US Offshore Wind: How State Mandates & Legal Wins Counter Political Risk in 2026

US Offshore Wind Project Viability: How Federal Hostility Created Unprecedented Risk in 2026

The primary risk to U.S. offshore wind projects has fundamentally shifted from economic pressures to direct political intervention, with federal actions since January 2025 designed to systematically halt commercial-scale development and dismantle investor confidence.

- Between 2021 and 2024, the industry’s main challenge was economic viability. High-profile projects like Ørsted’s Ocean Wind 1 and 2 were canceled due to rising interest rates and supply chain costs, while others like Vineyard Wind successfully navigated the federal approval process to begin construction. The focus was on scaling a nascent industry under supportive federal policy.

- Since January 2025, the risk profile has changed entirely due to targeted executive action. The administration implemented a moratorium on new offshore wind leasing, canceled $679 million in port infrastructure funding, and imposed a 50% tariff on critical imported components.

- The most severe action occurred in December 2025, when the administration ordered an immediate suspension of leases for five major projects already under construction, including Revolution Wind and Coastal Virginia Offshore Wind. This transformed the risk from a market-based problem to a direct, politically-driven attack on project execution.

- In response, the industry’s survival mechanism has become legal and political resilience. Developers like Ørsted and Equinor initiated lawsuits that, by February 2026, resulted in court-ordered injunctions allowing all five halted projects to resume construction, demonstrating that state-backed legal challenges can successfully counter federal hostility.

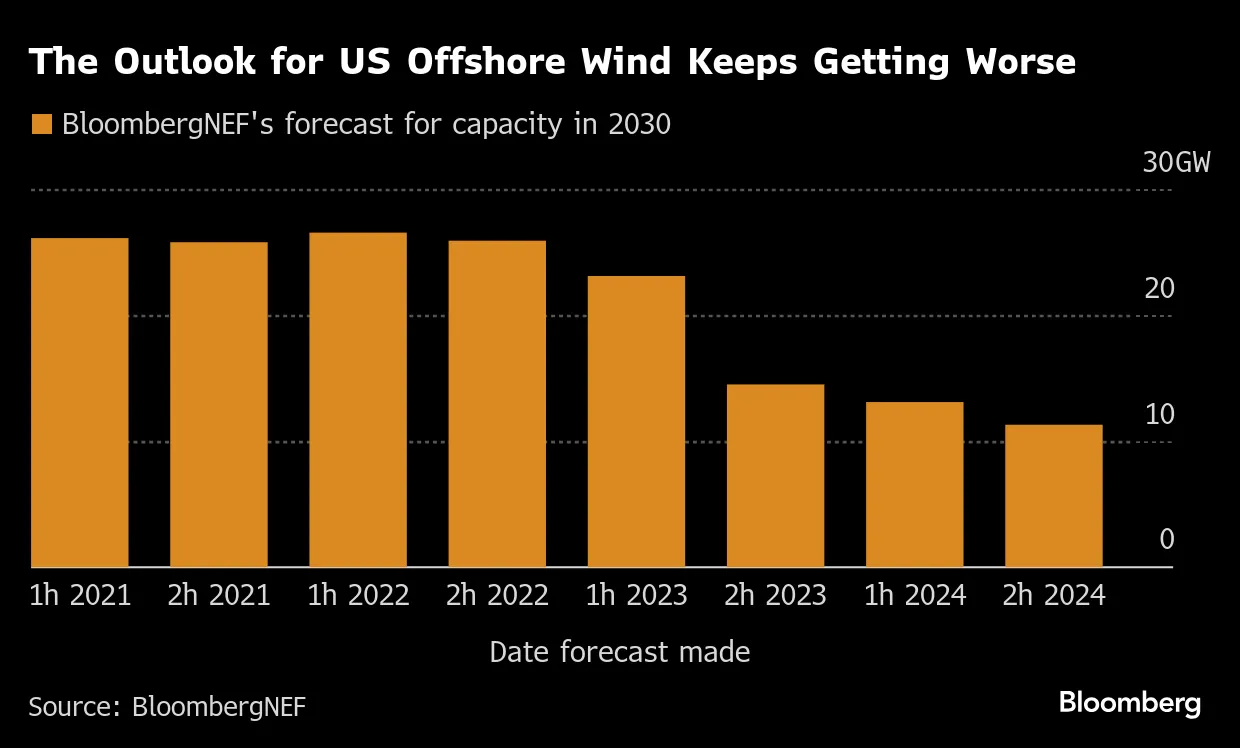

Forecasts Plummet as Project Viability Declines

This chart illustrates the eroding confidence in US offshore wind from 2021 to 2024, as successive forecasts for 2030 capacity were dramatically revised downward, visualizing the rising risk described in the section.

