur US R&D in “leapfrog” technologies that are less dependent on Chinese-controlled materials. However, this is a long-term strategy that does not address the immediate commercial deployment gap created by the OBBBA.

SWOT Analysis: US Clean Energy Competitiveness and Supply Chains in the Post-IRA Era

The strategic pivot from the IRA’s subsidy-led growth to the OBBBA’s protectionist framework fundamentally alters the risk and opportunity profile for the US clean energy sector. The move strengthens the long-term potential for supply chain security but introduces severe near-term economic weaknesses, operational threats, and a loss of global market momentum.

Chart Shows Pre-OBBBA Investment Boom

This chart visualizes the investment boom from 2022-2024, directly illustrating the IRA-era “market momentum” and “powerful investment incentives” that are key points of comparison in the SWOT analysis.

(Source: The Clean Investment Monitor)

- Strengths have shifted from the IRA’s powerful investment incentives and market momentum (2021–2024) to a renewed policy focus on national and energy security through domestic manufacturing (2025–2026).

- Weaknesses have been amplified, moving from a recognized dependency on the Chinese supply chain to an acute inability to comply with new PFE rules, which renders many projects unfinanceable.

- Opportunities now lie in the difficult, long-term task of building resilient, non-Chinese supply chains with allied nations, a stark contrast to the previous opportunity of simply capturing lucrative and accessible IRA tax credits.

- Threats have intensified from potential tariffs and trade disputes to the immediate reality of project cancellations, a looming subsidy cliff, and a permanent loss of technological leadership to China.

Table: SWOT Analysis for US Clean Energy Policy Shift

| SWOT Category | 2021 – 2024 (IRA Era) | 2025 – Today (OBBBA Era) | What Changed / Validated |

|---|---|---|---|

| Strengths | Lucrative, long-term tax credits (e.g., §45 X) attracted over $126 billion in investment. Tax credit transferability created a new $25 billion financing market. | Policy focus on creating a secure, domestic supply chain, reducing long-term geopolitical risk. Incentives for sourcing from allied nations like South Korea. | The focus shifted from economic opportunism to national security. The initial investment boom validated the power of subsidies, while the new era tests the viability of protectionism. |

| Weaknesses | Extreme supplier concentration risk, with China producing >75% of lithium-ion batteries and >80% of solar components. Long permitting timelines for new US facilities. | Inability to meet stringent PFE rules, making credits “near-impossible to use.” Lack of at-scale, cost-competitive domestic supply chains. Increased project CAPEX due to sourcing from nascent suppliers. | The latent weakness of supply chain dependency became an acute, disqualifying vulnerability. The policy change made the problem it sought to solve even more difficult in the short term. |

| Opportunities | Market creation for US manufacturers via §45 X credits. Investment in next-gen tech backed by $6 billion in federal funding. Capturing a share of a growing global market. | Investment in “leapfrog” technologies to bypass Chinese-dominated processes. Growth in compliance services to navigate PFE rules. Building new supply chains with allied nations. | The opportunity shifted from scaling existing technologies in the US to the much harder task of inventing or relocating entire supply chains, a higher-risk, longer-term proposition. |

| Threats | Policy instability from potential IRA repeal. WTO challenges from China and EU. Commodity price exposure due to reliance on imports. | Mass project cancellations due to subsidy cliff (July 4, 2026 deadline). Stranded assets and financial losses. Ceding of global market share and technological leadership to China. Retaliatory tariffs. | The abstract threat of policy reversal became a concrete reality. The new policy framework itself became the primary threat to near-term industry growth and financial stability. |

Forward Outlook for 2026: Navigating the ‘Valley of Death’ in US Clean Energy

For investors, developers, and strategists, the critical path forward requires navigating extreme policy-driven volatility. If the OBBBA’s hard deadlines and severe PFE rules are implemented as written, the US clean energy sector faces a period of sharp contraction and market fragmentation. The key signals to watch are not just market-based but legislative and regulatory, as any softening of the new rules would signal a potential, if temporary, reprieve.

Projections Show Lost Growth Potential

This chart supports the “Forward Outlook” by showing the massive solar growth projected under the IRA that is now lost, visually defining the opportunity cost and the “valley of death” the sector now faces.

- If the July 4, 2026, “begin construction” deadline for wind and solar projects remains firm, watch for a wave of project cancellations and asset write-downs in late 2025 and early 2026 as developers with stalled projects lose access to tax credits.

- Watch for an increase in distressed M&A activity, as smaller developers unable to secure PFE-compliant supply chains are forced to sell project pipelines to larger, better-capitalized players who have established supply lines in allied nations.

- The “underwhelming” interim PFE guidance issued in February 2026 has been a major source of uncertainty. If clear, final guidance is not released by mid-2026, this could mean a continued freeze on new manufacturing and project investment as the industry remains unable to confirm compliance.

- Watch for official announcements of new mining, processing, and manufacturing facilities in FTA partner countries like South Korea, Mexico, and Canada. These announcements are the most reliable leading indicators of whether a viable, non-Chinese supply chain is developing at a pace that can meet US demand.

Frequently Asked Questions

What is the main difference between the 2022 Inflation Reduction Act (IRA) and the new One Big Beautiful Bill Act (OBBBA)?

The primary difference lies in their approach to incentives. The IRA (2022-2024) offered stable, long-term tax credits (e.g., available through 2032) to stimulate broad investment. In contrast, the OBBBA (effective July 2025) creates a “subsidy cliff” by setting an abrupt deadline of July 4, 2026, for new wind and solar projects to begin construction to qualify for credits, shifting the policy from broad subsidy to protectionism aimed at decoupling from Chinese supply chains.

How does the OBBBA immediately affect clean energy projects planned under the IRA?

The OBBBA has frozen new investment and threatens billions in planned projects by creating extreme uncertainty. Its accelerated deadlines invalidate the financial models that projects were built on. This has led to project pauses and cancellations, as seen with Trina Solar’s Texas factory, and is projected to result in 237 GW less clean energy deployment by 2040.

What are the “Prohibited Foreign Entity” (PFE) rules and why are they a major problem?

The PFE rules are a far more stringent version of the IRA’s Foreign Entity of Concern (FEOC) rules, designed to restrict involvement from Chinese entities in the supply chain. They are a major problem because China controls over 80% of the manufacturing for key technologies like batteries and solar. This makes it “near-impossible” for developers to find compliant components, rendering them unable to use the tax credits and stalling investment decisions.

Has the OBBBA eliminated all federal support for clean energy?

While it hasn’t eliminated all support, the OBBBA has rescinded critical sources of funding. Specifically, it canceled the $27 billion Greenhouse Gas Reduction Fund and $5 billion allocated for clean energy loan programs. This removes major sources of low-cost capital that were instrumental in de-risking projects and attracting private investment under the IRA.

How is this US policy shift impacting global clean energy supply chains and China’s position?

The shift is fragmenting the global market. The US is becoming an insulated, high-cost market, while China is solidifying its dominance elsewhere. China is capitalizing on the US inward turn by exporting over $200 billion in clean energy tech in 2025 and investing heavily in overseas projects. The new US rules are also elevating the importance of Free-Trade Agreement partners like South Korea and Mexico as potential “lifeline” suppliers for compliant components.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- IMO Decarbonization & Net Zero 2025: Policy Collapse

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.