(Source: Bloomberg.com)

Offshore Wind Investment Cancellations: Quantifying the Financial Impact of US Political Risk

Federal policy actions since 2025 have directly triggered billions of dollars in new project costs, asset writedowns, and outright investment withdrawals, dwarfing the economic headwinds that previously challenged the sector.

Developers Cancel Projects Amid Political Headwinds

By mid-2025, political risks materialized into mass cancellations, with this chart quantifying the impact by showing that major developers had already withdrawn over 17 GW of planned capacity from the East Coast.

(Source: FactSet Insight)

- The most definitive signal of lost investment was the BP JV’s decision in October 2025 to exit the U.S. offshore wind market entirely, stating there was “no viable path for development” under the current administration and abandoning its Beacon Wind project.

- The hostile policy environment forced major financial reassessments from remaining players. Norwegian energy firm Equinor booked a nearly $1 billion writedown on its U.S. portfolio, which includes the federally targeted Empire Wind and Sunrise Wind projects.

- Direct operational costs have escalated due to the political actions. Dominion Energy reported that the stop-work order added an estimated $228 million to its Coastal Virginia Offshore Wind project, with new tariffs adding another $137 million.

- The cumulative impact is substantial, with analysts estimating that $35 billion in clean energy investments have been canceled and an additional $114 billion in offshore wind projects are at risk of delay or cancellation due to the administration’s policies.

Table: Project Cancellations and Financial Impacts (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| BP JV (Beacon Wind) | Oct 2025 | Company announced it was ending all U.S. offshore wind development activities, citing a lack of a viable path forward under the Trump administration. This removed a major global developer from the market. | Recharge |

| Equinor (U.S. Portfolio) | Jul 2025 | The company booked a nearly $1 billion writedown on its U.S. offshore wind projects, including Empire Wind and Sunrise Wind, directly attributing the decision to the new administration’s hostile policy moves. | Politico Pro |

| U.S. Dept. of Transportation | Aug 2025 | The administration canceled $679 million in federal financing that was designated for upgrading port and manufacturing infrastructure to support the offshore wind supply chain. | ESG Dive |

Offshore Wind Alliances: How State and International Partnerships Counteract Federal Opposition

In response to federal hostility, states and international partners are creating new alliances that bypass Washington, establishing non-federal corridors for clean energy investment and grid integration.

- The clearest example of this strategy is the February 2026 agreement between Massachusetts and Nova Scotia, Canada. The two governments are collaborating on a plan to ship electricity into the New England grid from future Canadian offshore wind farms, creating a direct workaround to the U.S. federal project freeze.

- Similarly, the United Kingdom sidestepped the federal administration to sign a clean energy pact directly with California in February 2026. This sub-national agreement is designed to promote investment and innovation in key areas, including offshore wind, independent of federal policy.

- This marks a strategic pivot from the pre-2025 era. Previously, collaboration was centered on federal-state initiatives, such as the Federal-State Offshore Wind Implementation Partnership launched in 2023, which brought together 11 East Coast states and the Biden administration to coordinate development.

- These new state-led international partnerships demonstrate a structural adaptation to political risk, creating durable, commercially focused relationships that are insulated from the administrative actions of the White House.

Table: Strategic Partnerships to Bypass Federal Roadblocks (2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| United Kingdom & California | Feb 2026 | The UK and California signed a direct clean energy pact to promote investment and innovation, specifically including offshore wind. The agreement was made to bypass the federal administration’s anti-renewable energy stance. | Recharge |

| Massachusetts (U.S.) & Nova Scotia (Canada) | Feb 2026 | The two governments reached an agreement to explore sending power from Canadian offshore wind farms to the New England grid. This collaboration provides a potential alternative energy source that avoids federal permitting hurdles in the U.S. | CBC |

| New York State | Feb 2026 | New York’s government began considering providing direct state-level funding to early-stage offshore wind projects. This action is intended to ensure project survival by de-risking them from federal political interference and funding cuts. | Recharge |

Geographic Power Shift: How US East Coast States Drive Offshore Wind Resilience

The geographic focus of U.S. offshore wind has decisively shifted from a federally-coordinated national buildout to a defensive, state-led effort concentrated in regions with legally binding clean energy mandates.

Partisan Politics Halt Federal Leasing Momentum

This chart shows how federal leasing, a driver under the Biden administration, became a key political risk after 2025, visually confirming the article’s point about the shift from a national to a state-led strategy.

(Source: Spinergie)

- Between 2021 and 2024, the strategy was national in scope, driven by the Biden administration’s goal of 30 GW by 2030 and federal lease auctions for areas off the Atlantic Coast, the Gulf of Mexico, and California.

- From 2025 onward, the federal government’s role reversed from enabler to antagonist. The January 2025 executive memorandum withdrawing all Outer Continental Shelf areas from new leasing effectively froze national expansion and shifted the battlefield to existing lease areas.

- The core of industry activity and survival is now concentrated in East Coast states with strong legal mandates. States like New York (9, 000 MW target), New Jersey (11, 000 MW target), and Massachusetts (5, 600 MW target) are using their state-level authority to defend projects in court and explore new funding mechanisms.

- This has led to a fragmentation of U.S. energy policy, where states like New York consider providing direct project funding and California forms international pacts with the UK. The industry’s geographic footprint is no longer expanding but consolidating in politically supportive states that can act as a bulwark against federal opposition.

Offshore Wind Technology Deployment: From Commercial Scaling to Survival Mode in 2026

The U.S. offshore wind industry’s technological focus has been forced to regress from optimizing commercial-scale deployment to ensuring the basic operational survival of approved projects, effectively stalling technical and supply chain momentum.

Industry Status at a Critical Turning Point

This snapshot from early 2025 shows the state of project deployment, with some projects operational or under construction, just as the industry was forced to shift from scaling technology to survival mode.

(Source: Inside Climate News)

- The 2021-2024 period was marked by key maturity milestones, proving the technology’s readiness for the U.S. market. This included the completion of the first utility-scale project, South Fork Wind, and the federal approval and start of construction for the much larger Vineyard Wind project. The primary challenge was economic scaling.

- In contrast, the period since January 2025 has been defined by defensive actions to preserve existing projects, not advance new technology. The administration’s stop-work order on five massive projects, totaling nearly 6 GW of capacity, directly threatened to halt the nation’s entire commercial-scale deployment pipeline.

- The industry’s successful legal challenges, which allowed projects like Ørsted’s Revolution Wind to resume work in January 2026, represent a validation of legal strategy, not technology. It confirms that projects are being built in spite of federal policy, not because of it.

- This political fight has diverted resources and attention away from solving next-generation challenges like floating turbine technology for the West Coast or building a domestic supply chain. The industry’s momentum has shifted from commercial innovation to legal preservation.

SWOT Analysis: US Offshore Wind’s Battle Against Political Headwinds

The primary strategic dynamic since 2024 is the materialization of political threats into a core industry weakness, which is now being countered by leveraging foundational strengths in state-level mandates and the legal system.

Federal Waters Expose a Core Industry Weakness

The industry’s critical vulnerability to federal political shifts, a key weakness in the SWOT analysis, is explained by this chart, which shows 100% of US offshore wind capacity is in federally controlled waters.

(Source: Energy Ventures Analysis)

- Strengths: The industry’s reliance on legally binding state procurement mandates has shifted from a planning tool to a powerful defensive shield in court.

- Weaknesses: The sector’s dependence on federal permitting and financial incentives has been exposed as a critical vulnerability to hostile executive action.

- Opportunities: New opportunities have emerged to bypass federal roadblocks through innovative state-to-state and international partnerships for energy and investment.

- Threats: The hypothetical threat of a hostile administration became a reality in 2025, with specific, targeted actions designed to halt projects and deter investment.

Table: SWOT Analysis for US Offshore Wind Under Political Pressure

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong, legally-binding state procurement targets (e.g., NY, NJ, MA) creating durable demand. Growing support from organized labor. | State mandates provide legal standing for successful court challenges. All five suspended projects won injunctions to resume work by Feb 2026. | The strength of state mandates was validated as a powerful legal and political defense mechanism against federal overreach, not just a market signal. |

| Weaknesses | High sensitivity to inflation and interest rates. Project economics led to cancellations like Ørsted’s Ocean Wind 1 & 2. | Extreme vulnerability to federal executive actions. Projects were halted by executive order, and a 50% tariff was imposed on components. | The primary weakness shifted from market economics to a structural dependency on a functional, or at least neutral, federal regulatory process. |

| Opportunities | Supportive federal policy, including IRA tax credits and a 30 GW by 2030 national target. Federal-State partnerships to build supply chains. | Bypassing federal opposition through new alliance structures, such as the Massachusetts-Nova Scotia energy plan and the UK-California pact. | Opportunities are now defined by their ability to circumvent the federal government, representing a strategic pivot from collaboration to insulation. |

| Threats | Looming political risk from a potential change in administration. Public opposition and NIMBYism. Ongoing supply chain bottlenecks. | The political threat materialized as a multi-pronged assault: leasing moratoriums, project suspensions, funding cancellations, and punitive tariffs. | The threat transformed from a hypothetical risk factor in financial models to a direct, quantifiable, and sustained attack on the industry’s operations. |

2026 Outlook: What Signals to Watch as US Offshore Wind Navigates Federal Opposition

The critical variable for the U.S. offshore wind industry in the year ahead is whether its successful legal and state-level defenses can restore enough investor confidence to restart momentum, even as federal hostility continues.

Rising Power Demand Signals Long-Term Need

As a key signal for the industry’s future, this chart shows that a projected surge in US electricity demand provides a powerful underlying incentive for investment in new generation sources like offshore wind.

(Source: e360-Yale)

- If this happens, watch this: If states with strong mandates, particularly New York, move forward with direct financial support for projects, it will signal a new de-risking model where state governments effectively insure projects against federal political risk. Watch for announcements of state-backed bridge loans or offtake agreement adjustments.

- These could be happening: Watch for final rulings in the lawsuits filed by Ørsted and Equinor. While preliminary injunctions allowed work to resume, definitive court victories would set a powerful legal precedent protecting major infrastructure projects from arbitrary political interference, potentially encouraging investors to re-engage.

- This signal is gaining traction: The formation of non-federal energy partnerships, like the Massachusetts-Nova Scotia plan, is a key trend. Further announcements of state-to-state or state-to-international collaborations for grid connection or supply chain development would confirm this workaround strategy is becoming a primary path for growth.

- This signal is losing steam: The prospect of a national, federally-led offshore wind buildout is effectively zero. Any expectation of new federal lease auctions or supportive regulatory changes should be discounted until there is a change in administration. The market has fragmented into a collection of resilient state-led initiatives.

Frequently Asked Questions

What is the biggest risk to US offshore wind projects in 2026?

The primary risk has fundamentally shifted from economic pressures to direct political hostility from the federal administration. Since January 2025, the administration has implemented a moratorium on new leases, canceled port infrastructure funding, imposed tariffs, and even ordered a temporary halt to projects already under construction, making political intervention the number one threat to project viability.

How is the offshore wind industry fighting back against the federal government’s actions?

The industry is responding with a two-pronged strategy of legal action and strategic partnerships. Developers successfully sued the federal government, winning court injunctions in February 2026 that allowed five major projects to resume construction. Simultaneously, states are forming alliances that bypass Washington, such as the pact between Massachusetts and Nova Scotia to import Canadian wind power and a direct clean energy agreement between California and the UK.

What has been the financial cost of the increased political risk since 2025?

The financial impact has been substantial. It prompted BP’s joint venture to exit the U.S. market entirely, caused Equinor to book a nearly $1 billion writedown on its U.S. projects, and added hundreds of millions in direct costs to projects like Dominion’s Coastal Virginia Offshore Wind ($228M from delays, $137M from tariffs). Analysts estimate that $35 billion in clean energy investments have been canceled and an additional $114 billion are at risk.

Have any projects been permanently canceled due to the new federal policies?

Yes. The most significant cancellation was BP’s Beacon Wind project. In October 2025, the BP joint venture announced it was ending all U.S. offshore wind development, stating there was “no viable path for development” under the current administration. This removed a major global player from the U.S. market.

Why are states like New York, New Jersey, and Massachusetts so important for the industry’s survival?

These states are critical because they have strong, legally-binding clean energy and offshore wind procurement mandates. These state laws have provided the legal standing for developers to successfully challenge the federal government in court. Their firm commitment creates durable demand and a political bulwark, making the East Coast the geographic center of the industry’s defensive efforts against federal opposition.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.